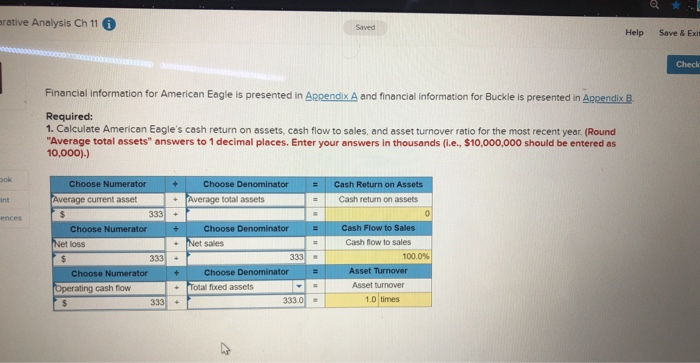

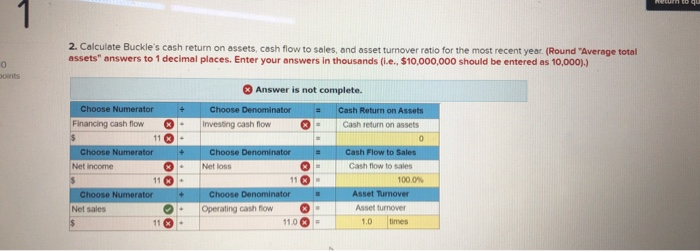

apendix a and apendix b below then the question:

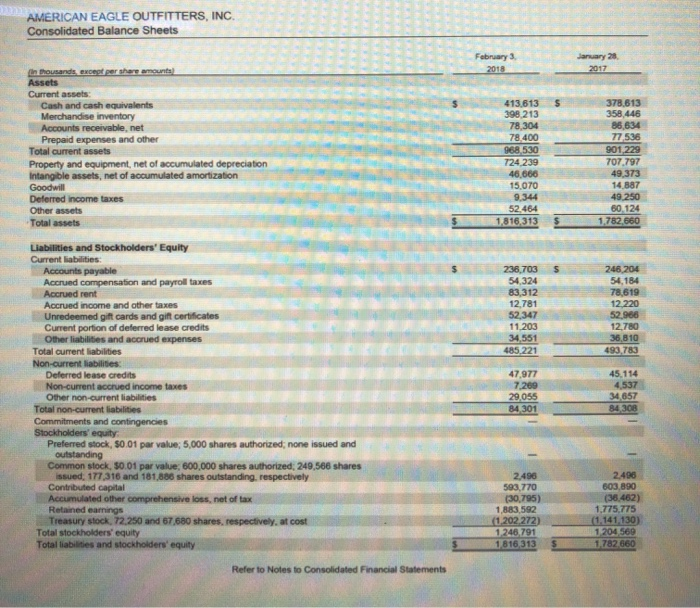

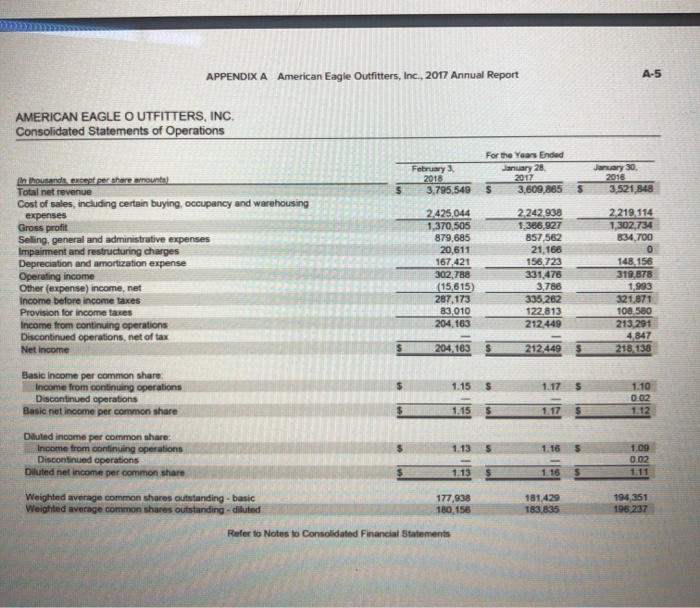

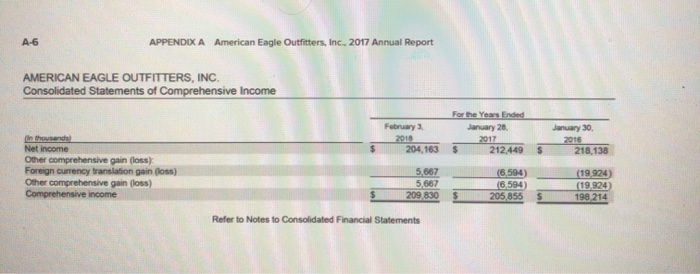

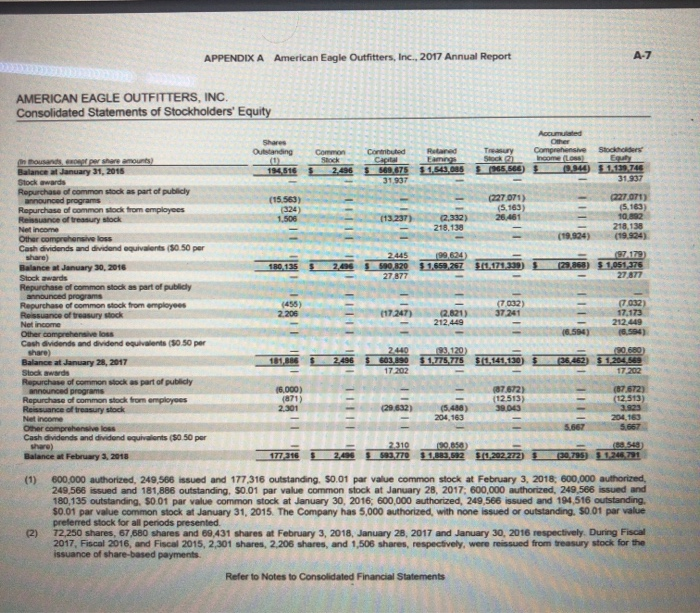

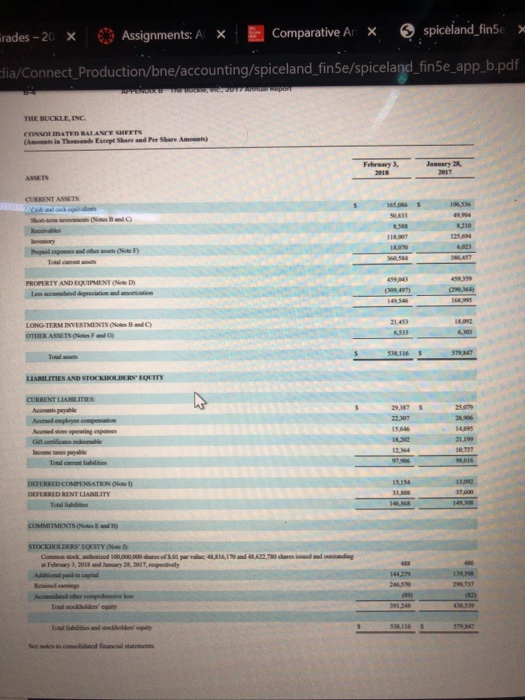

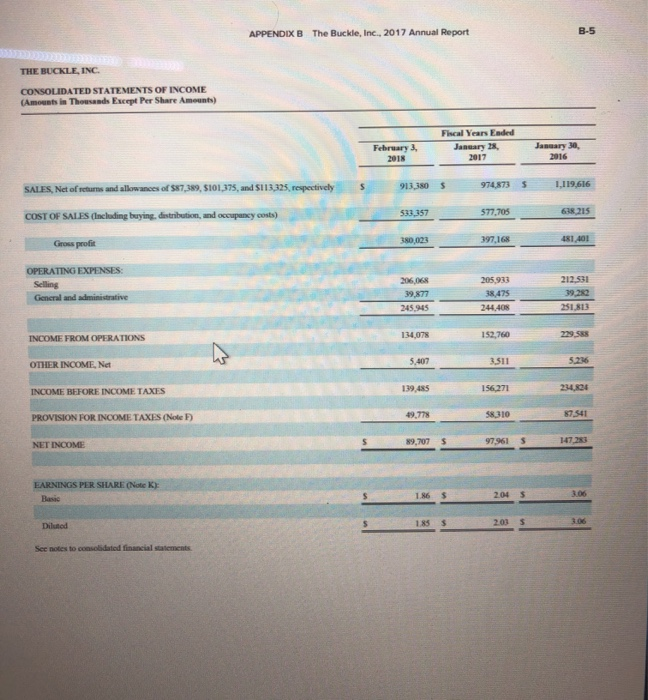

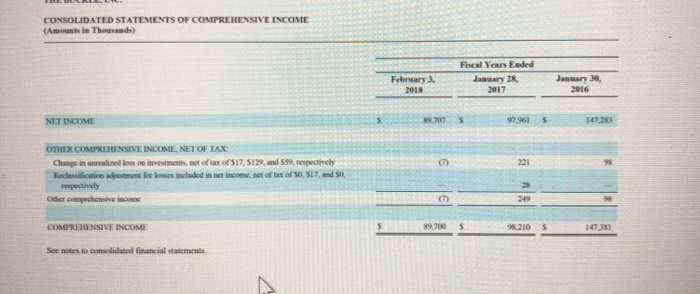

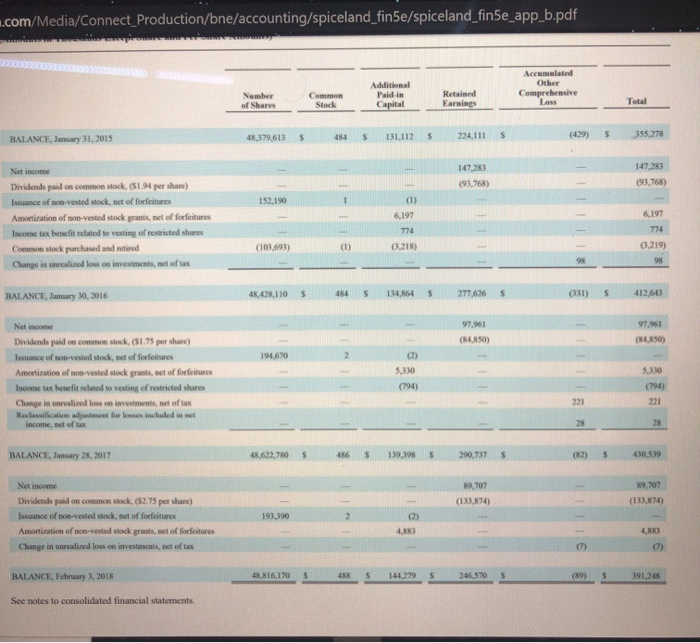

AMERICAN EAGLE OUTFITTERS, INC. Consolidated Balance Sheets onay l : anuary 28 $ in thousands, except per share amount Assets Current assets: Cash and cash equivalents Merchandise inventory Accounts receivable, net Prepaid expenses and other Total current assets Property and equipment, net of accumulated depreciation Intangible assets, net of accumulated amortization Goodwill Deferred income taxes Other assets Total assets ERIE 413,613 5 398 213 7830 78.400 968,530 724 239 46.666 15. 070 9,344 52.464 1,816,313 3 78,613 3 58,446 V 77 536 901.229 707.797 49 373 1 4887 4 9 250 60 124 1.782,660 $ $ 1.782.80 88281 246 204 54.184 78,619 12.220 52 966 12,780 36 810 93,783 485,221 4 45.114 Liabilities and Stockholders' Equity Current liabilities: Accounts payable Accrued compensation and payroll taxes Accrued rent Accrued income and other taxes Unredeemed gift cards and gift certificates Current portion of deferred lease credits Other liabilities and accrued expenses Total current liabilities Non-current liabilities: Deferred lease credits Non-current accrued income taxes Other non-current liabilities Total non-current liabilities Commitments and contingencies Stockholders' equity Preferred stock, S0.01 par value; 5,000 shares authorized: none issued and outstanding Common stock, 30.01 par value, 600,000 shares authorized: 249.566 shares issued, 177,316 and 181,886 shares outstanding, respectively Contributed capitale Accumulated other comprehensive loss, net of tax Retained earnings Treasury stock, 72.250 and 67 680 shares, respectively, at cost Total stockholders' equity Total liabilities and stockholders' equity 7.260 29,055 84 301 4.537 34.657 4 308 8 2.496 593.770 (30,795) 1,883,592 (1.202.272) 1 246,791 1 816 313 2.496 603.890 (36.462) 1.775.775 (1.141130) 1204 569 1782 660 Refer to Notes to Consolidated Financial Statements APPENDIX A American Eagle Outfitters, Inc., 2017 Annual Report AMERICAN EAGLE OUTFITTERS, INC Consolidated Statements of Operations February For the Year Ended January 28 2017 5 3,609,865 3,795,549 5 3.521.848 ehousing 2.219, 114 1.302.734 834,700 O in thousands, except per share amounts Total net revenue Cost of sales, including certain buying, occupancy and expenses Gross profit Seling, general and administrative expenses Impairment and restructuring charges Depreciation and amortization expense Operating income Other (expense) income, net Income before income taxes Provision for income taxes Income from continuing operations Discontinued operations, net of tax Net income 2425044 1,370,505 879,685 20,611 167,421 302.788 (15,615) 287.173 83,010 204,163 2 242,938 1,386,927 857,562 21,166 156,723 331.478 3.786 335.262 122.813 212.449 148,156 319 878 1993 321,871 108,580 213 291 4.847 218 138 204,163 212 449 Basic income per common share: Income from continuing operations Discontinued operations Basic net income per common share 115 5 1.10 0.02 Diluted income per common share Income from continuing operations Discontinued operations Diluted net income per common share 1.13 1.13 S $ 1.16 002 1.11 181.429 Weighted average common shares outstanding - basic Weighted average common shares outstanding-dibuted 180, 156 194 151 195 237 Refer to Notes to Consolidated Financial Statements A-6 APPENDIX A American Eagle Outfitters, Inc., 2017 Annual Report AMERICAN EAGLE OUTFITTERS, INC. Consolidated Statements of Comprehensive Income For the Year Ended January 20 2017 S 212,449 February 2018 204,163 January 30 2016 $ 218,138 in the end Net income Other comprehensive gain (loss) Foreign currency translation gain (los) Other comprehensive gain (loss) Comprehensive income (6,594) 5,667 5.667 209.830 (19924) (19924) 198 214 205,855 Refer to Notes to Consolidated Financial Statements APPENDIX A American Eagle Outfitters, Inc., 2017 Annual Report AMERICAN EAGLE OUTFITTERS, INC Consolidated Statements of Stockholders' Equity FRIN 1944) 5.1.1974 221 OT1) (15.563) 1.506 (III 22707 (5.163) 26.461 2.332) 218 19 - 2445 500 320 180,135 5 $1.652 2.257 0171 339) 74179) $ 1.051376 27 877 - 27 877 Balance January 31, 2015 Stockwards Repurchase of common stock as part of publicly announced programs Repurchase of common stock from employees Ressuance of t ry sock Net Income Other comprehensive loss Cash dividends and dividend equivalents (S0 50 per Share) Balance of January 30, 2016 Stock awards Repurchase of common stock as part of publicly announced programs Repurchase of common stock from employees Roissance of treasury shock Not income Other comprehensive oss Cash dividends and dividend equivalents (50.50 per share) Balance at January 28, 2017 Stockwws Repurchase of common stock as part of publicly announced programs Repurchase of common stock bon employees Ressuance of treasury stock Nincome Other comprehensions Cash dividends and dividend equivalents (50.50 per 17247) 2.821) 37241 7032) 17.173 212 449 37173 1 EN III 1965 2440 6011390 17202 93.120) 1.778.775 S . 141.130) 7262) $11204849 11 - - (5.488) 87 672) 12.513) 39 D (7 672) (12.513) 1923 (29.632) III 998 - - 5.667 5.657 2.310 83,770 (10 858) 1. 532 (8.54 20071 Balance February , 2018 $ 11 202 272) 207 S (1) 600.000 authorized, 249,506 issued and 177,316 outstanding. 50.01 par value common stock at February 3, 2018: 600,000 authorized 249.566 issued and 181.886 outstanding, 50.01 par value common stock at January 28, 2017, 600,000 authorized, 249.566 issued and 180,135 outstanding. So 01 par valve common stock at January 30, 2016: 500,000 authorized, 249.566 issued and 194,516 outstanding 50.01 par value common stock at January 31, 2015. The Company has 5,000 authorized, with none issued or outstanding. $0.01 par value preferred stock for all periods presented 72,250 shares, 67,680 shares and 60,431 shares at February 3, 2018 January 28, 2017 and January 30, 2016 respectively. During Fiscal 2017, Fiscal 2016, and Fiscal 2015, 2.301 shares, 2.206 shares, and 1,506 shares, respectively, were reissued from treasury stock for the Issuance of share-based payments. Refer to Notes to Consolidated Financial irades - 20 X Assignments: A X E Comparative AI X spiceland_fine > dia/Connect_Production/bne/accounting/spiceland_fin5e/spiceland_fin5e_app_b.pdf R EZU THE BUCKLE, INC. A CONSOLIDATEDRALANCE SHEETS i The Ep Share and Per Share Am ASSETS CURRENT ASSETS d Shan mes 210 PROPERTY AND E MENT ( ND Los dem B LONG-TERM INVESTMENTS ( N OTHER ASSETS (Nees ) Tools LIABILITIES AND STOKO KIROLDERS' EQUITY CURRENT LIANIES As puble A mployee Ar reperating certificate de male Income bases Tocal cu baie 21.190 ) DEFERRED COMPENSATION DERRRID RENT LARITY Tube COMMITMENTS IN STOCKHOLDERS' EQUITY (Note Consekwend 1000000 shof. Fey , 2005 2007, respectively pada Ind.622.750 resis APPENDIX B The Buckle, Inc., 2017 Annual Report THE BUCKLE, INC CONSOLIDATED STATEMENTS OF INCOME (Amounts a Thousands Except Per Share Amounts) Ed SALES, Net of returns and allowances of $87,389, 5101,375, and 5113,325, respectively 91 974735 1.119.616 COST OF SALES (Including buying, distribution, and occupancy costs) 577,705 61215 397,168 OPERATING EXPENSES 06.06 20593 General and administrative 24440 INCOME FROM OPERATIONS 114078 152,760 OTHER INCOME Net INCOME BEFORE INCOME TAXES 156 271 PROVISION FOR INCOME TAXES (Note NET INCOME EARNINGS PER SHARE (Note K): Diluted See mototec t ed financialement CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (Amounts in Thousands) Fiscal Year Ended January 28, 2017 February 3. 2018 January 30, NET INCOME OTHER COMPREHENSIVE INCOME, NET OF TAX: Change in unrealized loss on investments, net of tax of 517.5129 and 599, respectively Reclassification adjustment for losses included in net income, net of tax of 50, 517, and so respectively Other comprehensive COMPREHENSIVE INCOME See notes to consolidated financial statements n.com/Media/Connect_Production/bne/accounting/spiceland_fin5e/spiceland_fin5e_app_b.pdf Accumulated Other Comprehensive Additional Paid in Capital Number of Shares Retained Common Stock BALANCE, January 31, 2015 48,379,613 484 $ 131,112 $ 234,1115 (429) 5 355,278 147.283 (93.768) 147,283 (93.768) 152.190 (1) 6,197 Net income Dividends paid on common stock, (1.4 per share) Issuance of non-vested stock, net of forfeitures Amortization of non-vested stock grants, net of forfeitures Income tax benefit related to vesting of restricted shares Common stock purchased and retired Change in unecalized loss on investments, net of tax 774 (101.693) 0.218) 0.219) BALANCE, January 30, 2016 48,428,110 5 484 $ 134,864 $ 277,626 $ (331) $ 412,613 97.961 (84.850) 97.961 (84.850) SLU Net income Dividends paid on c o ck. (51.75 per share) Issuance of on-vested stock, net of forfeitunes Amortization of non-vested stock grants, net of forfeitures Income tax benefit related to vesting of restricted shares Change in realized loss on investments, net of tax Reclassification adjustment for losses included in net income, net ofta 5.330 (794) BALANCE, January 28, 2017 48.622,7805 4 86 $ 139,398 $ 290,737 S 430,539 89,707 (133.874) 89,707 (133,874) Net income Dividends paid on common stock. ($2.75 per share) Issuance of non-vested stock, net of forfeitures Amortization of non-vested stock grants, net of forfeitures Change in unrcalized loss on investments, net of tax 193,390 4.83 BALANCE, February 3, 2018 45,816,170 S 144. 29 246570 1914 See notes to consolidated financial statements arative Analysis Ch 11 Help Save & Exit Check Financial information for American Eagle is presented in Appendix A and financial information for Buckle is presented in Appendix B. Required: 1. Calculate American Eagle's cash return on assets, cash flow to sales, and asset turnover ratio for the most recent year. (Round "Average total assets" answers to 1 decimal places. Enter your answers in thousands (le, $10,000,000 should be entered as 10,000).) = Cash Return on Assets Cash return on assets Choose Numerator Average current asset $ 333 Choose Numerator Net loss + Choose Denominator + Average total assets + + Choose Denominator * Net Sales 0 = Cash Flow to Sales Cash flow to sales 100.0% Asset Turnover = 333 Choose Numerator Operating cash flow $ 333 + - + Choose Denominator Total fixed assets - 333.0 Asset turnover 1.0 times 2. Calculate Buckle's cash return on assets, cash flow to sales, and asset turnover ratio for the most recent year. (Round "Average total assets" answers to 1 decimal places. Enter your answers in thousands (ie, $10,000,000 should be entered as 10,000). points Answer is not complete. Choose Numerator Financing cash flow 11 Choose Denominator Investing cash flow = - Cash Return on Assets Cash return on assets + 3 - - + = Choose Denominator Net loss Cash Flow to Sales Cash flow to sales Choose Numerator Net Income 11 Choose Numerator Net sales 11 1000 Asset Turnover Choose Denominator - Operating cash flow - 110 3 = Asset turnover times AMERICAN EAGLE OUTFITTERS, INC. Consolidated Balance Sheets onay l : anuary 28 $ in thousands, except per share amount Assets Current assets: Cash and cash equivalents Merchandise inventory Accounts receivable, net Prepaid expenses and other Total current assets Property and equipment, net of accumulated depreciation Intangible assets, net of accumulated amortization Goodwill Deferred income taxes Other assets Total assets ERIE 413,613 5 398 213 7830 78.400 968,530 724 239 46.666 15. 070 9,344 52.464 1,816,313 3 78,613 3 58,446 V 77 536 901.229 707.797 49 373 1 4887 4 9 250 60 124 1.782,660 $ $ 1.782.80 88281 246 204 54.184 78,619 12.220 52 966 12,780 36 810 93,783 485,221 4 45.114 Liabilities and Stockholders' Equity Current liabilities: Accounts payable Accrued compensation and payroll taxes Accrued rent Accrued income and other taxes Unredeemed gift cards and gift certificates Current portion of deferred lease credits Other liabilities and accrued expenses Total current liabilities Non-current liabilities: Deferred lease credits Non-current accrued income taxes Other non-current liabilities Total non-current liabilities Commitments and contingencies Stockholders' equity Preferred stock, S0.01 par value; 5,000 shares authorized: none issued and outstanding Common stock, 30.01 par value, 600,000 shares authorized: 249.566 shares issued, 177,316 and 181,886 shares outstanding, respectively Contributed capitale Accumulated other comprehensive loss, net of tax Retained earnings Treasury stock, 72.250 and 67 680 shares, respectively, at cost Total stockholders' equity Total liabilities and stockholders' equity 7.260 29,055 84 301 4.537 34.657 4 308 8 2.496 593.770 (30,795) 1,883,592 (1.202.272) 1 246,791 1 816 313 2.496 603.890 (36.462) 1.775.775 (1.141130) 1204 569 1782 660 Refer to Notes to Consolidated Financial Statements APPENDIX A American Eagle Outfitters, Inc., 2017 Annual Report AMERICAN EAGLE OUTFITTERS, INC Consolidated Statements of Operations February For the Year Ended January 28 2017 5 3,609,865 3,795,549 5 3.521.848 ehousing 2.219, 114 1.302.734 834,700 O in thousands, except per share amounts Total net revenue Cost of sales, including certain buying, occupancy and expenses Gross profit Seling, general and administrative expenses Impairment and restructuring charges Depreciation and amortization expense Operating income Other (expense) income, net Income before income taxes Provision for income taxes Income from continuing operations Discontinued operations, net of tax Net income 2425044 1,370,505 879,685 20,611 167,421 302.788 (15,615) 287.173 83,010 204,163 2 242,938 1,386,927 857,562 21,166 156,723 331.478 3.786 335.262 122.813 212.449 148,156 319 878 1993 321,871 108,580 213 291 4.847 218 138 204,163 212 449 Basic income per common share: Income from continuing operations Discontinued operations Basic net income per common share 115 5 1.10 0.02 Diluted income per common share Income from continuing operations Discontinued operations Diluted net income per common share 1.13 1.13 S $ 1.16 002 1.11 181.429 Weighted average common shares outstanding - basic Weighted average common shares outstanding-dibuted 180, 156 194 151 195 237 Refer to Notes to Consolidated Financial Statements A-6 APPENDIX A American Eagle Outfitters, Inc., 2017 Annual Report AMERICAN EAGLE OUTFITTERS, INC. Consolidated Statements of Comprehensive Income For the Year Ended January 20 2017 S 212,449 February 2018 204,163 January 30 2016 $ 218,138 in the end Net income Other comprehensive gain (loss) Foreign currency translation gain (los) Other comprehensive gain (loss) Comprehensive income (6,594) 5,667 5.667 209.830 (19924) (19924) 198 214 205,855 Refer to Notes to Consolidated Financial Statements APPENDIX A American Eagle Outfitters, Inc., 2017 Annual Report AMERICAN EAGLE OUTFITTERS, INC Consolidated Statements of Stockholders' Equity FRIN 1944) 5.1.1974 221 OT1) (15.563) 1.506 (III 22707 (5.163) 26.461 2.332) 218 19 - 2445 500 320 180,135 5 $1.652 2.257 0171 339) 74179) $ 1.051376 27 877 - 27 877 Balance January 31, 2015 Stockwards Repurchase of common stock as part of publicly announced programs Repurchase of common stock from employees Ressuance of t ry sock Net Income Other comprehensive loss Cash dividends and dividend equivalents (S0 50 per Share) Balance of January 30, 2016 Stock awards Repurchase of common stock as part of publicly announced programs Repurchase of common stock from employees Roissance of treasury shock Not income Other comprehensive oss Cash dividends and dividend equivalents (50.50 per share) Balance at January 28, 2017 Stockwws Repurchase of common stock as part of publicly announced programs Repurchase of common stock bon employees Ressuance of treasury stock Nincome Other comprehensions Cash dividends and dividend equivalents (50.50 per 17247) 2.821) 37241 7032) 17.173 212 449 37173 1 EN III 1965 2440 6011390 17202 93.120) 1.778.775 S . 141.130) 7262) $11204849 11 - - (5.488) 87 672) 12.513) 39 D (7 672) (12.513) 1923 (29.632) III 998 - - 5.667 5.657 2.310 83,770 (10 858) 1. 532 (8.54 20071 Balance February , 2018 $ 11 202 272) 207 S (1) 600.000 authorized, 249,506 issued and 177,316 outstanding. 50.01 par value common stock at February 3, 2018: 600,000 authorized 249.566 issued and 181.886 outstanding, 50.01 par value common stock at January 28, 2017, 600,000 authorized, 249.566 issued and 180,135 outstanding. So 01 par valve common stock at January 30, 2016: 500,000 authorized, 249.566 issued and 194,516 outstanding 50.01 par value common stock at January 31, 2015. The Company has 5,000 authorized, with none issued or outstanding. $0.01 par value preferred stock for all periods presented 72,250 shares, 67,680 shares and 60,431 shares at February 3, 2018 January 28, 2017 and January 30, 2016 respectively. During Fiscal 2017, Fiscal 2016, and Fiscal 2015, 2.301 shares, 2.206 shares, and 1,506 shares, respectively, were reissued from treasury stock for the Issuance of share-based payments. Refer to Notes to Consolidated Financial irades - 20 X Assignments: A X E Comparative AI X spiceland_fine > dia/Connect_Production/bne/accounting/spiceland_fin5e/spiceland_fin5e_app_b.pdf R EZU THE BUCKLE, INC. A CONSOLIDATEDRALANCE SHEETS i The Ep Share and Per Share Am ASSETS CURRENT ASSETS d Shan mes 210 PROPERTY AND E MENT ( ND Los dem B LONG-TERM INVESTMENTS ( N OTHER ASSETS (Nees ) Tools LIABILITIES AND STOKO KIROLDERS' EQUITY CURRENT LIANIES As puble A mployee Ar reperating certificate de male Income bases Tocal cu baie 21.190 ) DEFERRED COMPENSATION DERRRID RENT LARITY Tube COMMITMENTS IN STOCKHOLDERS' EQUITY (Note Consekwend 1000000 shof. Fey , 2005 2007, respectively pada Ind.622.750 resis APPENDIX B The Buckle, Inc., 2017 Annual Report THE BUCKLE, INC CONSOLIDATED STATEMENTS OF INCOME (Amounts a Thousands Except Per Share Amounts) Ed SALES, Net of returns and allowances of $87,389, 5101,375, and 5113,325, respectively 91 974735 1.119.616 COST OF SALES (Including buying, distribution, and occupancy costs) 577,705 61215 397,168 OPERATING EXPENSES 06.06 20593 General and administrative 24440 INCOME FROM OPERATIONS 114078 152,760 OTHER INCOME Net INCOME BEFORE INCOME TAXES 156 271 PROVISION FOR INCOME TAXES (Note NET INCOME EARNINGS PER SHARE (Note K): Diluted See mototec t ed financialement CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (Amounts in Thousands) Fiscal Year Ended January 28, 2017 February 3. 2018 January 30, NET INCOME OTHER COMPREHENSIVE INCOME, NET OF TAX: Change in unrealized loss on investments, net of tax of 517.5129 and 599, respectively Reclassification adjustment for losses included in net income, net of tax of 50, 517, and so respectively Other comprehensive COMPREHENSIVE INCOME See notes to consolidated financial statements n.com/Media/Connect_Production/bne/accounting/spiceland_fin5e/spiceland_fin5e_app_b.pdf Accumulated Other Comprehensive Additional Paid in Capital Number of Shares Retained Common Stock BALANCE, January 31, 2015 48,379,613 484 $ 131,112 $ 234,1115 (429) 5 355,278 147.283 (93.768) 147,283 (93.768) 152.190 (1) 6,197 Net income Dividends paid on common stock, (1.4 per share) Issuance of non-vested stock, net of forfeitures Amortization of non-vested stock grants, net of forfeitures Income tax benefit related to vesting of restricted shares Common stock purchased and retired Change in unecalized loss on investments, net of tax 774 (101.693) 0.218) 0.219) BALANCE, January 30, 2016 48,428,110 5 484 $ 134,864 $ 277,626 $ (331) $ 412,613 97.961 (84.850) 97.961 (84.850) SLU Net income Dividends paid on c o ck. (51.75 per share) Issuance of on-vested stock, net of forfeitunes Amortization of non-vested stock grants, net of forfeitures Income tax benefit related to vesting of restricted shares Change in realized loss on investments, net of tax Reclassification adjustment for losses included in net income, net ofta 5.330 (794) BALANCE, January 28, 2017 48.622,7805 4 86 $ 139,398 $ 290,737 S 430,539 89,707 (133.874) 89,707 (133,874) Net income Dividends paid on common stock. ($2.75 per share) Issuance of non-vested stock, net of forfeitures Amortization of non-vested stock grants, net of forfeitures Change in unrcalized loss on investments, net of tax 193,390 4.83 BALANCE, February 3, 2018 45,816,170 S 144. 29 246570 1914 See notes to consolidated financial statements arative Analysis Ch 11 Help Save & Exit Check Financial information for American Eagle is presented in Appendix A and financial information for Buckle is presented in Appendix B. Required: 1. Calculate American Eagle's cash return on assets, cash flow to sales, and asset turnover ratio for the most recent year. (Round "Average total assets" answers to 1 decimal places. Enter your answers in thousands (le, $10,000,000 should be entered as 10,000).) = Cash Return on Assets Cash return on assets Choose Numerator Average current asset $ 333 Choose Numerator Net loss + Choose Denominator + Average total assets + + Choose Denominator * Net Sales 0 = Cash Flow to Sales Cash flow to sales 100.0% Asset Turnover = 333 Choose Numerator Operating cash flow $ 333 + - + Choose Denominator Total fixed assets - 333.0 Asset turnover 1.0 times 2. Calculate Buckle's cash return on assets, cash flow to sales, and asset turnover ratio for the most recent year. (Round "Average total assets" answers to 1 decimal places. Enter your answers in thousands (ie, $10,000,000 should be entered as 10,000). points Answer is not complete. Choose Numerator Financing cash flow 11 Choose Denominator Investing cash flow = - Cash Return on Assets Cash return on assets + 3 - - + = Choose Denominator Net loss Cash Flow to Sales Cash flow to sales Choose Numerator Net Income 11 Choose Numerator Net sales 11 1000 Asset Turnover Choose Denominator - Operating cash flow - 110 3 = Asset turnover times