Answered step by step

Verified Expert Solution

Question

1 Approved Answer

App stat For Questions 7-11 A private equity firm is considering five competing projects in which to invest in the upcoming quarter. The firm needs

App stat

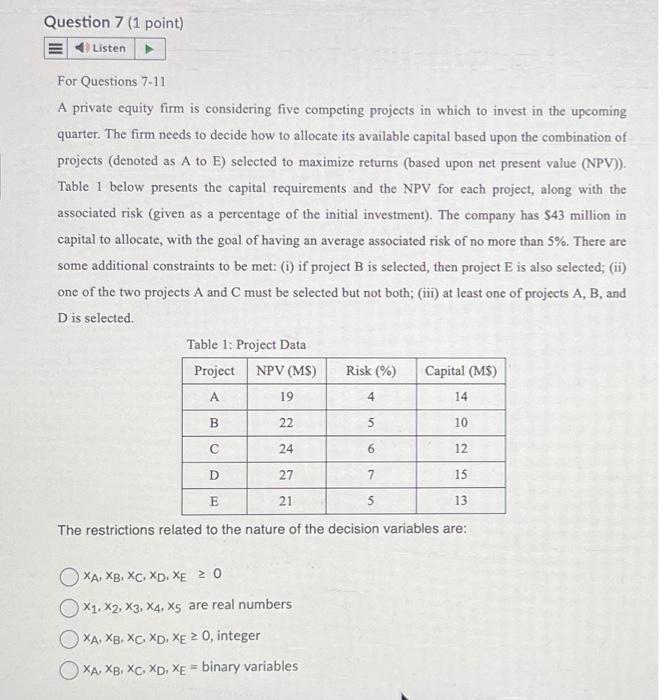

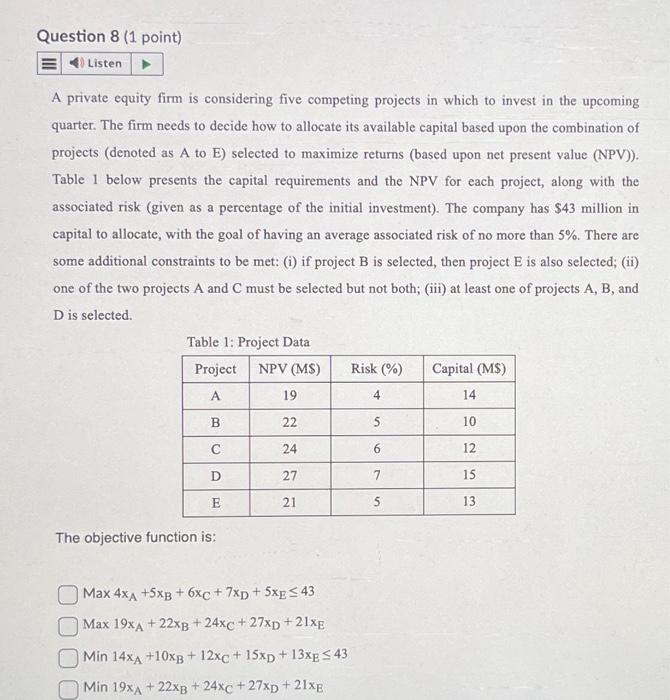

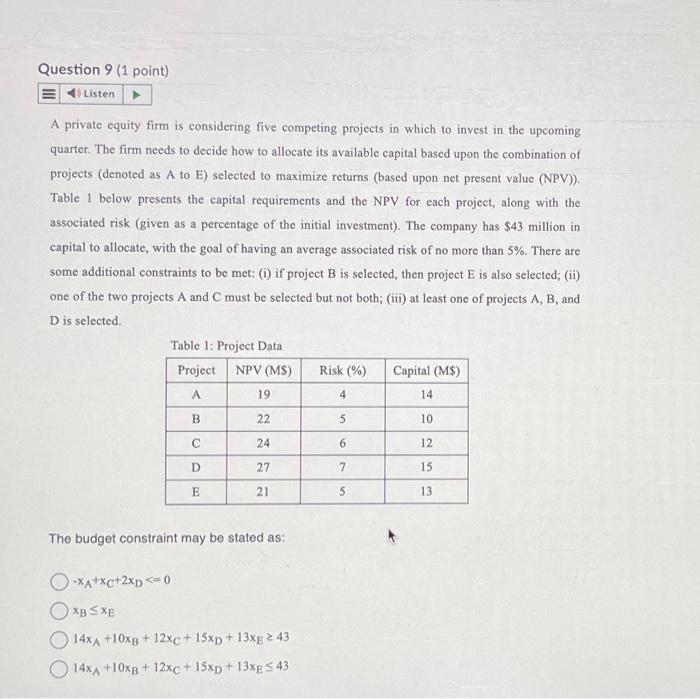

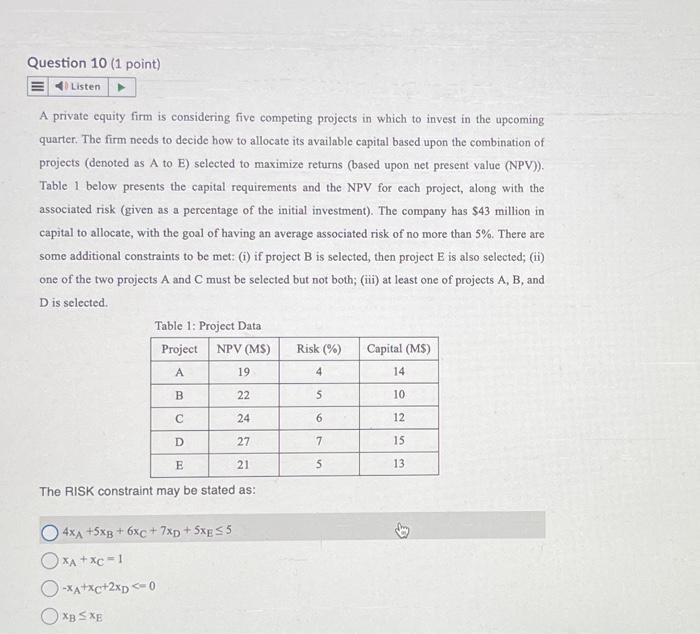

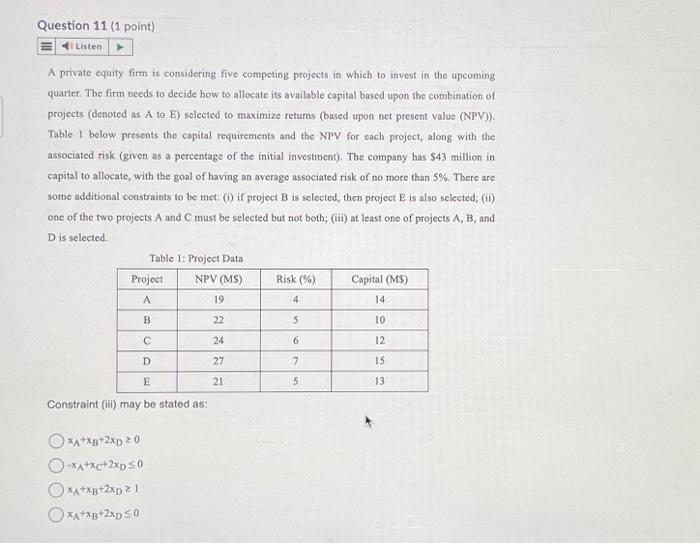

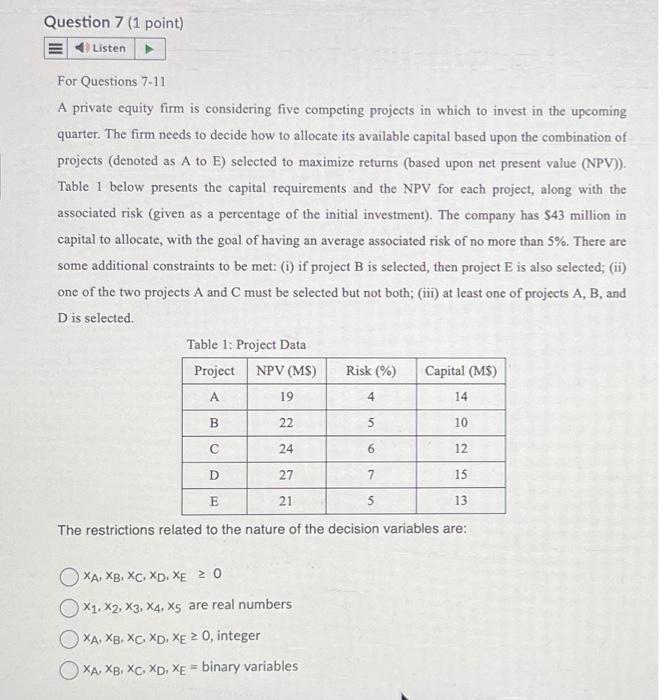

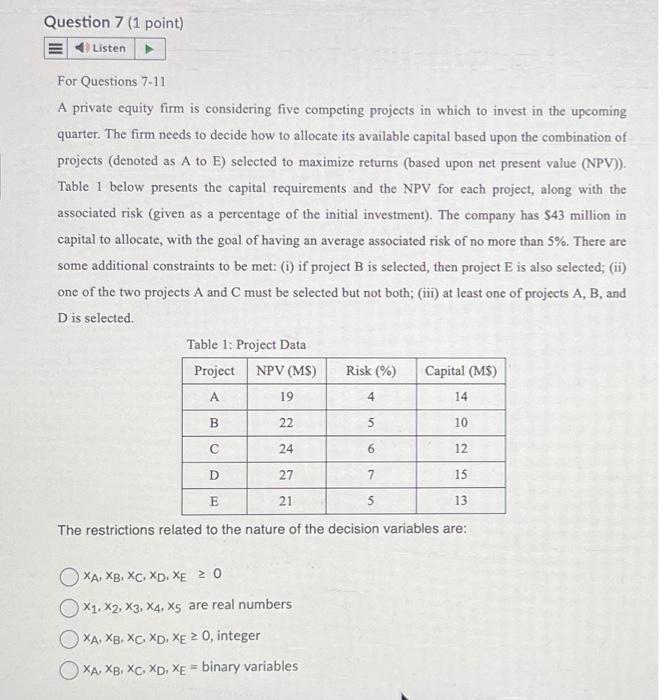

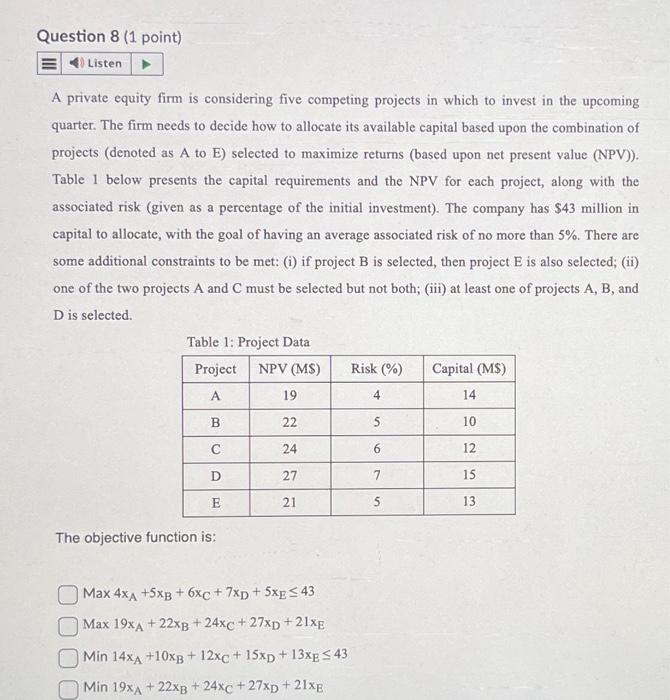

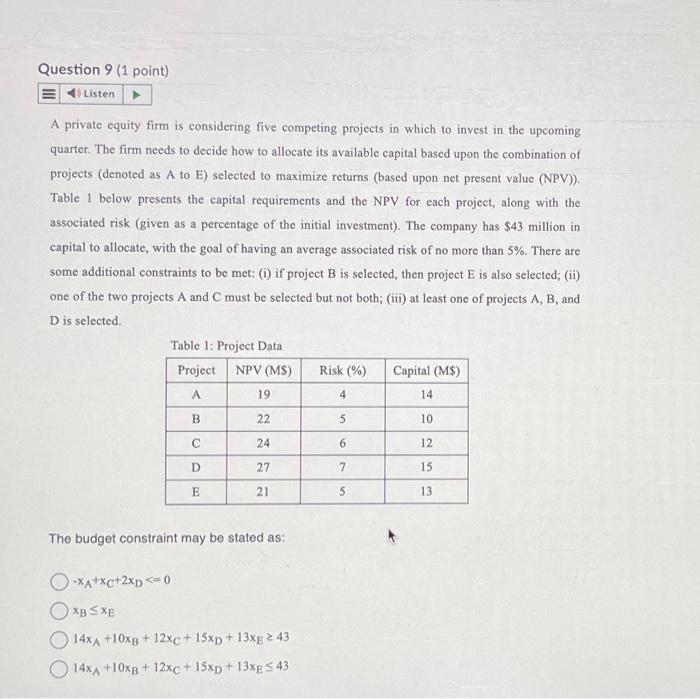

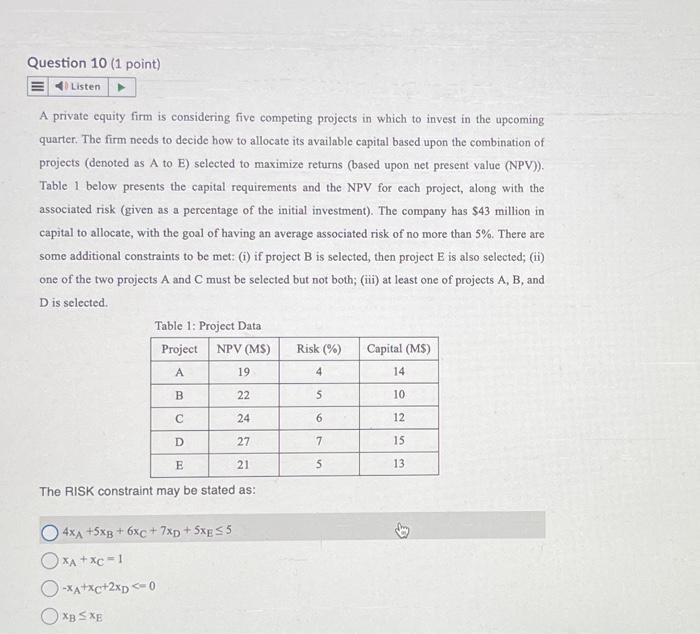

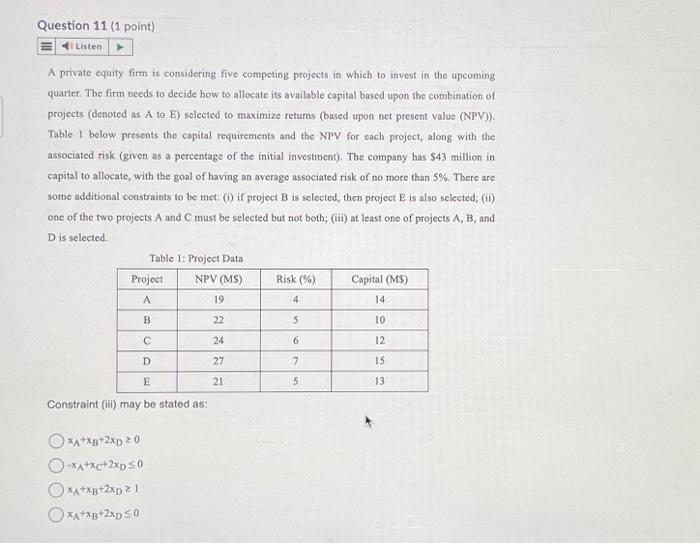

For Questions 7-11 A private equity firm is considering five competing projects in which to invest in the upcoming quarter. The firm needs to decide how to allocate its available capital based upon the combination of projects (denoted as A to E) selected to maximize returns (based upon net present value (NPV)). Table 1 below presents the capital requirements and the NPV for each project, along with the associated risk (given as a percentage of the initial investment). The company has $43 million in capital to allocate, with the goal of having an average associated risk of no more than 5%. There are some additional constraints to be met: (i) if project B is selected, then project E is also selected; (ii) one of the two projects A and C must be selected but not both; (iii) at least one of projects A, B, and D is selected. Table 1: Project Data The restrictions related to the nature of the decision variables are: xA,xB,xC,xD,xE0 x1,x2,x3,x4,x5 are real numbers xA,xB,xC,xD,xE0, integer xA,xB,xC,xD,xE= binary variables A private equity firm is considering five competing projects in which to invest in the upcoming quarter. The firm needs to decide how to allocate its available capital based upon the combination of projects (denoted as A to E) selected to maximize returns (based upon net present value (NPV)). Table 1 below presents the capital requirements and the NPV for each project, along with the associated risk (given as a percentage of the initial investment). The company has $43 million in capital to allocate, with the goal of having an average associated risk of no more than 5%. There are some additional constraints to be met: (i) if project B is selected, then project E is also selected; (ii) one of the two projects A and C must be selected but not both; (iii) at least one of projects A, B, and D is selected. Table 1: Proiect Data The objective function is: Max4xA+5xB+6xC+7xD+5xE43Max19xA+22xB+24xC+27xD+21xEMin14xA+10xB+12xC+15xD+13xB43Min19xA+22xB+24xC+27xD+21xE A private equity firm is considering five competing projects in which to invest in the upcoming quarter. The firm needs to decide how to allocate its available capital based upon the combination of projects (denoted as A to E) selected to maximize returns (based upon net present value (NPV)). Table 1 below presents the capital requirements and the NPV for each project, along with the associated risk (given as a percentage of the initial investment). The company has $43 million in capital to allocate, with the goal of having an average associated risk of no more than 5%. There are some additional constraints to be met: (i) if project B is selected, then project E is also selected; (ii) one of the two projects A and C must be selected but not both; (iii) at least one of projects A,B, and D is selected. Table 1: Proiect Data The budget constraint may be stated as: xA+xC+2xD

For Questions 7-11 A private equity firm is considering five competing projects in which to invest in the upcoming quarter. The firm needs to decide how to allocate its available capital based upon the combination of projects (denoted as A to E) selected to maximize returns (based upon net present value (NPV)). Table 1 below presents the capital requirements and the NPV for each project, along with the associated risk (given as a percentage of the initial investment). The company has $43 million in capital to allocate, with the goal of having an average associated risk of no more than 5%. There are some additional constraints to be met: (i) if project B is selected, then project E is also selected; (ii) one of the two projects A and C must be selected but not both; (iii) at least one of projects A, B, and D is selected. Table 1: Project Data The restrictions related to the nature of the decision variables are: xA,xB,xC,xD,xE0 x1,x2,x3,x4,x5 are real numbers xA,xB,xC,xD,xE0, integer xA,xB,xC,xD,xE= binary variables A private equity firm is considering five competing projects in which to invest in the upcoming quarter. The firm needs to decide how to allocate its available capital based upon the combination of projects (denoted as A to E) selected to maximize returns (based upon net present value (NPV)). Table 1 below presents the capital requirements and the NPV for each project, along with the associated risk (given as a percentage of the initial investment). The company has $43 million in capital to allocate, with the goal of having an average associated risk of no more than 5%. There are some additional constraints to be met: (i) if project B is selected, then project E is also selected; (ii) one of the two projects A and C must be selected but not both; (iii) at least one of projects A, B, and D is selected. Table 1: Proiect Data The objective function is: Max4xA+5xB+6xC+7xD+5xE43Max19xA+22xB+24xC+27xD+21xEMin14xA+10xB+12xC+15xD+13xB43Min19xA+22xB+24xC+27xD+21xE A private equity firm is considering five competing projects in which to invest in the upcoming quarter. The firm needs to decide how to allocate its available capital based upon the combination of projects (denoted as A to E) selected to maximize returns (based upon net present value (NPV)). Table 1 below presents the capital requirements and the NPV for each project, along with the associated risk (given as a percentage of the initial investment). The company has $43 million in capital to allocate, with the goal of having an average associated risk of no more than 5%. There are some additional constraints to be met: (i) if project B is selected, then project E is also selected; (ii) one of the two projects A and C must be selected but not both; (iii) at least one of projects A,B, and D is selected. Table 1: Proiect Data The budget constraint may be stated as: xA+xC+2xD

App stat

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started