Appendix

Question:

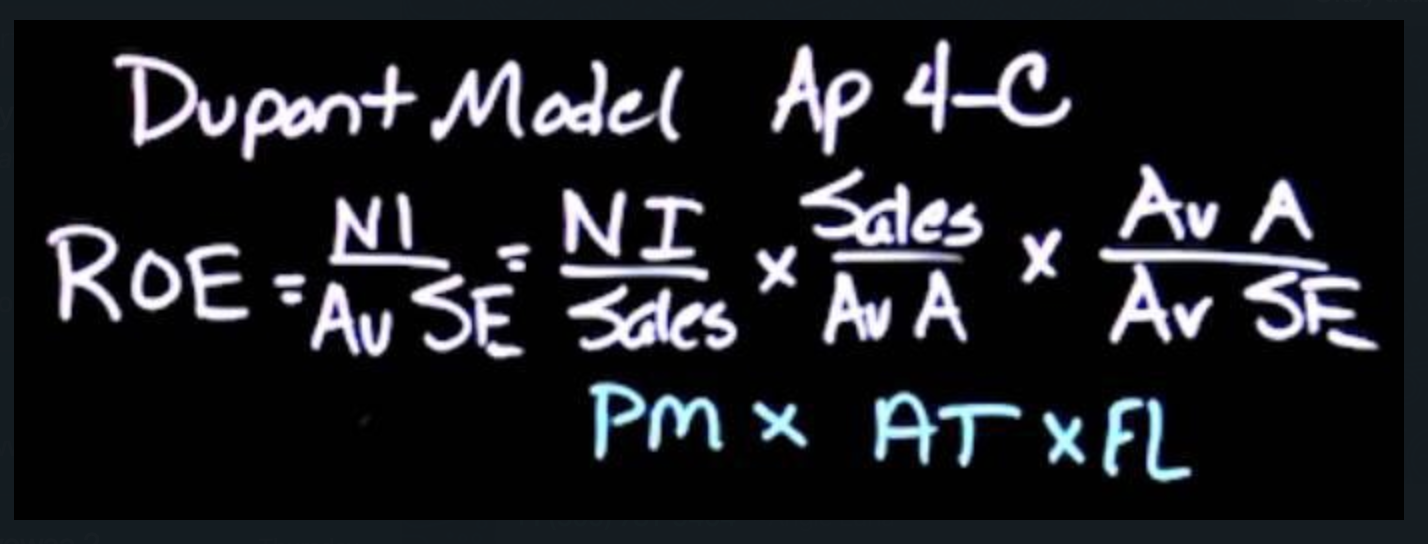

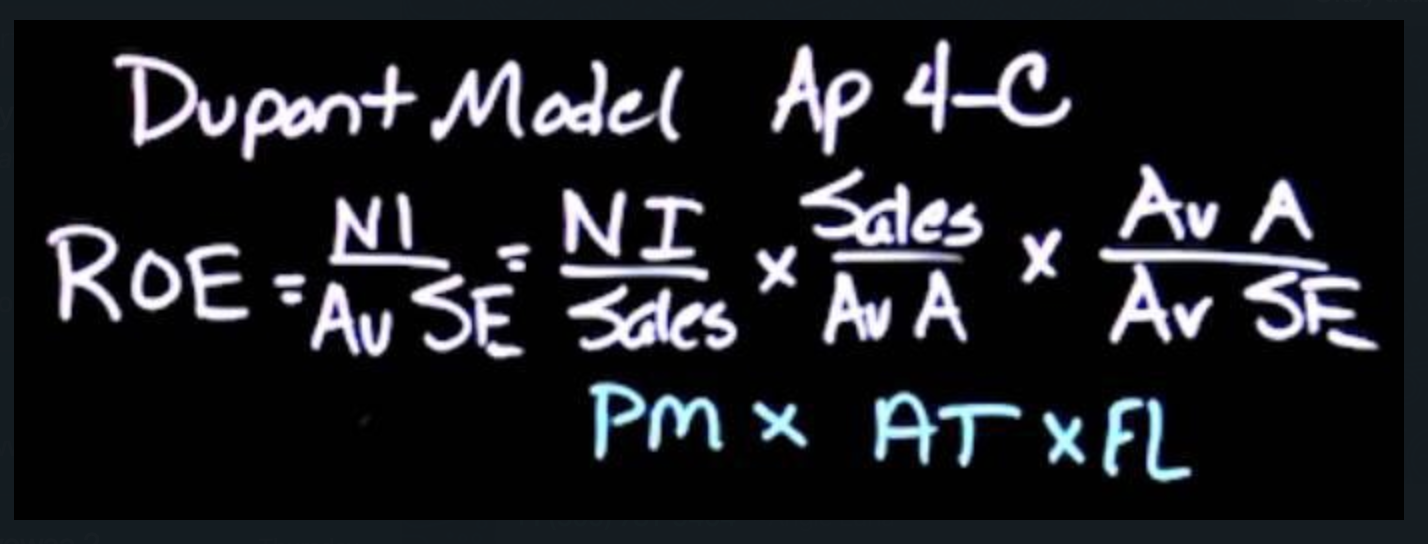

- DuPont Disaggregation Analysis for both companies (see Appendix)

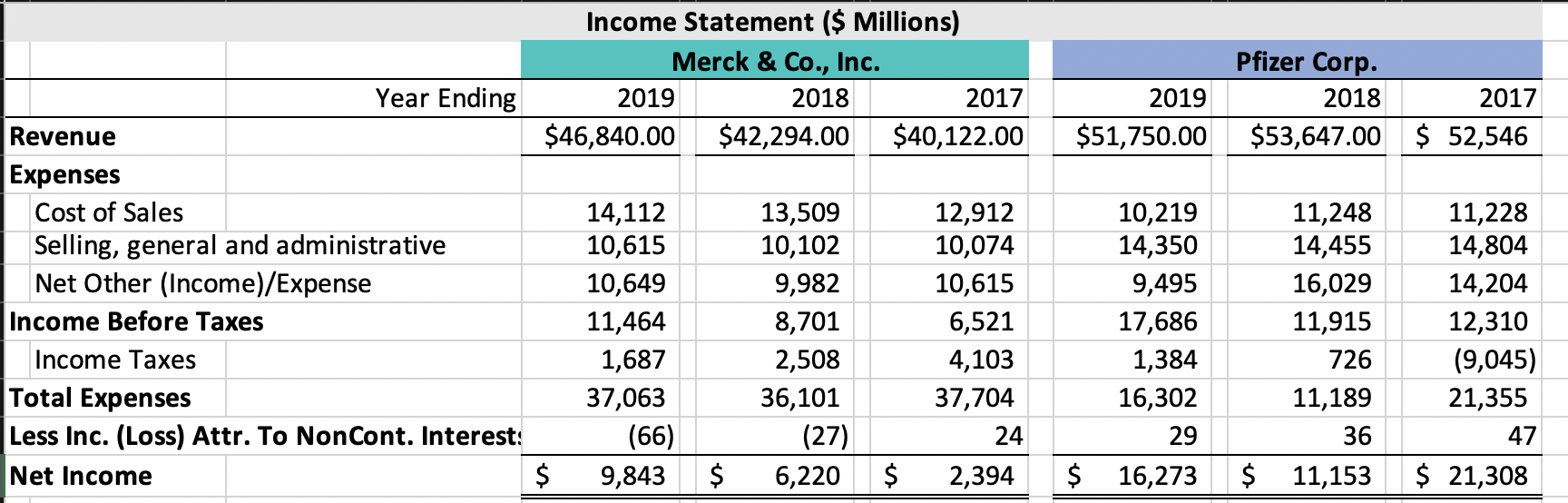

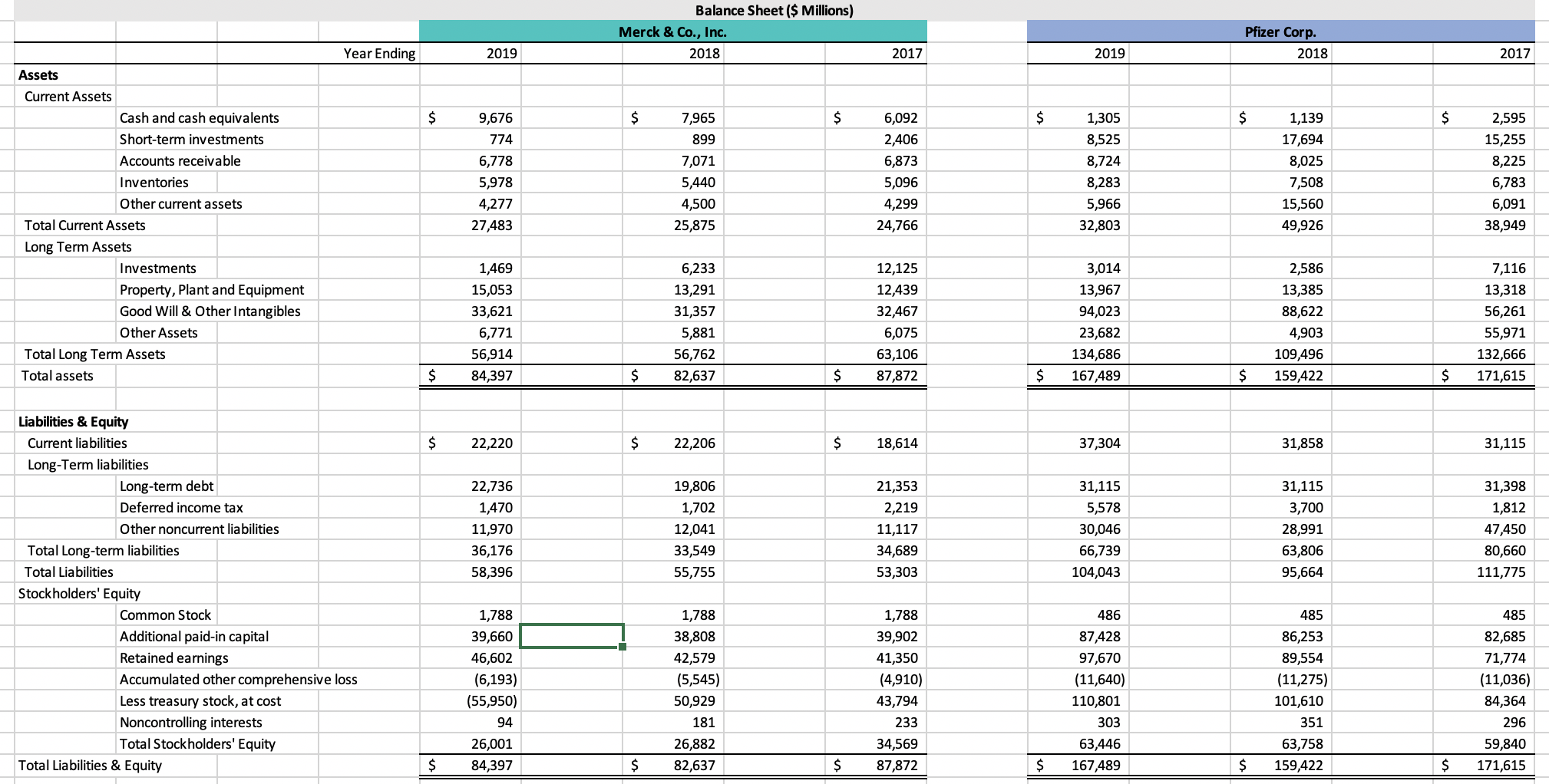

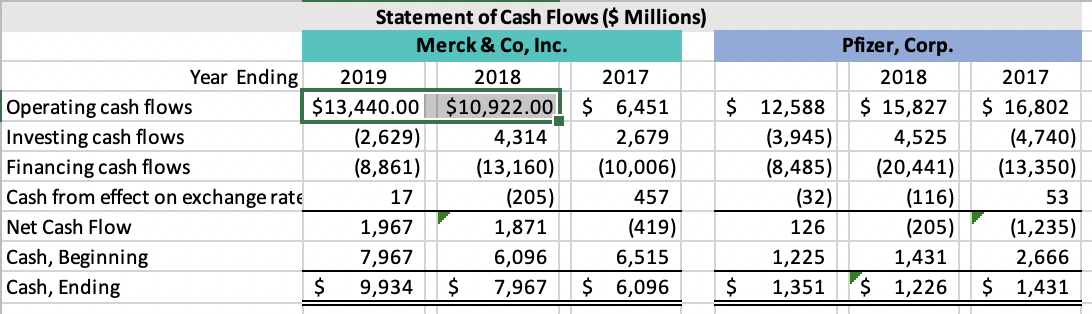

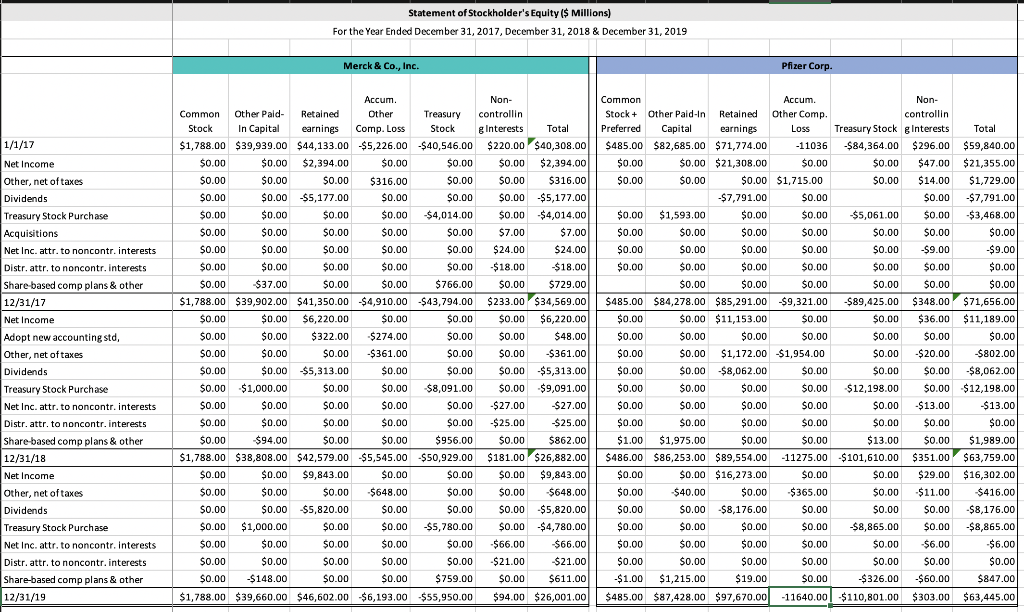

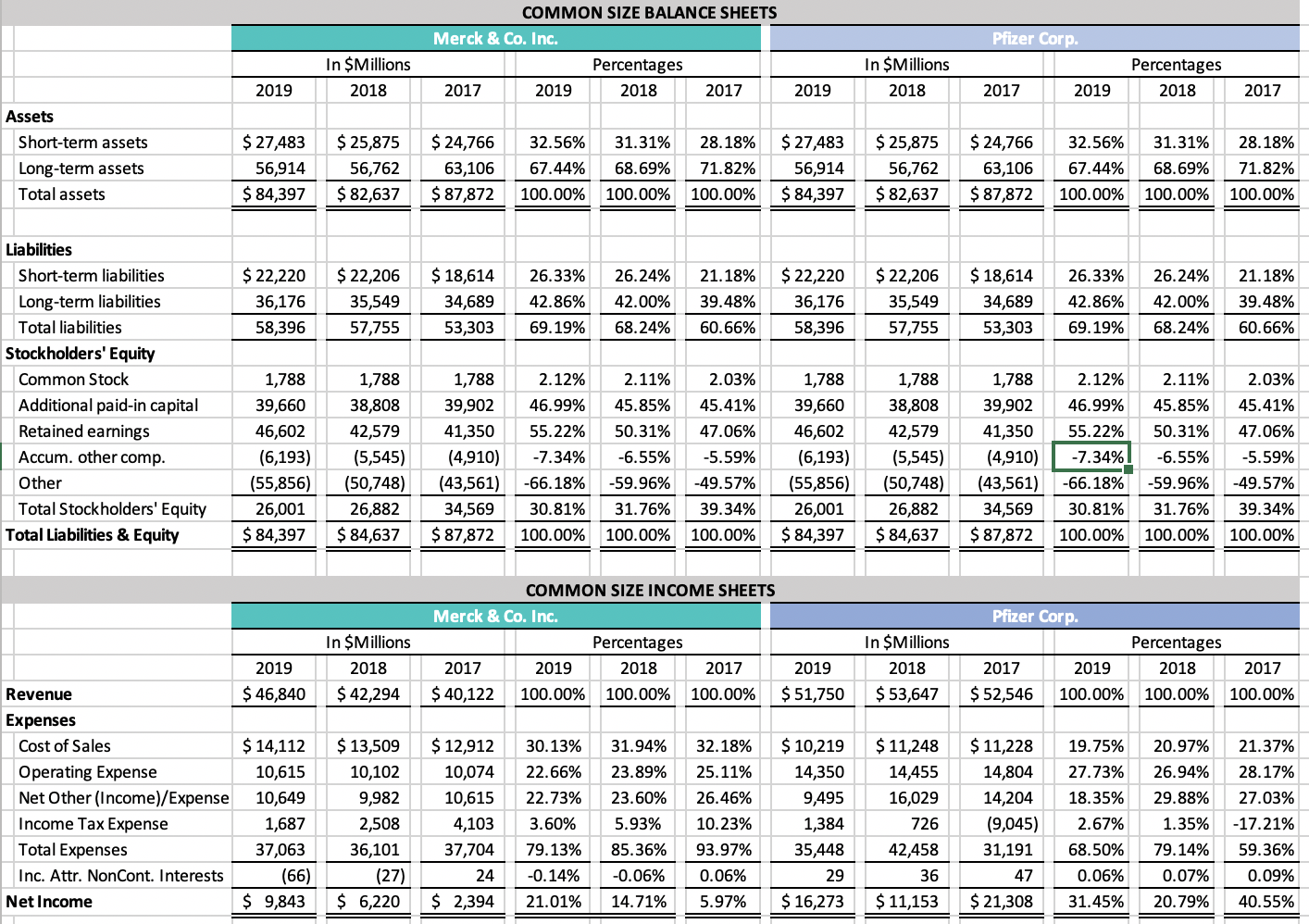

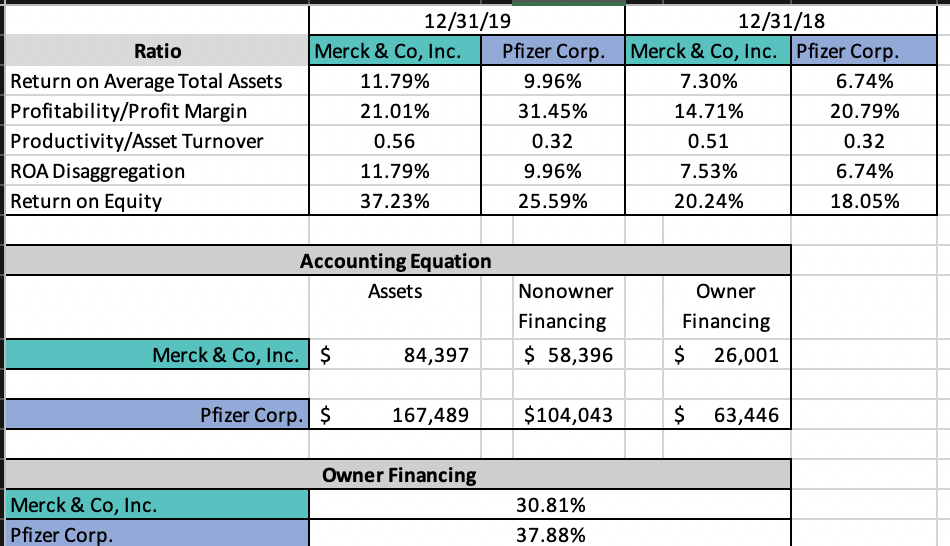

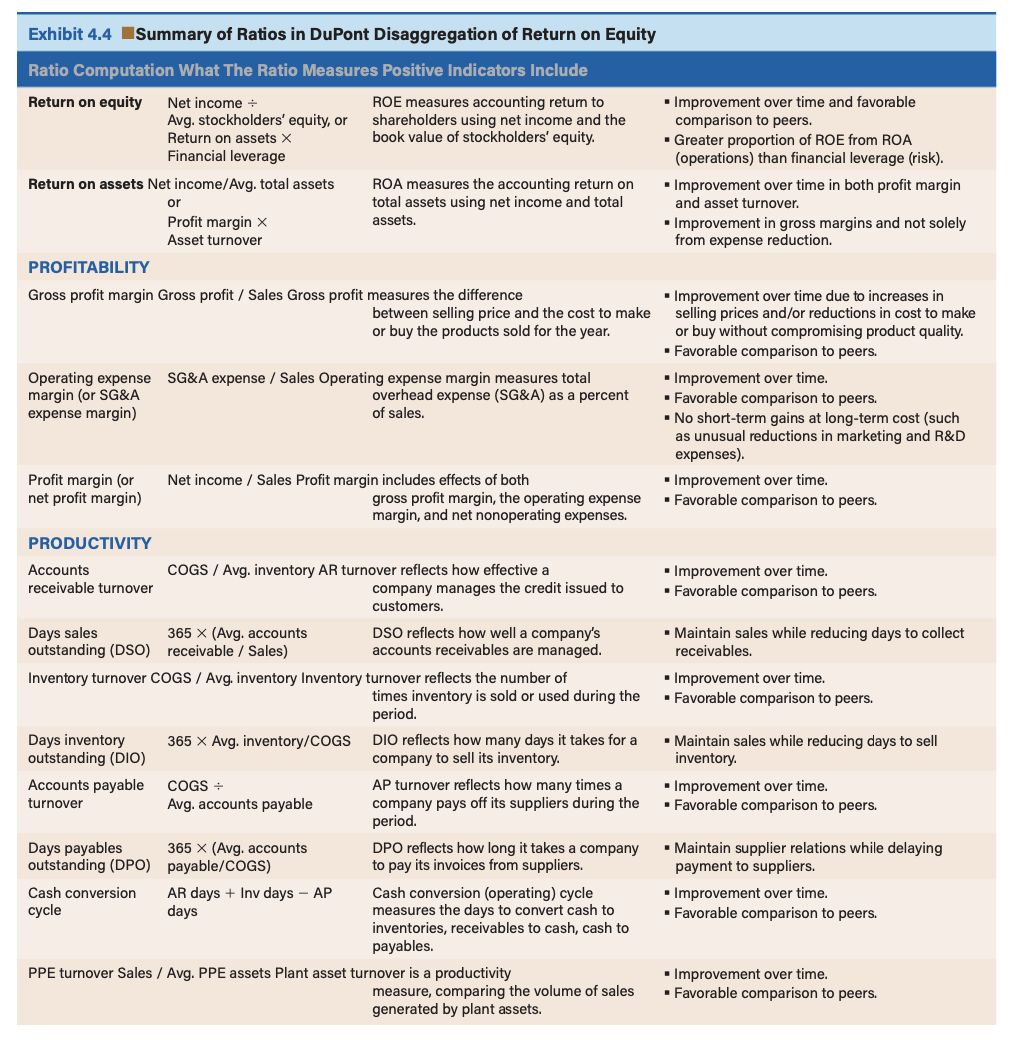

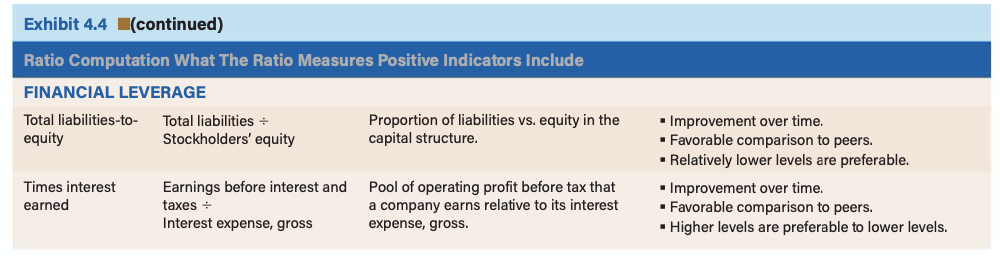

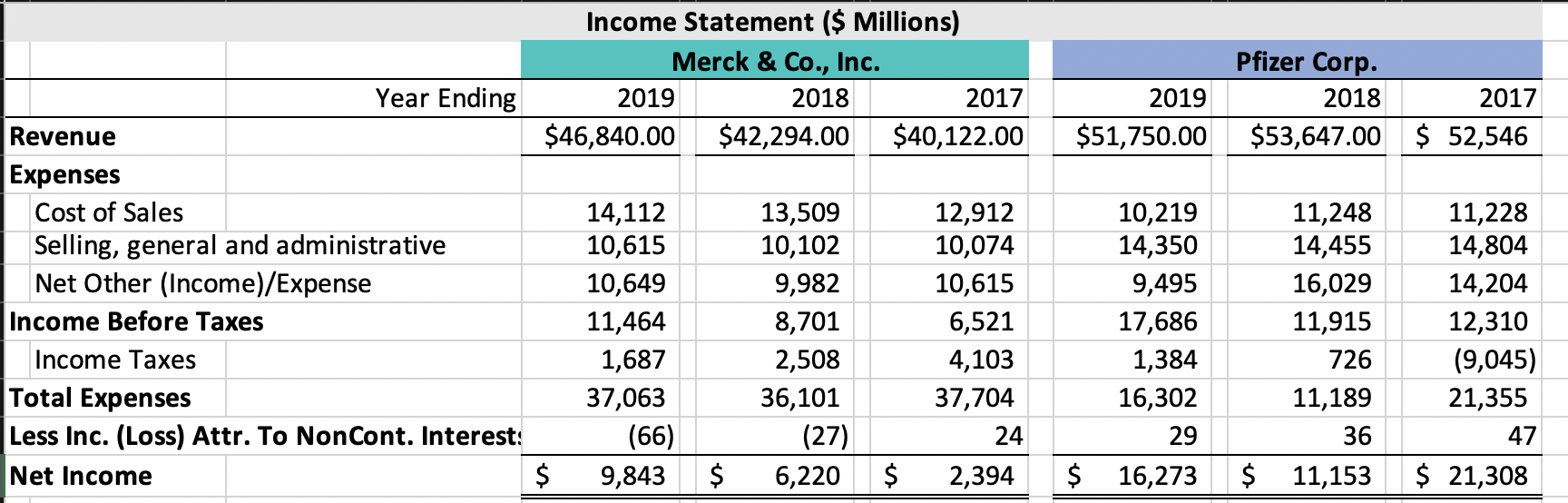

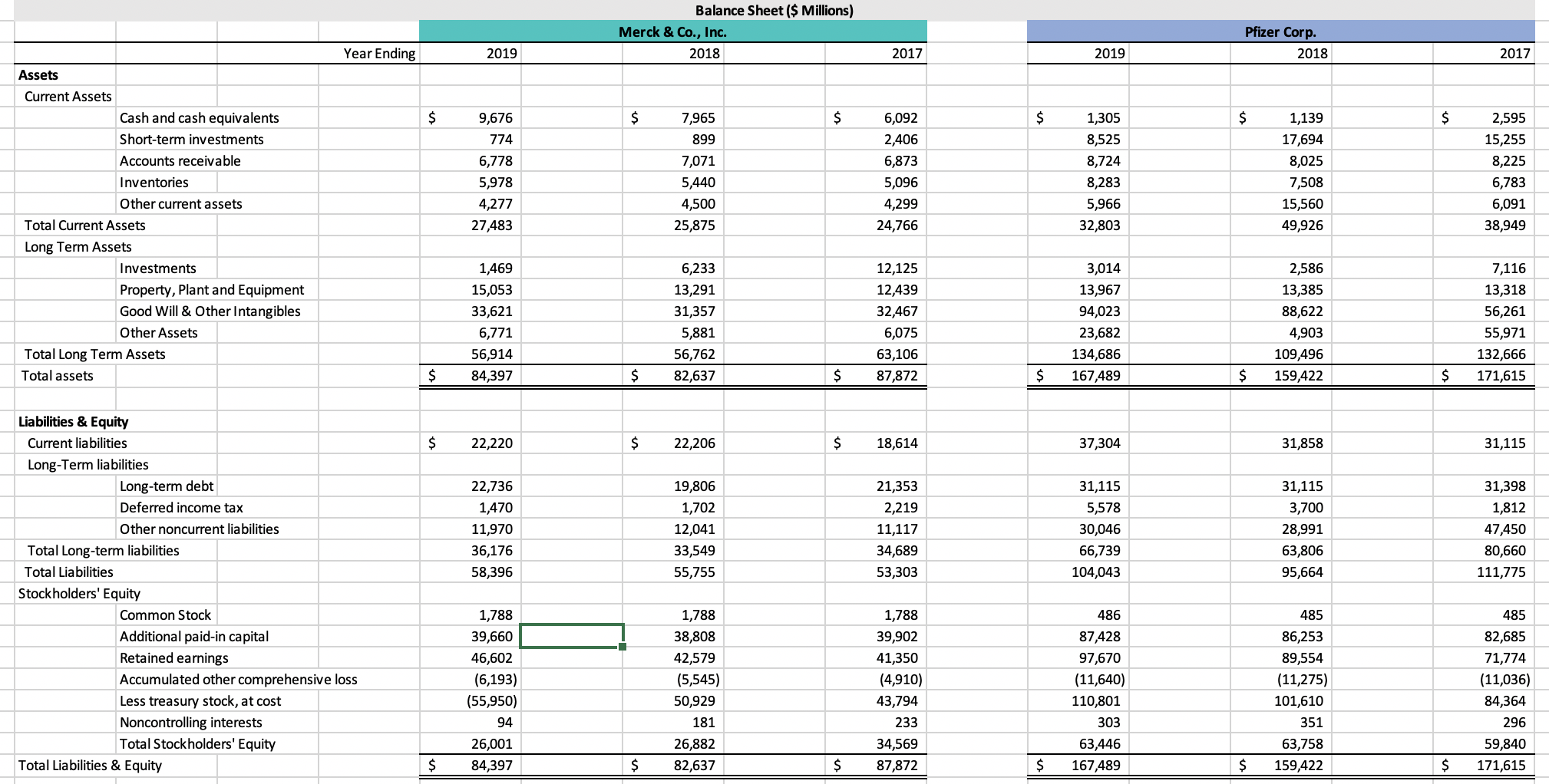

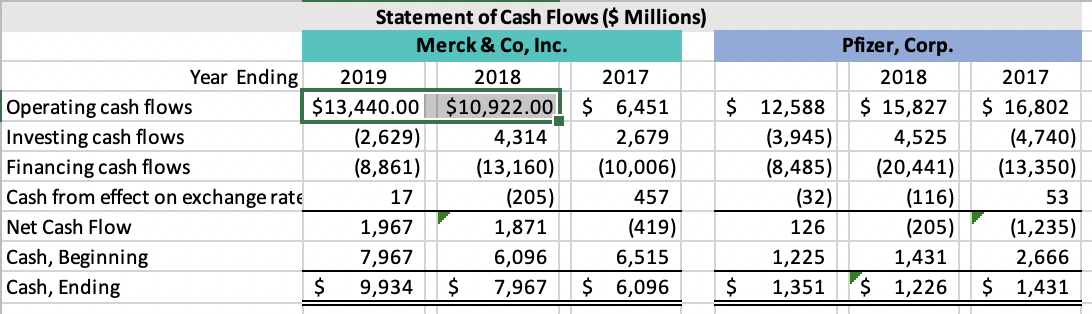

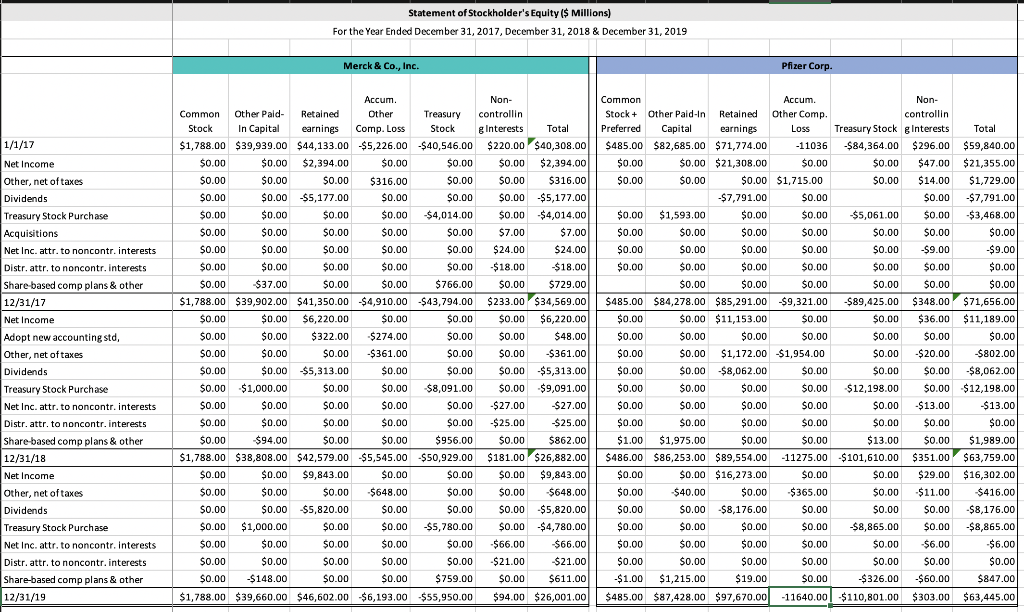

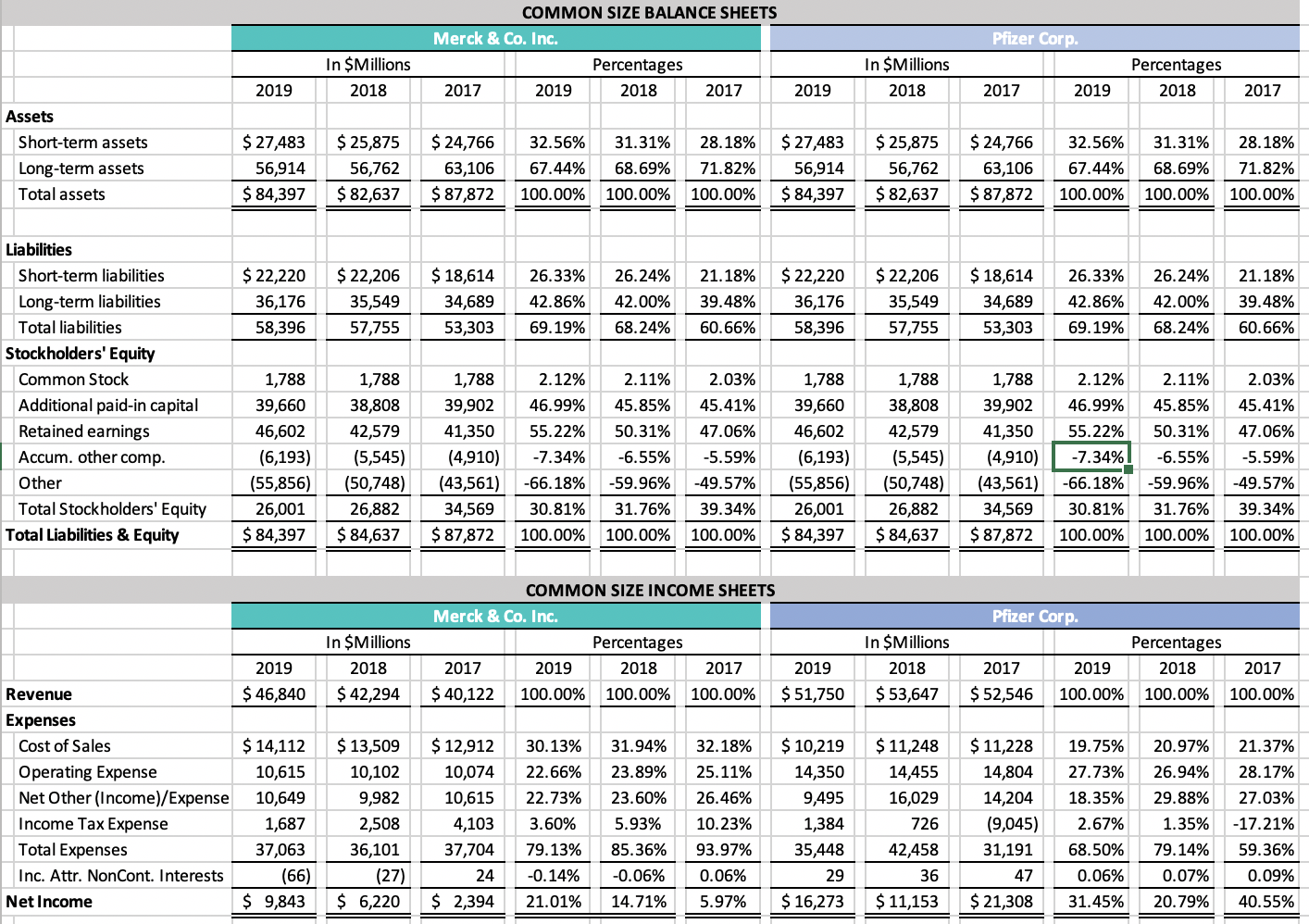

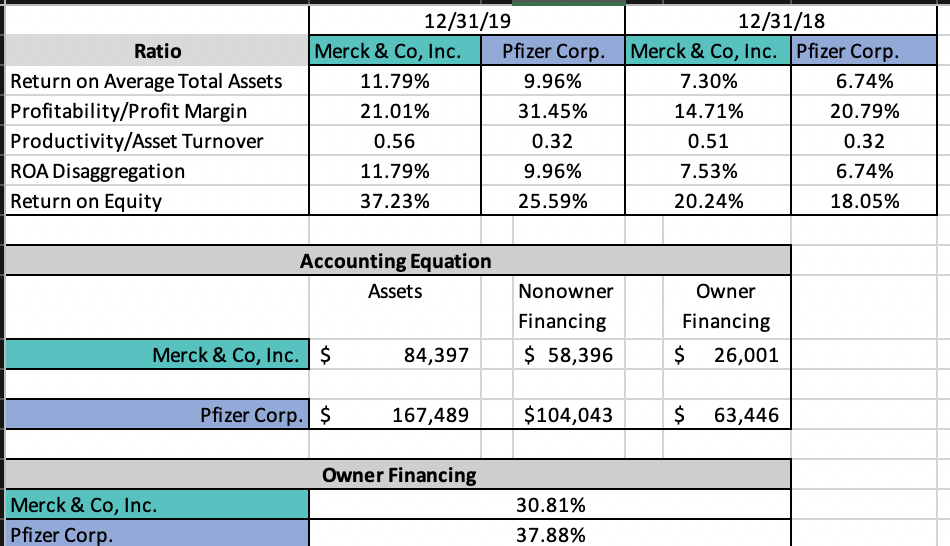

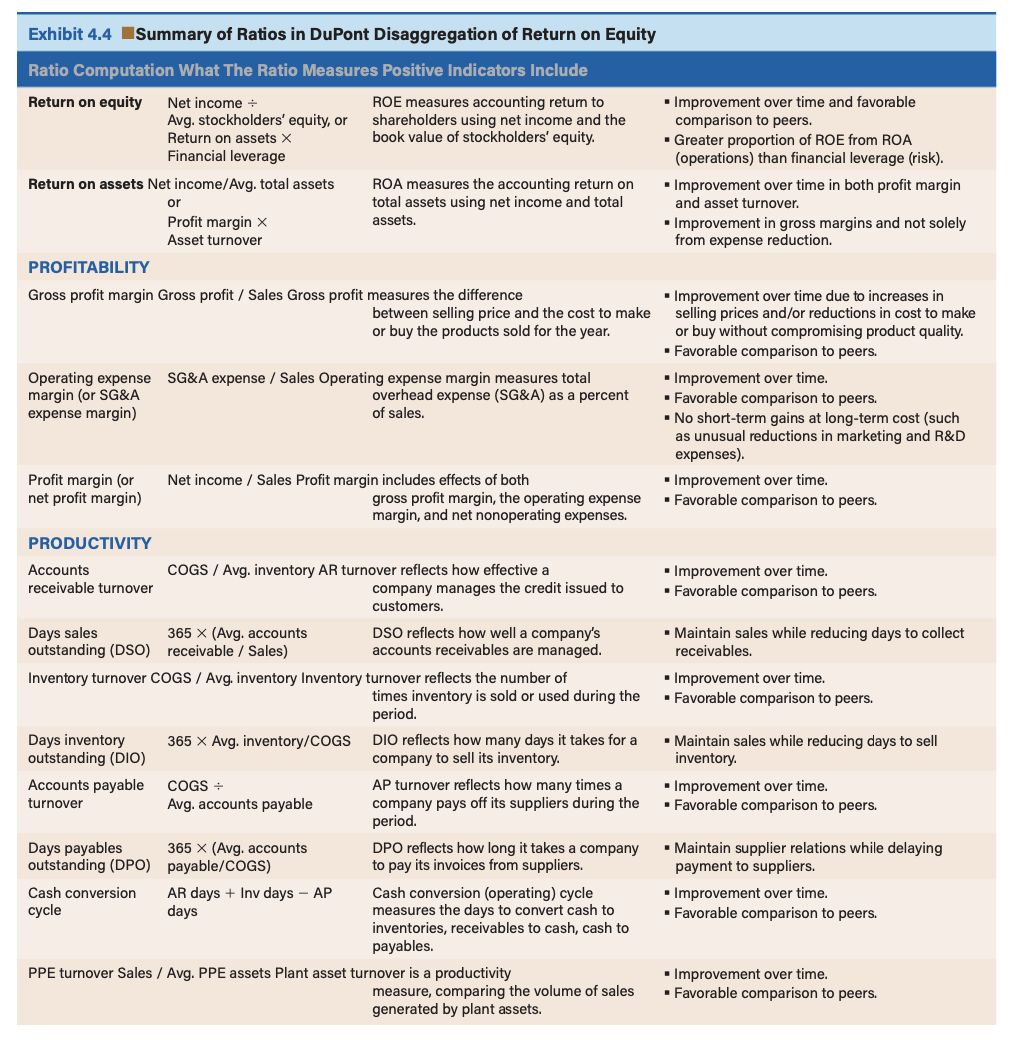

2019 $51,750.00 Pfizer Corp. 2018 2017 $53,647.00 $ 52,546 Income Statement ($ Millions) Merck & Co., Inc. Year Ending 2019 2018 2017 Revenue $46,840.00 $42,294.00 $40,122.00 Expenses Cost of Sales 14,112 13,509 12,912 Selling, general and administrative 10,615 10,102 10,074 Net Other (Income)/Expense 10,649 9,982 10,615 Income Before Taxes 11,464 8,701 6,521 Income Taxes 1,687 2,508 4,103 Total Expenses 37,063 36,101 37,704 Less Inc. (Loss) Attr. To NonCont. Interest: (66) (27) 24 Net Income $ 9,843 $ 6,220 $ 2,394 10,219 14,350 9,495 17,686 1,384 16,302 29 $ 16,273 11,248 14,455 16,029 11,915 726 11,189 36 $ 11,153 11,228 14,804 14,204 12,310 (9,045) 21,355 47 $ 21,308 Balance Sheet($ Millions) Merck & Co., Inc. 2018 Pfizer Corp Year Ending 2019 2017 2019 2018 2017 $ $ $ $ $ $ 9,676 774 Assets Current Assets Cash and cash equivalents Short-term investments Accounts receivable Inventories Other current assets Total Current Assets Long Term Assets Investments Property, plant and Equipment Good Will & Other Intangibles Other Assets Total Long Term Assets Total assets 6,778 5,978 4,277 27,483 7,965 899 7,071 5,440 4,500 25,875 6,092 2,406 6,873 5,096 4,299 24,766 1,305 8,525 8,724 8,283 5,966 32,803 1,139 17,694 8,025 7,508 15,560 49,926 2,595 15,255 8,225 6,783 6,091 38,949 1,469 15,053 33,621 6,771 56,914 84,397 6,233 13,291 31,357 5,881 56,762 82,637 12,125 12,439 32,467 6,075 63,106 87,872 3,014 13,967 94,023 23,682 134,686 167,489 2,586 13,385 88,622 4,903 109,496 159,422 7,116 13,318 56,261 55,971 13 171,615 $ $ $ $ $ $ $ 22,220 $ 22,206 $ 18,614 37,304 31,858 31,115 22,736 1,470 11,970 36,176 58,396 19,806 1,702 12,041 33,549 55,755 21,353 2,219 11,117 34,689 53,303 31,115 5,578 30,046 66,739 104,043 31,115 3,700 28,991 63,806 95,664 31,398 1,812 47,450 80,660 111,775 Liabilities & Equity Current liabilities Long-Term liabilities Long-term debt Deferred income tax Other noncurrent liabilities Total Long-term liabilities Total Liabilities Stockholders' Equity Common Stock Additional paid-in capital Retained earnings Accumulated other comprehensive loss Less treasury stock, at cost Noncontrolling interests Total Stockholders' Equity Total Liabilities & Equity 486 485 1,788 39,660 46,602 (6,193) (55,950) 94 26,001 84,397 1,788 38,808 42,579 (5,545) 50,929 181 26,882 82,637 1,788 39,902 41,350 (4,910) 43,794 233 34,569 87,872 87,428 97,670 (11,640) 110,801 303 63,446 167,489 485 86,253 89,554 (11,275) 101,610 351 63,758 159,422 82,685 71,774 (11,036) 84,364 296 59,840 171,615 $ $ $ $ $ $ Statement of Cash Flows ($ Millions) Merck & Co, Inc. Year Ending 2019 2018 2017 Operating cash flows $13,440.00 $10,922.00 $ 6,451 Investing cash flows (2,629) 4,314 2,679 Financing cash flows (8,861) (13,160) (10,006) Cash from effect on exchange rate 17 (205) 457 Net Cash Flow 1,967 1,871 (419) Cash, Beginning 7,967 6,096 6,515 Cash, Ending $ 9,934 $ 7,967 $ 6,096 $ 12,588 (3,945) (8,485) (32) 126 1,225 $ 1,351 Pfizer, Corp. 2018 $ 15,827 4,525 (20,441) (116) (205) 1,431 $ 1,226 2017 $ 16,802 (4,740) (13,350) 53 (1,235) 2,666 $ 1,431 Statement of Stockholder's Equity ($ Millions) For the Year Ended December 31, 2017, December 31, 2018 & December 31, 2019 , Merck & Co., Inc. Pfizer Corp. 1/1/17 Net Income Other, net of taxes Dividends Treasury Stock Purchase Acquisitions Net Inc. attr. to noncontr. interests Distr. attr. to noncontr. interests Share based comp plans & other 12/31/17 Net Income Adopt new accounting std, Other, net of taxes Dividends Treasury Stock Purchase Net Inc. attr. to noncontr. interests Accum. Common Other Pald Retained Other Treasury Stock In Capital earnings Comp. Loss Stock $1,788.00 $39,939.00 $44,133.00 $5,226.00 $40,546.00 $0.00 $0.00 $2.394.00 $0.00 $0.00 $0.00 $0.00 $0.00 $316.00 $0.00 $0.00 $0.00 $5,177.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $4,014.00 $0.00 $0.00 $0.00 $ $0.00 $0.00 $ $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $37.00 $0.00 $0.00 $766.00 $1,788.00 $39,902.00 $41,350.00 $4,910.00 $43,794.00 $0.00 $0.00 $6,220.00 $0.00 $0.00 $0.00 $0.00 $322.00 $274.00 $0.00 $0.00 $0.00 $0.00 -$361.00 $0.00 $0.00 $0.00 $5,313.00 $0.00 $0.00 $0.00 $1,000.00 $0.00 $0.00 $8,091.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $94.00 $0.00 $0.00 $956.00 $1,788.00 $38,808.00 $42,579.00 $5,545.00 $50,929.00 $0.00 $0.00 $9.843.00 $0.00 $0.00 $0.00 $0.00 $0.00 $648.00 $0.00 $0.00 $0.00 $5,820.00 $0.00 $0.00 $0.00 $1,000.00 $0.00 $0.00 $5,780.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $148.00 $0.00 $0.00 $759.00 Non- controllin g Interests Total $220.00 $40,308.00 $0.00 $2,394,001 $0.00 $316.00 $0.00 $5,177.00 $0.00 $4,014.00 $7.00 $7.00 $24.00 $24.00 $18.00 $18.00 $0.00 $729.00 $233.00 $34,569.00 $0.00 $6,220.00 $0.00 $48.00 $0.00 -$361.00 $0.00 $5,313.00 $0.00 $9,091.00 -$27.00 -$27.00 -$25.00 -$25.00 $0.00 $862.00 $181.00 $26,882.00 $0.00 $9,843.00 $648.00 $0.00 $5,820.00 $0.00 $4,780.00 $66.00 $66.00l $21.00 $21.00 $0.00 $611.00 Common Accum. Non- Stock+ Other Paid in Retained Other Comp. controllin Preferred Capital earnings Loss Treasury Stock gInterests Total $485.00 $82,685.00 $71,774.00 -11036 $84,364.00 $296.00 $59,840.00 $0.00 $0.00 $21.308.00 $0.00 $0.00 $47.00 $21,355.00 $0.00 $0.00 $0.00 $1,715.00 $0.00 $14.00 $1,729.00 -$7,791.00 $0.00 $0.00 $7,791.00 $0.00 $1,593.00 $0.00 $0.00 $5,061.00 $0.00 $3,468.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 -$9.00 $9.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $485.00 $84,278.00 $85,291.00 $9,321.00 -$89,425.00 $348.00 $348.00 $71,656.00 $0.00 $0.00 $11,153.00 $0.00 $0.00 $36.00 $11,189.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $1,172.00 -$1,954.00 $0.00 -$20.00 $802.00 $0.00 $0.00 $8,062.00 $0.00 $0.00 $0.00 -$8,062.00 $0.00 $0.00 $0.00 $0.00 $12,198.00 $0.00 $12,198.00 $0.00 $0.00 $0.00 $0.00 $0.00 -$13.00 $13.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $1.00 $1,975.00 $0.00 $0.00 $13.00 $0.00 $1,989.00 $486.00 $86,253.00 $89,554.00 -11275.00 $ 101,610.00 $351.00 $63,759.00 $0.00 $0.00 $16,273.00 $0.00 $0.00 $29.00 $16,302.00 $0.00 $40.00 $0.00 $11.00 $416.00 $0.00 $0.00 -$8,176.00 $0.00 $0.00 $0.00 -$8,176.00 $0.00 $0.00 $0.00 $0.00 -$8,865.00 $0.00 -$8,865.00 $0.00 $0.00 $0.00 $0.00 $0.00 $6.00 $6.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $1.00 $1,215.00 $19.00 $0.00 $326.00 $60.00 $847.00 $485.00 $87,428.00 $97,670.00 -11640.00 $110,801.00 $303.00 $63,445.00 Distr. attr. to noncontr. interests Share-based comp plans & other 12/31/18 Net Income $0.00 $365.00 $0.00 Other, net of taxes Dividends Treasury Stock Purchase Net Inc. attr. to noncontr. interests Distr. attr. to noncontr. interests Share-based comp plans & other 12/31/19 $1,788.00 $39,660.00 $46,602.00 $6,193.00 $55,950.00 $94.00 $26,001.00 Pfizer Corp. COMMON SIZE BALANCE SHEETS Merck & Co. Inc. Percentages 2017 2019 2018 2017 In $Millions 2018 In $Millions 2018 Percentages 2018 2019 2019 2017 2019 2017 Assets Short-term assets Long-term assets Total assets $ 27,483 56,914 $ 84,397 $ 25,875 56,762 $ 82,637 $ 24,766 63,106 $ 87,872 32.56% 67.44% 100.00% 31.31% 68.69% 100.00% 28.18% 71.82% 100.00% $ 27,483 56,914 $ 84,397 $ 25,875 56,762 $ 82,637 $ 24,766 63,106 $ 87,872 32.56% 67.44% 31.31% 68.69% 100.00% 28.18% 71.82% 100.00% 100.00% 26.24% $ 22,220 36,176 58,396 $ 22,206 35,549 57,755 $ 18,614 34,689 53,303 26.33% 42.86% 69.19% 42.00% 68.24% 21.18% 39.48% 60.66% $ 22,220 36,176 58,396 $ 22,206 35,549 57,755 $ 18,614 34,689 53,303 26.33% 42.86% 69.19% 26.24% 42.00% 68.24% 21.18% 39.48% 60.66% Liabilities Short-term liabilities Long-term liabilities Total liabilities Stockholders' Equity Common Stock Additional paid-in capital Retained earnings Accum. other comp. Other Total Stockholders' Equity Total Liabilities & Equity 1,788 39,660 46,602 (6,193) (55,856) 26,001 $ 84,397 1,788 38,808 42,579 (5,545) (50,748) 26,882 $ 84,637 1,788 39,902 41,350 (4,910) (43,561) 34,569 $ 87,872 2.12% 46.99% 55.22% -7.34% -66.18% 30.81% 100.00% 2.11% 45.85% 50.31% -6.55% -59.96% 31.76% 100.00% 2.03% 45.41% 47.06% -5.59% -49.57% 39.34% 1,788 39,660 46,602 (6,193) (55,856) 26,001 $ 84,397 1,788 38,808 42,579 (5,545) (50,748) 26,882 $ 84,637 1,788 39,902 41,350 (4,910) (43,561) 34,569 $ 87,872 2.12% 46.99% 55.22% -7.34% -66.18% 30.81% 100.00% 2.11% 45.85% 50.31% -6.55% -59.96% 31.76% 100.00% 2.03% 45.41% 47.06% -5.59% -49.57% 39.34% 100.00% 100.00% In Millions 2018 COMMON SIZE INCOME SHEETS Merck & Co. Inc. Percentages 2017 2019 2018 2017 2019 $ 40,122 100.00% 100.00% 100.00% $ 51,750 In $Millions 2018 $ 53,647 2019 Pfizer Corp Percentages 2017 2019 2018 $ 52,546 100.00% 100.00% 2017 $ 46,840 $ 42,294 100.00% 20.97% 26.94% Revenue Expenses Cost of Sales Operating Expense Net Other (Income)/Expense Income Tax Expense Total Expenses Inc. Attr. NonCont. Interests Net Income $ 14,112 10,615 10,649 1,687 37,063 (66) $ 9,843 $ 13,509 10,102 9,982 2,508 36,101 (27) $ 6,220 $ 12,912 10,074 10,615 4,103 37,704 24 $ 2,394 30.13% 22.66% 22.73% 3.60% 79.13% 31.94% 23.89% 23.60% 5.93% 85.36% -0.06% 14.71% 32.18% 25.11% 26.46% 10.23% 93.97% 0.06% 5.97% $ 10,219 14,350 9,495 1,384 35,448 29 $ 16,273 $ 11,248 14,455 16,029 726 42,458 36 $ 11,153 $ 11,228 14,804 14,204 (9,045) 31,191 47 $ 21,308 19.75% 27.73% 18.35% 2.67% 68.50% 0.06% 31.45% 29.88% 1.35% 79.14% 21.37% 28.17% 27.03% -17.21% 59.36% 0.09% 40.55% -0.14% 21.01% 0.07% 20.79% Ratio Return on Average Total Assets Profitability/Profit Margin Productivity/Asset Turnover ROA Disaggregation Return on Equity 12/31/19 12/31/18 Merck & Co, Inc. Pfizer Corp. Merck & Co, Inc. Pfizer Corp. 11.79% 9.96% 7.30% 6.74% 21.01% 31.45% 14.71% 20.79% 0.56 0.32 0.51 0.32 11.79% 9.96% 7.53% 6.74% 37.23% 25.59% 20.24% 18.05% Accounting Equation Assets Nonowner Financing $ 58,396 Owner Financing $ 26,001 Merck & Co, Inc. $ 84,397 Pfizer Corp. $ 167,489 $104,043 $ 63,446 Owner Financing Merck & Co, Inc. Pfizer Corp. 30.81% 37.88% Exhibit 4.4 Summary of Ratios in DuPont Disaggregation of Return on Equity Ratio Computation What The Ratio Measures Positive Indicators Include Return on equity Net income ROE measures accounting return to Avg. stockholders' equity, or shareholders using net income and the Return on assets X book value of stockholders' equity. Financial leverage Return on assets Net income/Avg. total assets ROA measures the accounting return on or total assets using net income and total Profit margin x assets. Asset turnover PROFITABILITY Gross profit margin Gross profit / Sales Gross profit measures the difference between selling price and the cost to make or buy the products sold for the year. - Improvement over time and favorable comparison to peers. Greater proportion of ROE from ROA (operations) than financial leverage (risk). - Improvement over time in both profit margin and asset turnover. - Improvement in gross margins and not solely from expense reduction. Operating expense SG&A expense / Sales Operating expense margin measures total margin (or SG&A overhead expense (SG&A) as a percent expense margin) of sales. - Improvement over time due to increases in selling prices and/or reductions in cost to make or buy without compromising product quality. Favorable comparison to peers. Improvement over time. - Favorable comparison to peers. - No short-term gains at long-term cost (such as unusual reductions in marketing and R&D expenses). - Improvement over time. Favorable comparison to peers. - Improvement over time. - Favorable comparison to peers. - Maintain sales while reducing days to collect receivables. Improvement over time. Favorable comparison to peers. Profit margin (or Net income / Sales Profit margin includes effects of both net profit margin) gross profit margin, the operating expense margin, and net nonoperating expenses. PRODUCTIVITY Accounts COGS / Avg. inventory AR turnover reflects how effective a receivable turnover company manages the credit issued to customers. Days sales 365 X (Avg. accounts DSO reflects how well a company's outstanding (DSO) receivable / Sales) accounts receivables are managed. Inventory turnover COGS / Avg. inventory Inventory turnover reflects the number of times inventory is sold or used during the period. Days inventory 365 X Avg. inventory/COGS DIO reflects how many days it takes for a outstanding (DIO) company to sell its inventory. Accounts payable COGS - AP turnover reflects how many times a turnover Avg. accounts payable company pays off its suppliers during the period. Days payables 365 X (Avg. accounts DPO reflects how long it takes a company outstanding (DPO) payable/COGS) to pay its invoices from suppliers. Cash conversion AR days + Inv days - AP Cash conversion (operating) cycle cycle days measures the days to convert cash to inventories, receivables to cash, cash to payables. PPE turnover Sales / Avg. PPE assets Plant asset turnover is a productivity measure, comparing the volume of sales generated by plant assets. - Maintain sales while reducing days to sell inventory Improvement over time. Favorable comparison to peers. - Maintain supplier relations while delaying payment to suppliers. Improvement over time. - Favorable comparison to peers. - Improvement over time. - Favorable comparison to peers. Exhibit 4.4 (continued) Ratio Computation What The Ratio Measures Positive Indicators Include FINANCIAL LEVERAGE Total liabilities-to Total liabilities equity Stockholders' equity Proportion of liabilities vs. equity in the capital structure. - Improvement over time. . Favorable comparison to peers. . Relatively lower levels are preferable. Improvement over time. - Favorable comparison to peers. - Higher levels are preferable to lower levels. Times interest earned Earnings before interest and taxes + Interest expense, gross Pool of operating profit before tax that a company earns relative to its interest expense, gross. Dupont Model Ap 4-C ROE NI NI Sales Av A Ar S PM x ATXEL 2019 $51,750.00 Pfizer Corp. 2018 2017 $53,647.00 $ 52,546 Income Statement ($ Millions) Merck & Co., Inc. Year Ending 2019 2018 2017 Revenue $46,840.00 $42,294.00 $40,122.00 Expenses Cost of Sales 14,112 13,509 12,912 Selling, general and administrative 10,615 10,102 10,074 Net Other (Income)/Expense 10,649 9,982 10,615 Income Before Taxes 11,464 8,701 6,521 Income Taxes 1,687 2,508 4,103 Total Expenses 37,063 36,101 37,704 Less Inc. (Loss) Attr. To NonCont. Interest: (66) (27) 24 Net Income $ 9,843 $ 6,220 $ 2,394 10,219 14,350 9,495 17,686 1,384 16,302 29 $ 16,273 11,248 14,455 16,029 11,915 726 11,189 36 $ 11,153 11,228 14,804 14,204 12,310 (9,045) 21,355 47 $ 21,308 Balance Sheet($ Millions) Merck & Co., Inc. 2018 Pfizer Corp Year Ending 2019 2017 2019 2018 2017 $ $ $ $ $ $ 9,676 774 Assets Current Assets Cash and cash equivalents Short-term investments Accounts receivable Inventories Other current assets Total Current Assets Long Term Assets Investments Property, plant and Equipment Good Will & Other Intangibles Other Assets Total Long Term Assets Total assets 6,778 5,978 4,277 27,483 7,965 899 7,071 5,440 4,500 25,875 6,092 2,406 6,873 5,096 4,299 24,766 1,305 8,525 8,724 8,283 5,966 32,803 1,139 17,694 8,025 7,508 15,560 49,926 2,595 15,255 8,225 6,783 6,091 38,949 1,469 15,053 33,621 6,771 56,914 84,397 6,233 13,291 31,357 5,881 56,762 82,637 12,125 12,439 32,467 6,075 63,106 87,872 3,014 13,967 94,023 23,682 134,686 167,489 2,586 13,385 88,622 4,903 109,496 159,422 7,116 13,318 56,261 55,971 13 171,615 $ $ $ $ $ $ $ 22,220 $ 22,206 $ 18,614 37,304 31,858 31,115 22,736 1,470 11,970 36,176 58,396 19,806 1,702 12,041 33,549 55,755 21,353 2,219 11,117 34,689 53,303 31,115 5,578 30,046 66,739 104,043 31,115 3,700 28,991 63,806 95,664 31,398 1,812 47,450 80,660 111,775 Liabilities & Equity Current liabilities Long-Term liabilities Long-term debt Deferred income tax Other noncurrent liabilities Total Long-term liabilities Total Liabilities Stockholders' Equity Common Stock Additional paid-in capital Retained earnings Accumulated other comprehensive loss Less treasury stock, at cost Noncontrolling interests Total Stockholders' Equity Total Liabilities & Equity 486 485 1,788 39,660 46,602 (6,193) (55,950) 94 26,001 84,397 1,788 38,808 42,579 (5,545) 50,929 181 26,882 82,637 1,788 39,902 41,350 (4,910) 43,794 233 34,569 87,872 87,428 97,670 (11,640) 110,801 303 63,446 167,489 485 86,253 89,554 (11,275) 101,610 351 63,758 159,422 82,685 71,774 (11,036) 84,364 296 59,840 171,615 $ $ $ $ $ $ Statement of Cash Flows ($ Millions) Merck & Co, Inc. Year Ending 2019 2018 2017 Operating cash flows $13,440.00 $10,922.00 $ 6,451 Investing cash flows (2,629) 4,314 2,679 Financing cash flows (8,861) (13,160) (10,006) Cash from effect on exchange rate 17 (205) 457 Net Cash Flow 1,967 1,871 (419) Cash, Beginning 7,967 6,096 6,515 Cash, Ending $ 9,934 $ 7,967 $ 6,096 $ 12,588 (3,945) (8,485) (32) 126 1,225 $ 1,351 Pfizer, Corp. 2018 $ 15,827 4,525 (20,441) (116) (205) 1,431 $ 1,226 2017 $ 16,802 (4,740) (13,350) 53 (1,235) 2,666 $ 1,431 Statement of Stockholder's Equity ($ Millions) For the Year Ended December 31, 2017, December 31, 2018 & December 31, 2019 , Merck & Co., Inc. Pfizer Corp. 1/1/17 Net Income Other, net of taxes Dividends Treasury Stock Purchase Acquisitions Net Inc. attr. to noncontr. interests Distr. attr. to noncontr. interests Share based comp plans & other 12/31/17 Net Income Adopt new accounting std, Other, net of taxes Dividends Treasury Stock Purchase Net Inc. attr. to noncontr. interests Accum. Common Other Pald Retained Other Treasury Stock In Capital earnings Comp. Loss Stock $1,788.00 $39,939.00 $44,133.00 $5,226.00 $40,546.00 $0.00 $0.00 $2.394.00 $0.00 $0.00 $0.00 $0.00 $0.00 $316.00 $0.00 $0.00 $0.00 $5,177.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $4,014.00 $0.00 $0.00 $0.00 $ $0.00 $0.00 $ $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $37.00 $0.00 $0.00 $766.00 $1,788.00 $39,902.00 $41,350.00 $4,910.00 $43,794.00 $0.00 $0.00 $6,220.00 $0.00 $0.00 $0.00 $0.00 $322.00 $274.00 $0.00 $0.00 $0.00 $0.00 -$361.00 $0.00 $0.00 $0.00 $5,313.00 $0.00 $0.00 $0.00 $1,000.00 $0.00 $0.00 $8,091.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $94.00 $0.00 $0.00 $956.00 $1,788.00 $38,808.00 $42,579.00 $5,545.00 $50,929.00 $0.00 $0.00 $9.843.00 $0.00 $0.00 $0.00 $0.00 $0.00 $648.00 $0.00 $0.00 $0.00 $5,820.00 $0.00 $0.00 $0.00 $1,000.00 $0.00 $0.00 $5,780.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $148.00 $0.00 $0.00 $759.00 Non- controllin g Interests Total $220.00 $40,308.00 $0.00 $2,394,001 $0.00 $316.00 $0.00 $5,177.00 $0.00 $4,014.00 $7.00 $7.00 $24.00 $24.00 $18.00 $18.00 $0.00 $729.00 $233.00 $34,569.00 $0.00 $6,220.00 $0.00 $48.00 $0.00 -$361.00 $0.00 $5,313.00 $0.00 $9,091.00 -$27.00 -$27.00 -$25.00 -$25.00 $0.00 $862.00 $181.00 $26,882.00 $0.00 $9,843.00 $648.00 $0.00 $5,820.00 $0.00 $4,780.00 $66.00 $66.00l $21.00 $21.00 $0.00 $611.00 Common Accum. Non- Stock+ Other Paid in Retained Other Comp. controllin Preferred Capital earnings Loss Treasury Stock gInterests Total $485.00 $82,685.00 $71,774.00 -11036 $84,364.00 $296.00 $59,840.00 $0.00 $0.00 $21.308.00 $0.00 $0.00 $47.00 $21,355.00 $0.00 $0.00 $0.00 $1,715.00 $0.00 $14.00 $1,729.00 -$7,791.00 $0.00 $0.00 $7,791.00 $0.00 $1,593.00 $0.00 $0.00 $5,061.00 $0.00 $3,468.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 -$9.00 $9.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $485.00 $84,278.00 $85,291.00 $9,321.00 -$89,425.00 $348.00 $348.00 $71,656.00 $0.00 $0.00 $11,153.00 $0.00 $0.00 $36.00 $11,189.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $1,172.00 -$1,954.00 $0.00 -$20.00 $802.00 $0.00 $0.00 $8,062.00 $0.00 $0.00 $0.00 -$8,062.00 $0.00 $0.00 $0.00 $0.00 $12,198.00 $0.00 $12,198.00 $0.00 $0.00 $0.00 $0.00 $0.00 -$13.00 $13.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $1.00 $1,975.00 $0.00 $0.00 $13.00 $0.00 $1,989.00 $486.00 $86,253.00 $89,554.00 -11275.00 $ 101,610.00 $351.00 $63,759.00 $0.00 $0.00 $16,273.00 $0.00 $0.00 $29.00 $16,302.00 $0.00 $40.00 $0.00 $11.00 $416.00 $0.00 $0.00 -$8,176.00 $0.00 $0.00 $0.00 -$8,176.00 $0.00 $0.00 $0.00 $0.00 -$8,865.00 $0.00 -$8,865.00 $0.00 $0.00 $0.00 $0.00 $0.00 $6.00 $6.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $1.00 $1,215.00 $19.00 $0.00 $326.00 $60.00 $847.00 $485.00 $87,428.00 $97,670.00 -11640.00 $110,801.00 $303.00 $63,445.00 Distr. attr. to noncontr. interests Share-based comp plans & other 12/31/18 Net Income $0.00 $365.00 $0.00 Other, net of taxes Dividends Treasury Stock Purchase Net Inc. attr. to noncontr. interests Distr. attr. to noncontr. interests Share-based comp plans & other 12/31/19 $1,788.00 $39,660.00 $46,602.00 $6,193.00 $55,950.00 $94.00 $26,001.00 Pfizer Corp. COMMON SIZE BALANCE SHEETS Merck & Co. Inc. Percentages 2017 2019 2018 2017 In $Millions 2018 In $Millions 2018 Percentages 2018 2019 2019 2017 2019 2017 Assets Short-term assets Long-term assets Total assets $ 27,483 56,914 $ 84,397 $ 25,875 56,762 $ 82,637 $ 24,766 63,106 $ 87,872 32.56% 67.44% 100.00% 31.31% 68.69% 100.00% 28.18% 71.82% 100.00% $ 27,483 56,914 $ 84,397 $ 25,875 56,762 $ 82,637 $ 24,766 63,106 $ 87,872 32.56% 67.44% 31.31% 68.69% 100.00% 28.18% 71.82% 100.00% 100.00% 26.24% $ 22,220 36,176 58,396 $ 22,206 35,549 57,755 $ 18,614 34,689 53,303 26.33% 42.86% 69.19% 42.00% 68.24% 21.18% 39.48% 60.66% $ 22,220 36,176 58,396 $ 22,206 35,549 57,755 $ 18,614 34,689 53,303 26.33% 42.86% 69.19% 26.24% 42.00% 68.24% 21.18% 39.48% 60.66% Liabilities Short-term liabilities Long-term liabilities Total liabilities Stockholders' Equity Common Stock Additional paid-in capital Retained earnings Accum. other comp. Other Total Stockholders' Equity Total Liabilities & Equity 1,788 39,660 46,602 (6,193) (55,856) 26,001 $ 84,397 1,788 38,808 42,579 (5,545) (50,748) 26,882 $ 84,637 1,788 39,902 41,350 (4,910) (43,561) 34,569 $ 87,872 2.12% 46.99% 55.22% -7.34% -66.18% 30.81% 100.00% 2.11% 45.85% 50.31% -6.55% -59.96% 31.76% 100.00% 2.03% 45.41% 47.06% -5.59% -49.57% 39.34% 1,788 39,660 46,602 (6,193) (55,856) 26,001 $ 84,397 1,788 38,808 42,579 (5,545) (50,748) 26,882 $ 84,637 1,788 39,902 41,350 (4,910) (43,561) 34,569 $ 87,872 2.12% 46.99% 55.22% -7.34% -66.18% 30.81% 100.00% 2.11% 45.85% 50.31% -6.55% -59.96% 31.76% 100.00% 2.03% 45.41% 47.06% -5.59% -49.57% 39.34% 100.00% 100.00% In Millions 2018 COMMON SIZE INCOME SHEETS Merck & Co. Inc. Percentages 2017 2019 2018 2017 2019 $ 40,122 100.00% 100.00% 100.00% $ 51,750 In $Millions 2018 $ 53,647 2019 Pfizer Corp Percentages 2017 2019 2018 $ 52,546 100.00% 100.00% 2017 $ 46,840 $ 42,294 100.00% 20.97% 26.94% Revenue Expenses Cost of Sales Operating Expense Net Other (Income)/Expense Income Tax Expense Total Expenses Inc. Attr. NonCont. Interests Net Income $ 14,112 10,615 10,649 1,687 37,063 (66) $ 9,843 $ 13,509 10,102 9,982 2,508 36,101 (27) $ 6,220 $ 12,912 10,074 10,615 4,103 37,704 24 $ 2,394 30.13% 22.66% 22.73% 3.60% 79.13% 31.94% 23.89% 23.60% 5.93% 85.36% -0.06% 14.71% 32.18% 25.11% 26.46% 10.23% 93.97% 0.06% 5.97% $ 10,219 14,350 9,495 1,384 35,448 29 $ 16,273 $ 11,248 14,455 16,029 726 42,458 36 $ 11,153 $ 11,228 14,804 14,204 (9,045) 31,191 47 $ 21,308 19.75% 27.73% 18.35% 2.67% 68.50% 0.06% 31.45% 29.88% 1.35% 79.14% 21.37% 28.17% 27.03% -17.21% 59.36% 0.09% 40.55% -0.14% 21.01% 0.07% 20.79% Ratio Return on Average Total Assets Profitability/Profit Margin Productivity/Asset Turnover ROA Disaggregation Return on Equity 12/31/19 12/31/18 Merck & Co, Inc. Pfizer Corp. Merck & Co, Inc. Pfizer Corp. 11.79% 9.96% 7.30% 6.74% 21.01% 31.45% 14.71% 20.79% 0.56 0.32 0.51 0.32 11.79% 9.96% 7.53% 6.74% 37.23% 25.59% 20.24% 18.05% Accounting Equation Assets Nonowner Financing $ 58,396 Owner Financing $ 26,001 Merck & Co, Inc. $ 84,397 Pfizer Corp. $ 167,489 $104,043 $ 63,446 Owner Financing Merck & Co, Inc. Pfizer Corp. 30.81% 37.88% Exhibit 4.4 Summary of Ratios in DuPont Disaggregation of Return on Equity Ratio Computation What The Ratio Measures Positive Indicators Include Return on equity Net income ROE measures accounting return to Avg. stockholders' equity, or shareholders using net income and the Return on assets X book value of stockholders' equity. Financial leverage Return on assets Net income/Avg. total assets ROA measures the accounting return on or total assets using net income and total Profit margin x assets. Asset turnover PROFITABILITY Gross profit margin Gross profit / Sales Gross profit measures the difference between selling price and the cost to make or buy the products sold for the year. - Improvement over time and favorable comparison to peers. Greater proportion of ROE from ROA (operations) than financial leverage (risk). - Improvement over time in both profit margin and asset turnover. - Improvement in gross margins and not solely from expense reduction. Operating expense SG&A expense / Sales Operating expense margin measures total margin (or SG&A overhead expense (SG&A) as a percent expense margin) of sales. - Improvement over time due to increases in selling prices and/or reductions in cost to make or buy without compromising product quality. Favorable comparison to peers. Improvement over time. - Favorable comparison to peers. - No short-term gains at long-term cost (such as unusual reductions in marketing and R&D expenses). - Improvement over time. Favorable comparison to peers. - Improvement over time. - Favorable comparison to peers. - Maintain sales while reducing days to collect receivables. Improvement over time. Favorable comparison to peers. Profit margin (or Net income / Sales Profit margin includes effects of both net profit margin) gross profit margin, the operating expense margin, and net nonoperating expenses. PRODUCTIVITY Accounts COGS / Avg. inventory AR turnover reflects how effective a receivable turnover company manages the credit issued to customers. Days sales 365 X (Avg. accounts DSO reflects how well a company's outstanding (DSO) receivable / Sales) accounts receivables are managed. Inventory turnover COGS / Avg. inventory Inventory turnover reflects the number of times inventory is sold or used during the period. Days inventory 365 X Avg. inventory/COGS DIO reflects how many days it takes for a outstanding (DIO) company to sell its inventory. Accounts payable COGS - AP turnover reflects how many times a turnover Avg. accounts payable company pays off its suppliers during the period. Days payables 365 X (Avg. accounts DPO reflects how long it takes a company outstanding (DPO) payable/COGS) to pay its invoices from suppliers. Cash conversion AR days + Inv days - AP Cash conversion (operating) cycle cycle days measures the days to convert cash to inventories, receivables to cash, cash to payables. PPE turnover Sales / Avg. PPE assets Plant asset turnover is a productivity measure, comparing the volume of sales generated by plant assets. - Maintain sales while reducing days to sell inventory Improvement over time. Favorable comparison to peers. - Maintain supplier relations while delaying payment to suppliers. Improvement over time. - Favorable comparison to peers. - Improvement over time. - Favorable comparison to peers. Exhibit 4.4 (continued) Ratio Computation What The Ratio Measures Positive Indicators Include FINANCIAL LEVERAGE Total liabilities-to Total liabilities equity Stockholders' equity Proportion of liabilities vs. equity in the capital structure. - Improvement over time. . Favorable comparison to peers. . Relatively lower levels are preferable. Improvement over time. - Favorable comparison to peers. - Higher levels are preferable to lower levels. Times interest earned Earnings before interest and taxes + Interest expense, gross Pool of operating profit before tax that a company earns relative to its interest expense, gross. Dupont Model Ap 4-C ROE NI NI Sales Av A Ar S PM x ATXEL