Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Jake Fromowitz owns and operates a tire and auto repair shop named Jake's Jack'em and Fix'em Shop. During the current month, the following activities

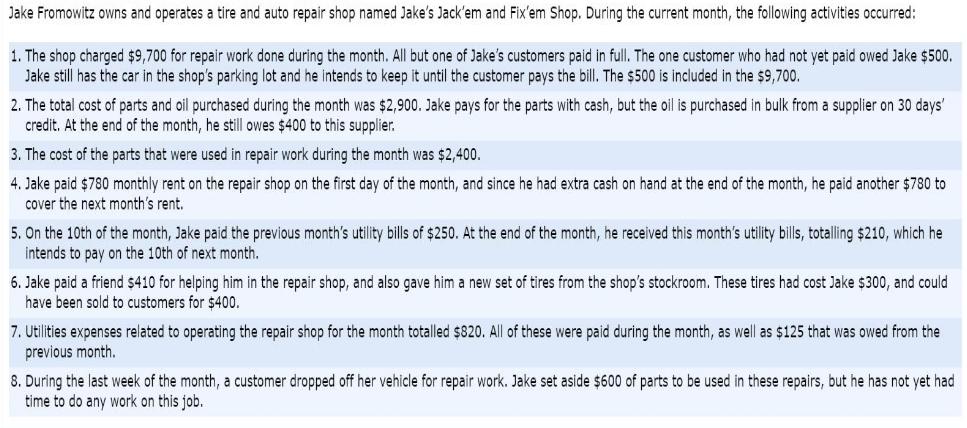

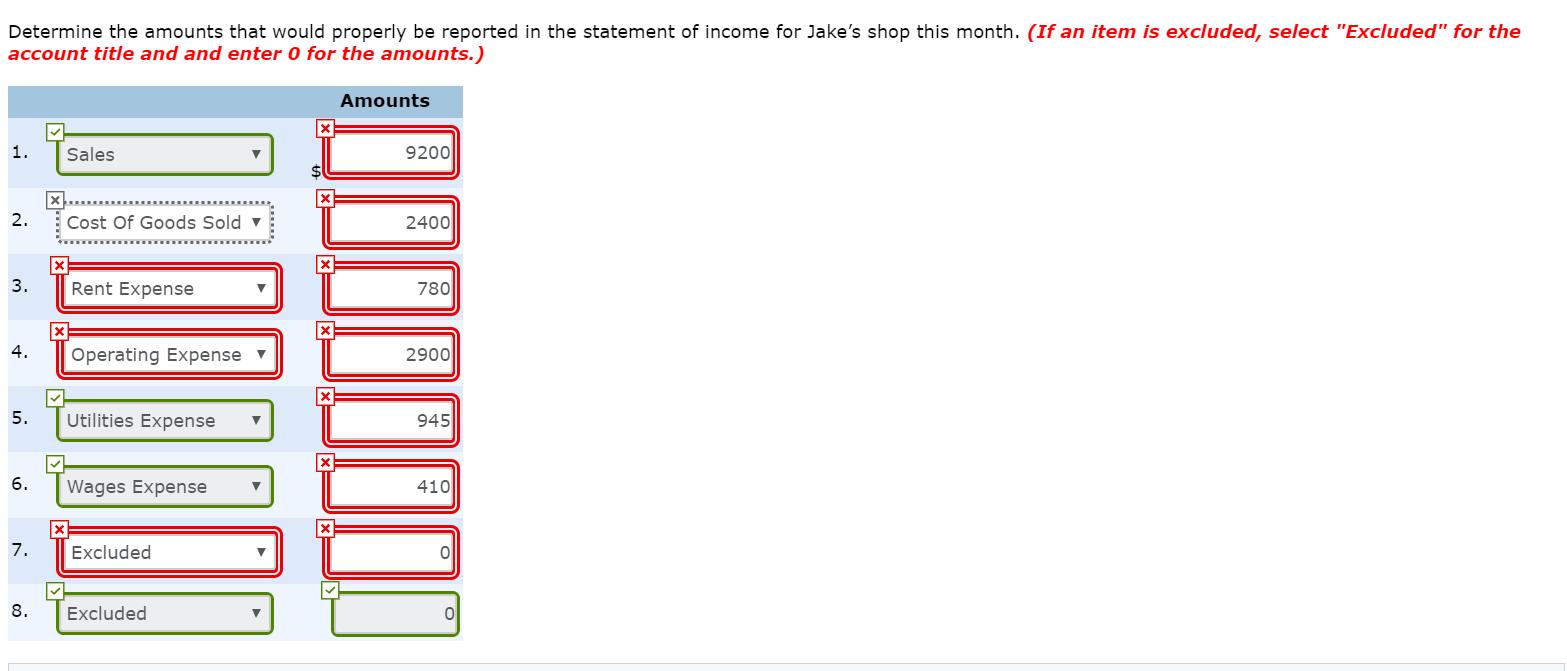

Jake Fromowitz owns and operates a tire and auto repair shop named Jake's Jack'em and Fix'em Shop. During the current month, the following activities occurred: 1. The shop charged $9,700 for repair work done during the month. All but one of Jake's customers paid in full. The one customer who had not yet paid owed Jake $500. Jake still has the car in the shop's parking lot and he intends to keep it until the customer pays the bill. The $500 is included in the $9,700. 2. The total cost of parts and oil purchased during the month was $2,900. Jake pays for the parts with cash, but the oil is purchased in bulk from a supplier on 30 days' credit. At the end of the month, he still owes $400 to this supplier. 3. The cost of the parts that were used in repair work during the month was $2,400. 4. Jake paid $780 monthly rent on the repair shop on the first day of the month, and since he had extra cash on hand at the end of the month, he paid another $780 to cover the next month's rent. 5. On the 10th of the month, Jake paid the previous month's utility bills of $250. At the end of the month, he received this month's utility bills, totalling $210, which he intends to pay on the 10th of next month. 6. Jake paid a friend $410 for helping him in the repair shop, and also gave him a new set of tires from the shop's stockroom. These tires had cost Jake $300, and could have been sold to customers for $400. 7. Utilities expenses related to operating the repair shop for the month totalled $820. All of these were paid during the month, as well as $125 that was owed from the previous month. 8. During the last week of the month, a customer dropped off her vehicle for repair work. Jake set aside $600 of parts to be used in these repairs, but he has not yet had time to do any work on this job. Determine the amounts that would properly be reported in the statement of income for Jake's shop this month. (If an item is excluded, select "Excluded" for the account title and and enter 0 for the amounts.) Amounts 1. Sales 9200 2. Cost Of Goods Sold v 2400 3. Rent Expense 780 4. Operating Expense v 2900 5. Utilities Expense 945 6. Wages Expense 410 7. Excluded 8. Excluded

Step by Step Solution

★★★★★

3.26 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Income Statement for Jackem and Fixem Shop for the period Amounts Notes see below Item 1 Sales for t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started