Answered step by step

Verified Expert Solution

Question

1 Approved Answer

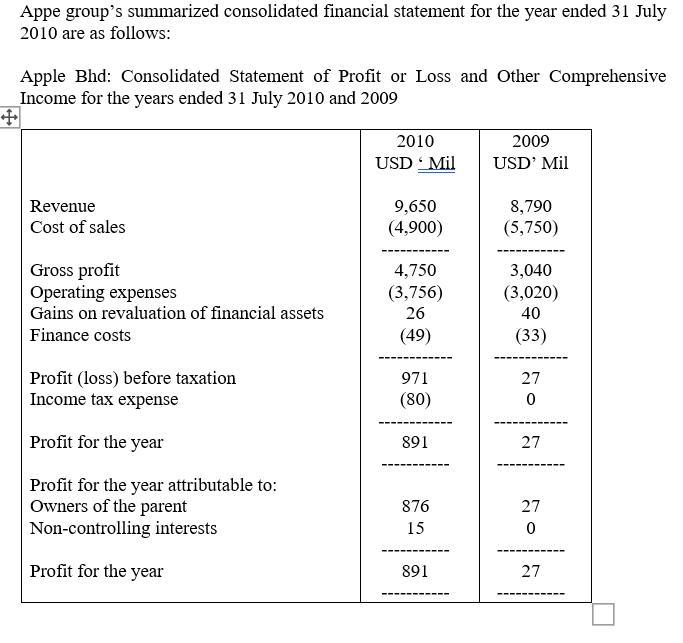

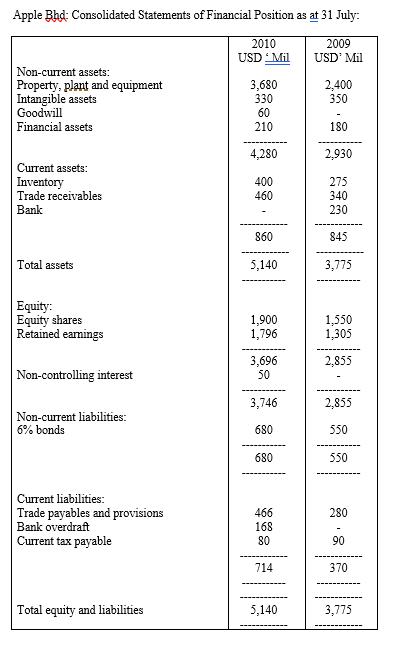

Appe group's summarized consolidated financial statement for the year ended 31 July 2010 are as follows: Apple Bhd: Consolidated Statement of Profit or Loss

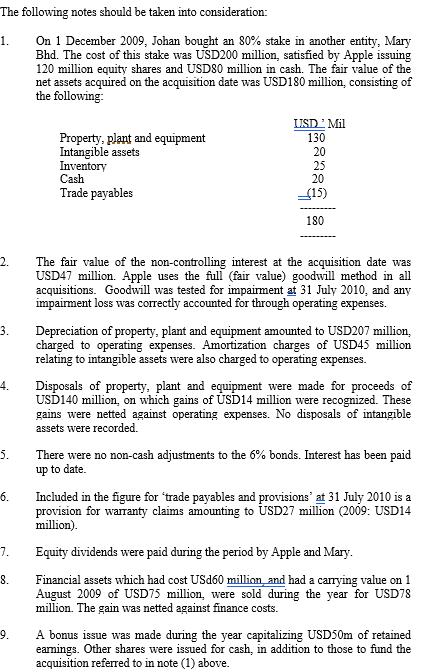

Appe group's summarized consolidated financial statement for the year ended 31 July 2010 are as follows: Apple Bhd: Consolidated Statement of Profit or Loss and Other Comprehensive Income for the years ended 31 July 2010 and 2009 + Revenue Cost of sales Gross profit Operating expenses Gains on revaluation of financial assets Finance costs Profit (loss) before taxation Income tax expense Profit for the year Profit for the year attributable to: Owners of the parent Non-controlling interests Profit for the year 2010 USD Mil 9,650 (4,900) 4,750 (3,756) 26 (49) 971 (80) 891 876 15 891 2009 USD' Mil 8,790 (5,750) 3,040 (3,020) 40 (33) 27 0 27 27 0 27 Apple Bhd: Consolidated Statements of Financial Position as at 31 July: 2010 2009 USD Mil USD Mil Non-current assets: Property, plant and equipment Intangible assets Goodwill Financial assets Current assets: Inventory Trade receivables Bank Total assets Equity: Equity shares Retained earnings Non-controlling interest Non-current liabilities: 6% bonds Current liabilities: Trade payables and provisions Bank overdraft Current tax payable Total equity and liabilities 3,680 330 60 210 4,280 400 460 860 5,140 1,900 1,796 3,696 50 3,746 680 680 466 168 80 714 5,140 2,400 350 180 2,930 275 340 230 845 3,775 1,550 1,305 2,855 2,855 550 550 280 90 370 3,775 The following notes should be taken into consideration: On 1 December 2009, Johan bought an 80% stake in another entity, Mary Bhd. The cost of this stake was USD200 million, satisfied by Apple issuing 120 million equity shares and USD80 million in cash. The fair value of the net assets acquired on the acquisition date was USD180 million, consisting of the following: 1. 2. 3. 4. 5. 6. 7. 8. 9. Property, plant and equipment Intangible assets Inventory Cash Trade payables USD Mil 130 20 25 20 _(15) 180 The fair value of the non-controlling interest at the acquisition date was USD47 million. Apple uses the full (fair value) goodwill method in all acquisitions. Goodwill was tested for impairment at 31 July 2010, and any impairment loss was correctly accounted for through operating expenses. Depreciation of property, plant and equipment amounted to USD207 million, charged to operating expenses. Amortization charges of USD45 million relating to intangible assets were also charged to operating expenses. Disposals of property, plant and equipment were made for proceeds of USD140 million, on which gains of USD14 million were recognized. These gains were netted against operating expenses. No disposals of intangible assets were recorded. There were no non-cash adjustments to the 6% bonds. Interest has been paid up to date. Included in the figure for 'trade payables and provisions' at 31 July 2010 is a provision for warranty claims amounting to USD27 million (2009: USD14 million). Equity dividends were paid during the period by Apple and Mary. Financial assets which had cost USd60 million and had a carrying value on 1 August 2009 of USD75 million, were sold during the year for USD78 million. The gain was netted against finance costs. A bonus issue was made during the year capitalizing USD50m of retained earings. Other shares were issued for cash, in addition to those to fund the acquisition referred to in note (1) above. Required: (a) (b) (c) Computation of the goodwill value that arises from the acquisition of Mary Bhd's business by Apple Bhd A consolidated Statement of Changes in Equity. A consolidated Statement of Cash Flows showing all the relevant supporting workings.

Step by Step Solution

★★★★★

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

aThe goodwill value arising from the acquisition of Mary Bhds business by Apple Bho is USD47 million ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started