Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Apparel Inc. manufactures sportswear for retailers and frequently sells its receivables to factors as a means of accelerating cash collections. On December 1, Apparel

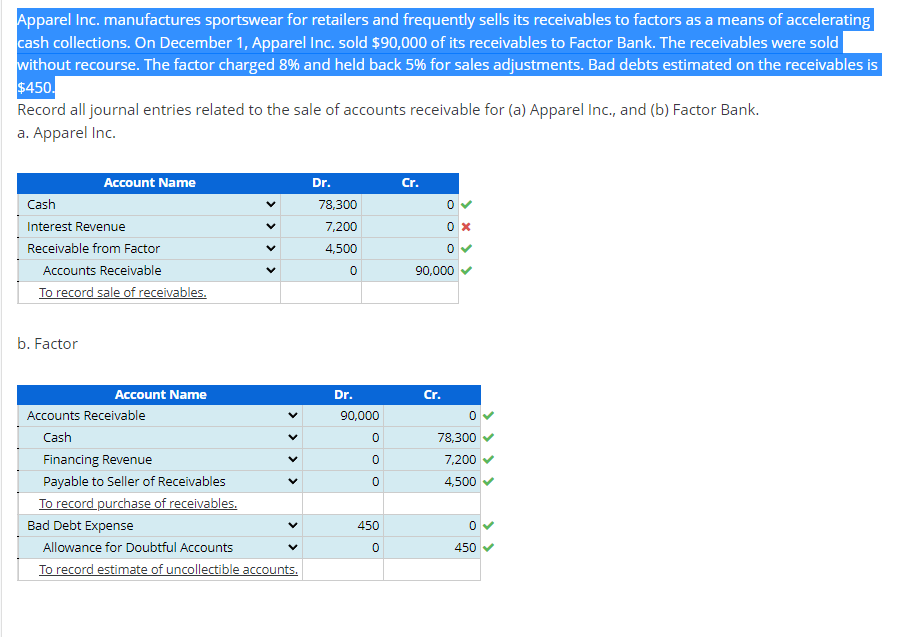

Apparel Inc. manufactures sportswear for retailers and frequently sells its receivables to factors as a means of accelerating cash collections. On December 1, Apparel Inc. sold $90,000 of its receivables to Factor Bank. The receivables were sold without recourse. The factor charged 8% and held back 5% for sales adjustments. Bad debts estimated on the receivables is $450. Record all journal entries related to the sale of accounts receivable for (a) Apparel Inc., and (b) Factor Bank. a. Apparel Inc. Account Name Dr. Cr. Cash 78,300 Interest Revenue 7,200 Receivable from Factor 4,500 Accounts Receivable 90,000 To record sale of receivables. b. Factor Account Name Dr. Cr. Accounts Receivable 90,000 Cash 78,300 Financing Revenue 7,200 Payable to Seller of Receivables 4,500 To record purchase of receivables. Bad Debt Expense 450 Allowance for Doubtful Accounts 450 To record estimate of uncollectible accounts. > > > > >

Step by Step Solution

★★★★★

3.48 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

a Cappa Apparel Account Name Dr Cr Cash 84 x 100000 84000 Loss on Sale o...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started