Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Appendix I Rudolph Corporation Cash Budget Notes Sales Information The unit selling price is $60.00 per unit. On average, 10% of the monthly sales

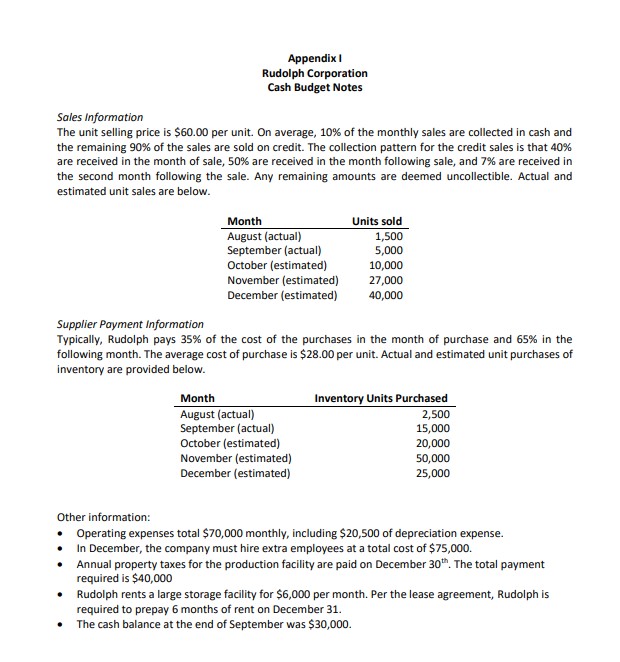

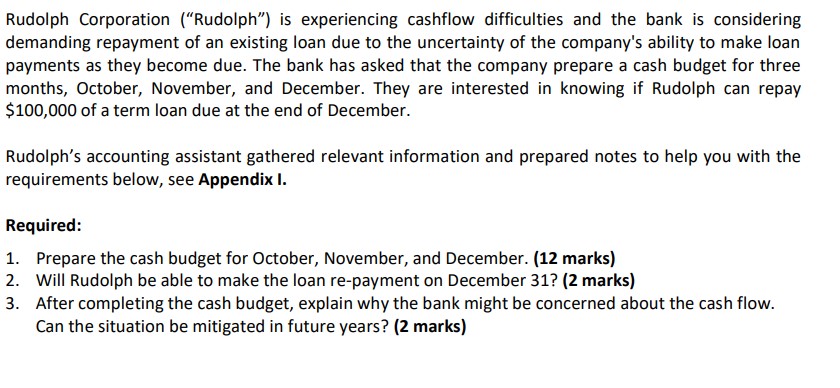

Appendix I Rudolph Corporation Cash Budget Notes Sales Information The unit selling price is $60.00 per unit. On average, 10% of the monthly sales are collected in cash and the remaining 90% of the sales are sold on credit. The collection pattern for the credit sales is that 40% are received in the month of sale, 50% are received in the month following sale, and 7% are received in the second month following the sale. Any remaining amounts are deemed uncollectible. Actual and estimated unit sales are below. Month Units sold August (actual) September (actual) 1,500 5,000 October (estimated) 10,000 November (estimated) 27,000 December (estimated) 40,000 Supplier Payment Information Typically, Rudolph pays 35% of the cost of the purchases in the month of purchase and 65% in the following month. The average cost of purchase is $28.00 per unit. Actual and estimated unit purchases of inventory are provided below. Month Inventory Units Purchased August (actual) September (actual) 2,500 15,000 October (estimated) 20,000 November (estimated) 50,000 December (estimated) 25,000 Other information: Operating expenses total $70,000 monthly, including $20,500 of depreciation expense. In December, the company must hire extra employees at a total cost of $75,000. Annual property taxes for the production facility are paid on December 30th. The total payment required is $40,000 Rudolph rents a large storage facility for $6,000 per month. Per the lease agreement, Rudolph is required to prepay 6 months of rent on December 31. The cash balance at the end of September was $30,000. Rudolph Corporation ("Rudolph") is experiencing cashflow difficulties and the bank is considering demanding repayment of an existing loan due to the uncertainty of the company's ability to make loan payments as they become due. The bank has asked that the company prepare a cash budget for three months, October, November, and December. They are interested in knowing if Rudolph can repay $100,000 of a term loan due at the end of December. Rudolph's accounting assistant gathered relevant information and prepared notes to help you with the requirements below, see Appendix I. Required: 1. Prepare the cash budget for October, November, and December. (12 marks) 2. Will Rudolph be able to make the loan re-payment on December 31? (2 marks) 3. After completing the cash budget, explain why the bank might be concerned about the cash flow. Can the situation be mitigated in future years? (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Based on the information provided in the Appendix I Rudolph Corporation Cash Budget Notes here is th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started