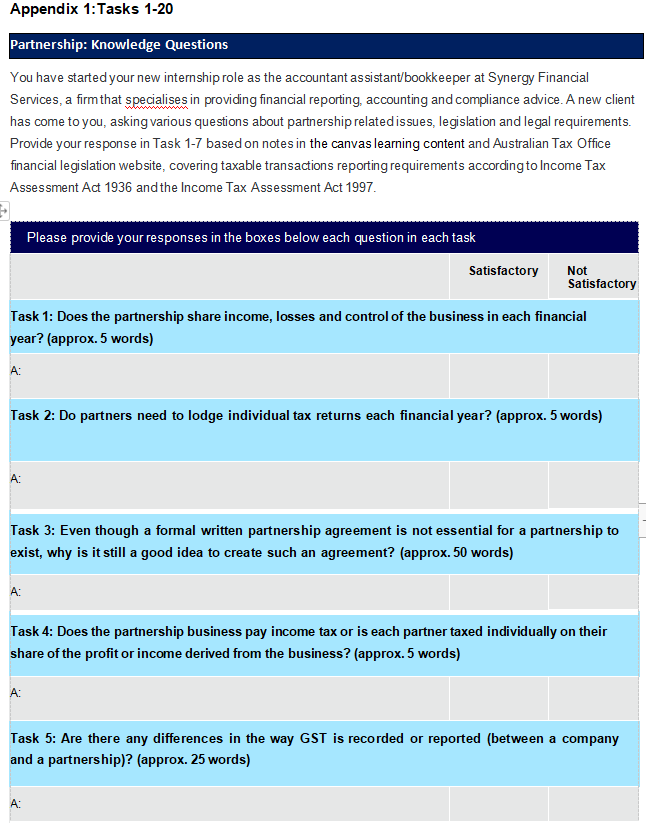

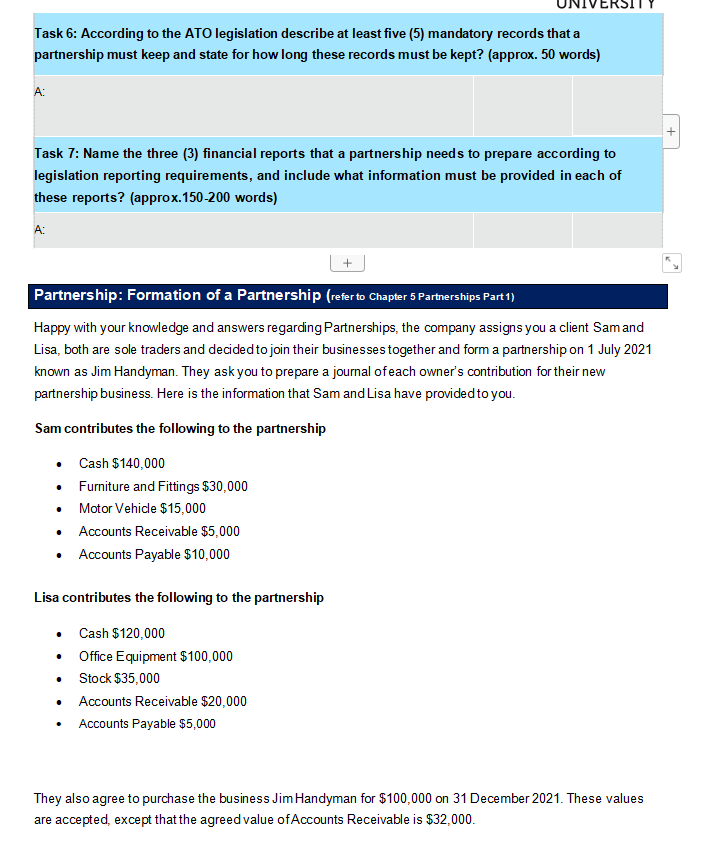

Appendix 1:Tasks 1-20 Partnership: Knowledge Questions You have started your new internship role as the accountant assistant/bookkeeper at Synergy Financial Services, a firm that specialises in providing financial reporting, accounting and compliance advice. A new client has come to you, asking various questions about partnership related issues, legislation and legal requirements. Provide your response in Task 1-7 based on notes in the canvas learning content and Australian Tax Office financial legislation website, covering taxable transactions reporting requirements according to Income Tax Assessment Act 1936 and the Income Tax Assessment Act 1997. Please provide your responses in the boxes below each question in each task Satisfactory Not Satisfactory Task 1: Does the partnership share income, losses and control of the business in each financial year? (approx. 5 words) A: Task 2: Do partners need to lodge individual tax returns each financial year? (approx. 5 words) A: Task 3: Even though a formal written partnership agreement is not essential for a partnership to exist, why is it still a good idea to create such an agreement? (approx. 50 words) A: Task 4: Does the partnership business pay income tax or is each partner taxed individually on their share of the profit or income derived from the business? (approx. 5 words) A: Task 5: Are there any differences in the way GST is recorded or reported (between a company and a partnership)? (approx. 25 words) A: Task 6: According to the ATO legislation describe at least five (5) mandatory records that a partnership must keep and state for how long these records must be kept? (approx. 50 words) A: + Task 7: Name the three (3) financial reports that a partnership needs to prepare according to legislation reporting requirements, and include what information must be provided in each of these reports? (approx.150-200 words) A: Partnership: Formation of a Partnership (refer to Chapter 5 Partnerships Part 1) Happy with your knowledge and answers regarding Partnerships, the company assigns you a client Sam and Lisa, both are sole traders and decided to join their businesses together and form a partnership on 1 July 2021 known as Jim Handyman. They ask you to prepare a journal of each owner's contribution for their new partnership business. Here is the information that Sam and Lisa have provided to you. Sam contributes the following to the partnership Cash $140,000 Furniture and Fittings $30,000 Motor Vehicle $15,000 Accounts Receivable $5,000 Accounts Payable $10,000 Lisa contributes the following to the partnership Cash $120,000 Office Equipment $100,000 Stock $35,000 Accounts Receivable $20,000 Accounts Payable $5,000 They also agree to purchase the business Jim Handyman for $100,000 on 31 December 2021. These values are accepted, except that the agreed value of Accounts Receivable is $32,000