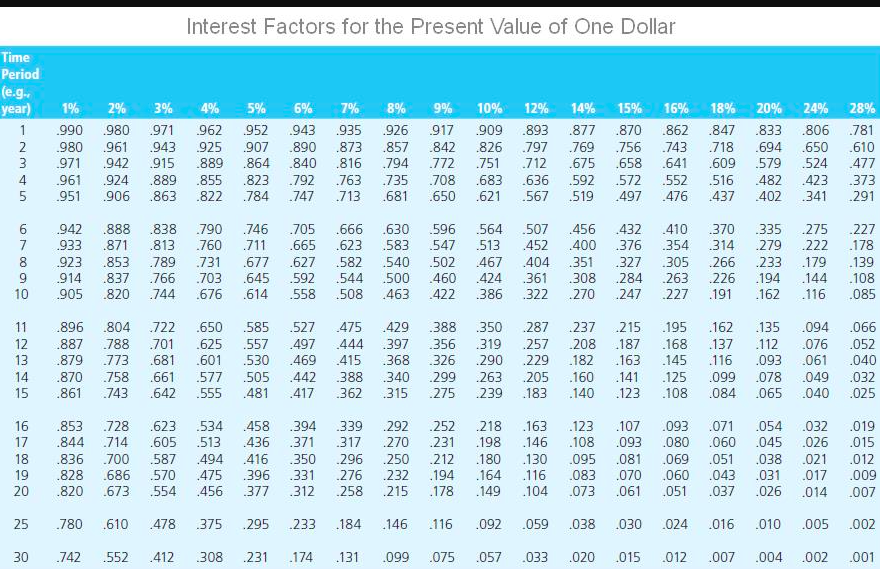

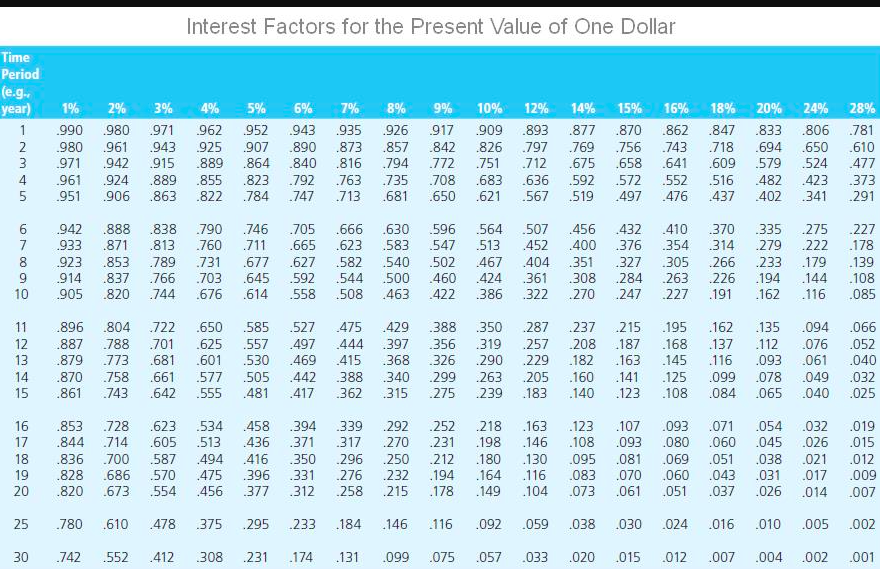

Appendix B

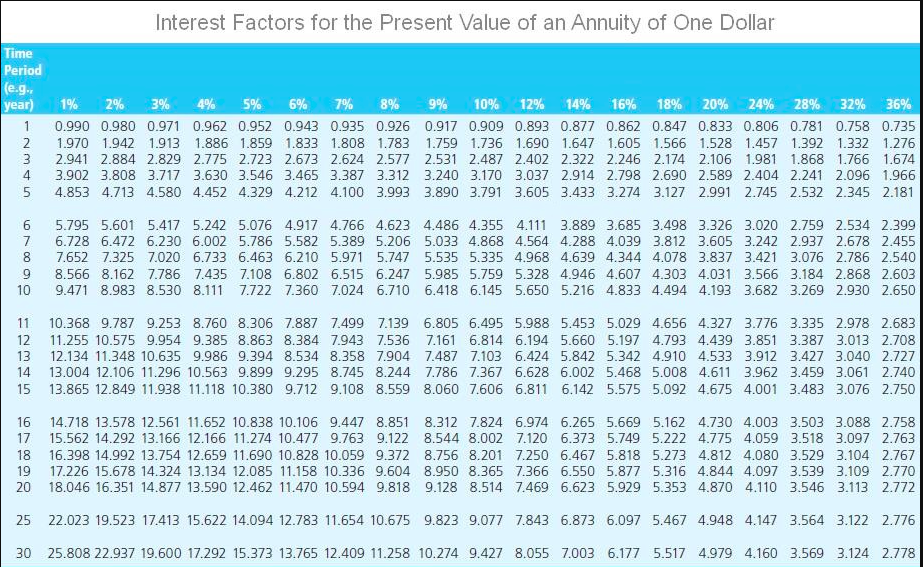

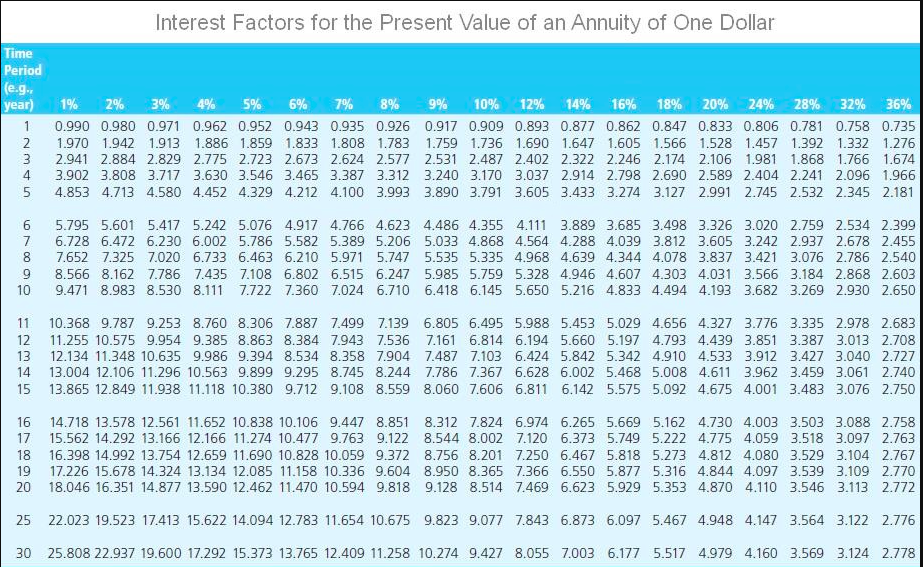

Appendix D

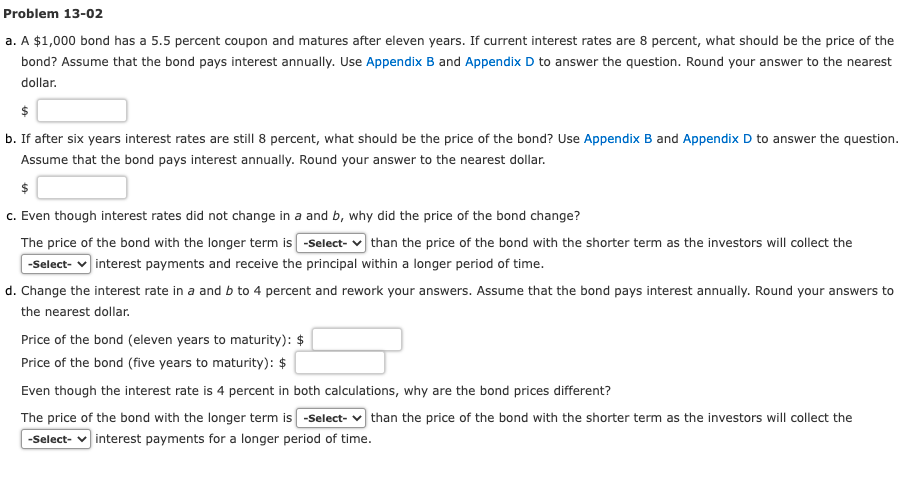

Problem 13-02 a. A $1,000 bond has a 5.5 percent coupon and matures after eleven years. If current interest rates are 8 percent, what should be the price of the bond? Assume that the bond pays interest annually. Use Appendix B and Appendix D to answer the question. Round your answer to the nearest dollar. $ b. If after six years interest rates are still 8 percent, what should be the price of the bond? Use Appendix B and Appendix D to answer the question. Assume that the bond pays interest annually. Round your answer to the nearest dollar. $ c. Even though interest rates did not change in a and b, why did the price of the bond change? The price of the bond with the longer term is -Select-than the price of the bond with the shorter term as the investors will collect the -Select- v interest payments and receive the principal within a longer period of time. d. Change the interest rate in a and b to 4 percent and rework your answers. Assume that the bond pays interest annually. Round your answers to the nearest dollar Price of the bond (eleven years to maturity): $ Price of the bond (five years to maturity): $ Even though the interest rate is 4 percent in both calculations, why are the bond prices different? The price of the bond with the longer term is -Select- v than the price of the bond with the shorter term as the investors will collect the -Select-vinterest payments for a longer period of time. Interest Factors for the Present Value of One Dollar Time Period (e.g. year) 6% NM 2 3 4 5 1% .990 980 971 961 951 2% 3% .980 971 1961 .943 .942915 .924 .889 .906 .863 4% 1962 .925 .889 .855 .822 5% 952 .907 .864 .823 .784 .943 .890 .840 .792 .747 7% .935 .873 .816 .763 .713 8% .926 .857 .794 .735 .681 9% 917 .842 .772 .708 .650 10% .909 .826 .751 .683 .621 12% .893 .797 712 .636 .567 14% .877 .769 .675 .592 .519 15% .870 .756 .658 .572 497 16% .862 .743 .641 .552 .476 18% .847 .718 .609 .516 437 20% .833 .694 .579 482 402 24% .806 .650 .524 .423 .341 28% .781 .610 .477 .373 .291 6 7 8 9 10 942 888 838 933 871 .813 923 853 .789 914 .837 .766 905 .820 .744 .790 .760 .731 .703 .676 .746 .711 .677 .645 .614 .705.666 630 596 .665.623 583 547 .627 582 .540 .502 .592 .544 .500 460 .558 .508 .463 422 .564 513 467 424 386 .507 452 404 456 400 351 .308 .270 .432 .376 .327 .284 .247 410 .354 .305 .263 .227 .370 .314 .266 .226 .191 .335 .279 .233 .194 .162 .275 .222 .179 .144 .116 .227 .178 .139 . 108 .085 361 322 11 12 13 14 15 .896 .887 .879 .870 .861 .804 .788 .773 .758 .743 .722 .701 .681 .661 .642 .650 .625 .601 .577 .555 .585 .557 .530 .505 .481 .527 497 .469 .442 .417 475 .444 .415 388 .362 429 .397 .368 .340 .315 .388 356 326 .299 .275 .350 .319 .290 .263 .239 .287 .257 .229 .205 .183 .237 .208 .182 .160 .140 .215 .187 .163 .141 .123 .195.162 135 094 .168 137 .112 076 .145 116 .093 061 .125 .099 .078 .049 .108 084 .065 .040 .066 .052 .040 .032 .025 16 17 18 19 20 .853 .844 .836 .828 .820 .728 .714 .700 .686 .673 .623 .605 .587 .570 .554 .534 .513 494 475 456 458 436 416 396 377 .394 .371 .350 .331 .312 339 .292 .317 .270 .296 250 .276 .232 .258 .215 .252 .231 .212 .194 .178 .218 .198 .180 .164 .149 .163 .146 .130 .116 .104 .123 . 108 .095 .083 .073 .107 .093 .081 .070 .061 .093 .071 .054 .032 .019 .080 060 045 026 015 ,069 .051.038 021012 .060 .043 031 .017 .009 .051 .037 .026 .014 .007 25 .780 .610 .478 .375 .295 .233 .184 .146 .116 .092 .059 .038 .030 .024 .016 .010 .005 .002 30 .742 1552 412 308 .231 .174 .131 .099 .075 .057 .033 .020 .015 .012 .007 .004 002 001 Interest Factors for the Present Value of an Annuity of One Dollar Time Period (e.g. 7% year) 1 2 3 4 5 NMetin 1% 2% 3% 4% 5% 6% 8% 9% 10% 12% 14% 16% 18% 20% 24% 28% 32% 36% 0.990 0.980 0.971 0.962 0.952 0.943 0.935 0.926 0.917 0.909 0.893 0.877 0.862 0.847 0.833 0.806 0.781 0.758 0.735 1.970 1.942 1.913 1.886 1.859 1.833 1.808 1.783 1.759 1.736 1.690 1.647 1.605 1.566 1.528 1.457 1.392 1.332 1.276 2.941 2.884 2.829 2.775 2.723 2.673 2.624 2.577 2.531 2.487 2.402 2.322 2.246 2.174 2.106 1.981 1.868 1.766 1674 3.902 3.808 3.717 3.630 3.546 3.465 3.387 3.312 3.240 3.170 3.037 2.914 2.798 2.690 2.589 2.404 2.241 2.096 1.966 4.853 4.713 4.580 4.452 4.329 4.212 4.100 3.993 3.890 3.791 3.605 3.433 3.274 3.127 2.991 2.745 2.532 2.345 2.181 6 7 8 9 10 5.795 5.601 5.417 5.242 5.076 4.917 4.766 4.623 4.486 4.355 4.111 3.889 3.685 3.498 3.326 3.020 2.759 2.534 2.399 6.728 6.472 6.230 6.002 5.786 5.582 5.389 5.206 5.033 4.868 4.564 4.288 4.039 3.812 3.605 3.242 2.937 2.678 2.455 7.652 7.325 7.020 6.733 6.463 6.210 5.971 5.747 5.535 5.335 4.968 4.639 4.344 4.078 3.837 3.421 3.076 2.786 2.540 8.566 8.162 7.786 7.435 7.108 6.802 6.515 6.247 5.985 5.759 5.328 4.946 4.607 4.303 4.031 3.566 3.184 2.868 2.603 9.471 8.983 8.530 8.111 7.722 7.360 7024 6.710 6.418 6.145 5.650 5.216 4.833 4.494 4.193 3.682 3.269 2.930 2.650 11 12 13 14 15 10.368 9.787 9.253 8.760 8.306 7.887 7.499 7.139 6.805 6.495 5.988 5.453 5.029 4.656 4.327 3.776 3.335 2.978 2.683 11.255 10.575 9.954 9.385 8.863 8.384 7.943 7.536 7.161 6.814 6.194 5.660 5.197 4.793 4.439 3.851 3.387 3.013 2.708 12.134 11.348 10.635 9.986 9.394 8.534 8.358 7.904 7.487 7.103 6.424 5.842 5.342 4.910 4.533 3.912 3.427 3.040 2.727 13.004 12.106 11.296 10.563 9.899 9.295 8.745 8.244 7.786 7.367 6.628 6.002 5.468 5.008 4.611 3.962 3.459 3.061 2.740 13.865 12.849 11.938 11.118 10.380 9.712 9.108 8.559 8.060 7.606 6.811 6.142 5.575 5.092 4.675 4.001 3.483 3.076 2.750 16 17 18 19 20 14.718 13.578 12.561 11.652 10.838 10.106 9.447 8.851 8.312 7.824 6.974 6.265 5.669 5.162 4.730 4.003 3.503 3.088 2.758 15.562 14.292 13.166 12.166 11.274 10.477 9.763 9.122 8.544 8.002 7.120 6.373 5.749 5.222 4.775 4.059 3.518 3.097 2.763 16.398 14.992 13.754 12.659 11.690 10.828 10.059 9.372 8.756 8.201 7.250 6.467 5.818 5.273 4.812 4.080 3.529 3.104 2.767 17.226 15.678 14.324 13.134 12.085 11.158 10.336 9.604 8.950 8.365 7.366 6.550 5.877 5.316 4.844 4.097 3.539 3.109 2.770 18.046 16.351 14.877 13.590 12.462 11.470 10.594 9.818 9.128 8.514 7.469 6.623 5.929 5.353 4.870 4.110 3.546 3.113 2.772 25 22.023 19.523 17.413 15.622 14.094 12.783 11.654 10.675 9.823 9.077 7.843 6.873 6.097 5.467 4.948 4.147 3.564 3.122 2.776 30 25.808 22.937 19.600 17.292 15.373 13.765 12.409 11.258 10.274 9.427 8.055 7.003 6.177 5.517 4.979 4.160 3.569 3.124 2.778