Answered step by step

Verified Expert Solution

Question

1 Approved Answer

aperations over the years by acquiring more land and cows and improving its facilities to increase milk production and quality. Mina Moo started selling their

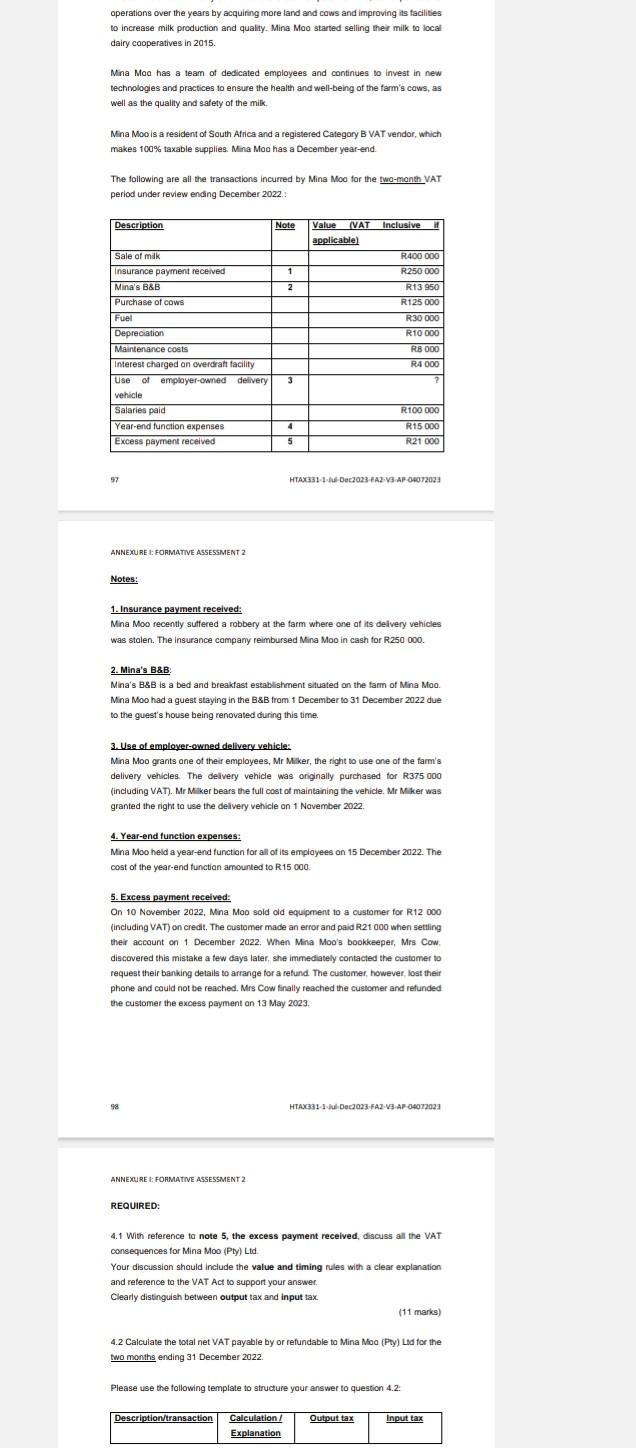

aperations over the years by acquiring more land and cows and improving its facilities to increase milk production and quality. Mina Moo started selling their milk to local dairy cooperatives in 2015. Mina Moo has a team of dedicated employees and continues to invest in new technologies and practices to ensure the health and well-being of the farm's cows, as well as the quality and satety of the mik. Mina Moo is a resident of South Africa and a registered Category B VAT vendor, which makes 100% taxable supplies. Mina Moo has a December year-end. The following are all the transactions incurred by Mina Moo for the two-month VAT period under review ending December 2022. 97 HTAX331-4.AL-Dec2023 FA2,V3-AP-O4On2023 ANNEXOURE I: FORMATINE ASSESSIMENT 2 Notes: 1. Insurance payment received: Mina Moo recently suffered a robbery at the farm where one at its delvery vehicles was stolen. The insurance company reimbursed Mina Moo in cash for R250 000 . 2. Mina's B8B Mina's B\&B is a bed and breakfast establishment siluated on the farm of Mina Moo. Mina Moo had a guest staying in the B\&B from 1 December to 31 December 2022 due to the guest's house being renovated during this time. 3. Use of employer-owned delivery vehicle: Mina Moo grants one of their employees, Mr Miker, the right to use one of the farm's delivery vehicles. The delvery vehicle was oniginally purchased for R375 000 (including VAT). Mr Miker bears the full cost of maintaining the vehicle. Mr Miker was granted the right to use the delivery vehicle on 1 November 2022. 4. Year-end function expenses: Mina Moo held a year-end function for all of its employees on 15 December 2022 . The cost of the year-end function amounted to R15 000 . 5. Excess payment received: On 10 November 2022, Mina Moo sold old equipment to a customer for R12 000 (including VAT) on credt. The customer made an error and paid R.21 000 when settling their account on 1 December 2022. When Mina Moo's bookkeeper, Mrs Cow, discovered this mistake a tew days later, she immediately contacted the customer to request their banking details to arrange for a retund. The customer, however, lost their phone and could not be reached. Mrs Cow finally reached the customer and refunded the customer the excess payment on 13 May 2023. ANNEXURE E: FORMATNE ASSESSMENT 2 REQUIRED: 4.1 With reference to note 5, the excess payment received, discuss all the VAT consequences for Mina Moo (Pty) Lid Your discussion should include the value and timing nules with a clear explanation and reterence to the VAT Act to support your answer. Clearly distinguish between output tax and input tax (11 marks) 4.2 Calculate the total net VAT payable by or refundable to Mina Moo (PDy) Ldd for the two months ending 31 December 2022. Please use the following template to structure your answer to question 4.2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started