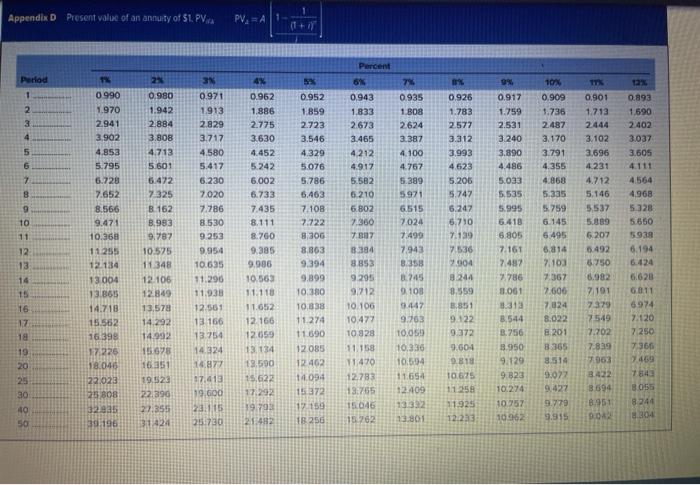

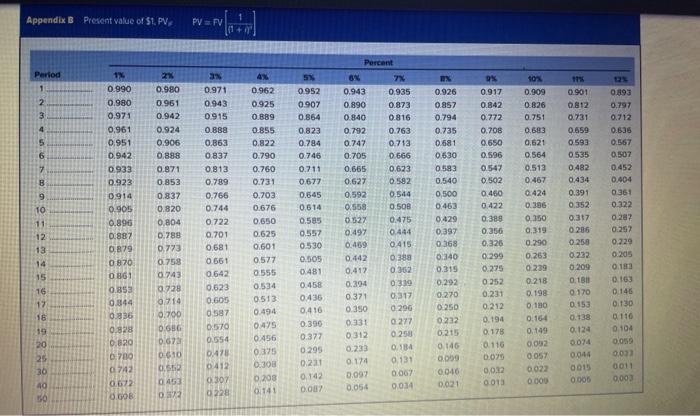

app B

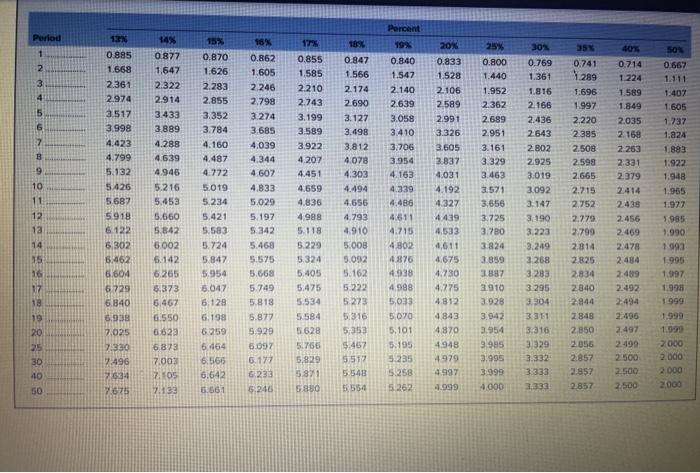

AppD

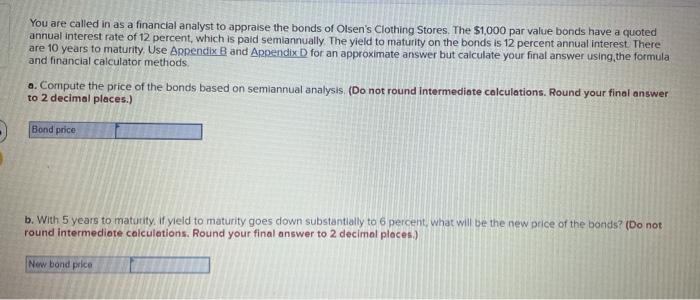

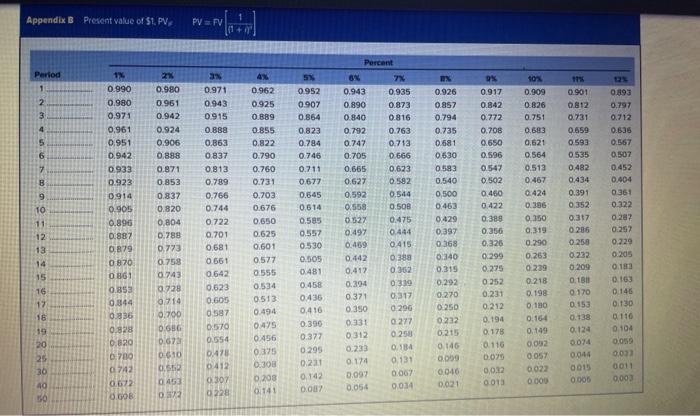

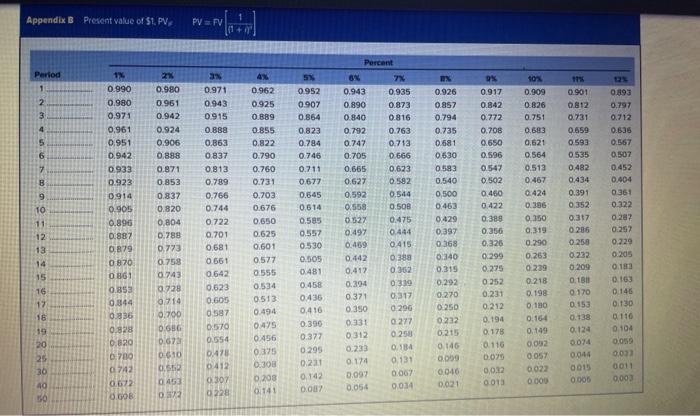

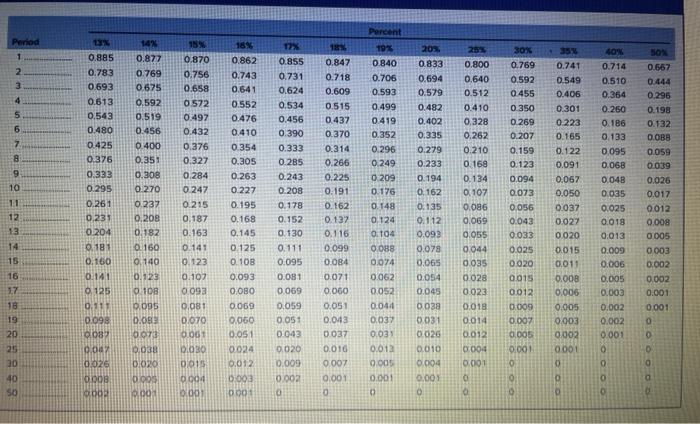

You are called in as a financial analyst to appraise the bonds of Olsen's Clothing Stores. The $1,000 par value bonds have a quoted annual interest rate of 12 percent, which is paid semiannually. The yield to maturity on the bonds is 12 percent annual interest There are 10 years to maturity. Use Appendix B and Appendix D for an approximate answer but calculate your final answer using the formula and financial calculator methods. a. Compute the price of the bonds based on semiannual analysis (Do not round intermediate calculations. Round your final answer to 2 decimal places.) Bond price b. With 5 years to maturity. If yield to maturity goes down substantially to 6 percent, what will be the new price of the bonds? (Do not round intermediate calculations. Round your final answer to 2 decimal places.) New bond price Appendix B Present value of S1, PV PVFV Period 1 EN 2 3 4 5 6 7 B 9 10 11 12 11 0.990 0.980 0.971 0.961 0.951 0.942 0933 0.923 0914 0.905 0.890 0.887 0.879 0870 O 361 0.33 0.944 0936 0.828 0.820 0.709 0742 0012 W.GOB 21 0.980 0.961 0.942 0.924 0.906 0.888 0.871 0.853 0.837 0.820 0.804 0.788 0.773 0.750 0743 0.728 0714 0.700 0.686 0.623 0.971 0.943 0915 O.BBS 0.863 0.837 0.813 0.789 0.766 0.744 0.722 0.701 0.681 0.651 0642 0.623 0.605 0587 0.570 0.554 0.478 0412 01307 0228 0.962 0.925 0.889 0.855 0.822 0.790 0.760 0.731 0.703 0.676 0.650 0.625 0.601 0.577 0.555 0.534 0513 0.494 0.45 0.456 015 030 0.208 SX 0.952 0.907 0.864 0.823 0.784 0.746 0.711 0.677 0.545 0.614 0.585 0.557 0.530 0.305 0.481 0.458 04:36 0.416 0.390 0377 0295 0.221 0.142 0.007 Percent 7% 0.943 0.935 0.890 0.873 0.840 0.816 0.792 0.763 0.747 0.713 0.705 0.666 0.655 0.623 0.627 0.582 0.592 0.544 0.558 0.508 0327 0.475 0.497 0.444 0.409 0415 0.442 0.380 0.412 0.362 0.394 0.339 0.371 0:317 0.350 0 290 0331 0312 0.250 0.233 0.134 0.174 0.131 0,097 0.007 0.054 0.034 0.926 0.857 0.794 0.735 0.681 0.530 0.583 0.540 0.500 0.463 0429 0.397 0.368 0.340 0.315 0.292 0270 0.250 0232 0.215 0.145 0.059 0046 0.021 0% 0917 0.842 0.772 0.708 0.650 0.596 0.547 0.502 0.460 0.422 0.388 0.356 0.326 0.299 0.275 0.252 0.231 0.212 0.194 0.178 0 116 0.079 0032 0013 0.909 0.826 0.751 0.583 0.621 0.564 0.513 0.467 0.424 0.306 0.350 0.319 0.290 0.263 0239 0.218 0.198 0 130 0.164 11% 0.901 0.812 0.731 0.659 0.593 0.535 0.482 0.434 0.391 0.352 0.317 0286 0.250 0.232 0 209 0.180 0.170 0.153 0.138 0.124 0.074 0.893 0.797 0.712 0.636 0.567 0.507 0.452 0.404 0.361 0.322 0.287 0.257 0.229 0.205 0.18 0.163 0.148 0.130 0110 0.104 0 0 14 15 16 12 16 19 20 25 30 0199 0.044 0610 1.52 145 032 0032 0 057 0022 0 000 0011 0003 0 000 40 BO 0.141 15 Period 1 BON 13% 0.885 0.783 0.693 30% 0.769 2 3 0.667 0.444 4 0.613 0.543 0.480 0.425 5 6 7 Percent 19% 0.840 0.706 0.593 0.499 0.419 0.352 0.296 0.249 0209 0.176 8 9 10 14% 0.877 0.769 0.675 0.592 0.519 0.456 0.400 0.35) 0.308 0.270 0.237 0.208 0.182 0.160 0.140 0.123 0108 18% 0.862 0.743 0.641 0.552 0.476 0.410 0.354 0.305 0.263 0.227 0.195 0.168 0.145 0.125 0.108 0.093 0.080 0.069 0.060 0.051 0.870 0.756 0.658 0572 0.497 0.432 0.376 0.327 0.284 0247 0.215 0.187 0.163 0.141 0.123 0.102 0.093 0,081 0.070 0.001 0.030 2015 0004 0.001 T2X 0.855 0.731 0.624 0.534 0.456 0.390 0.333 0.285 0.243 0.208 0.178 0.152 0.130 0.111 0.095 0.081 0.069 0.059 0.051 0.043 0.376 0.333 0.295 0.261 0.231 0.204 0.181 0.160 0.141 0.125 0.111 0.098 0.082 0.00 0,026 000B 00 0.847 0.718 0.609 0.515 0.437 0.370 0.314 0.266 0.225 0.191 0.162 0.137 0.116 0.099 0.084 0.071 0.060 0.051 0.043 0.037 0.016 0.007 0.001 0 25% 0.800 0.640 0.512 0.410 0.328 0.262 0.210 0.168 0.134 0.107 0.086 0.069 0.055 0.044 0.035 20% 0.833 0.694 0.579 0.482 0.402 0.335 0.279 0.233 0.194 0.162 0.135 0.112 0.093 0.078 0.065 0.054 0.045 0.03a 0.031 0026 0.010 0.004 0.001 0 0.592 0.455 0.350 0.269 0.207 0.159 0.123 0.094 0.073 0.056 0.043 0.033 35% 0.741 0.549 0.406 0.301 0.223 0.165 0.122 0.091 0,067 0.050 0.037 0.027 0.020 0.015 0.011 0.008 0.006 0.005 0.003 0.002 0001 40M 0.714 0.510 0.364 0.260 0.186 0.133 0.095 0.068 0.048 0.035 0.025 0.018 0.013 0.009 0.006 0.005 0.003 0.002 0.002 0.001 0.148 0.124 0.104 0.088 0.074 0.062 0.052 0.044 0.037 0.03 14 15 16 0.296 0.198 0.132 . 0.059 0.039 0.026 0.017 0.012 0.008 0.005 0003 0.002 0.002 0.001 0.001 0.025 0020 0.015 0012 0.009 0.00% 0.005 0.00 18 19 20 25 30 40 50 0028 0.023 0.018 0.014 0.012 0.004 0.001 0.095 0.0 0.073 0,038 0.020 0 0.024 0.012 0.003 0001 0 0.020 0.009 0.002 a aeo o op 0.012 0.005 0.001 0 0.005 0.00 Ooo 0 O Appendix D Present value of an annuity of $1. PVxx. PV =A1 Percent 6% Period 9% TTK 12% 2 0.980 1 0.909 1.735 2 3 4 5 0990 1.970 2.941 3,902 4.853 5.795 6.728 7.652 8.566 9.471 10.368 11255 12134 13.004 13.865 1.942 2.884 3.808 4.713 5.601 6,472 7325 7 8 9 10 3 0.971 1.913 2.829 3.717 4.580 5.417 6.230 7.020 7.786 8.530 9253 9954 10.635 11.290 11.9.38 12.561 13 166 13.754 14.324 14.877 17,413 19.609 23.115 25.730 12 13 0.962 1.886 2.775 3.630 4.452 5.242 6.002 6.733 7.435 8.111 8.760 9,385 9.986 10.563 11.118 11.652 12 166 12.659 13134 13,590 15.623 17292 19.79 21.482 B 162 8.983 9,787 10.525 11 348 12.106 12849 13,578 14,292 14.992 15675 16.351 19.520 22.390 27.855 31424 0.952 1.859 2.723 3.546 4.329 5076 5.786 6.463 7. 108 7.722 9306 8.363 9.394 9.899 10380 10.338 11.274 11.690 12.085 12 462 14094 15 372 17 159 18250 0.943 1.833 2673 3.465 4.212 4.9.17 5.582 5.210 5.802 7.360 7.387 8384 8853 9295 9712 10.106 10.477 10.928 11.158 11470 12783 18:765 15.045 18.762 * 0.926 1.783 2577 3.312 3.993 4.623 5.206 5.747 6.247 6.710 7.139 7.536 2004 8.244 3.959 3.851 9.122 9.372 0.935 1.808 2624 3.387 4.100 4.757 5.389 5971 6.515 7.024 7.499 7.943 8.358 3.745 0108 447 9.703 10.059 10.336 10:594 11.654 12.409 13332 13.801 0.917 1.759 2.531 3240 3.890 4.486 5.033 5.535 5.995 6.418 6.805 7.161 2.487 7.786 11061 8.313 8.544 3.756 3.950 9.129 9.823 10:274 10.757 10362 0.901 1.713 2.444 3./102 3,696 4.231 4.712 5.146 5,537 5.889 6207 6.492 6.750 6.982 7191 7379 7549 7.202 7.839 7003 2.487 3.170 3.791 4.355 4.868 5.335 5759 6.145 6.495 5.814 7.103 2.367 7.606 7824 8.022 8. 201 8365 8.514 9.077 9427 9.779 9.915 0.893 1,690 2.402 3,037 3.605 4.111 4.564 4.968 5328 5.650 5939 6.194 6.424 6.620 6011 6974 7.120 7.250 7360 7.469 7814 8055 8 244 8.304 14 15 16 17 19 19 20 14.710 15.562 16398 17226 18.046 22.023 25 808 32935 39.196 9.604 9.818 10.675 11.258 11.925 12:23 30 40 50 3.422 3694 8.951 90