Question

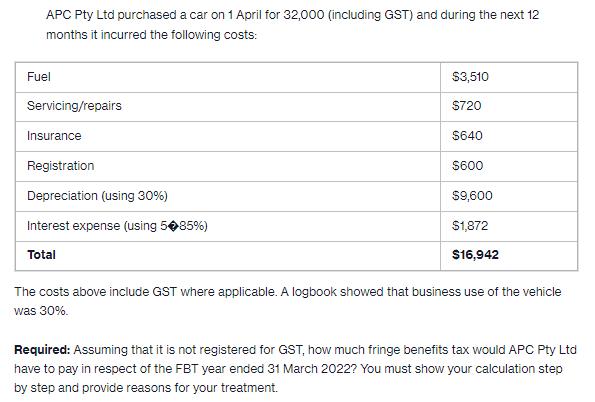

APC Pty Ltd purchased a car on 1 April for 32,000 (including GST) and during the next 12 months it incurred the following costs:

APC Pty Ltd purchased a car on 1 April for 32,000 (including GST) and during the next 12 months it incurred the following costs: Fuel Servicing/repairs Insurance Registration Depreciation (using 30%) Interest expense (using 5 85%) Total $3,510 $720 $640 $600 $9,600 $1,872 $16,942 The costs above include GST where applicable. A logbook showed that business use of the vehicle was 30%. Required: Assuming that it is not registered for GST, how much fringe benefits tax would APC Pty Ltd have to pay in respect of the FBT year ended 31 March 2022? You must show your calculation step by step and provide reasons for your treatment.

Step by Step Solution

3.56 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

1 Calculate the business use percentage Business use percentage 30 2 Calculate the total operating c...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Income Tax Fundamentals 2013

Authors: Gerald E. Whittenburg, Martha Altus Buller, Steven L Gill

31st Edition

1111972516, 978-1285586618, 1285586611, 978-1285613109, 978-1111972516

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App