Question

Apart from listing shares on stock markets and engaging in initial public offerings (IPOs), companies often resort to alternative methods of raising capital. Consider the

Apart from listing shares on stock markets and engaging in initial public offerings (IPOs), companies often resort to alternative methods of raising capital.

Consider the following case, and answer the question that follows:

In June 2010, WSFS Financial Corporation filed Form S-3 under SEC Rule 415 and announced that the company will be raising $150 million over a three-year period and using these funds for working capital and general corporate purposes.

The previous case is an example of:

Public cash offering

Private placement

Shelf registration

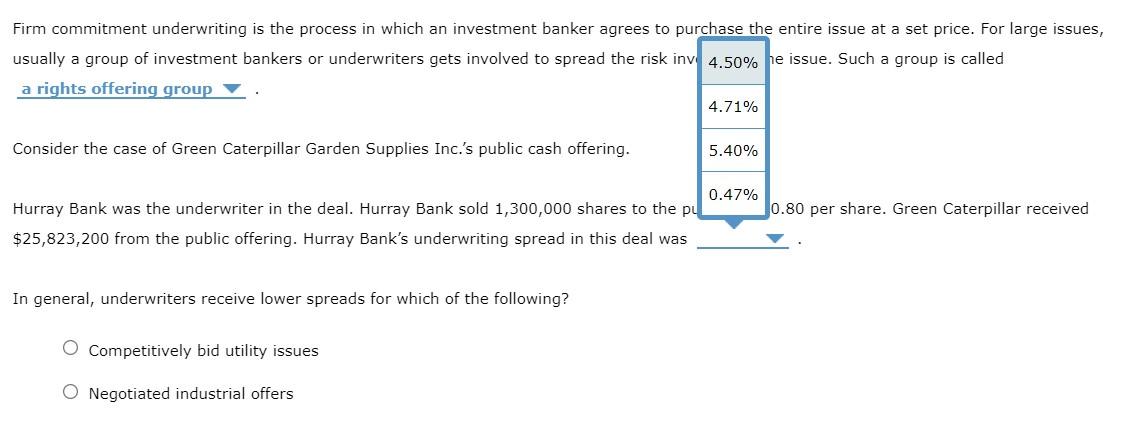

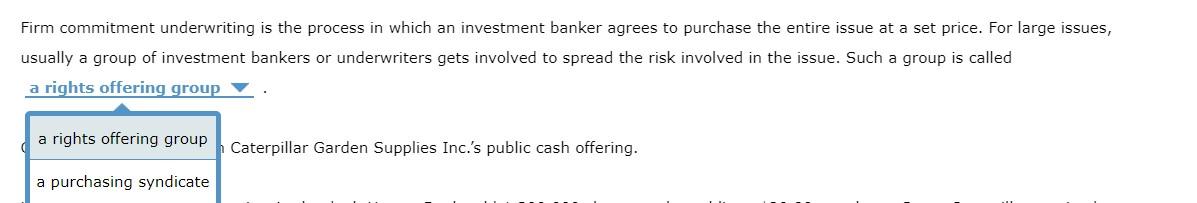

Firm commitment underwriting is the process in which an investment banker agrees to purchase the entire issue at a set price. For large issues, usually a group of investment bankers or underwriters gets involved to spread the risk involved in the issue. Such a group is called .

Consider the case of Green Caterpillar Garden Supplies Inc.s public cash offering.

Hurray Bank was the underwriter in the deal. Hurray Bank sold 1,300,000 shares to the public at $20.80 per share. Green Caterpillar received $25,823,200 from the public offering. Hurray Banks underwriting spread in this deal was .

In general, underwriters receive lower spreads for which of the following?

Competitively bid utility issues

Negotiated industrial offers

Firm commitment underwriting is the process in which an investment banker agrees to purchase the entire issue at a set price. For large issues, usually a group of investment bankers or underwriters gets involved to spread the risk inv 4.50% he issue. Such a group is called a rights offering group 4.71% Consider the case of Green Caterpillar Garden Supplies Inc.'s public cash offering. 5.40% 0.47% Hurray Bank was the underwriter in the deal. Hurray Bank sold 1,300,000 shares to the pul 0.80 per share. Green Caterpillar received $25,823,200 from the public offering. Hurray Bank's underwriting spread in this deal was In general, underwriters receive lower spreads for which of the following? O Competitively bid utility issues O Negotiated industrial offers Firm commitment underwriting is the process in which an investment banker agrees to purchase the entire issue at a set price. For large issues, usually a group of investment bankers or underwriters gets involved to spread the risk involved in the issue. Such a group is called a rights offering group a rights offering group Caterpillar Garden Supplies Inc.'s public cash offering. a purchasing syndicate 7. Non-IPO fundraising Apart from listing shares on stock markets and engaging in initial public offerings (IPOs), companies often resort to alternative methods of raising capital. Consider the following case, and answer the question that follows: In June 2010, WSFS Financial Corporation filed Form S-3 under SEC Rule 415 and announced that the company will be raising $150 million over a three-year period and using these funds for working capital and general corporate purposes. The previous case is an example of: Public cash offering Private placement Shelf registrationStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started