Answered step by step

Verified Expert Solution

Question

1 Approved Answer

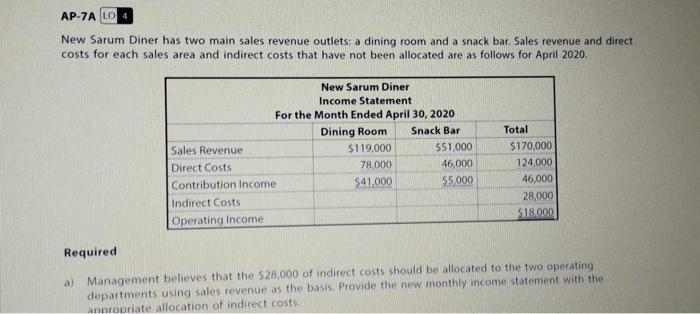

AP-7A LO 4 New Sarum Diner has two main sales revenue outlets: a dining room and a snack bar. Sales revenue and direct costs for

AP-7A LO 4 New Sarum Diner has two main sales revenue outlets: a dining room and a snack bar. Sales revenue and direct costs for each sales area and indirect costs that have not been allocated are as follows for April 2020. Required a) Sales Revenue Direct Costs New Sarum Diner Income Statement For the Month Ended April 30, 2020 Dining Room Snack Bar $119,000 78,000 $41,000 Contribution Income Indirect Costs Operating Income $51,000 46,000 $5,000 Total $170,000 124,000 46,000 28,000 $18,000 Management believes that the $28,000 of indirect costs should be allocated to the two operating departments using sales revenue as the basis. Provide the new monthly income statement with the appropriate allocation of indirect costs.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started