Answered step by step

Verified Expert Solution

Question

1 Approved Answer

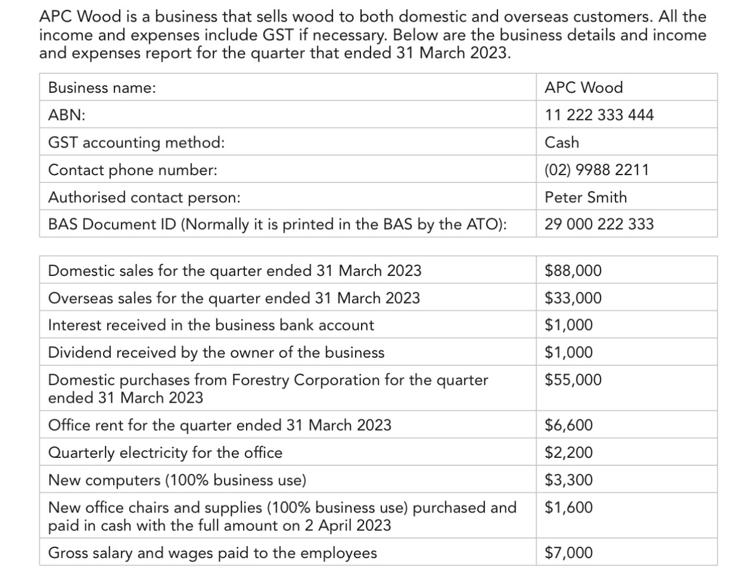

APC Wood is a business that sells wood to both domestic and overseas customers. All the income and expenses include GST if necessary. Below

APC Wood is a business that sells wood to both domestic and overseas customers. All the income and expenses include GST if necessary. Below are the business details and income and expenses report for the quarter that ended 31 March 2023. Business name: ABN: GST accounting method: Contact phone number: Authorised contact person: BAS Document ID (Normally it is printed in the BAS by the ATO): Domestic sales for the quarter ended 31 March 2023 APC Wood 11 222 333 444 Cash (02) 9988 2211 Peter Smith 29 000 222 333 $88,000 Overseas sales for the quarter ended 31 March 2023 $33,000 Interest received in the business bank account $1,000 Dividend received by the owner of the business $1,000 Domestic purchases from Forestry Corporation for the quarter $55,000 ended 31 March 2023 Office rent for the quarter ended 31 March 2023 $6,600 Quarterly electricity for the office $2,200 New computers (100% business use) $3,300 New office chairs and supplies (100% business use) purchased and paid in cash with the full amount on 2 April 2023 $1,600 Gross salary and wages paid to the employees $7,000 Tax withheld $598 Superannuation guarantee paid during the quarter $800 PAYG instalment calculated by ATO $1,000 Required: Assuming the full reporting method is used, calculate the GST and complete the GST Calculation Worksheet and Business Activity Statement (BAS) for APC Wood for the quarter ended 31 March 2023. (Hint: The GST Calculation Worksheet and Business Activity Statement templates are available in myAPC.hub, in the form of an Excel spreadsheet.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer To calculate the GST and complete the Business Activity Statement BAS for APC Wood for the qu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started