Question

1. Students are to open an Excel spreadsheet and create two tabs at the bottom - one for each payroll period. 2. Students are to

1. Students are to open an Excel spreadsheet and create two tabs at the bottom - one for each payroll period.

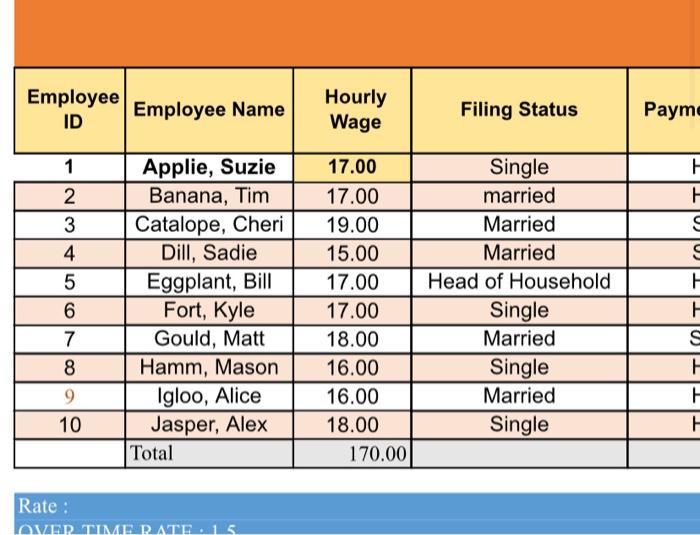

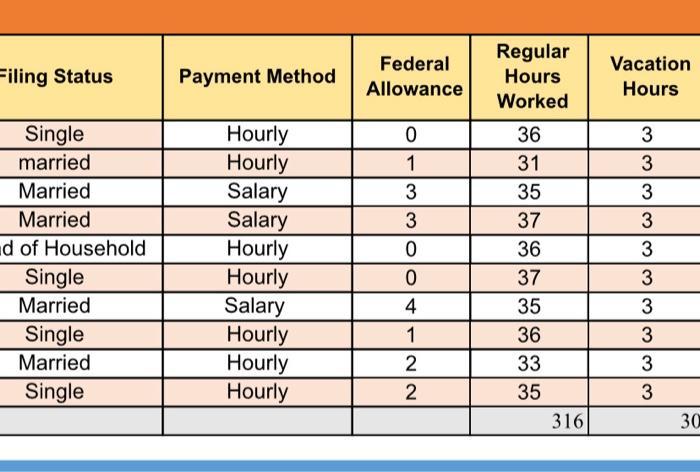

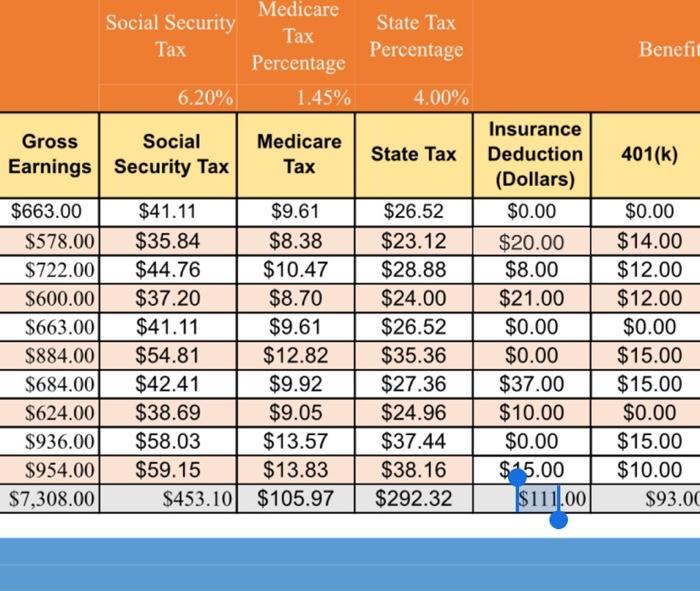

2. Students are to create columns for the employee name, filing status, pay rate, gross pay, mandatory voluntary deductions, vacation, and gross pay. Assume that the employees have no cumulative earnings prior to these payroll periods.

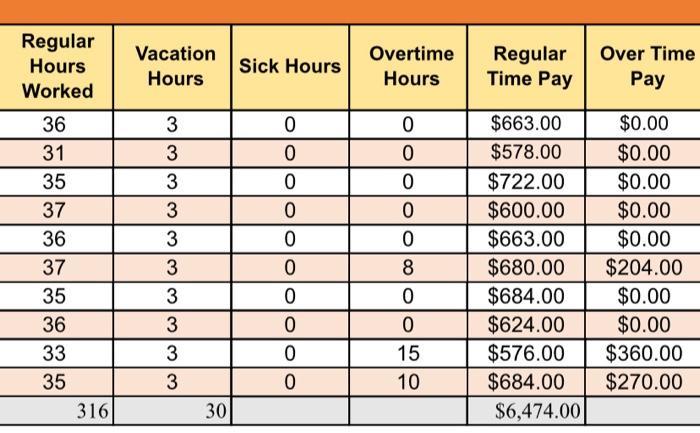

3. Students are to decide the pay rate for all employees and the number of hours worked. The number of hours worked must be different between the two payroll periods. In addition, three employees must have overtime in each payroll period.

4. Columns must also be created for hours worked, overtime, and Net Pay.

5. Students are to decide the cost of each voluntary benefit for each employee.

6. Students must include the mandatory withholdings. Use 6.2 percent for Social Security and

1.45 percent for Medicare for each employee.

7. For FUTA, use .08 of the first $7,000 of each employee. For SUTA, use 5.4% of the first $8,500 of each employee.

Employee ID 1 2345 6 7 8 9 10 Employee Name Applie, Suzie Banana, Tim Catalope, Cheri Dill, Sadie Eggplant, Bill Fort, Kyle Gould, Matt Hamm, Mason Igloo, Alice Jasper, Alex Total Rate : OVER TIME RATE: 15. Hourly Wage 17.00 17.00 19.00 15.00 17.00 17.00 18.00 16.00 16.00 18.00 170.00 Filing Status Single married Married Married Head of Household Single Married Single Married Single Payme H S S S H

Step by Step Solution

3.41 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Employee Name Applie Suzie Banana Tim Cotalope Cheri Dill Sadie Eggplant Bill Fort Kyle Go...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started