Appendix B

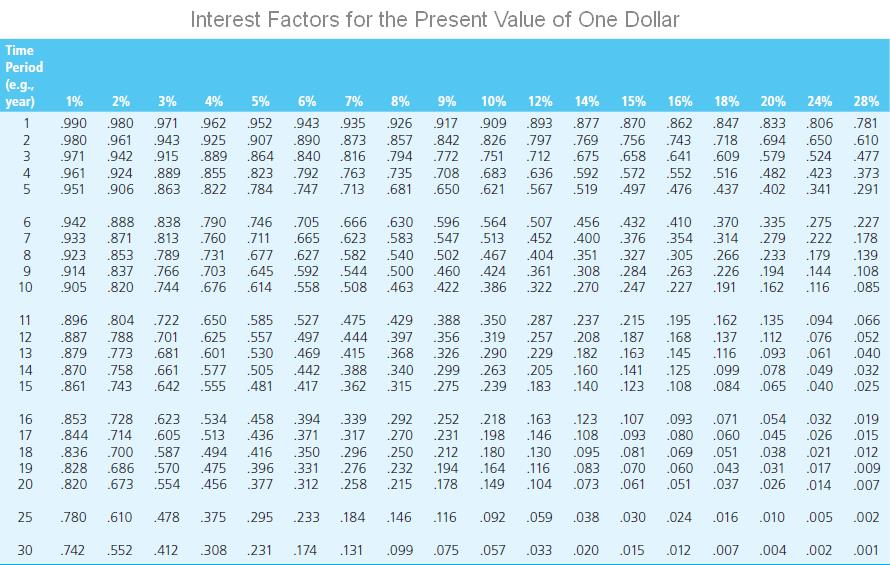

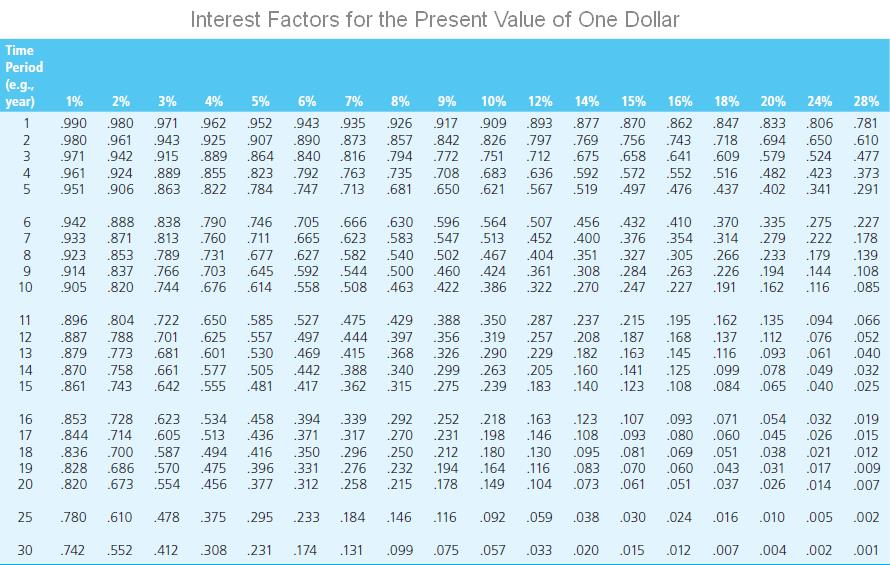

Appendix B

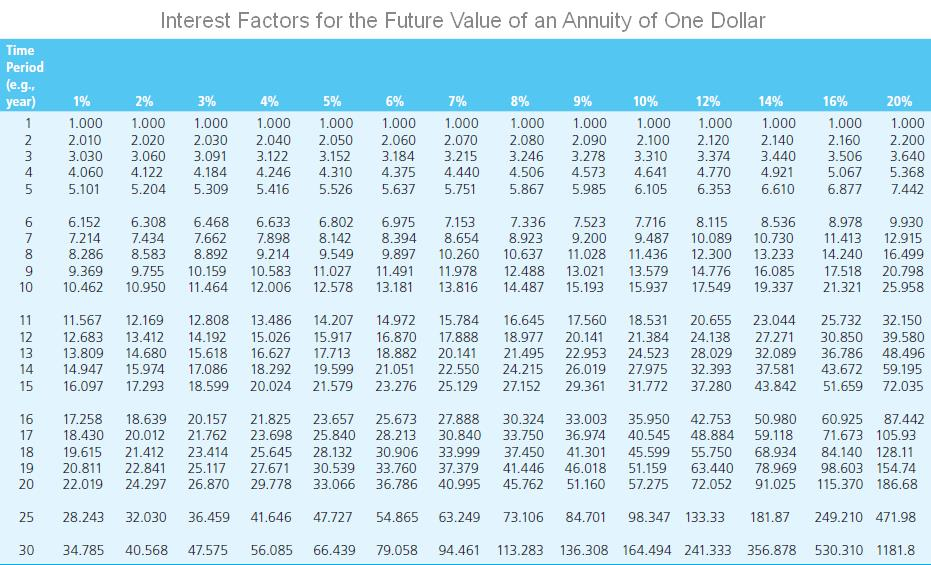

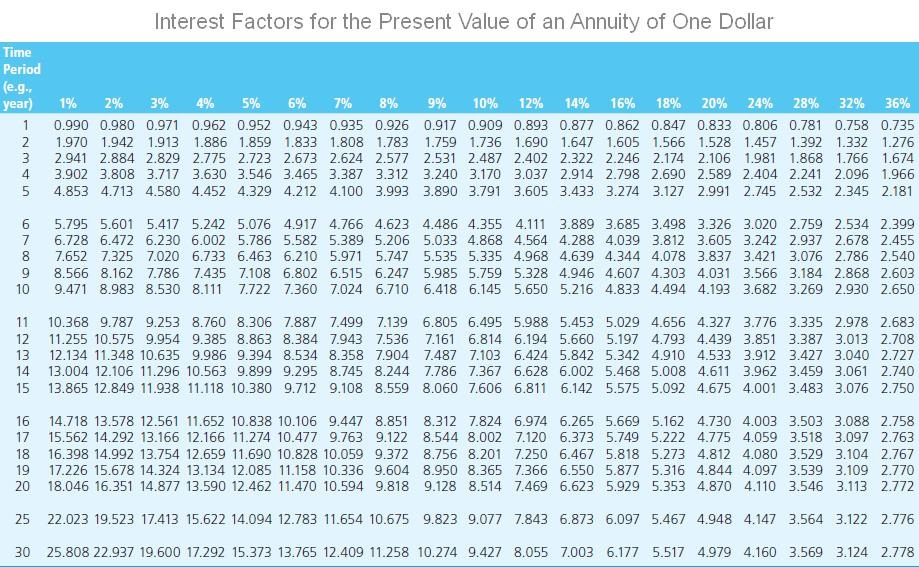

Appendix C

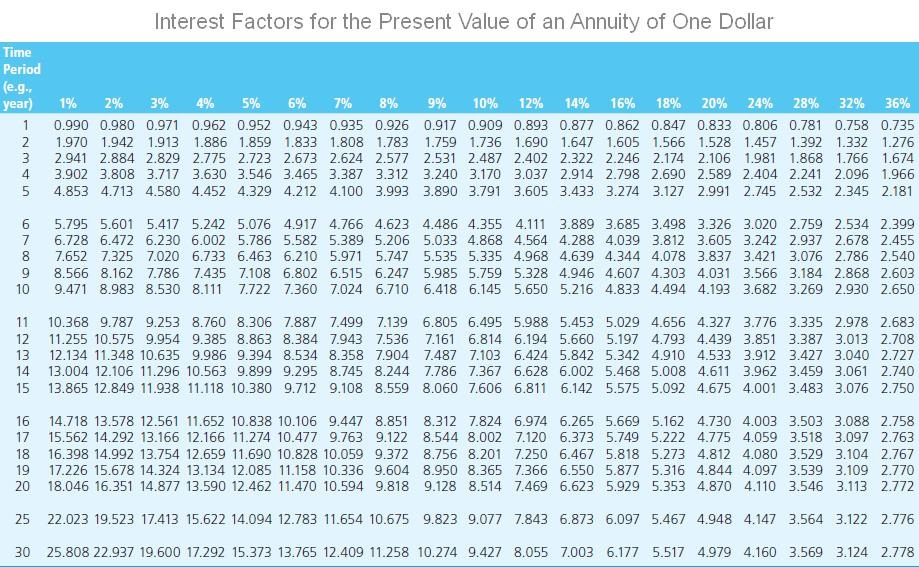

Appendix C

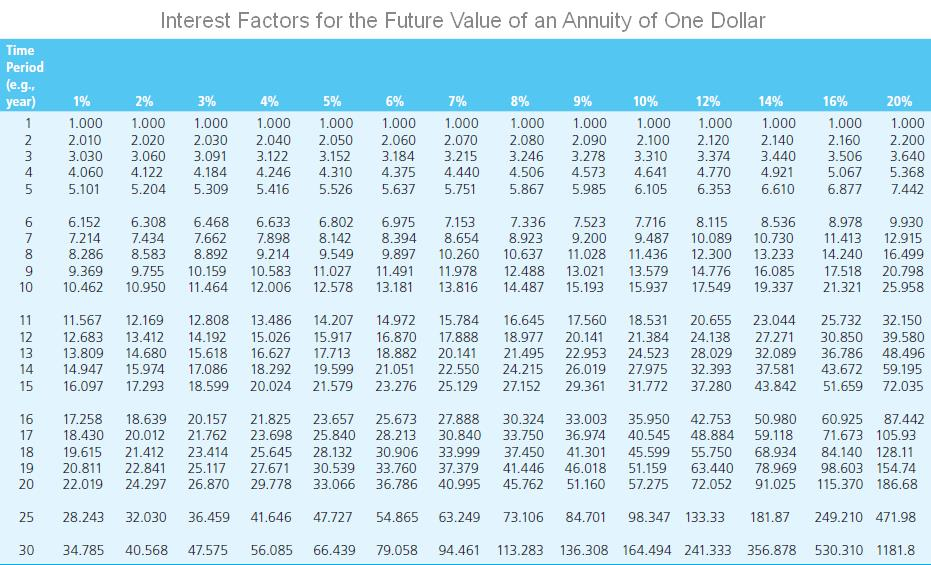

Appendix D

Appendix D

* UPDATE* appendix D and B look alike but D is the 3rd graph (the numbers get bigger).. Thank You for the help

You are given the following information concerning a noncallable, sinking fund debenture:

- Principal: $1,000

- Coupon rate of interest: 8 percent

- Term to maturity: 17 years

- Sinking fund: 3 percent of outstanding bonds retired annually; the balance at maturity

-

If you buy the bond today at its face amount and interest rates rise to 14 percent after two years have passed, what is your capital gain or loss? Assume that the bond pays interest annually. Use Appendix B and Appendix D to answer the question. Use a minus sign to enter the loss amount, if any, as a negative value. Round your answer to the nearest dollar.

$

-

If you hold the bond 17 years, what do you receive at maturity?

-Select -Principal OR coupon payments

-

What is the bond's current yield as of right now? Round your answer to the nearest whole number.

%

-

Given your price in a, what is the yield at maturity? Round your answer to the nearest whole number.

%

-

What proportion of the total debt issue is retired by the sinking fund? Round your answer to the nearest whole number.

%

-

If the final payment to retire this bond is $1,200,000, how much must the firm invest annually to accumulate this sum if the firm is able to earn 8 percent on the invested funds? Use Appendix C to answer the question. Round your answer to the nearest dollar.

$

Interest Factors for the Present Value of One Dollar Time Period (e.gr Year % 2% 3% 4% 5% 6% 7% 8% % 10% 12% 14% 15% 6% 18%,20% 24% 28% 990 980 71 962 952 943 935 926 917909 893 87 870 862 87 833806 781 980 961943 925907.890 873,857842 826 77 769 756 43 718 694 650 610 71942 91589864 840 816794 772 751712675658 64160959524 477 1961924 ,889 855 823 792 763 735 708 .683636 592 572 552 516 482 423 373 1951906 863 822 784747713681 650 621567519497476 437402 341 291 3 2rm 4 5 6 1942 1888 838 790 746 1705 666 630 56 564 507456 432 410 30 335275 1933 871 83 760 711 .665 .623 583 547513 .452 400 36 354 314 279 222 1923 1853 789 731 67.627 582 540 502 467 404 351 327 305 266 233 179 914 837766703 645592 544 500 460 424361308 284 263 1226 194 144 905 820 144 676 614 558 508 463 422386 322 20 247 227 191 162 16 227 178 139 108 .085 12345 6789m nuBUS 6DB9% ii 237 215 195 162 1896 804 1887 78 1879 773 870 758 1.861743 2 722 650 701 681 661577 642 555 * 5w 55 527 45 429 388 350 287 557497444 37 356 39 257 530469 415368 326 290 229 388 340 299 263 205 .481 .47 362 315 275239 183 182 160 140 163 141 23 145 125 108 116 099 084 135094066 112 076 1052 098 061 .040 .078 049 032 065 040 .025 17 1853 728 .623 534 1.458 394 844 714 .605513436 371 1.836 700 587494 .416 350 828 686 570 475396 1396 331 1.820 673 554 456 377312 339 1292 37 270 296 .250 276 1232 258 .215 252 231 212 194 178 .218 198 180 .164 .149 163 146 130 116 104 123 107 093 .07] 054 108 093 080 .060 .045 .095 .081069 .051,038 .083 .070 .060 .043 .03] 073 .06] 051 .037026 032 .026 021 017 014 .019 015 .012 .009 007 25 | 30 780 .610 .478 375 .295 233 742 552 412 308 .231 174 184 146 16 131 099 .075 .092 057 059 033 038 .030 024 2016 .010 .005 002 020 015 2012 007 .004 002 001 Interest Factors for the Future Value of an Annuity of One Dollar Time Period (e.g., year 1 1% 1.000 2.010 3.030 .060 5.101 2% 1.000 2.020 3.060 4.122 5.204 3% 1.000 2.030 3.091 4.184 5.309 4% 1.000 2.040 3.122 4.246 5.416 5% 1.000 2.050 3.152 4.3104 5.526 6% 1.000 2.060 3.184 .375 5.637 7% 1.000 2.070 3.215 4.440 5.751 8% 1.000 2.080 3.246 4.506 5.867 9% 1.000 2.090 3.278 4.573 5.985 10% 1.000 2.100 3.310 4.641 6.105 12% 1.000 2.120 3.374 4.770 6.353 14% 16% 1.000 1.000 2.140 2.160 3.440 3.506 4.9215 .067 6.610 6.877 20% 1.000 2.200 3.640 5.368 7.442 4 4 6.152 7.214 8.286 9.369 10.462 6.308 7.434 8.583 9.755 10.950 6.468 7.662 8.892 10.159 11.464 6.633 7.898 9.214 10.583 12.006 6.802 8.142 9.549 11.027 12.578 6.975 8.394 9.897 11.491 13.181 7.153 8.654 10.260 11.978 13.816 7.336 8.923 10.637 12.488 14.487 7.523 7.716 9.2009 .487 11.028 11.436 13.021 13.579 15.193 15.937 8.115 10.089 12.300 14.776 17.549 8.536 10.730 13.233 16.085 19.337 8.978 9.930 11.413 12.915 14.240 16.499 17.518 20.798 21.321 25.958 10 11 12 11.567 12.683 13.809 14.947 16.097 12.169 12.808 13.412 14.192 14.680 15.618 15.974 17.086 17.29318.599 13.486 15.026 16.627 18.292 20.024 14.207 15.917 17.713 19.599 21.579 14.972 16.870 18.882 21.051 23.276 15.784 17.888 20.141 22.550 25.129 16.645 18.977 21.495 24.215 27.152 17.560 20.141 22.953 26.019 29.361 18.531 21.384 24.523 27.975 31.772 20.655 24.138 28.029 32.393 37.280 23.044 27.271 32.089 37.581 43.842 25.732 30.850 36.786 43.672 51.659 32.150 39.580 48.496 59.195 72.035 14 16 17 17.25818.639 18.430 20.012 19.615 21.412 18 19 20.157 21.762 23.414 5.117 26.870 21.825 23.698 25.645 27.671 29.778 23.657 25.673 25.840 28.213 28.132 30.906 30.53933.760 33.066 36.786 27.888 30.840 33.999 37.379 40.995 30.324 33.750 37.450 41.446 45.762 33.003 36.974 41.301 46.018 51.160 35.950 42.753 50.980 40.545 48.884 59.118 45.599 55.750 68.934 51.15963.440 78.969 57.275 72.05291.025 60.925 87.442 71.673 105.93 84.140 128.11 98.603 154.74 115.370 186.68 20 22.019 24.297 25 28.243 32.030 36.459 41.646 47.727 54.865 63.249 73.106 84.701 98.347 133.33 181.87 249.210 471.98 30 34.785 40.568 47.575 56.085 66.439 79.058 94.461 113.283 136.308 164.494 241.333 356.878 530.310 1181.8 Interest Factors for the Present Value of an Annuity of One Dollar Time Period (e.g. year) 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 12% 14% 16% 18% 20% 24% 28% 32% 36% 1 0.990 0.980 0.971 0.962 0.952 0.943 0.935 0.926 0.917 0.909 0.893 0.877 0.862 0.847 0.833 0.806 0.781 0.758 0.735 2 1.970 1.942 1.913 1.886 1.859 1.833 1.808 1.783 1.759 1.736 1.690 1.647 1.605 1.566 1.528 1.457 1.392 1.332 1.276 3 2.941 2.884 2.829 2.775 2.723 2.673 2.624 2.577 2.531 2.487 2.402 2.322 2.246 2.174 2.106 1.981 1.868 1.766 1674 4 3.902 3.808 3.717 3.630 3.546 3.465 3.387 3.312 3.240 3.170 3.037 2.914 2.798 2.690 2.589 2.404 2.241 2.096 1.966 5 4.853 4.713 4.580 4.452 4.329 4.212 4.100 3.993 3.890 3.791 3.605 3.433 3.274 3.127 2.991 2.745 2.532 2.345 2.181 6 7 8 9 10 5.795 5.601 5.417 5.242 5.076 4.917 4.766 4.623 4.486 4.355 4.111 3.889 3.685 3.498 3.326 3.020 2.759 2.534 2.399 6 .728 6.472 6.230 6.002 5.786 5.582 5.389 5.206 5.033 4.868 4.564 4.288 4.039 3.812 3.605 3.242 2.937 2.678 2.455 7.652 7.325 7.020 6.733 6.463 6.210 5.971 5.747 5.535 5.335 4.968 4.639 4.344 4.078 3.837 3.421 3.076 2.786 2.540 8.566 8.162 7.786 7.435 7.108 6.802 6.515 6.247 5.985 5.759 5.328 4.946 4.607 4.303 4.031 3.566 3.184 2.868 2.603 9.471 8.983 8.530 8.111 7.722 7.360 7.024 6.710 6.418 6.145 5.650 5.216 4.833 4.494 4.193 3.682 3.269 2.930 2.650 11 12 13 14 15 10.368 9.787 9.253 8.760 8.306 7.887 7.499 7.139 6.805 6.495 5.988 5.453 5.029 4.656 4.327 3.776 3.335 2.978 2.683 11.255 10.575 9.954 9.385 8.863 8.384 7.943 7.536 7.161 6.814 6.194 5.660 5.197 4.793 4.439 3.851 3.387 3.013 2.708 12.134 11.348 10.635 9.986 9.394 8.534 8.358 7.904 7.487 7.103 6.424 5.842 5.342 4.910 4.533 3.912 3.427 3.040 2.727 13.004 12.106 11.296 10.563 9.899 9.295 8.745 8.244 7.786 7.367 6.628 6.002 5.468 5.008 4.611 3.962 3.459 3.061 2.740 13.865 12.849 11.938 11.118 10.380 9.712 9.108 8.559 8.060 7.606 6.811 6.142 5.575 5.092 4.675 4.001 3.483 3.076 2.750 16 17 18 19 20 14.718 13.578 12.561 11.652 10.838 10.106 9.447 8.851 8.312 7.824 6.974 6.265 5.669 5.162 4.730 4.003 3.503 3.088 2.758 15.562 14.292 13.166 12.166 11.274 10.477 9.763 9.122 8.544 8.002 7.120 6.373 5.749 5.222 4.775 4.059 3.518 3.097 2.763 16.398 14.992 13.754 12.659 11.690 10.828 10.059 9.372 8.756 8.2017.250 6.467 5.818 5.273 4.812 4.080 3.529 3.104 2.767 17.226 15.678 14.324 13.134 12.085 11.158 10.336 9.604 8.950 8.365 7.366 6.550 5.877 5.316 4.844 4.097 3.539 3.109 2.770 18.046 16.351 14.877 13.590 12.462 11.470 10.594 9.818 9.128 8.514 7.469 6.623 5.929 5.353 4.870 4.110 3.546 3.113 2.772 25 22.023 19.523 17.413 15.622 14.094 12.783 11.654 10.675 9.823 9.077 7.843 6.873 6.097 5.467 4.948 4.147 3.564 3.122 2.776 30 25.808 22.937 19.600 17.292 15.373 13.765 12.409 11.258 10.274 9.427 8.055 7.003 6.177 5.517 4.979 4.160 3.569 3.124 2.778 Interest Factors for the Present Value of One Dollar Time Period (e.gr Year % 2% 3% 4% 5% 6% 7% 8% % 10% 12% 14% 15% 6% 18%,20% 24% 28% 990 980 71 962 952 943 935 926 917909 893 87 870 862 87 833806 781 980 961943 925907.890 873,857842 826 77 769 756 43 718 694 650 610 71942 91589864 840 816794 772 751712675658 64160959524 477 1961924 ,889 855 823 792 763 735 708 .683636 592 572 552 516 482 423 373 1951906 863 822 784747713681 650 621567519497476 437402 341 291 3 2rm 4 5 6 1942 1888 838 790 746 1705 666 630 56 564 507456 432 410 30 335275 1933 871 83 760 711 .665 .623 583 547513 .452 400 36 354 314 279 222 1923 1853 789 731 67.627 582 540 502 467 404 351 327 305 266 233 179 914 837766703 645592 544 500 460 424361308 284 263 1226 194 144 905 820 144 676 614 558 508 463 422386 322 20 247 227 191 162 16 227 178 139 108 .085 12345 6789m nuBUS 6DB9% ii 237 215 195 162 1896 804 1887 78 1879 773 870 758 1.861743 2 722 650 701 681 661577 642 555 * 5w 55 527 45 429 388 350 287 557497444 37 356 39 257 530469 415368 326 290 229 388 340 299 263 205 .481 .47 362 315 275239 183 182 160 140 163 141 23 145 125 108 116 099 084 135094066 112 076 1052 098 061 .040 .078 049 032 065 040 .025 17 1853 728 .623 534 1.458 394 844 714 .605513436 371 1.836 700 587494 .416 350 828 686 570 475396 1396 331 1.820 673 554 456 377312 339 1292 37 270 296 .250 276 1232 258 .215 252 231 212 194 178 .218 198 180 .164 .149 163 146 130 116 104 123 107 093 .07] 054 108 093 080 .060 .045 .095 .081069 .051,038 .083 .070 .060 .043 .03] 073 .06] 051 .037026 032 .026 021 017 014 .019 015 .012 .009 007 25 | 30 780 .610 .478 375 .295 233 742 552 412 308 .231 174 184 146 16 131 099 .075 .092 057 059 033 038 .030 024 2016 .010 .005 002 020 015 2012 007 .004 002 001 Interest Factors for the Future Value of an Annuity of One Dollar Time Period (e.g., year 1 1% 1.000 2.010 3.030 .060 5.101 2% 1.000 2.020 3.060 4.122 5.204 3% 1.000 2.030 3.091 4.184 5.309 4% 1.000 2.040 3.122 4.246 5.416 5% 1.000 2.050 3.152 4.3104 5.526 6% 1.000 2.060 3.184 .375 5.637 7% 1.000 2.070 3.215 4.440 5.751 8% 1.000 2.080 3.246 4.506 5.867 9% 1.000 2.090 3.278 4.573 5.985 10% 1.000 2.100 3.310 4.641 6.105 12% 1.000 2.120 3.374 4.770 6.353 14% 16% 1.000 1.000 2.140 2.160 3.440 3.506 4.9215 .067 6.610 6.877 20% 1.000 2.200 3.640 5.368 7.442 4 4 6.152 7.214 8.286 9.369 10.462 6.308 7.434 8.583 9.755 10.950 6.468 7.662 8.892 10.159 11.464 6.633 7.898 9.214 10.583 12.006 6.802 8.142 9.549 11.027 12.578 6.975 8.394 9.897 11.491 13.181 7.153 8.654 10.260 11.978 13.816 7.336 8.923 10.637 12.488 14.487 7.523 7.716 9.2009 .487 11.028 11.436 13.021 13.579 15.193 15.937 8.115 10.089 12.300 14.776 17.549 8.536 10.730 13.233 16.085 19.337 8.978 9.930 11.413 12.915 14.240 16.499 17.518 20.798 21.321 25.958 10 11 12 11.567 12.683 13.809 14.947 16.097 12.169 12.808 13.412 14.192 14.680 15.618 15.974 17.086 17.29318.599 13.486 15.026 16.627 18.292 20.024 14.207 15.917 17.713 19.599 21.579 14.972 16.870 18.882 21.051 23.276 15.784 17.888 20.141 22.550 25.129 16.645 18.977 21.495 24.215 27.152 17.560 20.141 22.953 26.019 29.361 18.531 21.384 24.523 27.975 31.772 20.655 24.138 28.029 32.393 37.280 23.044 27.271 32.089 37.581 43.842 25.732 30.850 36.786 43.672 51.659 32.150 39.580 48.496 59.195 72.035 14 16 17 17.25818.639 18.430 20.012 19.615 21.412 18 19 20.157 21.762 23.414 5.117 26.870 21.825 23.698 25.645 27.671 29.778 23.657 25.673 25.840 28.213 28.132 30.906 30.53933.760 33.066 36.786 27.888 30.840 33.999 37.379 40.995 30.324 33.750 37.450 41.446 45.762 33.003 36.974 41.301 46.018 51.160 35.950 42.753 50.980 40.545 48.884 59.118 45.599 55.750 68.934 51.15963.440 78.969 57.275 72.05291.025 60.925 87.442 71.673 105.93 84.140 128.11 98.603 154.74 115.370 186.68 20 22.019 24.297 25 28.243 32.030 36.459 41.646 47.727 54.865 63.249 73.106 84.701 98.347 133.33 181.87 249.210 471.98 30 34.785 40.568 47.575 56.085 66.439 79.058 94.461 113.283 136.308 164.494 241.333 356.878 530.310 1181.8 Interest Factors for the Present Value of an Annuity of One Dollar Time Period (e.g. year) 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 12% 14% 16% 18% 20% 24% 28% 32% 36% 1 0.990 0.980 0.971 0.962 0.952 0.943 0.935 0.926 0.917 0.909 0.893 0.877 0.862 0.847 0.833 0.806 0.781 0.758 0.735 2 1.970 1.942 1.913 1.886 1.859 1.833 1.808 1.783 1.759 1.736 1.690 1.647 1.605 1.566 1.528 1.457 1.392 1.332 1.276 3 2.941 2.884 2.829 2.775 2.723 2.673 2.624 2.577 2.531 2.487 2.402 2.322 2.246 2.174 2.106 1.981 1.868 1.766 1674 4 3.902 3.808 3.717 3.630 3.546 3.465 3.387 3.312 3.240 3.170 3.037 2.914 2.798 2.690 2.589 2.404 2.241 2.096 1.966 5 4.853 4.713 4.580 4.452 4.329 4.212 4.100 3.993 3.890 3.791 3.605 3.433 3.274 3.127 2.991 2.745 2.532 2.345 2.181 6 7 8 9 10 5.795 5.601 5.417 5.242 5.076 4.917 4.766 4.623 4.486 4.355 4.111 3.889 3.685 3.498 3.326 3.020 2.759 2.534 2.399 6 .728 6.472 6.230 6.002 5.786 5.582 5.389 5.206 5.033 4.868 4.564 4.288 4.039 3.812 3.605 3.242 2.937 2.678 2.455 7.652 7.325 7.020 6.733 6.463 6.210 5.971 5.747 5.535 5.335 4.968 4.639 4.344 4.078 3.837 3.421 3.076 2.786 2.540 8.566 8.162 7.786 7.435 7.108 6.802 6.515 6.247 5.985 5.759 5.328 4.946 4.607 4.303 4.031 3.566 3.184 2.868 2.603 9.471 8.983 8.530 8.111 7.722 7.360 7.024 6.710 6.418 6.145 5.650 5.216 4.833 4.494 4.193 3.682 3.269 2.930 2.650 11 12 13 14 15 10.368 9.787 9.253 8.760 8.306 7.887 7.499 7.139 6.805 6.495 5.988 5.453 5.029 4.656 4.327 3.776 3.335 2.978 2.683 11.255 10.575 9.954 9.385 8.863 8.384 7.943 7.536 7.161 6.814 6.194 5.660 5.197 4.793 4.439 3.851 3.387 3.013 2.708 12.134 11.348 10.635 9.986 9.394 8.534 8.358 7.904 7.487 7.103 6.424 5.842 5.342 4.910 4.533 3.912 3.427 3.040 2.727 13.004 12.106 11.296 10.563 9.899 9.295 8.745 8.244 7.786 7.367 6.628 6.002 5.468 5.008 4.611 3.962 3.459 3.061 2.740 13.865 12.849 11.938 11.118 10.380 9.712 9.108 8.559 8.060 7.606 6.811 6.142 5.575 5.092 4.675 4.001 3.483 3.076 2.750 16 17 18 19 20 14.718 13.578 12.561 11.652 10.838 10.106 9.447 8.851 8.312 7.824 6.974 6.265 5.669 5.162 4.730 4.003 3.503 3.088 2.758 15.562 14.292 13.166 12.166 11.274 10.477 9.763 9.122 8.544 8.002 7.120 6.373 5.749 5.222 4.775 4.059 3.518 3.097 2.763 16.398 14.992 13.754 12.659 11.690 10.828 10.059 9.372 8.756 8.2017.250 6.467 5.818 5.273 4.812 4.080 3.529 3.104 2.767 17.226 15.678 14.324 13.134 12.085 11.158 10.336 9.604 8.950 8.365 7.366 6.550 5.877 5.316 4.844 4.097 3.539 3.109 2.770 18.046 16.351 14.877 13.590 12.462 11.470 10.594 9.818 9.128 8.514 7.469 6.623 5.929 5.353 4.870 4.110 3.546 3.113 2.772 25 22.023 19.523 17.413 15.622 14.094 12.783 11.654 10.675 9.823 9.077 7.843 6.873 6.097 5.467 4.948 4.147 3.564 3.122 2.776 30 25.808 22.937 19.600 17.292 15.373 13.765 12.409 11.258 10.274 9.427 8.055 7.003 6.177 5.517 4.979 4.160 3.569 3.124 2.778

Appendix B

Appendix B Appendix C

Appendix C Appendix D

Appendix D