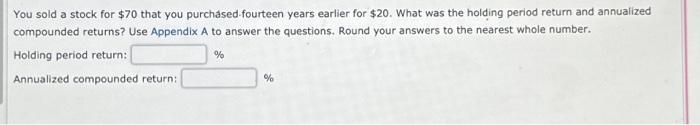

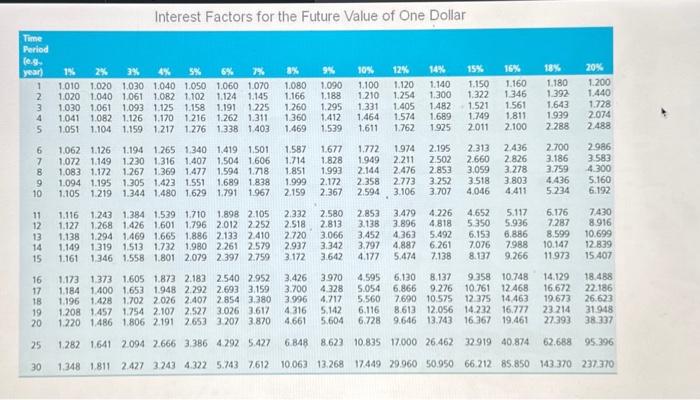

You sold a stock for $70 that you purchased.fourteen years earlier for $20. What was the holding period return and annualized compounded returns? Use Appendix A to answer the questions. Round your answers to the nearest whole number. Holding period return: % Annualized compounded return: % Interest Factors for the Future Value of One Dollar \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|} \hline ThePeriod(eg.year) & 18 & 2% & & 4x & 3x & 6% & & & 94 & 10% & 12% & 14% & 15% & 16% & 18 & 20% \\ \hline 1 & 1.010 & 1.020 & 1.030 & 1.040 & 1.050 & 1.060 & 1.0701.145 & 1.0801.166 & 1.0901.188 & 1.1001.210 & 1.120 & 1.140 & 1.1501.322 & 1.160 & 1.1801.392 & 1.2001.440 \\ \hline 2 & 1.020 & 1.0401.061 & 1.061 & 1.082 & 1.1021.158 & 1.1241.191 & 1.1451.225 & 1.1661.260 & 1.1881.295 & 1.2101.331 & 1.254 & 1.3001.482 & 1.3221.521 & 1.3461.561 & 1.3921.643 & 1.4401.728 \\ \hline 34 & 1.0301.041 & 1.0611.082 & 1.0931.126 & 1.1251.170 & 1.1581.216 & 1.1911.262 & 1.2251.311 & 1.2601.360 & 1.2951.412 & 1.3311.464 & 1.4051.574 & 1.4821.689 & 1.5211.749 & 1.811 & 1.6431.939 & 1.7282.074 \\ \hline & 1.0411.051 & 1.0821.104 & 1.1261.159 & 1.1701.217 & 1.2161.276 & 1.2621.338 & 1.403 & 1.469 & 1.539 & 1.4641.611 & 1.5741.762 & 1.6891.925 & 2.011 & 2.100 & 2.288 & 2.488 \\ \hline 6 & 1.062 & 1.126 & 1.194 & 1.265 & 1.340 & 1.419 & 1,501 & 1.587 & 1.677 & 1.772 & 1974 & 2.195 & 2.313 & 2.436 & 2.700 & 2986 \\ \hline 7 & 1.072 & 1.149 & 1.230 & 1.316 & 1.407 & 1.504 & 1.606 & 1.714 & 1.828 & 1.949 & 2.211 & 2.502 & 2.660 & 2.826 & 3.186 & 3.583 \\ \hline 8 & 1.083 & 1.172 & 1.267 & 1.369 & 1.477 & 1.594 & 1.718 & 1.851 & 1.993 & 2.144 & 2,476 & 2.853 & 3.059 & 3.278 & 3.759 & 4.300 \\ \hline 9 & 1.094 & 1.195 & 1.305 & 1.423 & 1.551 & 1.689 & 1.838 & 1.999 & 2.172 & 2.358 & 2.773 & 3.252 & 3518 & 3.803 & 4.436 & 5.160 \\ \hline 10 & 1.105 & 1.219 & 1.344 & 1.480 & 1.629 & 1.791 & 1.967 & 2.159 & 2.367 & 2.594 & 3.106 & 3707 & 4.046 & 4.411 & 5.234 & 6.192 \\ \hline 11 & 1.116 & 1.243 & 1.384 & 1.539 & 1.710 & 1.898 & 2.105 & 2.332 & 2.580 & 2.853 & 3.479 & 4.226 & 4.652 & 5.117 & 6.176 & 7.430 \\ \hline 12 & 1.127 & 1.268 & 1.426 & 1.601 & 1.796 & 2.012 & 2252 & 2.518 & 2.813 & 3.138 & 3.896 & 4.818 & 5.350 & 5.936 & 7.287 & 8.916 \\ \hline 13 & 1.138 & 1.294 & 1.469 & 1.665 & 1.886 & 2.133 & 2.410 & 2720 & 3.066 & 3.452 & 4.363 & 5.492 & 6.153 & 6.886 & 8.599 & 10.699 \\ \hline 14 & 1.149 & 1319 & 1.513 & 1.732 & 1.980 & 2.261 & 2.579 & 2.937 & 3.342 & 3.797 & 4.887 & 6.261 & 7.076 & 7988 & 10.147 & 12839 \\ \hline 15 & 1.161 & 1.346 & 1.558 & 1.801 & 2.079 & 2397 & 2759 & 3.172 & 3.642 & 4.177 & 5.474 & 7.138 & 8.137 & 9.266 & 11973 & 15.407 \\ \hline 16 & 1.173 & 1,373 & 1.605 & 1.873 & 2.183 & 2.540 & 2.952 & 3.426 & 3970 & 4.595 & 6.130 & 8.137 & 9.358 & 10.748 & 14.129 & 18.488 \\ \hline 17 & 1.184 & 1.400 & 1.653 & 1.948 & 2.292 & 2.693 & 3,159 & 3.700 & 4.328 & 5.054 & 6.866 & 9.276 & 10.761 & 12.468 & 16.672 & 22.186 \\ \hline 18 & 1.196 & 1.428 & 1.702 & 2026 & 2.407 & 2.854 & 3.380 & 3996 & 4.717 & 5.560 & 7.690 & 10.575 & 12.375 & 14.463 & 19.673 & 26.623 \\ \hline 19 & 1.208 & 1.457 & 1.754 & 2.107 & 2527 & 3.026 & 3.617 & 4316 & 5.142 & 6.116 & 8.613 & 12.056 & 14.232 & 16.777 & 23214 & 31948 \\ \hline 20 & 1.220 & 1,486 & 1.806 & 2.191 & 2.653 & 3.207 & 3.870 & 4.661 & 5.604 & 6.728 & 9.646 & 13.743 & 16367 & 19.461 & 27393 & 38337 \\ \hline 25 & 1.282 & 1.641 & 2094 & 2.666 & 3.386 & 4292 & 5.427 & 6.848 & 8.623 & 10.835 & 17.000 & 26.462 & 32919 & 40.874 & 62.688 & 95.396 \\ \hline 30 & 1,348 & 1.811 & 2.427 & 3.243 & 4.322 & 5.743 & 7.612 & 10.063 & 13.268 & 17.449 & 29.960 & 50.950 & 66.212 & 85.850 & 143.370 & 237370 \\ \hline \end{tabular}