Answered step by step

Verified Expert Solution

Question

1 Approved Answer

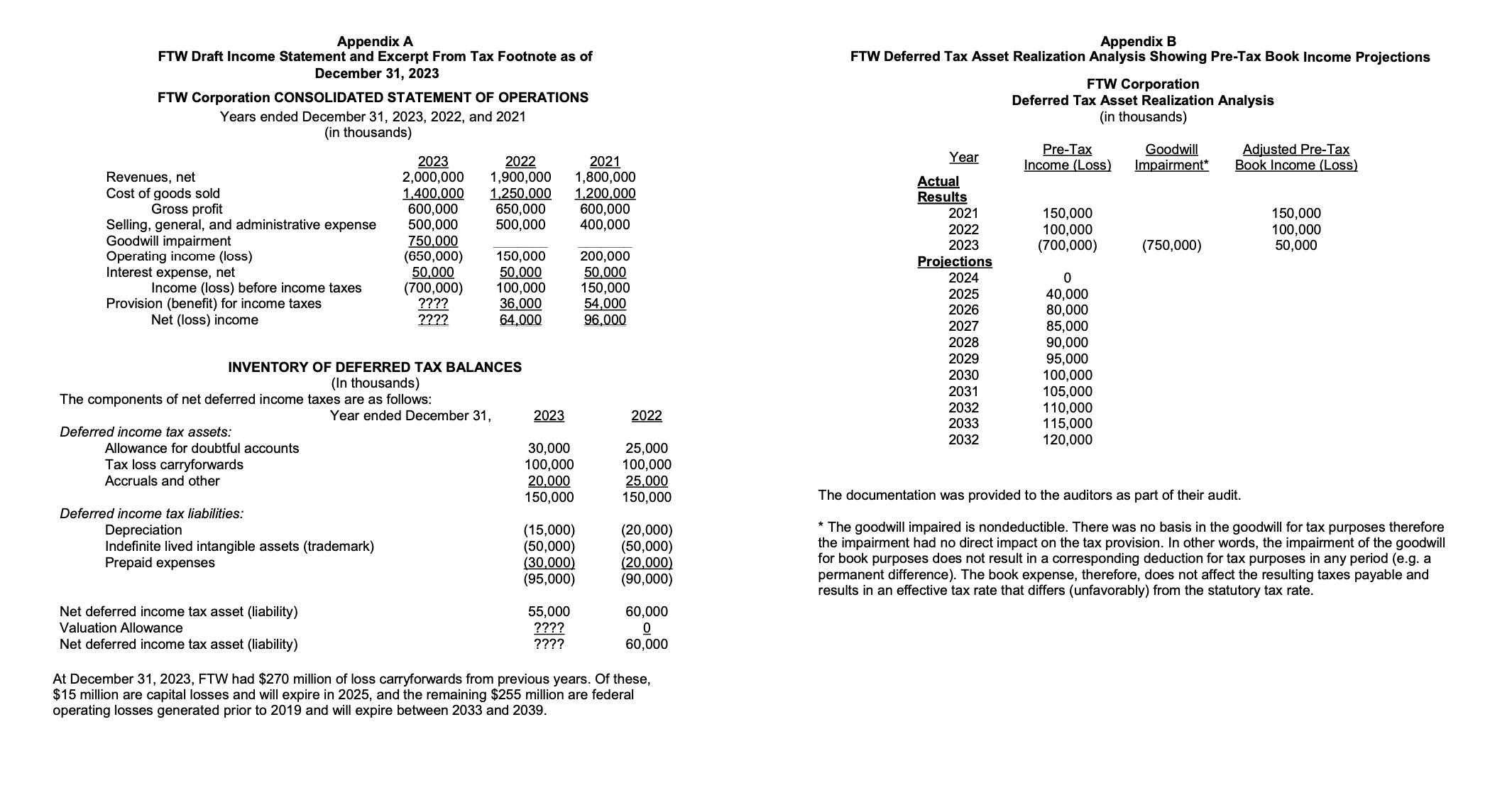

Appendix A FTW Draft Income Statement and Excerpt From Tax Footnote as of December 31, 2023 FTW Corporation CONSOLIDATED STATEMENT OF OPERATIONS Years ended

Appendix A FTW Draft Income Statement and Excerpt From Tax Footnote as of December 31, 2023 FTW Corporation CONSOLIDATED STATEMENT OF OPERATIONS Years ended December 31, 2023, 2022, and 2021 (in thousands) Appendix B FTW Deferred Tax Asset Realization Analysis Showing Pre-Tax Book Income Projections FTW Corporation Deferred Tax Asset Realization Analysis (in thousands) 2023 2022 2021 Year Pre-Tax Income (Loss) Goodwill Impairment* Adjusted Pre-Tax Book Income (Loss) Revenues, net Cost of goods sold 2,000,000 1,900,000 1,800,000 1,400,000 1,250,000 1,200,000 Gross profit 600,000 650,000 600,000 Actual Results 2021 Selling, general, and administrative expense 500,000 500,000 400,000 2022 Goodwill impairment 750,000 2023 150,000 100,000 (700,000) 150,000 100,000 (750,000) 50,000 Operating income (loss) (650,000) 150,000 200,000 Projections Interest expense, net 50,000 50,000 50,000 2024 0 Income (loss) before income taxes (700,000) 100,000 150,000 2025 40,000 Provision (benefit) for income taxes ???? 36,000 54,000 2026 80,000 Net (loss) income ???? 64,000 96,000 2027 85,000 2028 90,000 2029 95,000 INVENTORY OF DEFERRED TAX BALANCES (In thousands) 2030 100,000 2031 105,000 2032 110,000 2033 115,000 2032 120,000 The components of net deferred income taxes are as follows: Year ended December 31, 2023 2022 Deferred income tax assets: Allowance for doubtful accounts 30,000 25,000 Tax loss carryforwards 100,000 100,000 Accruals and other 20,000 25,000 150,000 150,000 Deferred income tax liabilities: Depreciation (15,000) (20,000) Indefinite lived intangible assets (trademark) Prepaid expenses (50,000) (50,000) (30,000) (20,000) (95,000) (90,000) Net deferred income tax asset (liability) Valuation Allowance 55,000 ???? 60,000 0 Net deferred income tax asset (liability) ???? 60,000 At December 31, 2023, FTW had $270 million of loss carryforwards from previous years. Of these, $15 million are capital losses and will expire in 2025, and the remaining $255 million are federal operating losses generated prior to 2019 and will expire between 2033 and 2039. The documentation was provided to the auditors as part of their audit. * The goodwill impaired is nondeductible. There was no basis in the goodwill for tax purposes therefore the impairment had no direct impact on the tax provision. In other words, the impairment of the goodwill for book purposes does not result in a corresponding deduction for tax purposes in any period (e.g. a permanent difference). The book expense, therefore, does not affect the resulting taxes payable and results in an effective tax rate that differs (unfavorably) from the statutory tax rate.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started