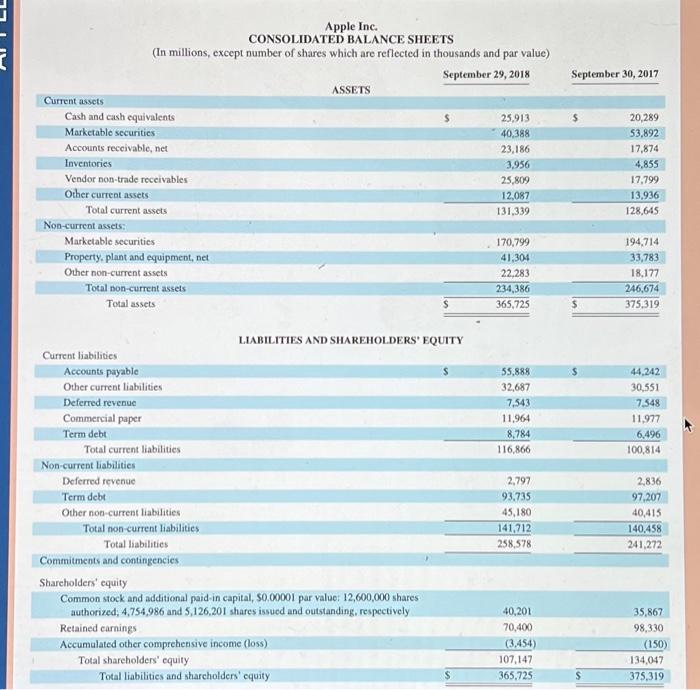

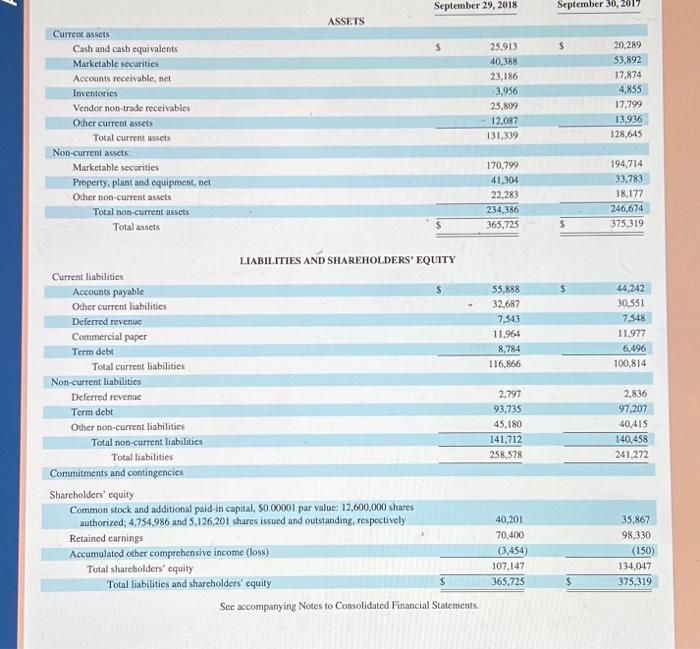

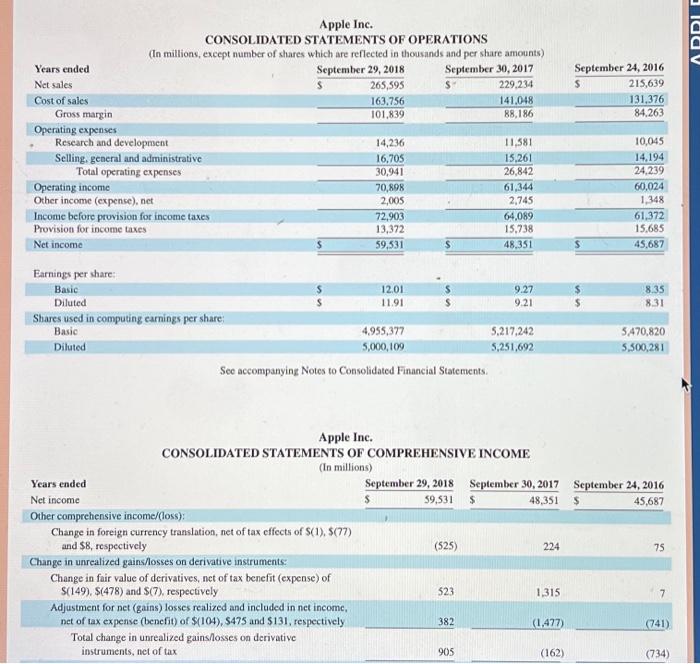

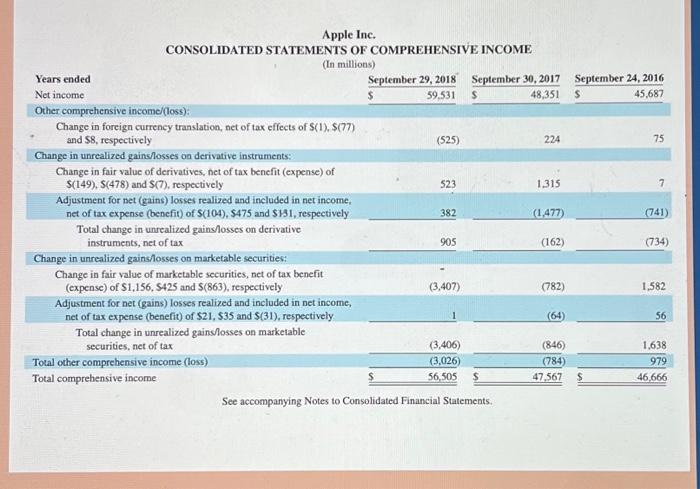

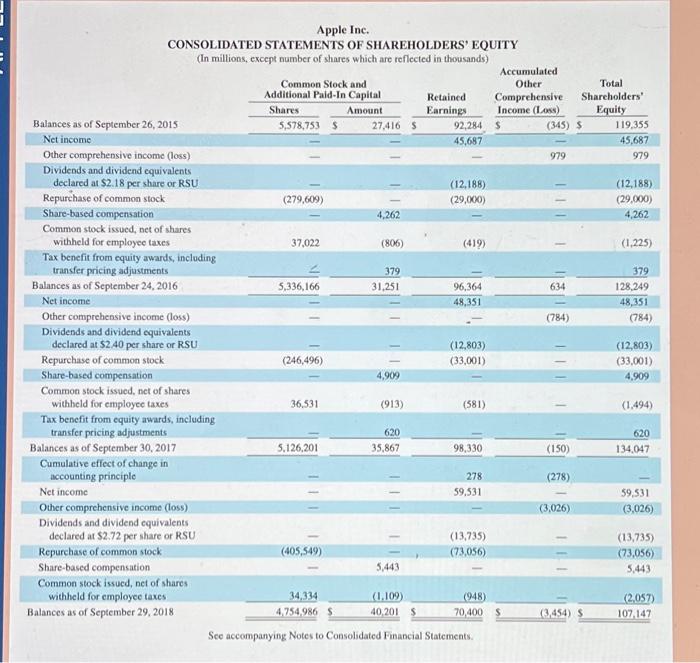

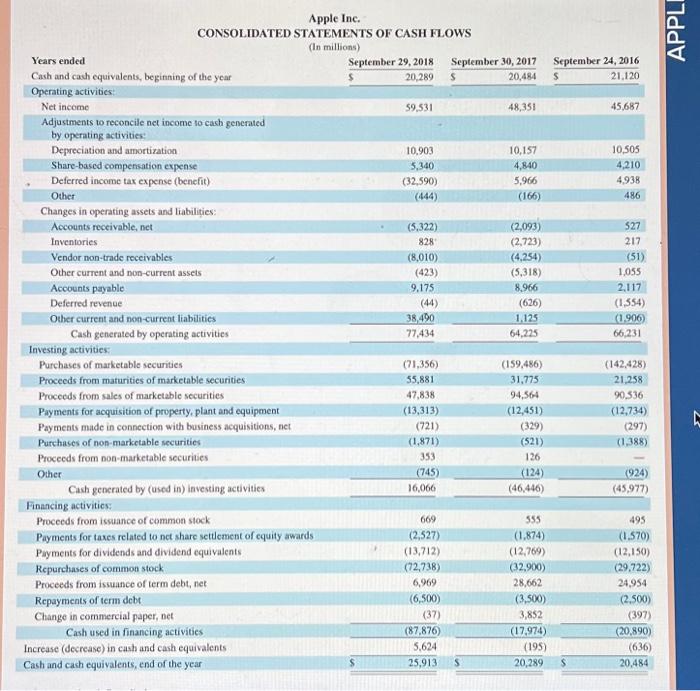

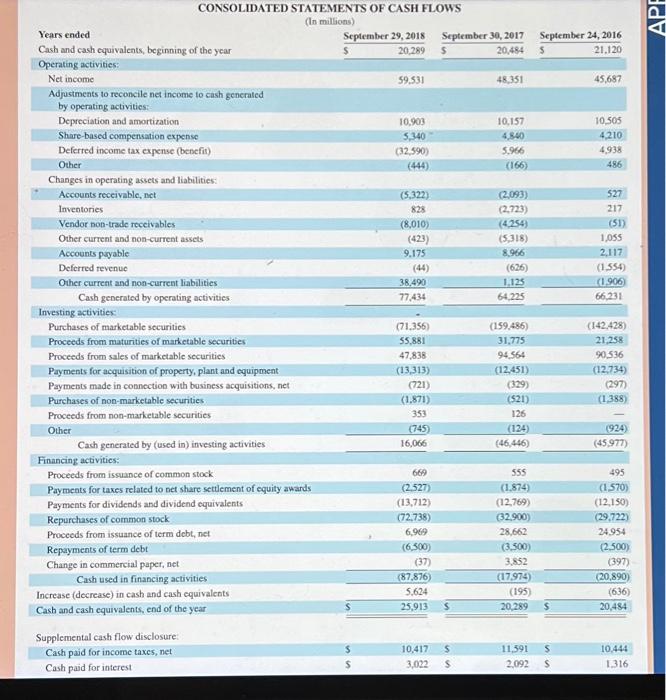

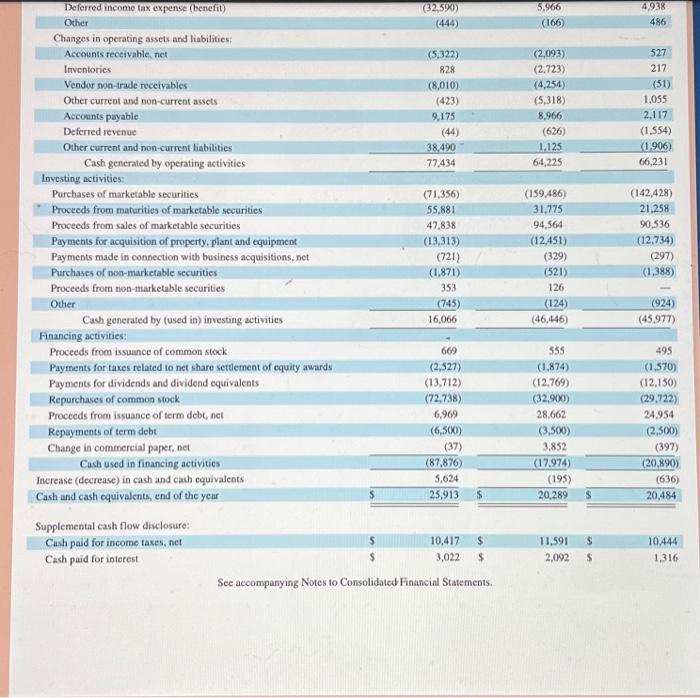

Apple Inc. CONSOLIDATED BALANCE SHEETS (In millions, except number of shares which are reflected in thousands and par value) See accompanying Notes to Consolidated Financial Statcments. Apple Inc. CONSOLIDATED STATEMENTS OF OPERATIONS In millions. except number of shares which are reflected in thousands and per share amounts) See accompanying Notes to Consolidated Financial Statements. Apple Inc. See accompanying Notes to Consolidated Financial Statements. Apple Inc. Apple Inc. CONSOLIDATED STATEMENTS OF CASH FLOWS (In millions) Years ended Cash and cash equivalents, beginning of the year Operating activities: Net income $September29,2018 59.531 5September30,201720,484 48,351 5September24,201621,120 45,687 Adjustments to reconcile net income to cash generated by operating activities: Depreciation and amortization Share-based compensation expense Deferred income tax expense (benefit) Other Changes in operating assets and liabilities: Accounts receivable, net Inventories Vendor non-trade receivables Other current and non-current assets Accounts pryable Deferred revenue Other current and non-current liabilities Cash generated by operating activities: 10,903 10,157 10,505 4,210 (32,590) 4,938 (444) (166) 486 Supplemental cash flow disclosure: Cash paid for income taxes, net Cash paid for interest 10,417 11,591 10,444 3,022 2.092 1,316 See accompanying Notes to Consolidated Financial Statements. Use Apple's financial statements ir to answer the following. Required: 1. Is Apple's statement of cash flows prepared under the direct method or the indirect method? 2. For each fiscal year 2018, 2017, and 2016, identify the amount of cash provided by operating activities and cash paid for dividends. 3. In 2018, did Apple have sufficient cash flows from operations to pay dividends? 4. Did Apple spend more or less cash to repurchase common stock in 2018 versus 2017? Complete this question by entering your answers in the tabs below. Is Apple's statement of cash flows prepared under the direct method or the indirect method? Use Apple's financial statements in Appendix A to answer the following. Required: 1. Is Apple's statement of cash flows prepared under the direct method or the indirect method? 2. For each fiscal year 2018, 2017, and 2016, identify the amount of cash provided by operating activities and cash paid for dividends. 3. In 2018, did Apple have sufficient cash flows from operations to pay dividends? 4. Did Apple spend more or less cash to repurchase common stock in 2018 versus 2017? Complete this question by entering your answers in the tabs below. For each fiscal year 2018, 2017, and 2016, identify the amount of cash provided by operating activities and cash paid for dividends. Note: Enter your answers in millions of dollars