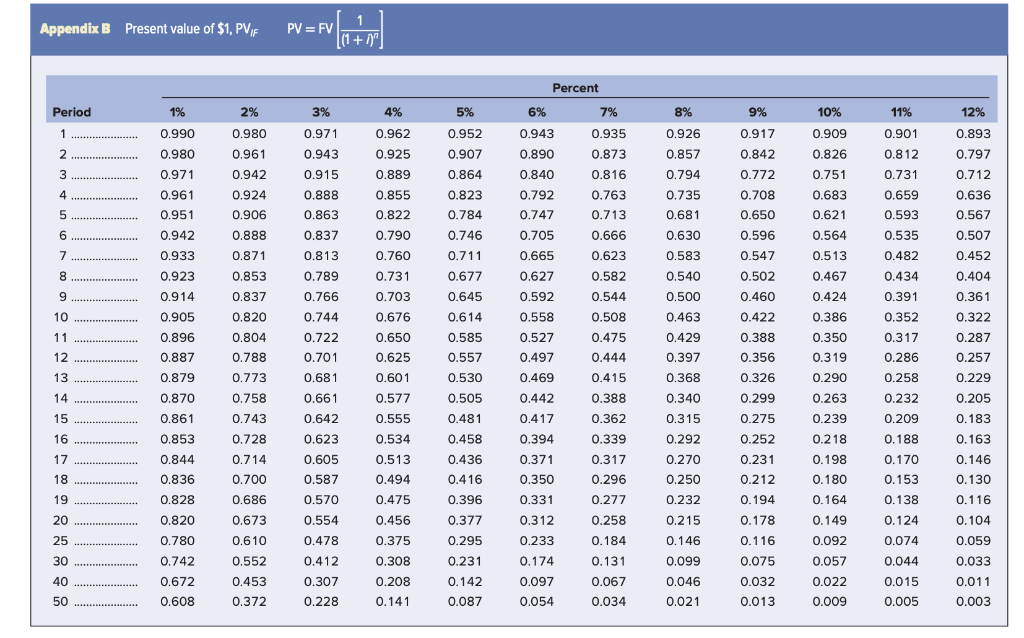

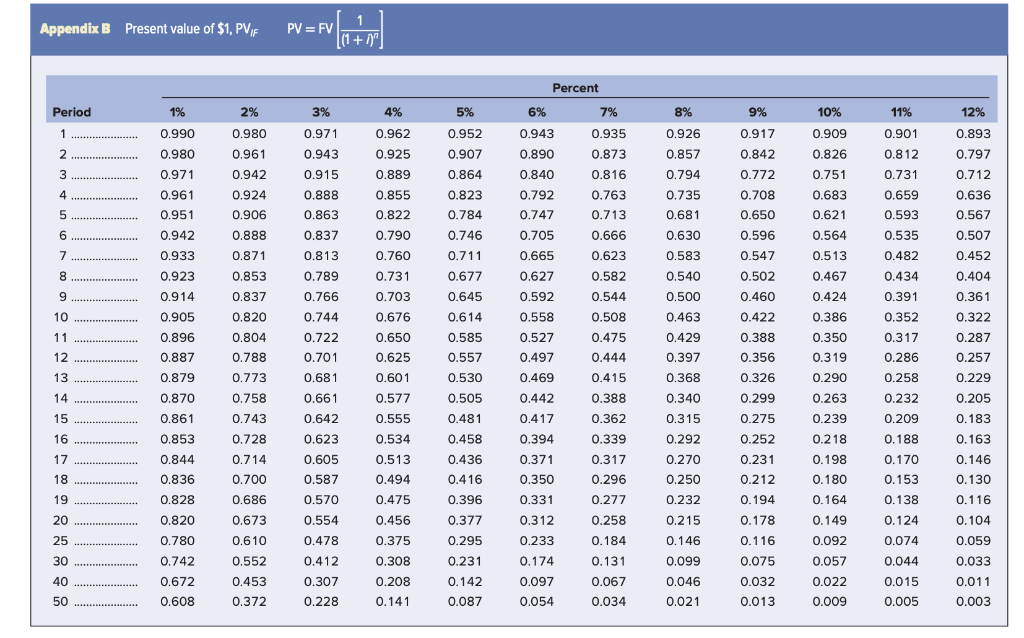

APPENDIX B =

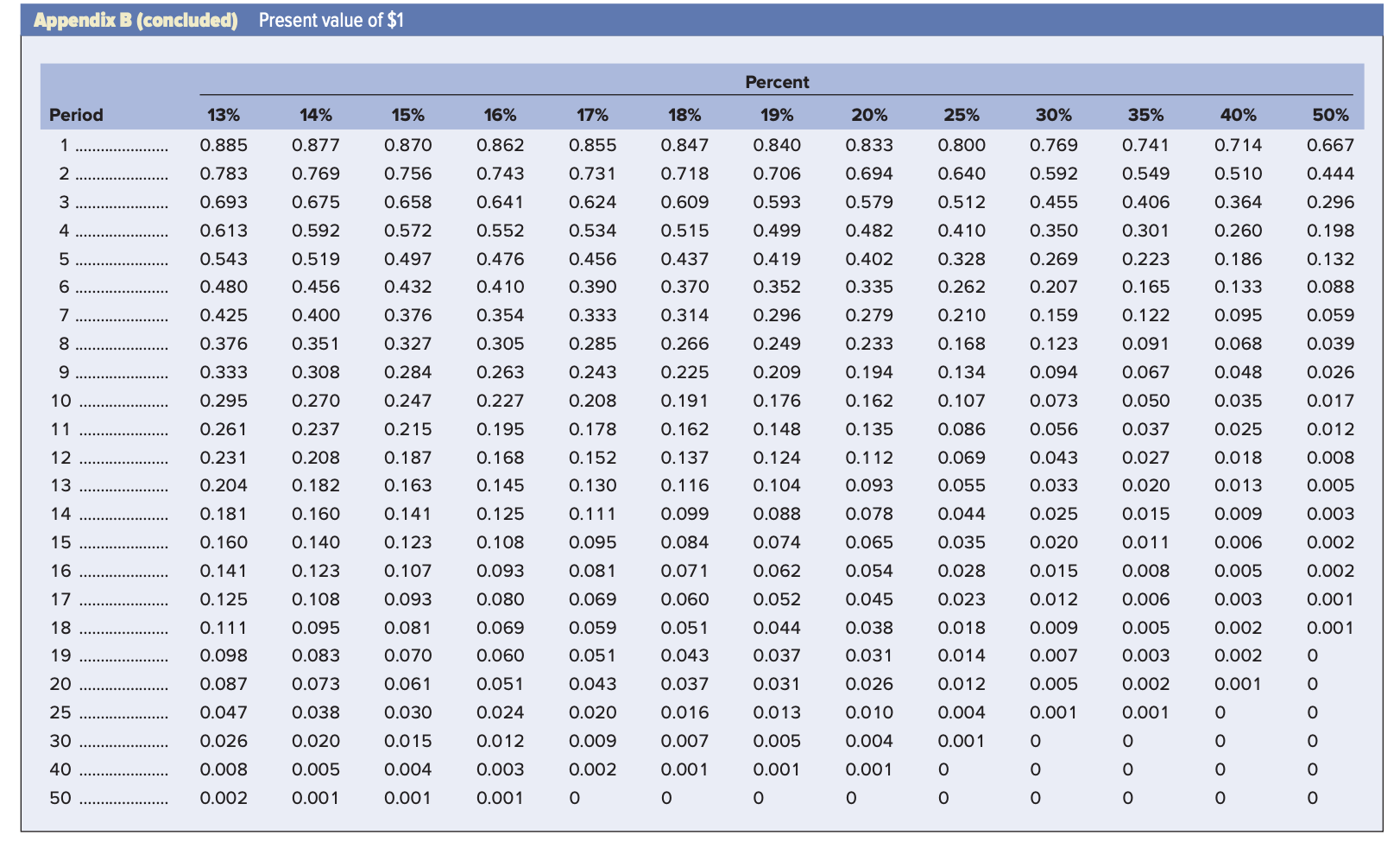

APPENDIX B =

b. Which method should be selected using net present value analysis? multiple choice

-

Method 1

-

Method 2

-

Neither of these

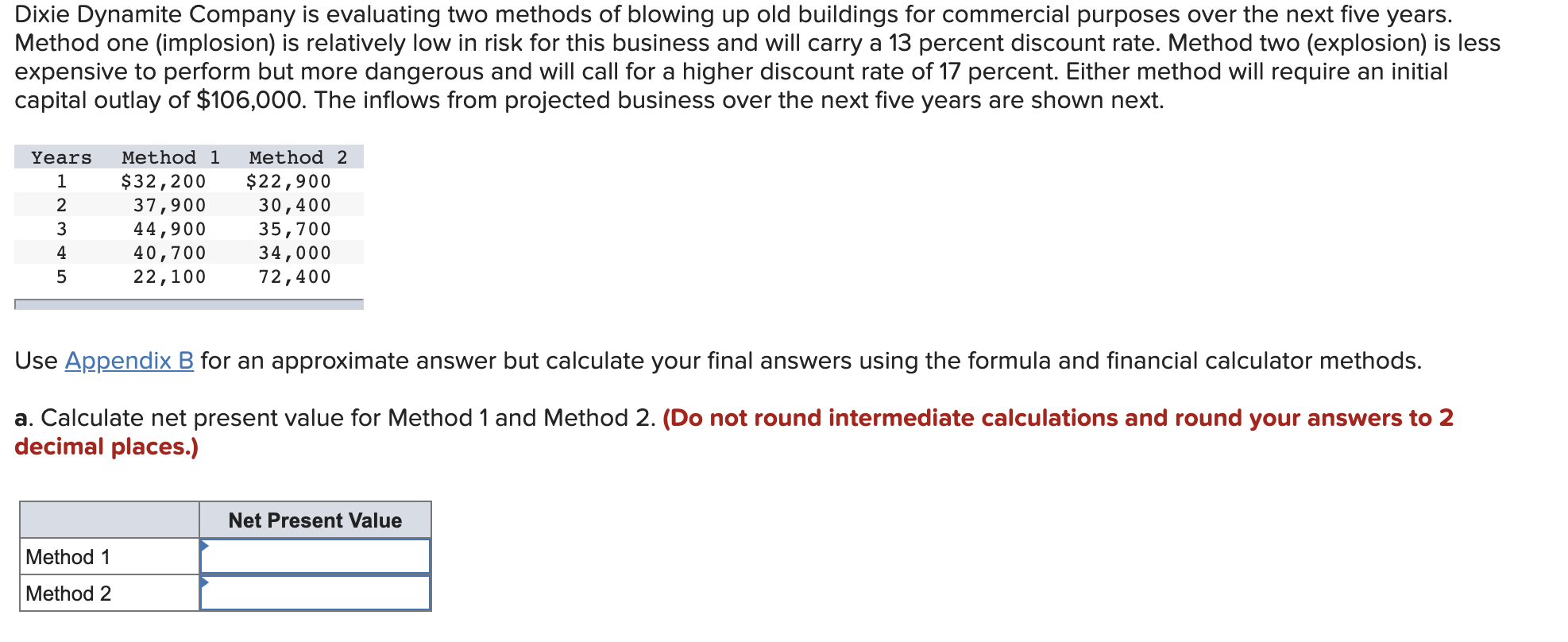

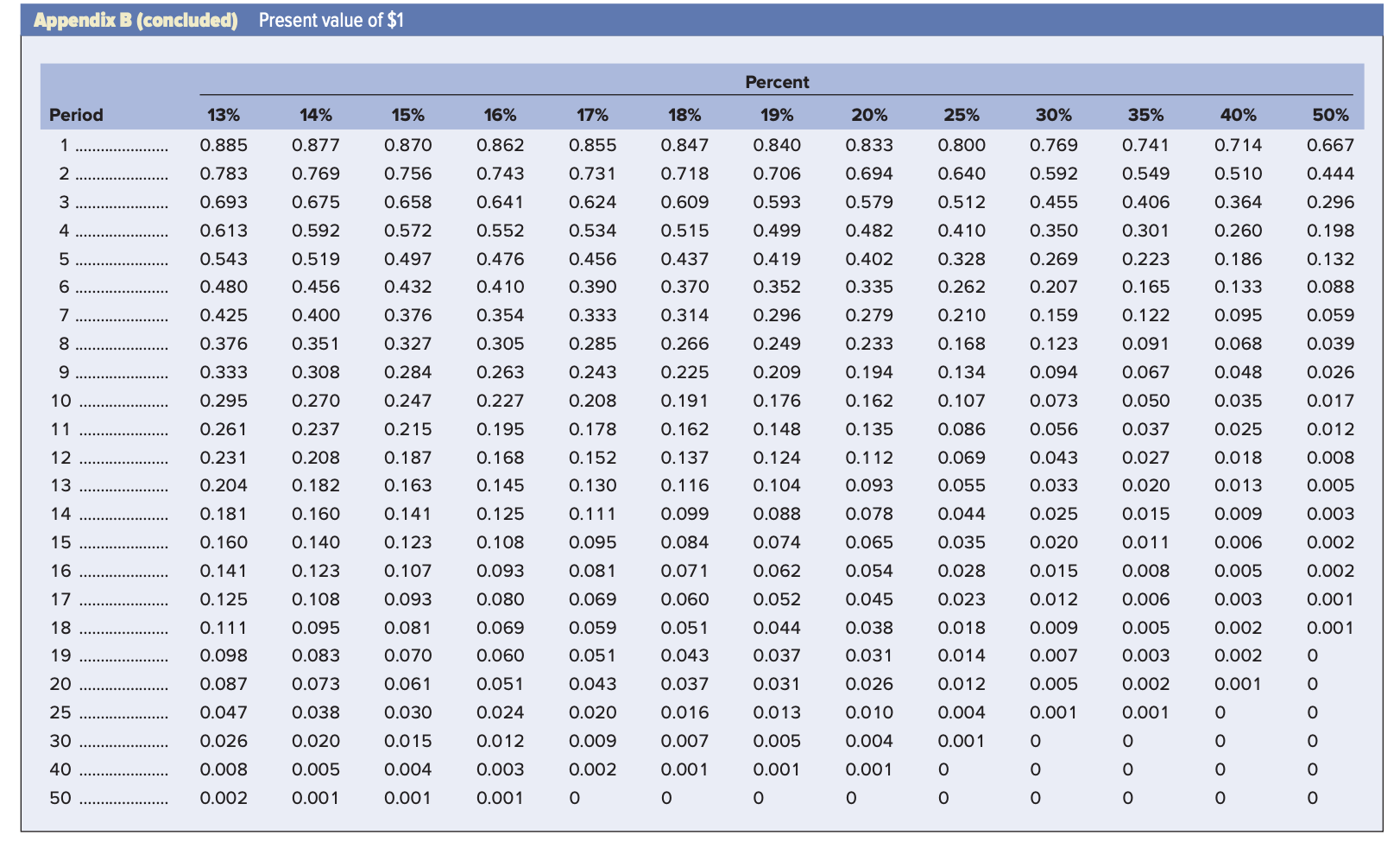

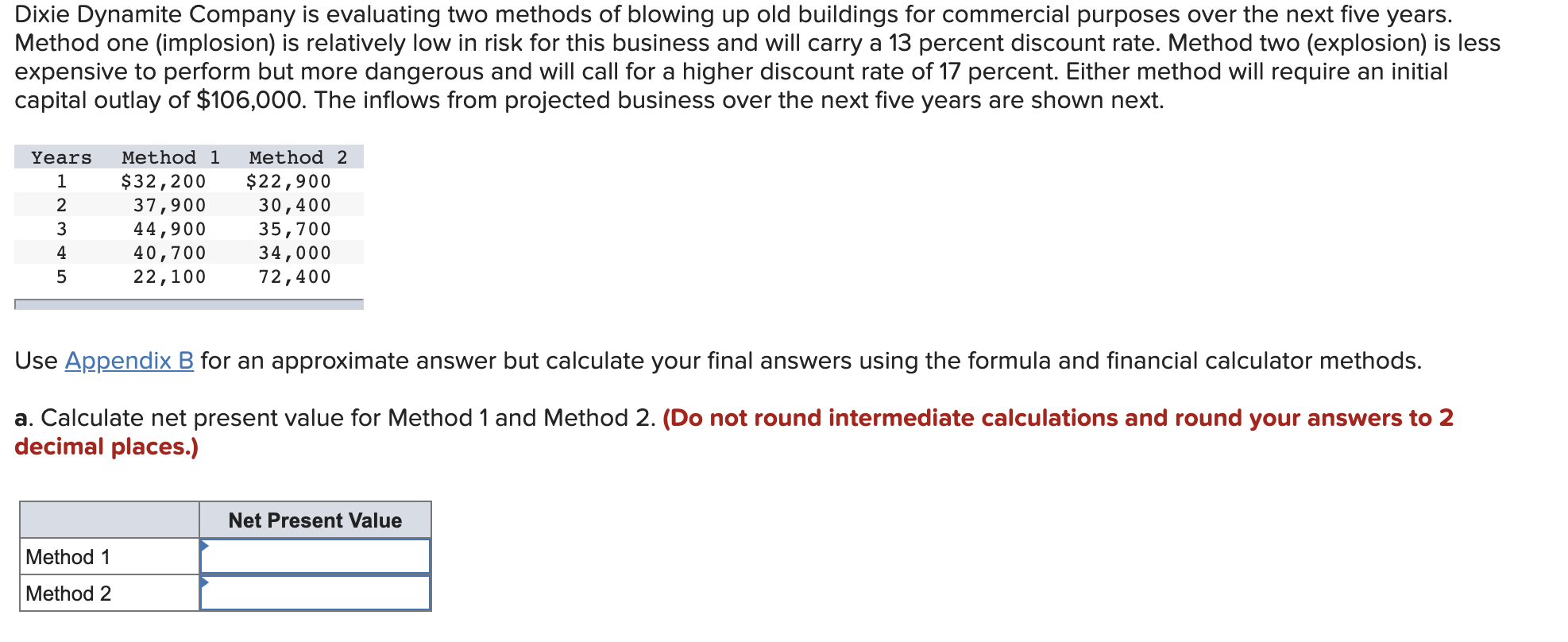

Dixie Dynamite Company is evaluating two methods of blowing up old buildings for commercial purposes over the next five years. Method one (implosion) is relatively low in risk for this business and will carry a 13 percent discount rate. Method two (explosion) is less expensive to perform but more dangerous and will call for a higher discount rate of 17 percent. Either method will require an initial capital outlay of $106,000. The inflows from projected business over the next five years are shown next. Years 1 2 3 Method 1 $32,200 37,900 44,900 40,700 22,100 Method 2 $22,900 30,400 35,700 34,000 72,400 4 5 Use Appendix B for an approximate answer but calculate your final answers using the formula and financial calculator methods. a. Calculate net present value for Method 1 and Method 2. (Do not round intermediate calculations and round your answers to 2 decimal places.) Net Present Value Method 1 Method 2 Appendix B Present value of $1, PVF PV = FV (+ =F01040 Percent Period 5% 12% 3% 0.971 1 4% 0.962 0.925 0.889 6% 0.943 0.890 0.840 0.952 0.907 0.864 2 8% 0.926 0.857 0.794 0.943 7% 0.935 0.873 0.816 0.763 0.713 1% 0.990 0.980 0.971 0.961 0.951 0.942 0.933 0.893 0.797 0.712 3 2% 0.980 0.961 0.942 0.924 0.906 0.888 0.871 0.915 9% 0.917 0.842 0.772 0.708 0.650 0.596 11% 0.901 0.812 0.731 0.659 0.593 4 0.888 0.863 0.855 0.822 0.790 0.823 0.784 10% 0.909 0.826 0.751 0.683 0.621 0.564 0.513 0.467 0.792 0.747 0.705 5 0.735 0.681 0.630 0.636 0.567 6 0.837 0.746 0.666 0.535 0.507 7 0.760 0.547 0.452 0.813 0.789 0.711 0.677 0.665 0.627 0.623 0.582 0.583 0.540 0.482 0.434 8 0.923 0.853 0.731 0.404 9 0.500 0.424 0.391 0.914 0.905 0.361 0.837 0.820 0.766 0.744 0.703 0.676 0.502 0.460 0.422 0.645 0.614 0.592 0.558 0.544 0.508 0.463 0.386 0.352 0.322 10 11 0.896 0.804 0.475 0.429 0.350 0.317 0.287 0.650 0.625 0.527 0.497 12 0.887 0.788 0.397 0.286 0.722 0.701 0.681 0.661 13 0.773 0.601 0.585 0.557 0.530 0.505 0.481 0.879 0.870 0.368 0.258 0.232 14 0.257 0.229 0.205 0.469 0.442 0.417 0.758 0.444 0.415 0.388 0.362 0.339 0.577 0.340 15 0.861 0.853 16 0.743 0.728 0.714 0.700 0.642 0.623 0.605 0.394 0.371 0.315 0.292 0.270 0.209 0.188 0.170 17 0.555 0.534 0.513 0.494 0.475 0.456 0.844 0.836 0.183 0.163 0.146 0.130 0.388 0.356 0.326 0.299 0.275 0.252 0.231 0.212 0.194 0.178 0.116 0.075 0.032 0.013 0.319 0.290 0.263 0.239 0.218 0.198 0.180 0.164 0.149 0.092 0.057 0.458 0.436 0.416 0.396 0.377 18 0.587 0.350 0.250 0.153 19 0.828 0.820 0.116 0.317 0.296 0.277 0.258 0.184 0.686 0.673 0.570 0.554 0.331 0.312 0.138 0.124 20 0.104 0.232 0.215 0.146 0.099 25 0.610 0.295 0.233 0.780 0.742 0.478 0.412 0.375 0.308 0.074 0.044 0.059 0.033 30 0.552 0.231 0.174 40 0.672 0.142 0.097 0.046 0.022 0.131 0.067 0.034 0.453 0.372 0.015 0.307 0.228 0.208 0.141 0.011 0.003 50 0.608 0.087 0.054 0.021 0.009 0.005 Appendix B (concluded) Present value of $1 Percent Period 13% 14% 15% 16% 17% 18% 19% 20% 25% 30% 35% 40% 50% 1 0.714 0.877 0.769 0.870 0.756 0.862 0.743 0.741 0.549 2 0.885 0.783 0.693 0.613 0.667 0.444 0.855 0.731 0.624 0.534 0.847 0.718 0.609 0.515 0.833 0.694 0.579 0.769 0.592 0.455 0.800 0.640 0.512 0.410 0.840 0.706 0.593 0.499 0.419 0.510 0.364 3 0.675 0.658 0.641 0.406 0.296 4 0.572 0.552 0.482 0.350 0.301 0.260 0.198 5 0.543 0.592 0.519 0.456 0.497 0.456 0.328 0.186 0.132 0.476 0.410 0.437 0.370 0.402 0.335 6 0.480 0.432 0.390 0.352 0.262 0.269 0.207 0.159 0.133 0.088 0.223 0.165 0.122 0.091 7 0.425 0.400 0.376 0.333 0.314 0.296 0.095 0.059 0.354 0.305 0.210 0.168 8 0.376 0.351 0.285 0.266 0.249 0.279 0.233 0.194 0.123 0.068 0.039 9 0.333 0.327 0.284 0.247 0.308 0.263 0.243 0.209 0.134 0.094 0.067 0.048 0.026 10 0.227 0.162 0.225 0.191 0.162 0.073 0.270 0.237 0.035 0.208 0.178 0.176 0.148 0.107 0.086 0.050 0.037 0.017 0.012 11 0.195 0.135 0.056 0.025 0.295 0.261 0.231 0.204 0.181 0.215 0.187 12 0.152 0.137 0.124 0.112 0.069 0.043 0.027 0.018 0.008 0.208 0.182 0.168 0.145 13 0.163 0.130 0.116 0.104 0.093 0.055 0.033 0.020 0.013 0.005 14 0.160 0.141 0.078 0.044 0.025 0.003 0.099 0.084 15 0.160 0.141 0.140 0.123 0.125 0.108 0.093 0.080 0.123 0.107 0.093 0.111 0.095 0.081 0.069 0.088 0.074 0.062 0.065 0.054 0.020 0.015 0.015 0.011 0.008 0.006 0.035 0.028 0.023 0.009 0.006 0.005 16 0.002 0.002 0.071 0.060 17 0.125 0.108 0.052 0.012 0.003 0.001 18 0.111 0.081 0.059 0.051 0.009 0.002 0.001 0.095 0.083 0.044 0.037 0.069 0.060 0.051 0.018 0.014 19 0.005 0.003 0.098 0.070 0.045 0.038 0.031 0.026 0.010 0.051 0.043 0.007 0.002 20 0.087 0.073 0.061 0.043 0.031 0.012 0.001 0.005 0.001 0.002 0.001 25 0.030 0.024 0.004 0.047 0.026 0.038 0.020 0.020 0.009 0.037 0.016 0.007 0.001 0.013 0.005 30 0.015 0.012 0.004 0.001 40 0.005 0.004 0.002 0.001 0.001 0.008 0.002 0.003 0.001 50 0.001 0.001

APPENDIX B =

APPENDIX B =