Answered step by step

Verified Expert Solution

Question

1 Approved Answer

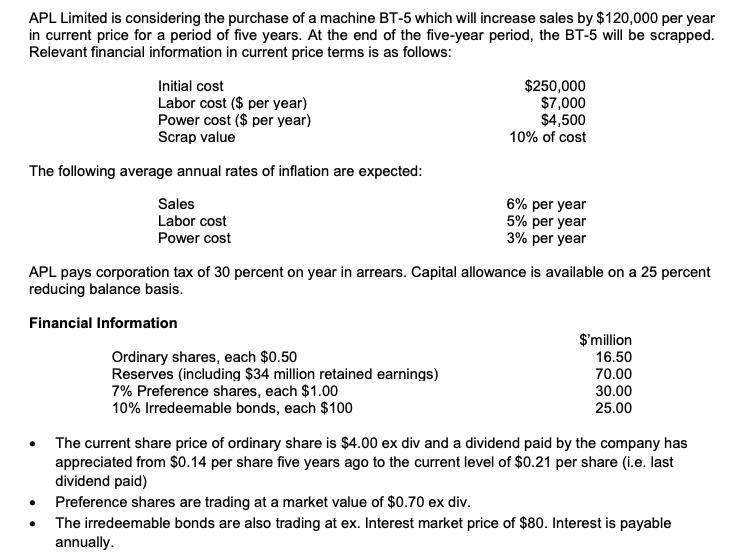

APL Limited is considering the purchase of a machine BT-5 which will increase sales by $120,000 per year in current price for a period

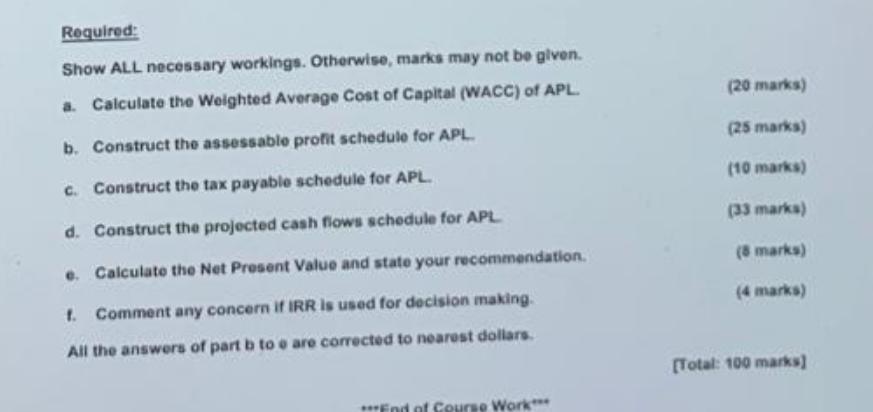

APL Limited is considering the purchase of a machine BT-5 which will increase sales by $120,000 per year in current price for a period of five years. At the end of the five-year period, the BT-5 will be scrapped. Relevant financial information in current price terms is as follows: Initial cost Labor cost ($ per year) Power cost ($ per year) Scrap value The following average annual rates of inflation are expected: Sales Labor cost Power cost $250,000 $7,000 $4,500 10% of cost Ordinary shares, each $0.50 Reserves (including $34 million retained earnings) 7% Preference shares, each $1.00 10% Irredeemable bonds, each $100 6% per year 5% per year 3% per year APL pays corporation tax of 30 percent on year in arrears. Capital allowance is available on a 25 percent reducing balance basis. Financial Information $'million 16.50 70.00 30.00 25.00 The current share price of ordinary share is $4.00 ex div and a dividend paid by the company has appreciated from $0.14 per share five years ago to the current level of $0.21 per share (i.e. last dividend paid) Preference shares are trading at a market value of $0.70 ex div. The irredeemable bonds are also trading at ex. Interest market price of $80. Interest is payable annually. Required: Show ALL necessary workings. Otherwise, marks may not be given. a. Calculate the Weighted Average Cost of Capital (WACC) of APL. b. Construct the assessable profit schedule for APL. c. Construct the tax payable schedule for APL. d. Construct the projected cash flows schedule for APL e. Calculate the Net Present Value and state your recommendation. f. Comment any concern if IRR is used for decision making. All the answers of part b to e are corrected to nearest dollars. ***End of Course Work*** (20 marks) (25 marks) (10 marks) (33 marks) (8 marks) (4 marks) [Total: 100 marks]

Step by Step Solution

★★★★★

3.39 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION a Calculate the Weighted Average Cost of Capital WACC WACC Kinetic Capital x K Preferred Stock x P Debt x D Total Capital Where K 030 corpora...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started