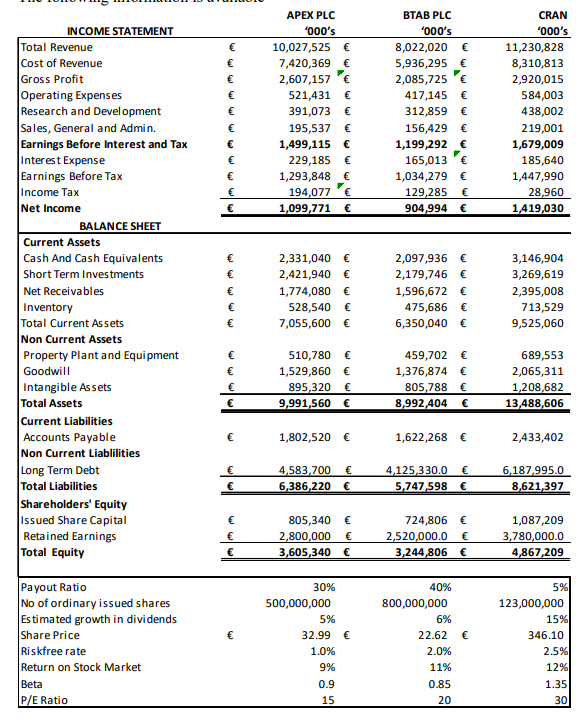

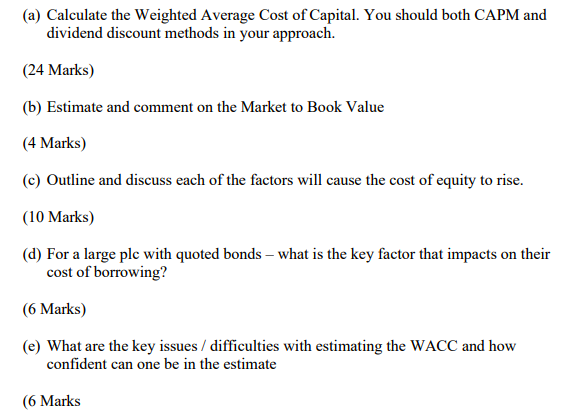

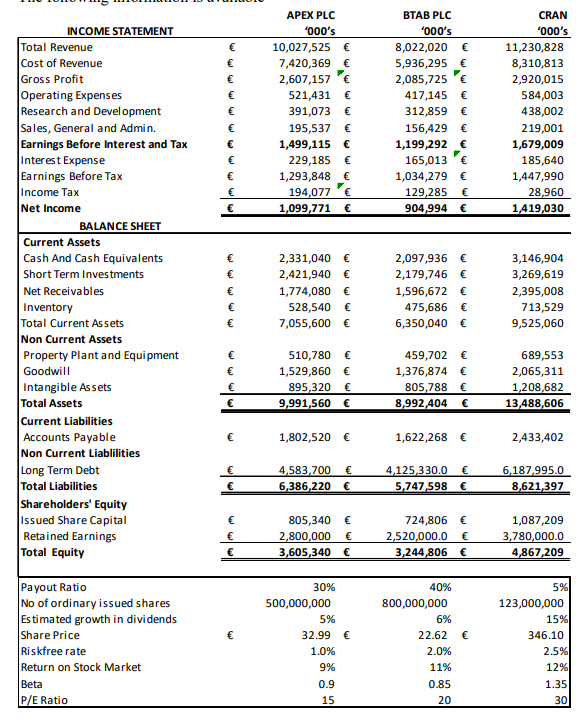

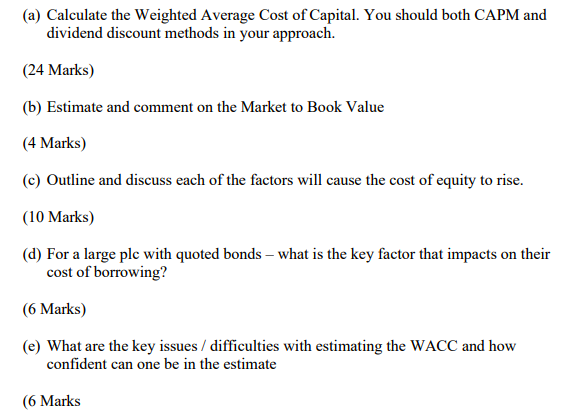

APEX PLC '000's 10,027,525 7,420,369 2,607,157 521,431 391,073 195,537 1,499,115 229,185 1,293,848 194,077 1,099,771 BTAB PLC '000's 8,022,020 5,936,295 2,085,725 417,145 312,859 156,429 1,199,292 165,013 1,034,279 129,285 904,994 CRAN '000's 11,230,828 8,310,813 2,920,015 584,003 438,002 219,001 1,679,009 185,640 1,447,990 28,960 1,419,030 INCOME STATEMENT Total Revenue Cost of Revenue Gross Profit Operating Expenses Research and Development Sales, General and Admin. Earnings Before Interest and Tax Interest Expense Earnings Before Tax Income Tax Net Income BALANCE SHEET Current Assets Cash And Cash Equivalents Short Term Investments Net Receivables Inventory Total Current Assets Non Current Assets Property Plant and Equipment Goodwill Intangible Assets Total Assets Current Liabilities Accounts Payable Non Current Liablilities Long Term Debt Total Liabilities Shareholders' Equity issued Share Capital Retained Earnings Total Equity 2,331,040 2,421,940 1,774,080 528,540 7,055,600 2,097,936 2,179,746 1,596,672 475,686 6,350,040 3,146,904 3,269,619 2,395,008 713,529 9,525,060 510,780 1,529,860 895,320 9,991,560 459,702 1,376,874 805,788 8,992,404 689,553 2,065,311 1,208,682 13,488,606 1,802,520 1,622,268 2,433,402 4,583,700 6,386,220 4,125,330.0 5,747,598 6,187,995.0 8,621,397 805,340 2,800,000 3,605,340 724,806 2,520,000.0 3,244,806 1,087,209 3,780,000.0 4,867,209 Payout Ratio No of ordinary issued shares Estimated growth in dividends Share Price Riskfree rate Return on Stock Market Beta P/E Ratio 30% 500,000,000 5% 32.99 1.0% 9% 0.9 15 40% 800,000,000 6% 22.62 2.0% 11% 0.85 20 5% 123,000,000 15% 346.10 2.5% 12% 1.35 30 (a) Calculate the Weighted Average Cost of Capital. You should both CAPM and dividend discount methods in your approach. (24 Marks) (b) Estimate and comment on the Market to Book Value (4 Marks) (c) Outline and discuss each of the factors will cause the cost of equity to rise. (10 Marks) (d) For a large ple with quoted bonds what is the key factor that impacts on their cost of borrowing? (6 Marks) (e) What are the key issues / difficulties with estimating the WACC and how confident can one be in the estimate (6 Marks APEX PLC '000's 10,027,525 7,420,369 2,607,157 521,431 391,073 195,537 1,499,115 229,185 1,293,848 194,077 1,099,771 BTAB PLC '000's 8,022,020 5,936,295 2,085,725 417,145 312,859 156,429 1,199,292 165,013 1,034,279 129,285 904,994 CRAN '000's 11,230,828 8,310,813 2,920,015 584,003 438,002 219,001 1,679,009 185,640 1,447,990 28,960 1,419,030 INCOME STATEMENT Total Revenue Cost of Revenue Gross Profit Operating Expenses Research and Development Sales, General and Admin. Earnings Before Interest and Tax Interest Expense Earnings Before Tax Income Tax Net Income BALANCE SHEET Current Assets Cash And Cash Equivalents Short Term Investments Net Receivables Inventory Total Current Assets Non Current Assets Property Plant and Equipment Goodwill Intangible Assets Total Assets Current Liabilities Accounts Payable Non Current Liablilities Long Term Debt Total Liabilities Shareholders' Equity issued Share Capital Retained Earnings Total Equity 2,331,040 2,421,940 1,774,080 528,540 7,055,600 2,097,936 2,179,746 1,596,672 475,686 6,350,040 3,146,904 3,269,619 2,395,008 713,529 9,525,060 510,780 1,529,860 895,320 9,991,560 459,702 1,376,874 805,788 8,992,404 689,553 2,065,311 1,208,682 13,488,606 1,802,520 1,622,268 2,433,402 4,583,700 6,386,220 4,125,330.0 5,747,598 6,187,995.0 8,621,397 805,340 2,800,000 3,605,340 724,806 2,520,000.0 3,244,806 1,087,209 3,780,000.0 4,867,209 Payout Ratio No of ordinary issued shares Estimated growth in dividends Share Price Riskfree rate Return on Stock Market Beta P/E Ratio 30% 500,000,000 5% 32.99 1.0% 9% 0.9 15 40% 800,000,000 6% 22.62 2.0% 11% 0.85 20 5% 123,000,000 15% 346.10 2.5% 12% 1.35 30 (a) Calculate the Weighted Average Cost of Capital. You should both CAPM and dividend discount methods in your approach. (24 Marks) (b) Estimate and comment on the Market to Book Value (4 Marks) (c) Outline and discuss each of the factors will cause the cost of equity to rise. (10 Marks) (d) For a large ple with quoted bonds what is the key factor that impacts on their cost of borrowing? (6 Marks) (e) What are the key issues / difficulties with estimating the WACC and how confident can one be in the estimate (6 Marks