Answered step by step

Verified Expert Solution

Question

1 Approved Answer

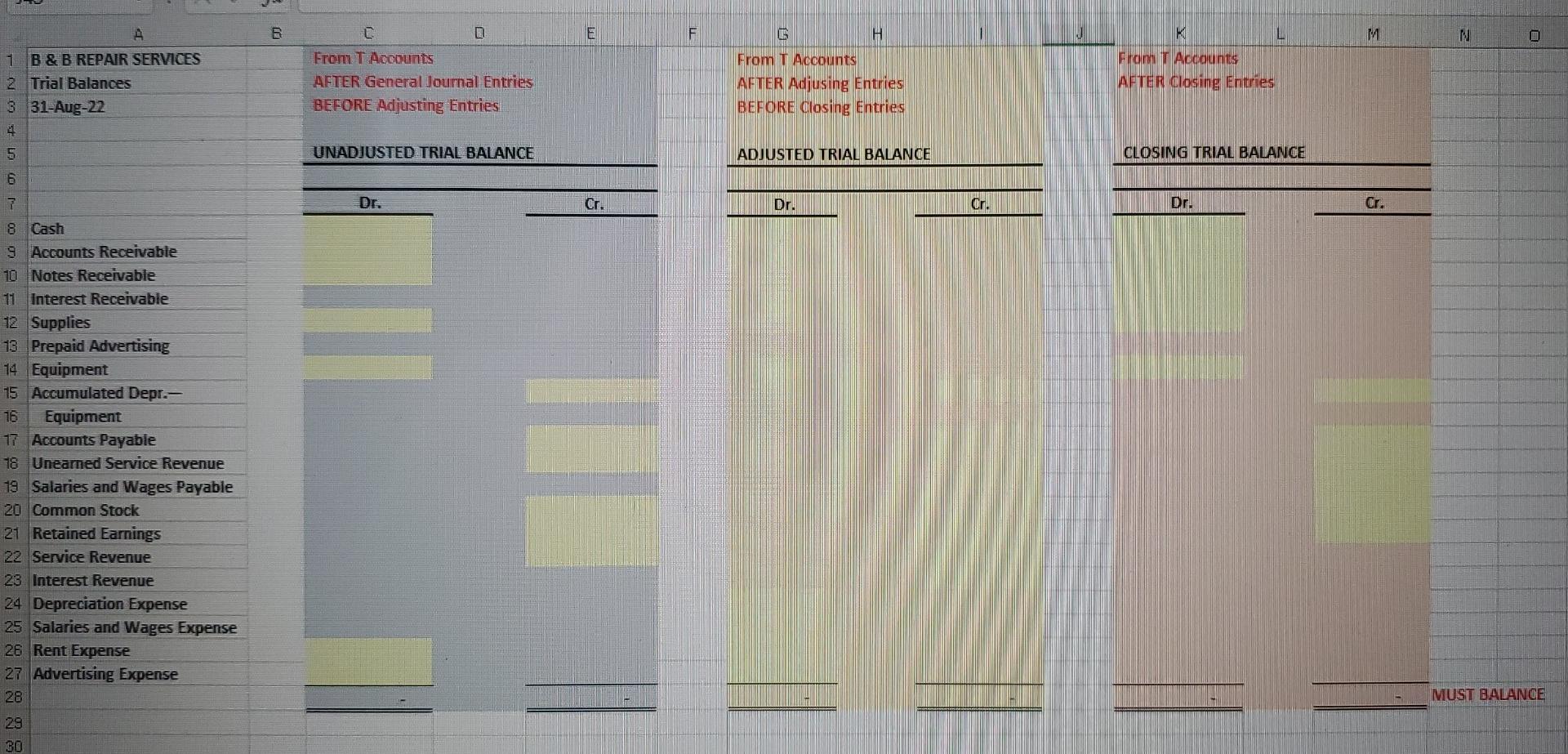

Apologies for the long problem however it is urgent I just have to fill in all the highlighted blanks any help is appreciated very much

Apologies for the long problem however it is urgent I just have to fill in all the highlighted blanks any help is appreciated very much thank you.

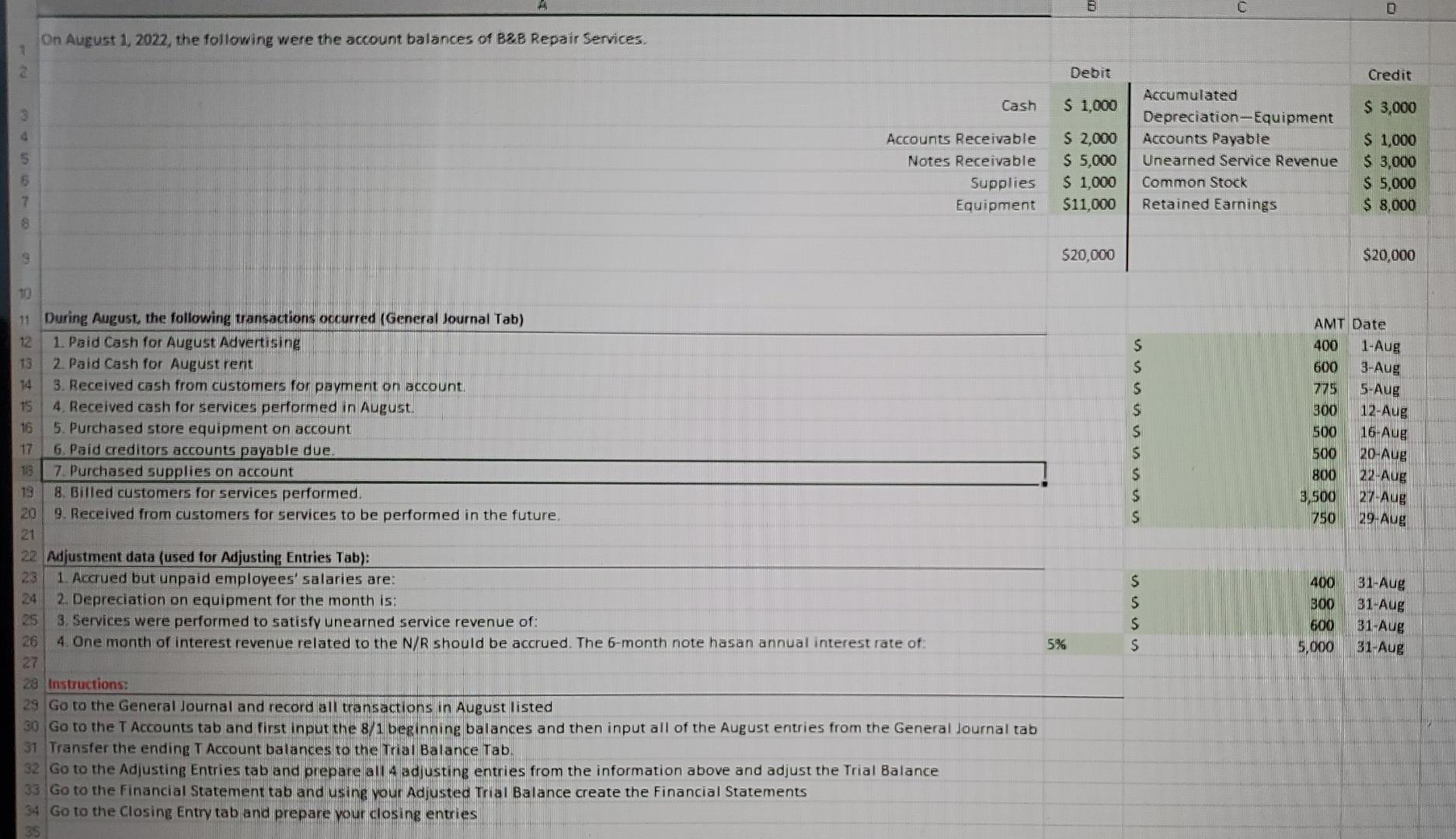

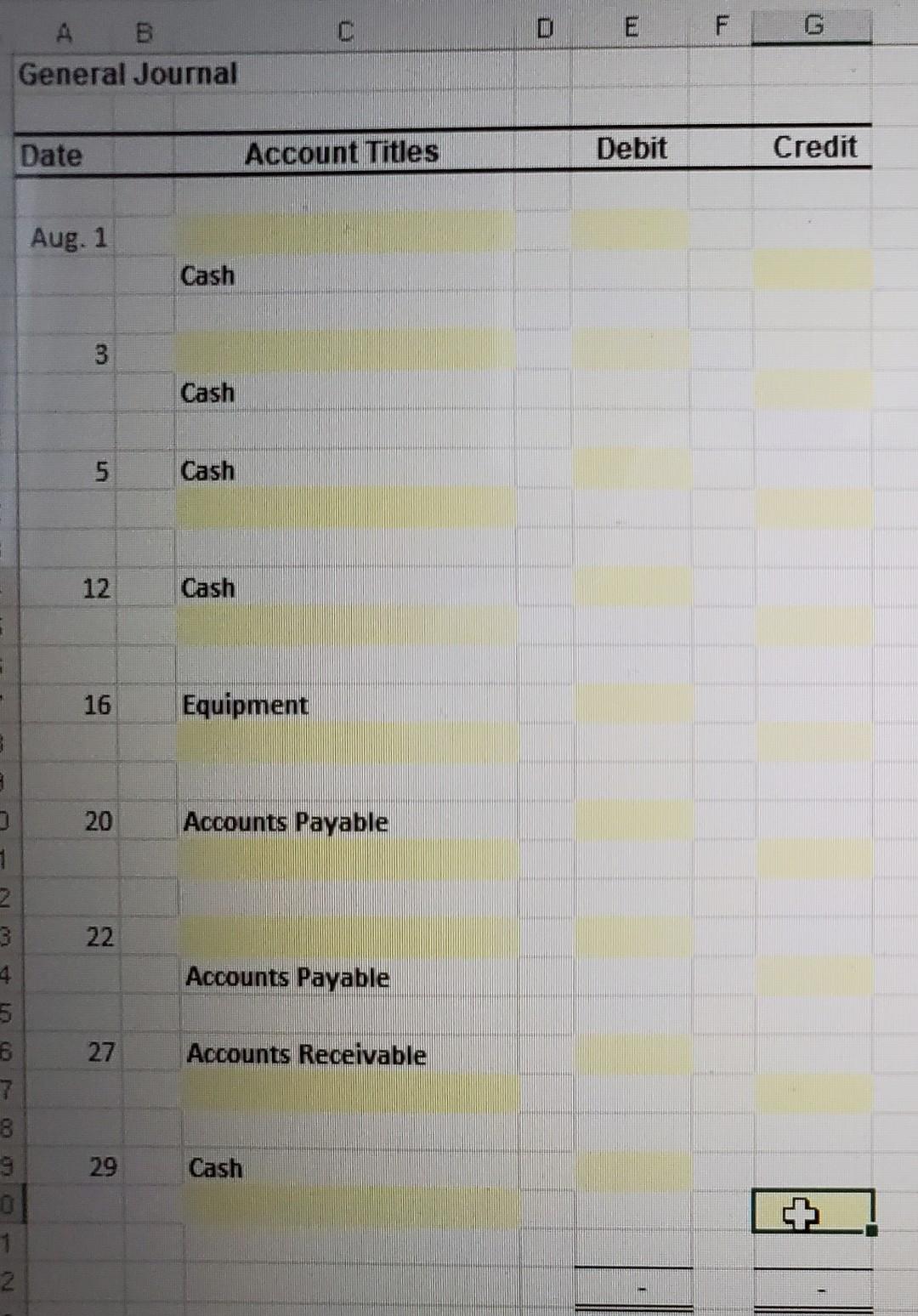

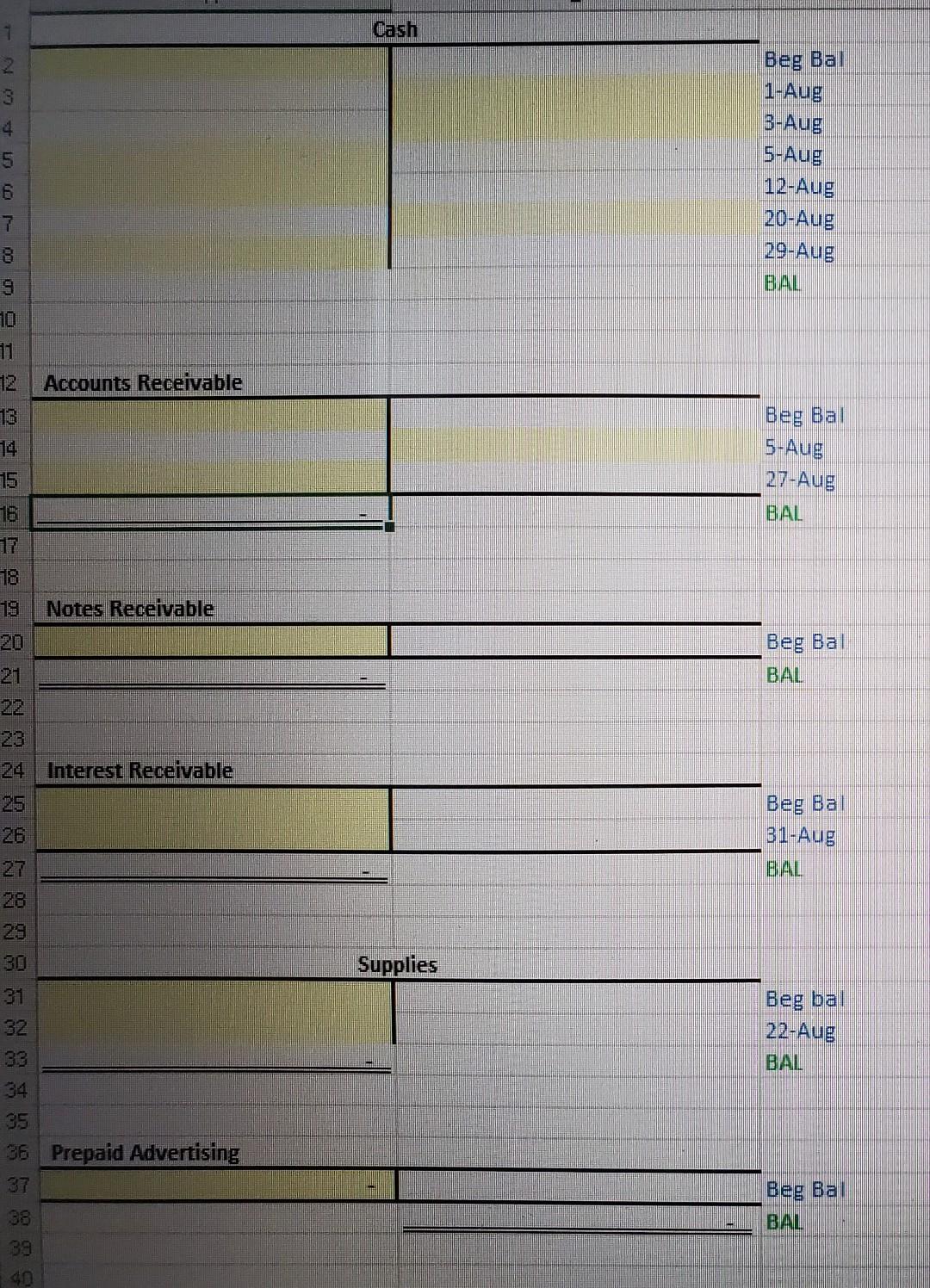

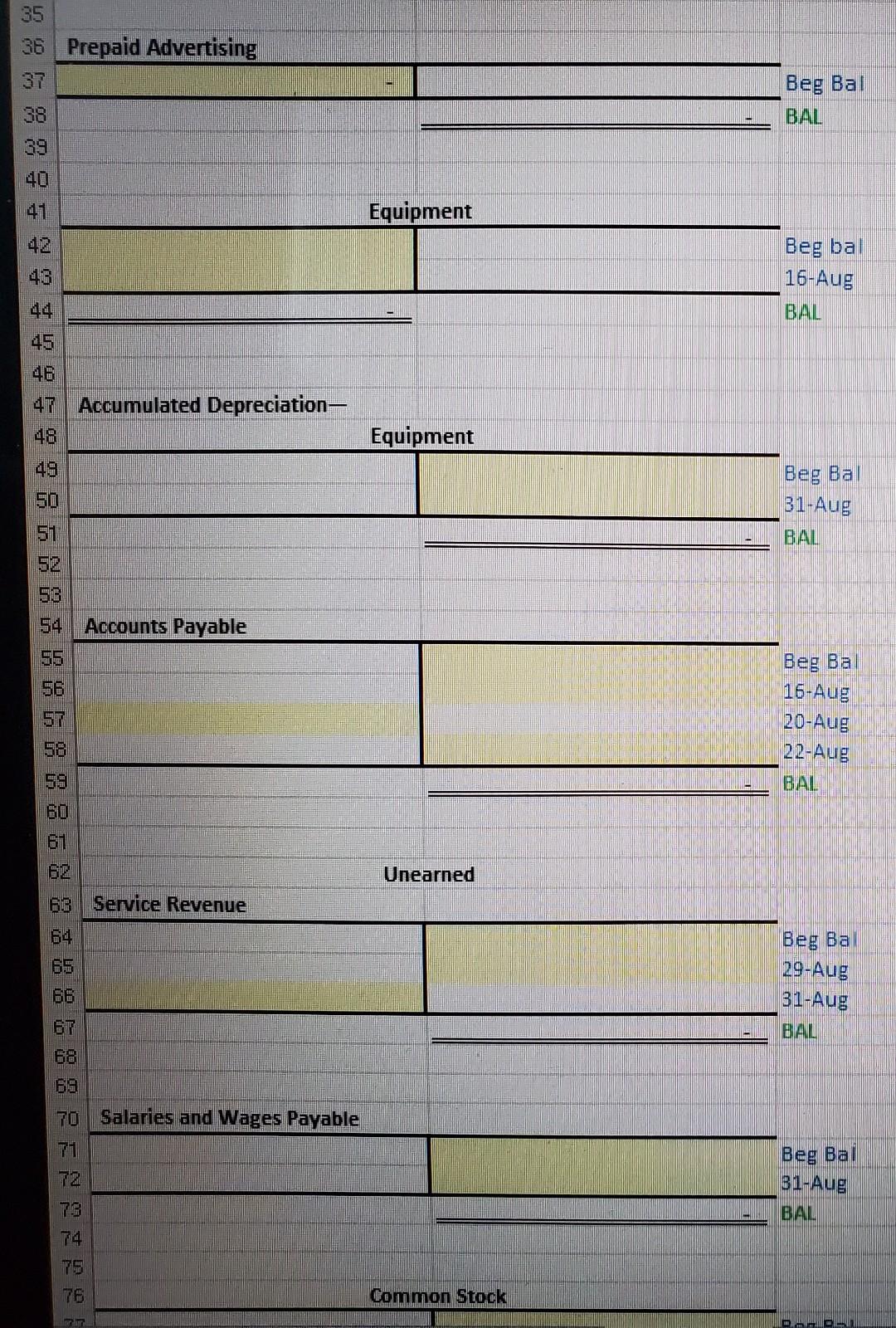

D On August 1, 2022, the following were the account balances of B2B Repair Services Debit Credit Cash $ 1,000 $ 3,000 Accounts Receivable Notes Receivable Supplies Equipment 5 6 7 8 Accumulated Depreciation-Equipment Accounts Payable Unearned Service Revenue Common Stock Retained Earnings $ 2,000 S 5,000 $ 1,000 $11,000 $ 1,000 $ 3,000 $ 5,000 $ 8,000 9 520,000 $20,000 775 rinunnurinn AMT Date 400 1-Aug 600 3-Aug 5-Aug 300 12-Aug 500 16-Aug 500 20-Aug 800 22-Aug 3,500 27 Aug 750 29-Aug $ 11 During August, the following transactions occurred (General Journal Tab) 12 1. Paid Cash for August Advertising 13 2. Paid Cash for August rent 3. Received cash from customers for payment on account. 75 4. Received cash for services performed in August. 16 5. Purchased store equipment on account 17 6. Paid creditors accounts payable due 19 7. Purchased supplies on account 13 8. Billed customers for services performed. 20 9. Received from customers for services to be performed in the future, 21 22 Adjustment data (used for Adjusting Entries Tab): 28 1. Accrued but unpaid employees' salaries are: 2.Depreciation on equipment for the month is: 25 3. Services were performed to satisfy unearned service revenue of: 4. One month of interest revenue related to the N/R should be accrued. The 6-month note hasan annual interest rate of 27 28 Instructions: 29 Go to the General Journal and record all transactions in August listed 30 Go to the T Accounts tab and first input the 8/1 beginning balances and then input all of the August entries from the General Journal tab 31 Transfer the ending T Account balances to the Trial Balance Tab. 32 Go to the Adjusting Entries tab and prepare all 4 adjusting entries from the information above and adjust the Trial Balance 33 Go to the Financial Statement tab and using your Adjusted Tral Balance create the Financial Statements 34 Go to the Closine Entry tab and prepare your closing entries 35 $ 5 $ S 400 300 600 5,000 31-Aug 31-Aug 31-Aug 31-Aug 5% E F in General Journal Date Account Titles Debit Credit Aug. 1 Cash 3 Cash Un 5 Cash 12 Cash 16 Equipment 20 Accounts Payable 3 7 2 22 Accounts Payable 4 5 8 7 8 27 Accounts Receivable OLD00 29 Cash 0 1 2 Cash Beg Bal 2 3 4 5 1-Aug 3-Aug 5-Aug 12-Aug 20-Aug 29-Aug 6 7 9 BAL 10 71 Accounts Receivable Beg Bal 5-Aug 27-Aug BAL Notes Receivable Beg Bal BAL 24 Interest Receivable Beg Bal 31-Aug BAL uoo & ANTANA 8 85 SSSSSSS 29 Supplies 32 Beg bal 22-Aue BAL 33 34 35 36 Prepaid Advertising 37 Beg Bal BAL 35 36 Prepaid Advertising 37 Beg Bal BAL 41 Equipment 4 Beg bal 16-Aug BAL 44 46 Accumulated Depreciation- 48 Equipment Beg Bal 50 31-Aug 51 BAL mgmm8%B%8mmBBB%E88n 53 54 Accounts Payable 55 Beg Ba 16-Aug 20-Aug 22-Aug BAL 58 Unearned 63 Service Revenue 64 Beg Bal 86 29-Aug 31-Aug BAL 68 69 TO Salaries and Wages Payable 71 Beg Bai 31-Aug BAL 78 74 76 Common Stock OLDA Common Stock Beg Bal BAL 73 30 Service Revenue 81 Beg Bal 83 814 85 88 12-Aug 27-Aug 31-Aug BAL CLOSING 87 88 Interest Revenue 89 90 Beg Bal 31-Aug BAL CLOSING 91 92 93 94 Depreciation Expense 95 Beg Ba 96 97 98 31-Aug BAL CLOSING 99 100 101 Salaries and Wages Expense 102 Beg Ba 10- 31-Aug BAL CLOSING 104 105 108 0 108 Rent Expense Beg Bal 3-Aug BAL CLOSING Beg Bal 1 Aug General Journal T Accounts Adjusting Ent A16Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

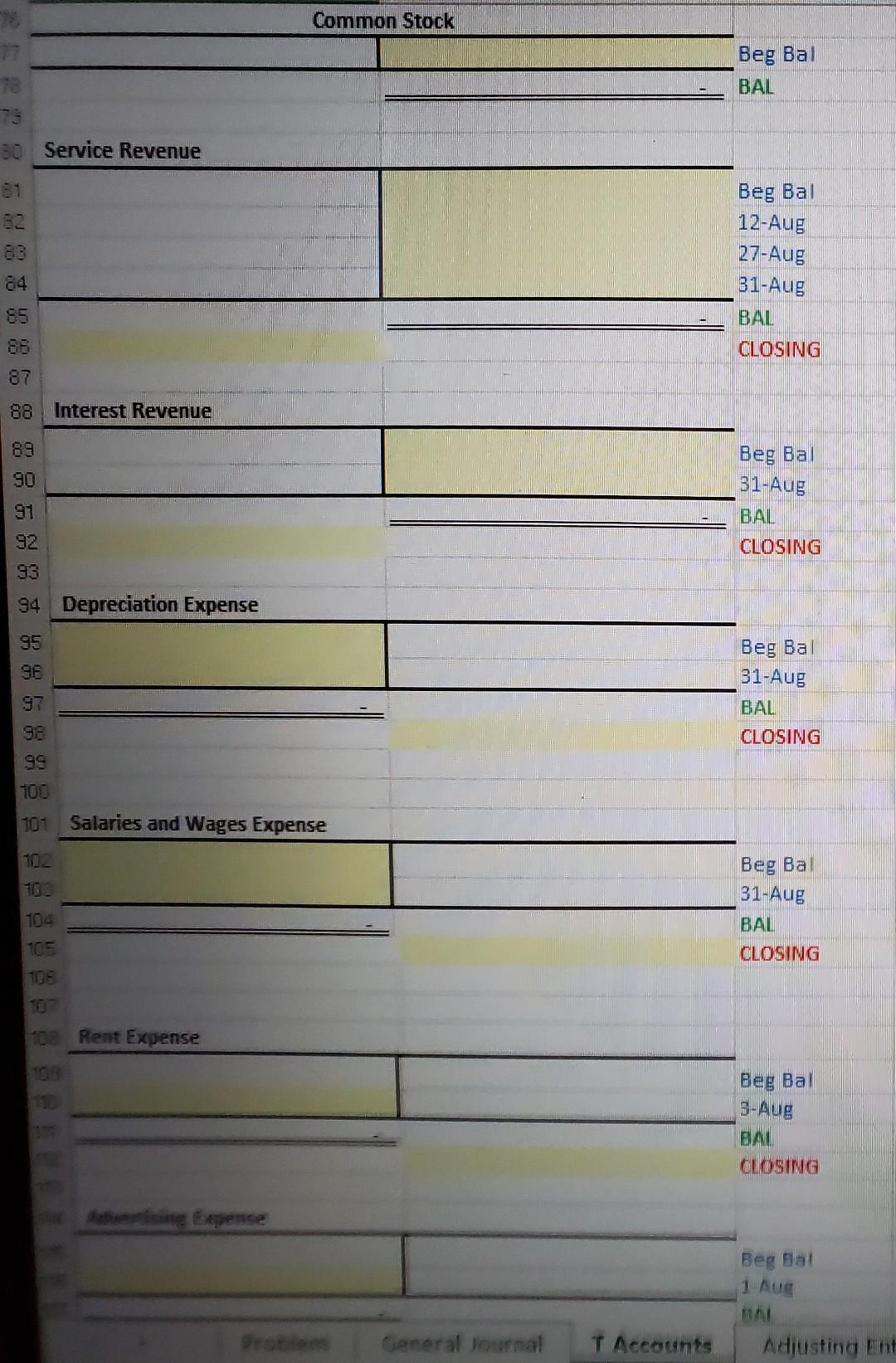

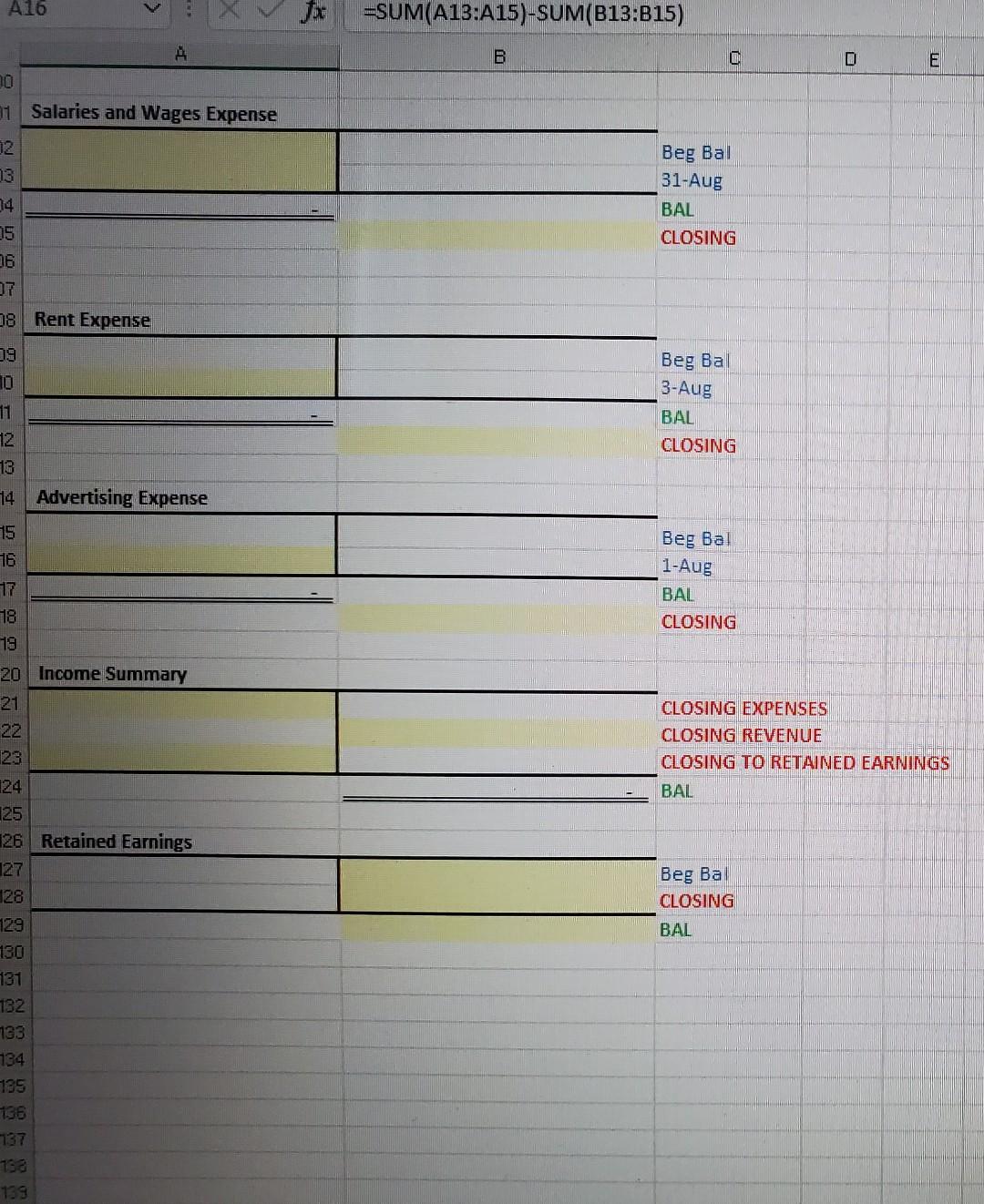

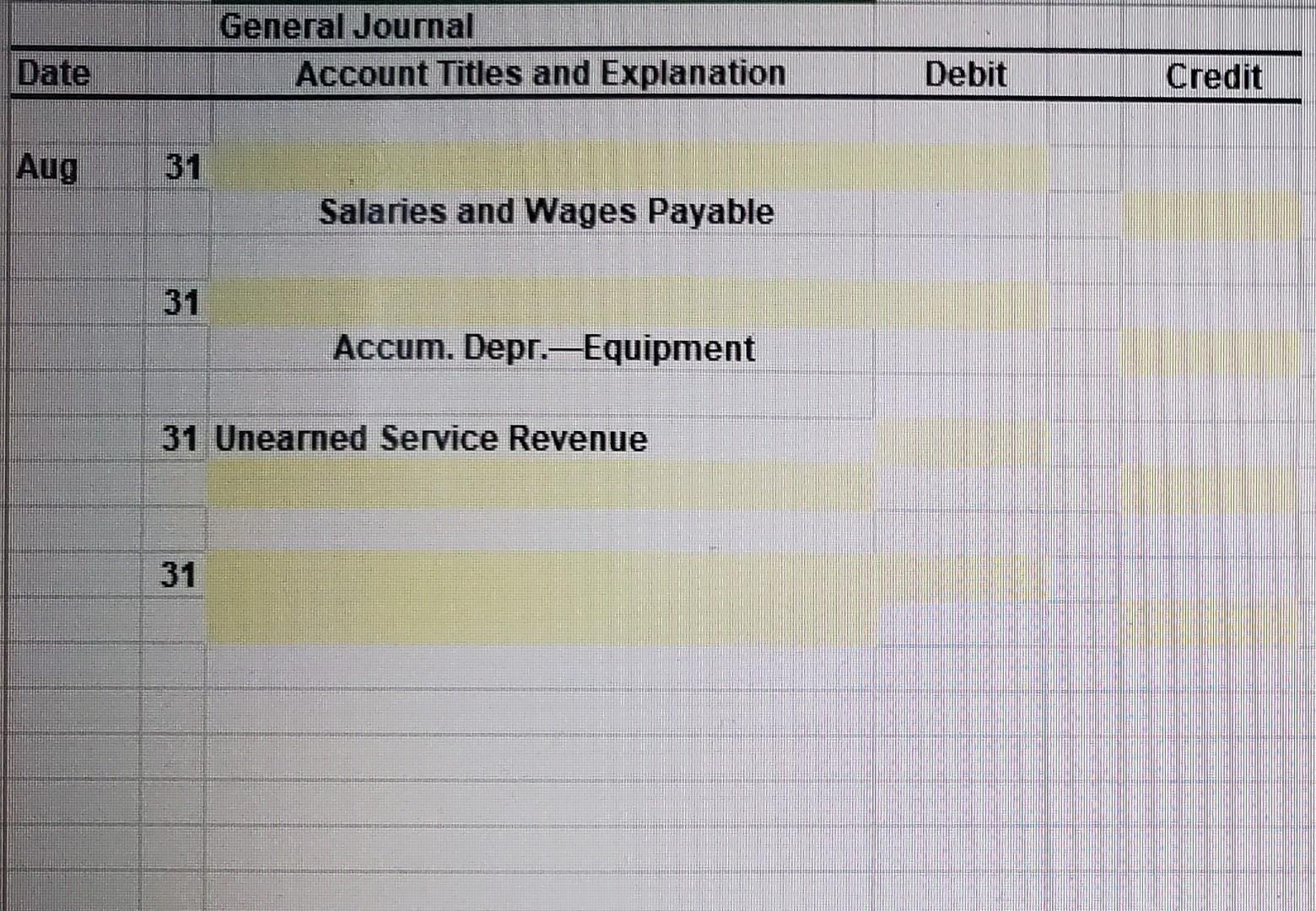

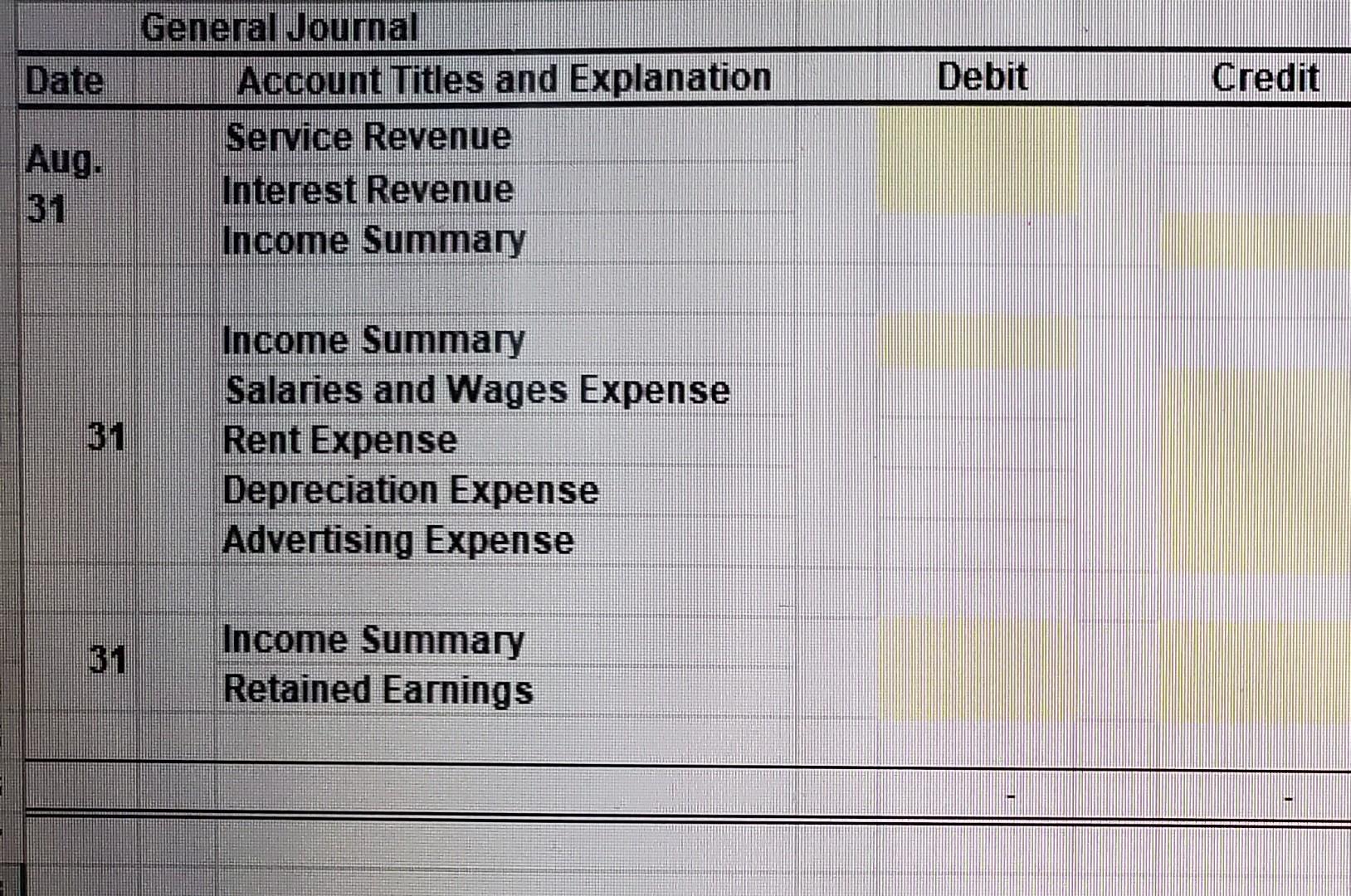

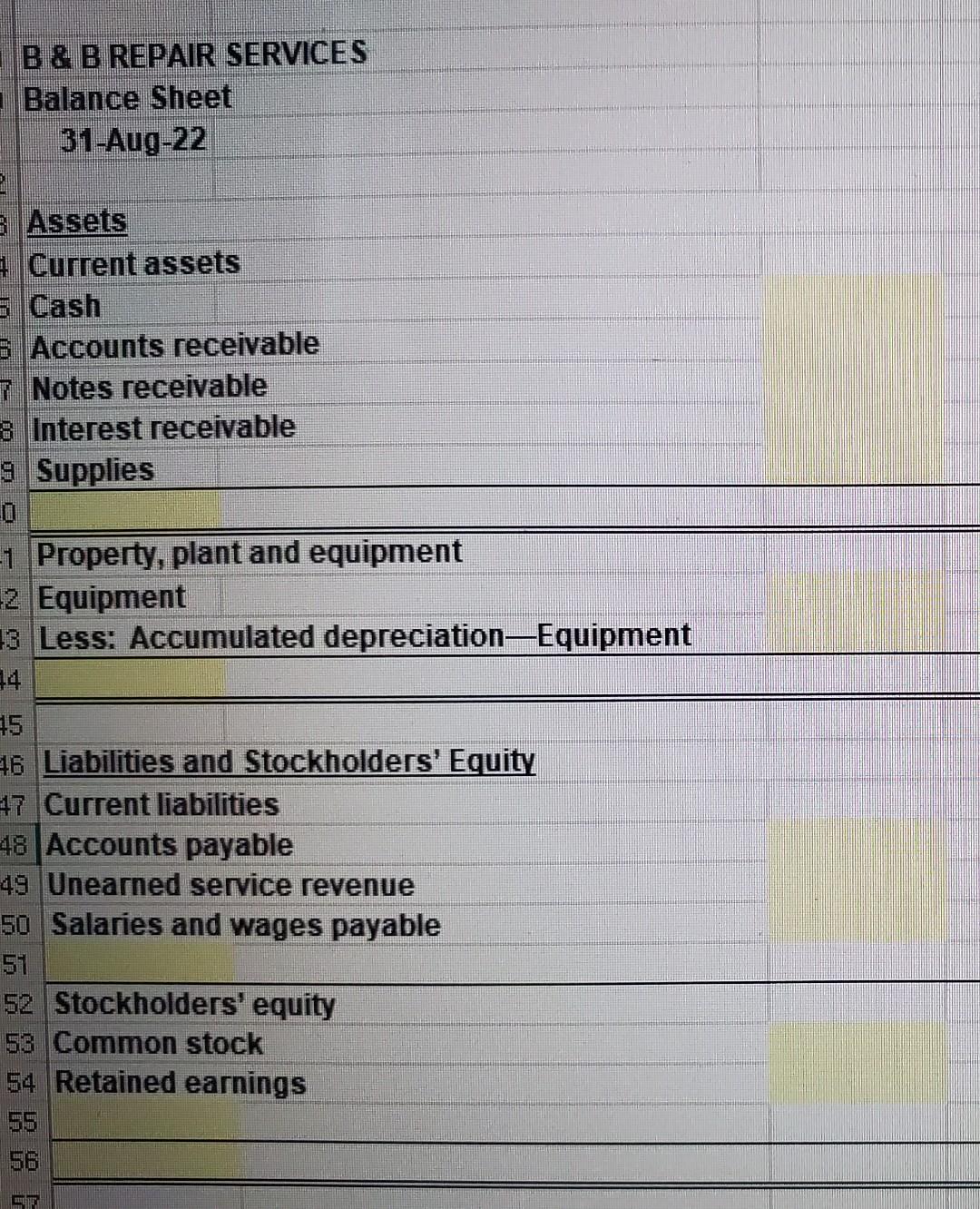

Get Started