Answered step by step

Verified Expert Solution

Question

1 Approved Answer

App Soft Inc. just paid a dividend of $3.00/share. App Soft has a new technology that is expected to go on the market this

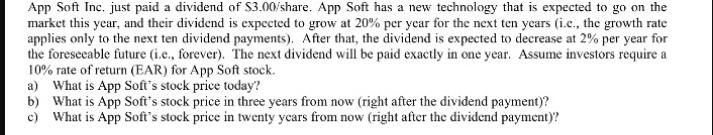

App Soft Inc. just paid a dividend of $3.00/share. App Soft has a new technology that is expected to go on the market this year, and their dividend is expected to grow at 20% per year for the next ten years (i.c., the growth rate applies only to the next ten dividend payments). After that, the dividend is expected to decrease at 2% per year for the foreseeable future (i.e., forever). The next dividend will be paid exactly in one year. Assume investors require a 10% rate of return (EAR) for App Soft stock. a) What is App Soft's stock price today? b) What is App Soft's stock price in three years from now (right after the dividend payment)? c) What is App Soft's stock price in twenty years from now (right after the dividend payment)?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the stock price of App Soft Inc we can use the Dividend Discount Model DDM under the as...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started