Question: Apollo Shoes is an audit case that is designed to help students better understand the audit process beginning with the planning stages of the audit.

Apollo Shoes is an audit case that is designed to help students better understand the audit process beginning with the planning stages of the audit. You should put yourself in the role of an in-charge auditor.

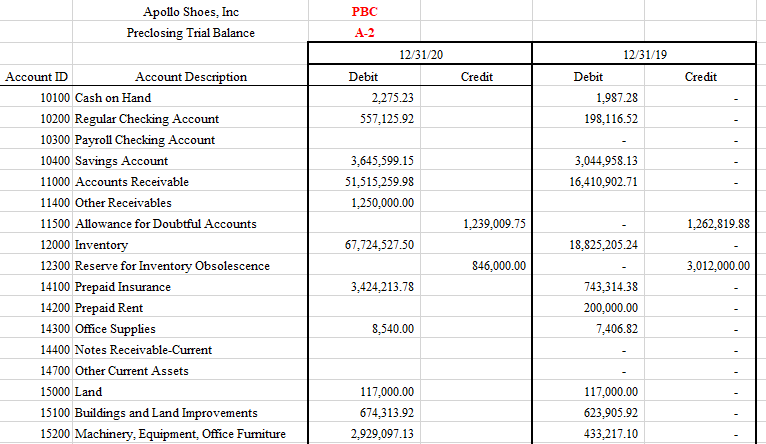

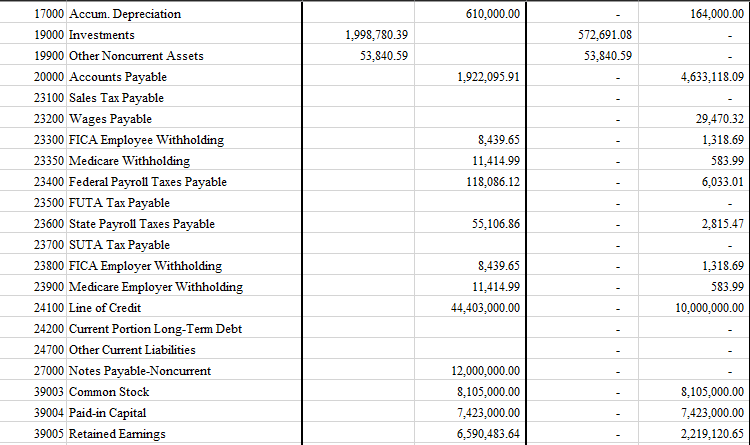

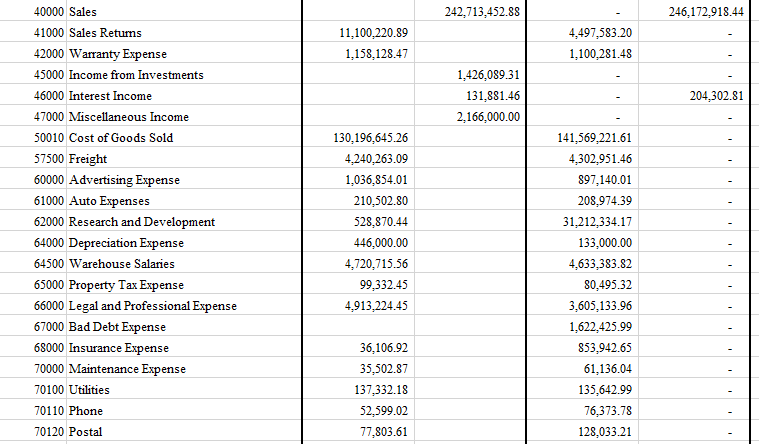

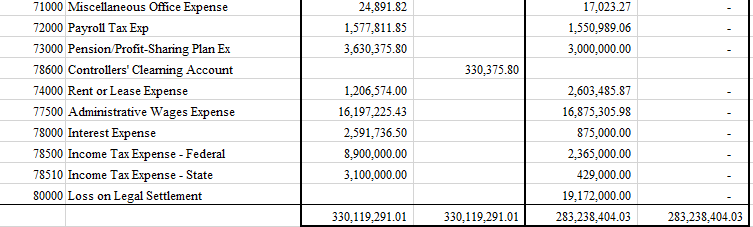

PART I Using the comparative Trial Balance (at eLearn) prepare the financial statements. Every account on the trial balance will go to either the Income Statement (revenues, contra revenues, gains, income, expenses, losses) or the Balance Sheet (assets, contra assets, liabilities, owners equity).

- Income Statement: Prepare the Income Statement first (not a formal income statement- just an excel statement). Put the financial statement on the same sheet beneath the comparative trial balance.

- Copy and paste the revenues, contra revenues, gains, income, expenses, losses. Make sure that the accounts that have credit balances are copied into the credit column and that the accounts with debit balances are copied into the debit column.

- Retained Earnings Statement

- Balance Sheet: Prepare the Retained Earnings Statement and Balance Sheet next.

- Remember that every account not on the Income Statement will be on the Balance Sheet (See Chapter 4- ACCT 201 book). Copy and paste the assets, contra assets, liabilities, owners equity from the trial balance to the Balance Sheet.

- Do not prepare a classified balance sheet. You do not need classifications or categories.

- Remember that the income from the Income Statement must be added to retained earnings on the Retained Earnings Statement.

- Remember that the ending retained earnings balance from the Retained Earnings Statement must be shown as the ending retained earnings on the Balance Sheet.

***If you carry all of the balances over as indicated above everything will balance.

PART 2

Using Excel income statement and balance sheet prepare the following:

- Common Size Income Statement: Accounting Principles textbooks show how to calculate common size percentages, trend percentages, and ratios. (Chapter 17 in the Principles text we used here.)

- Just copy the previously prepared income statement excel worksheet and add columns to show common size percentages.

- Common size Balance Sheet

- Just copy the previously prepared balance sheet excel worksheet and add columns to show common size percentages.

- Trend Percentages

- Calculate trend percentages for only the following accounts. The base year should be set equal to 100% and the other years shown as a percentage relative to the base year.

Show the trends for 2020, 2019, and 2018 (base year).

Find the 2020and 2019 numbers on your trial balance spreadsheets. Find 2018 numbers on the company income statement on the form 10-K which can be found at the very bottom of this document.

Prepare trend percentages only for the following accounts:

Sales-net

Cost of goods sold

Gross profit

Net Income

610,000.00 164,000.00 1.998,780.39 53,840.59 572,691.08 53,840.59 1,922,095.91 4,633,118.09 8,439.65 11,414.99 118,086.12 29,470.32 1,318.69 583.99 6,033.01 17000 Accum. Depreciation 19000 Investments 19900 Other Noncurrent Assets 20000 Accounts Payable 23100 Sales Tax Payable 23200 Wages Payable 23300 FICA Employee Withholding 23350 Medicare Withholding 23400 Federal Payroll Taxes Payable 23500 FUTA Tax Payable 23600 State Payroll Taxes Payable 23700 SUTA Tax Payable 23800 FICA Employer Withholding 23900 Medicare Employer Withholding 24100 Line of Credit 24200 Current Portion Long-Term Debt 24700 Other Current Liabilities 27000 Notes Payable-Noncurrent 39003 Common Stock 39004 Paid-in Capital 39005 Retained Eamings 55.106.86 2.815.47 8,439.65 11,414.99 44.403,000.00 1,318.69 583.99 10,000,000.00 12,000,000.00 8,105,000.00 7,423,000.00 6,590,483.64 8,105,000.00 7.423,000.00 2,219,120.65 242,713,452.88 246,172,918.44 11,100,220.89 1,158,128.47 4,497,583.20 1,100,281.48 1,426,089.31 131,881.46 2,166,000.00 204,302.81 40000 Sales 41000 Sales Retums 42000 Warranty Expense 45000 Income from Investments 46000 Interest Income 47000 Miscellaneous Income 50010 Cost of Goods Sold 57500 Freight 60000 Advertising Expense 61000 Auto Expenses 62000 Research and Development 64000 Depreciation Expense 64500 Warehouse Salaries 65000 Property Tax Expense 66000 Legal and Professional Expense 67000 Bad Debt Expense 68000 Insurance Expense 70000 Maintenance Expense 70100 Utilities 70110 Phone 70120 Postal 130.196,645.26 4,240,263.09 1,036,854.01 210,502.80 528.870.44 446,000.00 4.720,715.56 99,332.45 4,913.224.45 141,569.221.61 4,302,951.46 897,140.01 208,974.39 31,212,334.17 133,000.00 4,633,383.82 80,495.32 3,605,133.96 1,622,425.99 853,942.65 61,136.04 135.642.99 76,373.78 128.033.21 - 36,106.92 35,502.87 137.332.18 52,599.02 77,803.61 - 24,891.82 1,577,811.85 3.630,375.80 17,023.27 1,550.989.06 3,000,000.00 330,375.80 71000 Miscellaneous Office Expense 72000 Payroll Tax Exp 73000 Pension Profit Sharing Plan Ex 78600 Controllers' Clearning Account 74000 Rent or Lease Expense 77500 Administrative Wages Expense 78000 Interest Expense 78500 Income Tax Expense - Federal 78510 Income Tax Expense - State 80000 Loss on Legal Settlement 1,206,574.00 16,197,225.43 2,591,736.50 8,900,000.00 3,100,000.00 2,603,485.87 16,875,305.98 875,000.00 2,365,000.00 429,000.00 19,172,000.00 283,238,404.03 330,119,291.01 330,119,291.01 283.238.404.03 610,000.00 164,000.00 1.998,780.39 53,840.59 572,691.08 53,840.59 1,922,095.91 4,633,118.09 8,439.65 11,414.99 118,086.12 29,470.32 1,318.69 583.99 6,033.01 17000 Accum. Depreciation 19000 Investments 19900 Other Noncurrent Assets 20000 Accounts Payable 23100 Sales Tax Payable 23200 Wages Payable 23300 FICA Employee Withholding 23350 Medicare Withholding 23400 Federal Payroll Taxes Payable 23500 FUTA Tax Payable 23600 State Payroll Taxes Payable 23700 SUTA Tax Payable 23800 FICA Employer Withholding 23900 Medicare Employer Withholding 24100 Line of Credit 24200 Current Portion Long-Term Debt 24700 Other Current Liabilities 27000 Notes Payable-Noncurrent 39003 Common Stock 39004 Paid-in Capital 39005 Retained Eamings 55.106.86 2.815.47 8,439.65 11,414.99 44.403,000.00 1,318.69 583.99 10,000,000.00 12,000,000.00 8,105,000.00 7,423,000.00 6,590,483.64 8,105,000.00 7.423,000.00 2,219,120.65 242,713,452.88 246,172,918.44 11,100,220.89 1,158,128.47 4,497,583.20 1,100,281.48 1,426,089.31 131,881.46 2,166,000.00 204,302.81 40000 Sales 41000 Sales Retums 42000 Warranty Expense 45000 Income from Investments 46000 Interest Income 47000 Miscellaneous Income 50010 Cost of Goods Sold 57500 Freight 60000 Advertising Expense 61000 Auto Expenses 62000 Research and Development 64000 Depreciation Expense 64500 Warehouse Salaries 65000 Property Tax Expense 66000 Legal and Professional Expense 67000 Bad Debt Expense 68000 Insurance Expense 70000 Maintenance Expense 70100 Utilities 70110 Phone 70120 Postal 130.196,645.26 4,240,263.09 1,036,854.01 210,502.80 528.870.44 446,000.00 4.720,715.56 99,332.45 4,913.224.45 141,569.221.61 4,302,951.46 897,140.01 208,974.39 31,212,334.17 133,000.00 4,633,383.82 80,495.32 3,605,133.96 1,622,425.99 853,942.65 61,136.04 135.642.99 76,373.78 128.033.21 - 36,106.92 35,502.87 137.332.18 52,599.02 77,803.61 - 24,891.82 1,577,811.85 3.630,375.80 17,023.27 1,550.989.06 3,000,000.00 330,375.80 71000 Miscellaneous Office Expense 72000 Payroll Tax Exp 73000 Pension Profit Sharing Plan Ex 78600 Controllers' Clearning Account 74000 Rent or Lease Expense 77500 Administrative Wages Expense 78000 Interest Expense 78500 Income Tax Expense - Federal 78510 Income Tax Expense - State 80000 Loss on Legal Settlement 1,206,574.00 16,197,225.43 2,591,736.50 8,900,000.00 3,100,000.00 2,603,485.87 16,875,305.98 875,000.00 2,365,000.00 429,000.00 19,172,000.00 283,238,404.03 330,119,291.01 330,119,291.01 283.238.404.03

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts