Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Apple Inc. designs, manufactures, and markets smartphones, personal computers, tablets, wearables, and accessories worldwide. It also provides AppleCare support and cloud services; and operates

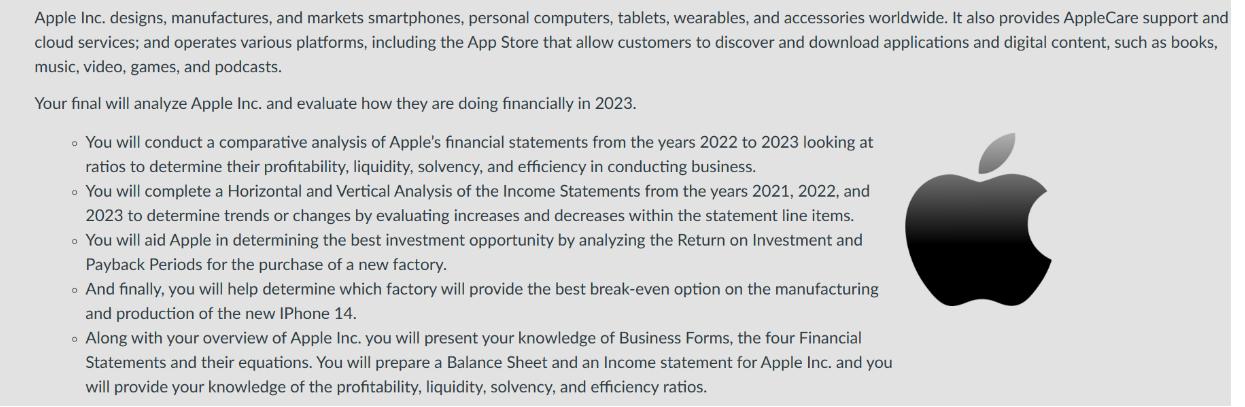

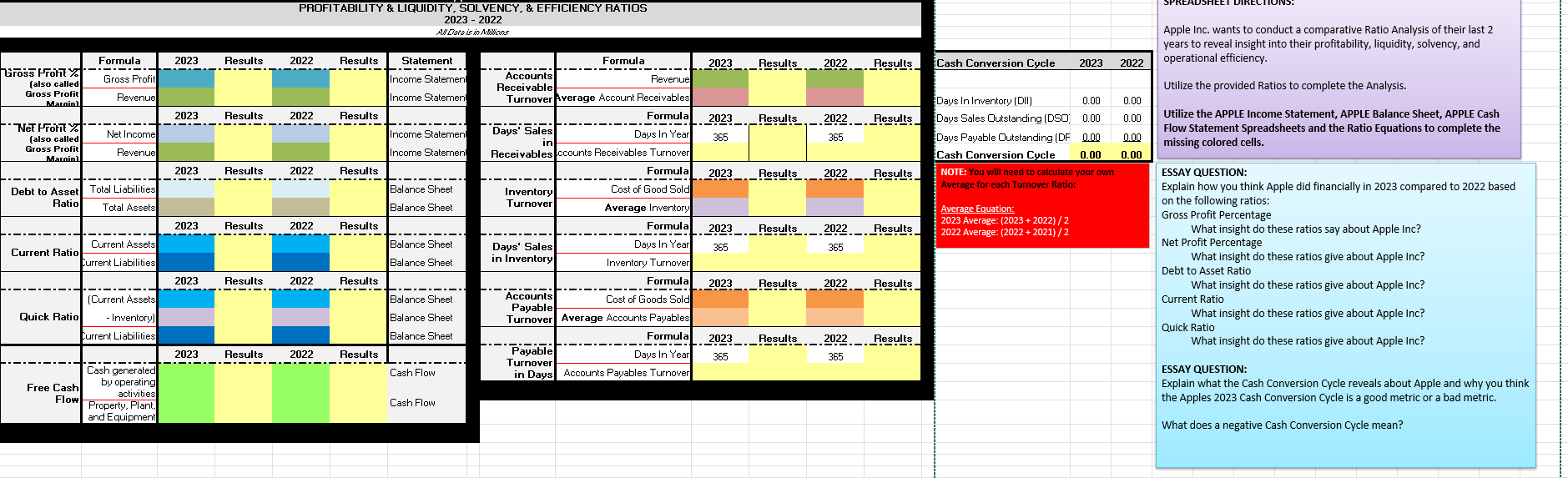

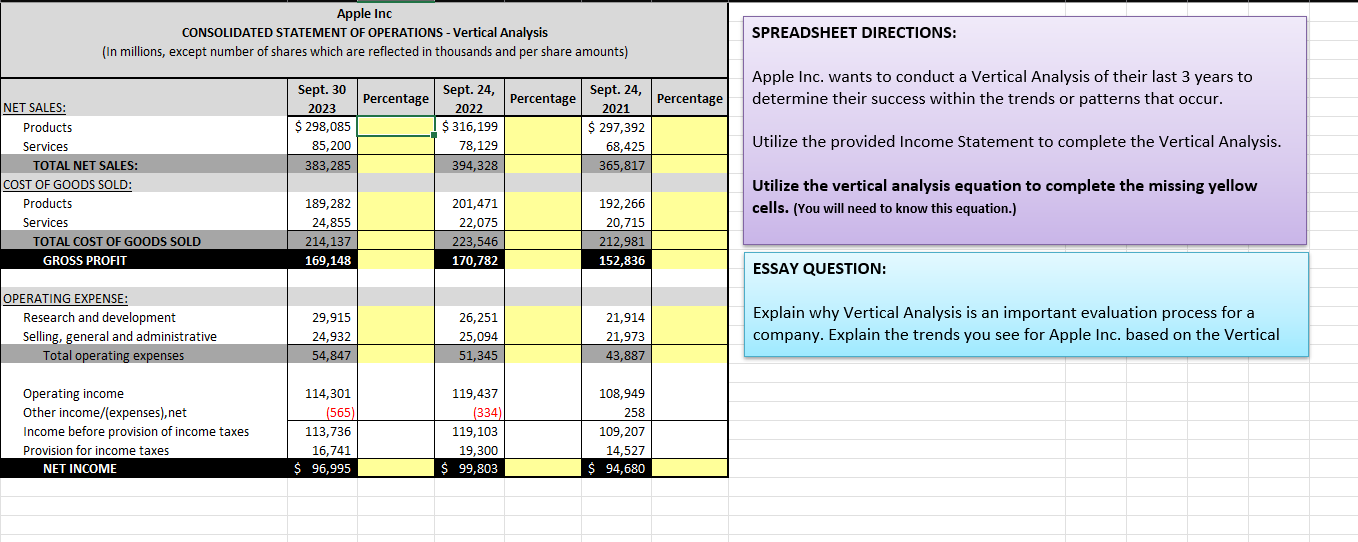

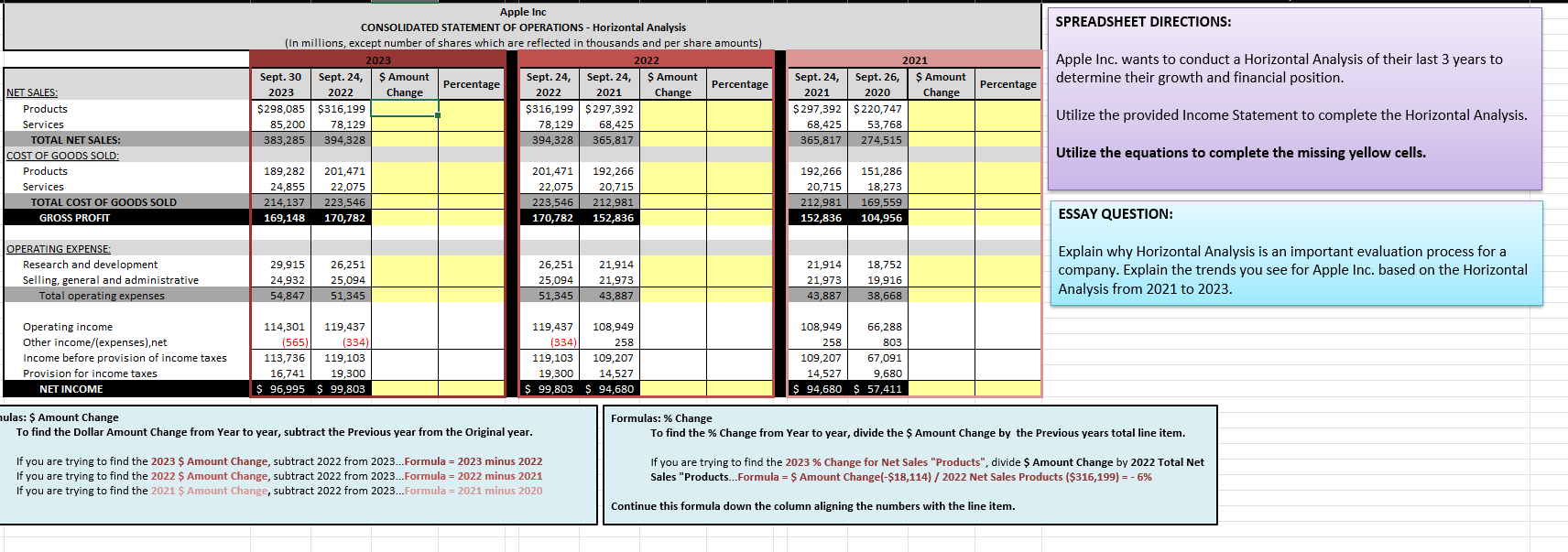

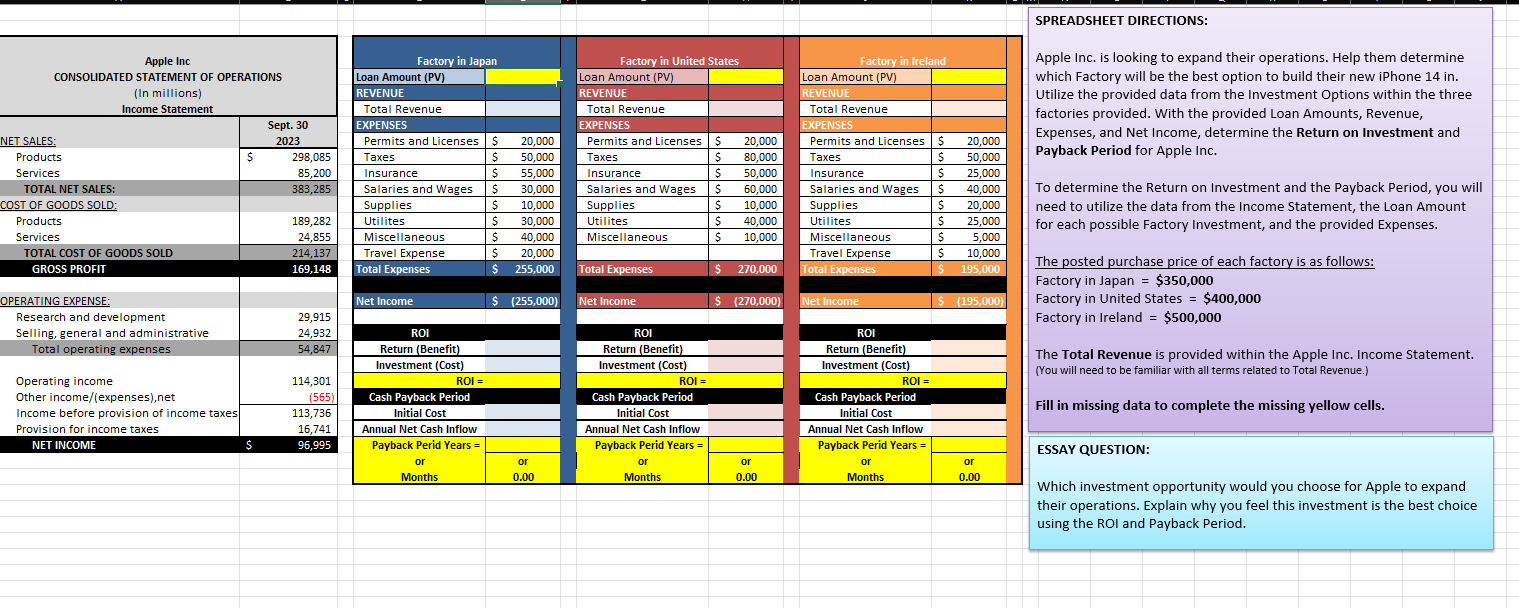

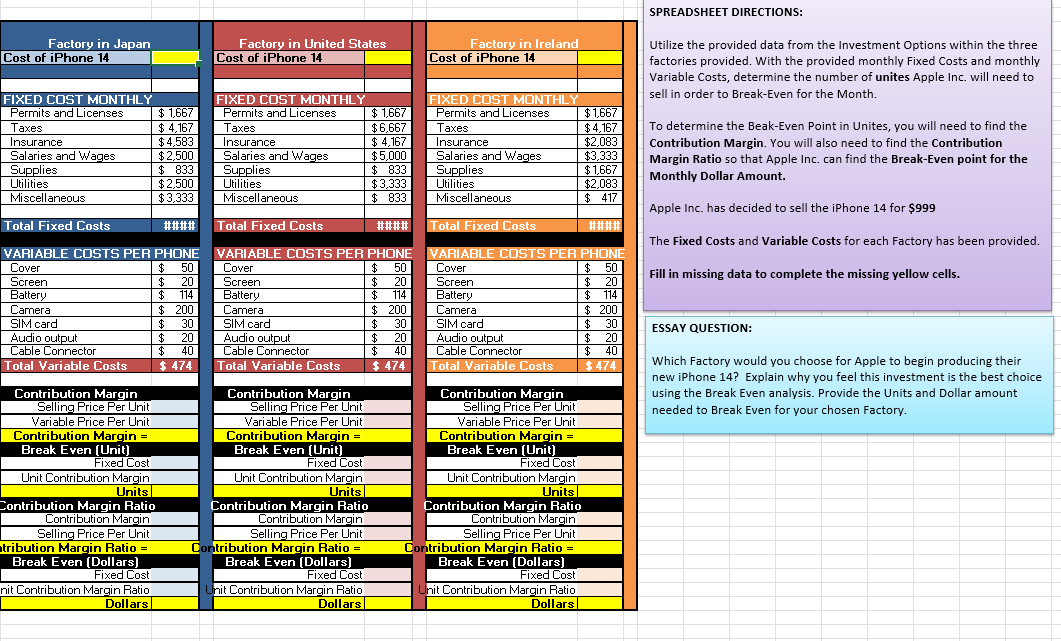

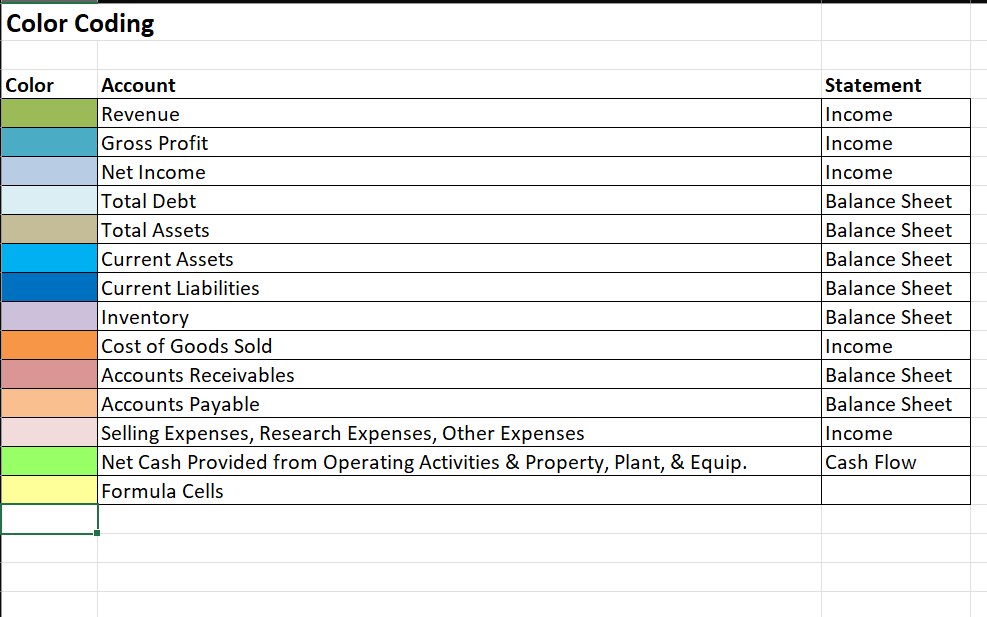

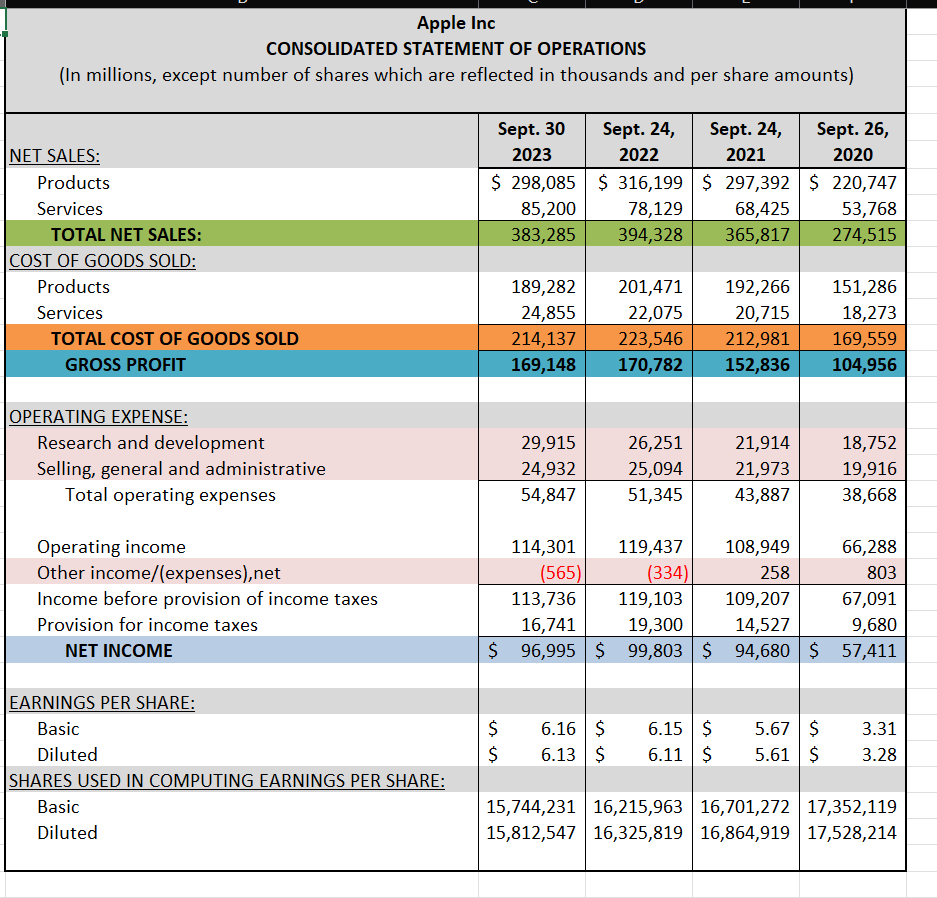

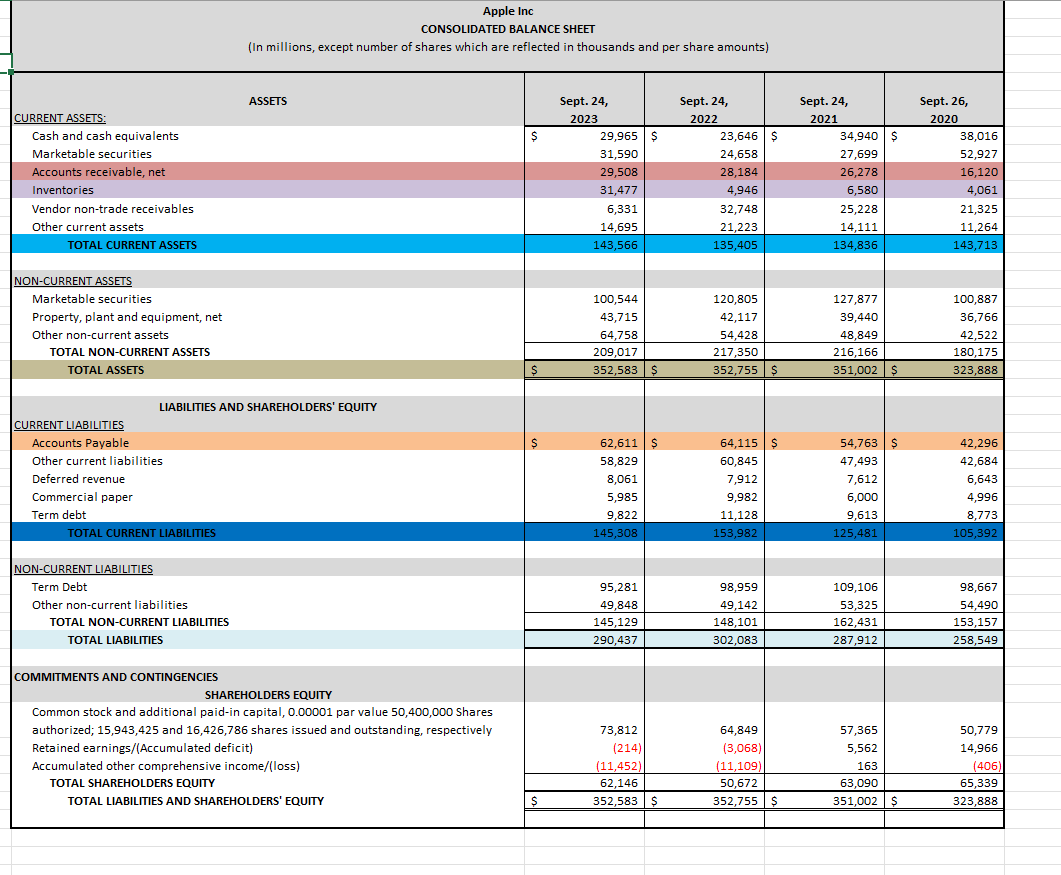

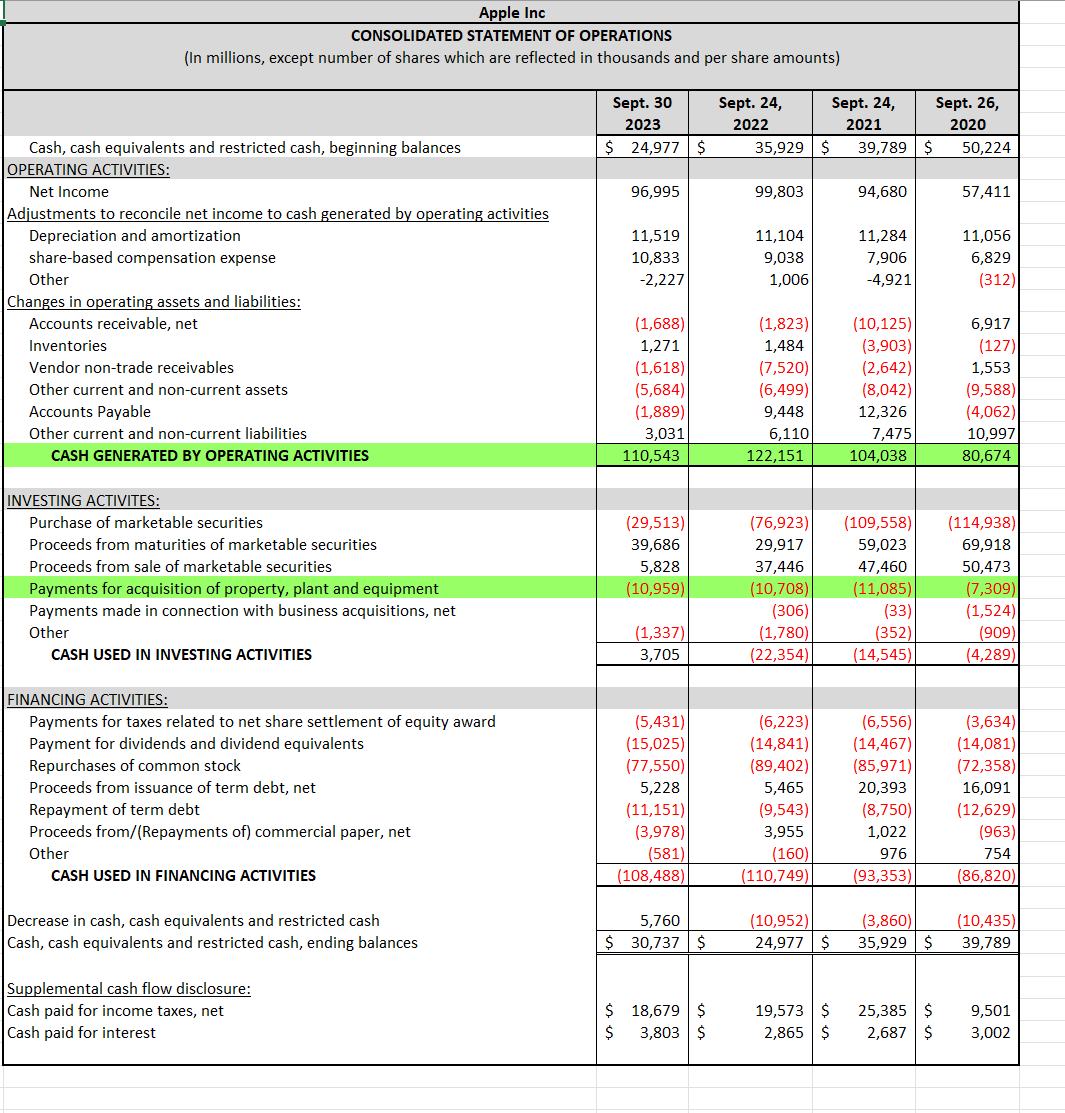

Apple Inc. designs, manufactures, and markets smartphones, personal computers, tablets, wearables, and accessories worldwide. It also provides AppleCare support and cloud services; and operates various platforms, including the App Store that allow customers to discover and download applications and digital content, such as books, music, video, games, and podcasts. Your final will analyze Apple Inc. and evaluate how they are doing financially in 2023. You will conduct a comparative analysis of Apple's financial statements from the years 2022 to 2023 looking at ratios to determine their profitability, liquidity, solvency, and efficiency in conducting business. You will complete a Horizontal and Vertical Analysis of the Income Statements from the years 2021, 2022, and 2023 to determine trends or changes by evaluating increases and decreases within the statement line items. You will aid Apple in determining the best investment opportunity by analyzing the Return on Investment and Payback Periods for the purchase of a new factory. And finally, you will help determine which factory will provide the best break-even option on the manufacturing and production of the new IPhone 14. Along with your overview of Apple Inc. you will present your knowledge of Business Forms, the four Financial Statements and their equations. You will prepare a Balance Sheet and an Income statement for Apple Inc. and you will provide your knowledge of the profitability, liquidity, solvency, and efficiency ratios. PROFITABILITY & LIQUIDITY, SOLVENCY, & EFFICIENCY RATIOS 2023 - 2022 All Data is in Millions Apple Inc. wants to conduct a comparative Ratio Analysis of their last 2 years to reveal insight into their profitability, liquidity, solvency, and operational efficiency. Formula 2023 Results 2022 Results Statement Formula 2023 Results 2022 Results Cash Conversion Cycle 2023 2022 Gross Pront (also called Gross Profit Marginl "Net Profit% Gross Profit Revenue Income Statemen Income Statemen Accounts Receivable Revenue Utilize the provided Ratios to complete the Analysis. Turnover Average Account Receivables Days In Inventory (DII) 2023 Results 2022 Results (also called Net Income Gross Profit Marginl Revenue Income Statemen Income Statemen Days' Sales Formula Days In Year 2023 365 Results 2022 365 Results in Receivables ccounts Receivables Turnover Days Sales Outstanding (DSO) Days Payable Outstanding (DF 0.00 Cash Conversion Cycle 0.00 0.00 0.00 0.00 0.00 Utilize the APPLE Income Statement, APPLE Balance Sheet, APPLE Cash Flow Statement Spreadsheets and the Ratio Equations to complete the missing colored cells. 0.00 0.00 2023 Results 2022 Results Formula 2023 Results 2022 Results Debt to Asset Total Liabilities Ratio Total Assets Balance Sheet Balance Sheet Inventory Turnover Cost of Good Sold Average Inventory NOTE: You will need to calculate your own Average for each Turnover Ratio: Average Equation: 2023 Results 2022 Results Current Ratio Current Assets Current Liabilities Balance Sheet Balance Sheet Days' Sales in Inventory Formula Days In Year Inventory Turnover 2023 Average: (2023 + 2022)/2 2023 Results 2022 Results 365 365 2022 Average: (2022 + 2021)/2 2023 Results 2022 Results Formula 2023 Results 2022 Results Quick Ratio (Current Assets - Inventory) Current Liabilities Balance Sheet Accounts Cost of Goods Sold Balance Sheet Payable Turnover Average Accounts Payables Balance Sheet 2023 Results 2022 Results Payable Turnover Formula Days In Year 2023 365 Results 2022 Results 365 Free Cash Flow Cash generated by operating activities Property, Plant, and Equipment Cash Flow in Days Accounts Payables Turnover Cash Flow ESSAY QUESTION: Explain how you think Apple did financially in 2023 compared to 2022 based on the following ratios: Gross Profit Percentage What insight do these ratios say about Apple Inc? Net Profit Percentage What insight do these ratios give about Apple Inc? Debt to Asset Ratio What insight do these ratios give about Apple Inc? Current Ratio What insight do these ratios give about Apple Inc? Quick Ratio What insight do these ratios give about Apple Inc? ESSAY QUESTION: Explain what the Cash Conversion Cycle reveals about Apple and why you think the Apples 2023 Cash Conversion Cycle is a good metric or a bad metric. What does a negative Cash Conversion Cycle mean? Apple Inc CONSOLIDATED STATEMENT OF OPERATIONS - Vertical Analysis (In millions, except number of shares which are reflected in thousands and per share amounts) NET SALES: Sept. 30 2023 Percentage Sept. 24, 2022 Percentage Products $ 298,085 $316,199 Services TOTAL NET SALES: 85,200 78,129 Sept. 24, 2021 $297,392 68,425 383,285 394,328 365,817 COST OF GOODS SOLD: Products 189,282 201,471 192,266 Services 24,855 22,075 20,715 TOTAL COST OF GOODS SOLD 214,137 223,546 212,981 GROSS PROFIT 169,148 170,782 152,836 OPERATING EXPENSE: Research and development 29,915 26,251 21,914 Selling, general and administrative 24,932 25,094 21,973 Total operating expenses 54,847 51,345 43,887 Operating income 114,301 119,437 108,949 Other income/(expenses), net (565) (334) Income before provision of income taxes 113,736 119,103 Provision for income taxes 16,741 19,300 258 109,207 14,527 NET INCOME $ 96,995 $ 99,803 $ 94,680 Percentage SPREADSHEET DIRECTIONS: Apple Inc. wants to conduct a Vertical Analysis of their last 3 years to determine their success within the trends or patterns that occur. Utilize the provided Income Statement to complete the Vertical Analysis. Utilize the vertical analysis equation to complete the missing yellow cells. (You will need to know this equation.) ESSAY QUESTION: Explain why Vertical Analysis is an important evaluation process for a company. Explain the trends you see for Apple Inc. based on the Vertical Apple Inc CONSOLIDATED STATEMENT OF OPERATIONS - Horizontal Analysis (In millions, except number of shares which are reflected in thousands and per share amounts) 2023 2022 2021 Sept. 30 NET SALES: 2023 2022 Sept. 24, $ Amount Change Percentage 2022 2021 Sept. 24, Sept. 24, $ Amount Change Sept. 24, Sept. 26, Percentage 2021 Products $298,085 $316,199 $316,199 $297,392 $297,392 2020 $220,747 $ Amount Change Services 85,200 78,129 78,129 68,425 68,425 53,768 TOTAL NET SALES: 383,285 394,328 COST OF GOODS SOLD: Products 189,282 201,471 394,328 365,817 201,471 192,266 365,817 274,515 Percentage SPREADSHEET DIRECTIONS: Apple Inc. wants to conduct a Horizontal Analysis of their last 3 years to determine their growth and financial position. Utilize the provided Income Statement to complete the Horizontal Analysis. Utilize the equations to complete the missing yellow cells. Services 24,855 22,075 TOTAL COST OF GOODS SOLD 214,137 223,546 22,075 20,715 223,546 212,981 GROSS PROFIT 169,148 170,782 170,782 152,836 192,266 151,286 20,715 18,273 212,981 169,559 152,836 104,956 ESSAY QUESTION: OPERATING EXPENSE: Research and development 29,915 26,251 26,251 21,914 21,914 Selling, general and administrative 24,932 25,094 25,094 21,973 21,973 18,752 19,916 Explain why Horizontal Analysis is an important evaluation process for a company. Explain the trends you see for Apple Inc. based on the Horizontal Analysis from 2021 to 2023. Total operating expenses 54,847 51,345 51,345 43,887 43,887 38,668 Operating income Other income/(expenses),net 114,301 (565) 119,437 (334) 119,437 (334) 108,949 258 108,949 258 66,288 803 113,736 16,741 119,103 19,300 119,103 19,300 $ 99,803 $ 94,680 Income before provision of income taxes Provision for income taxes NET INCOME ulas: $ Amount Change $ 96,995 $ 99,803 To find the Dollar Amount Change from year to year, subtract the Previous year from the Original year. If you are trying to find the 2023 $ Amount Change, subtract 2022 from 2023...Formula = 2023 minus 2022 If you are trying to find the 2022 $ Amount Change, subtract 2022 from 2023... Formula = 2022 minus 2021 If you are trying to find the 2021 $ Amount Change, subtract 2022 from 2023...Formula = 2021 minus 2020 Formulas: % Change To find the % Change from Year to year, divide the $ Amount Change by the Previous years total line item. If you are trying to find the 2023 % Change for Net Sales "Products", divide $ Amount Change by 2022 Total Net Sales "Products...Formula = $ Amount Change(-$18,114) / 2022 Net Sales Products ($316,199) = -6% Continue this formula down the column aligning the numbers with the line item. 109,207 109,207 67,091 14,527 14,527 9,680 $ 94,680 $ 57,411 Apple Inc CONSOLIDATED STATEMENT OF OPERATIONS (In millions) Income Statement Factory in Japan Factory in United States Factory in Ireland Loan Amount (PV) Loan Amount (PV) REVENUE REVENUE Loan Amount (PV) REVENUE Total Revenue NET SALES: Sept. 30 2023 EXPENSES Total Revenue EXPENSES Total Revenue EXPENSES Products $ 298,085 Permits and Licenses $ 20,000 Taxes Permits and Licenses $ 20,000 $ 50,000 Taxes $ 80,000 $ 50,000 Services TOTAL NET SALES: 85,200 Insurance $ 55,000 Insurance $ 50,000 383,285 Salaries and Wages $ 30,000 Salaries and Wages COST OF GOODS SOLD: Supplies $ 10,000 Products 189,282 Utilites $ 30,000 Supplies Utilites $ 60,000 $ 10,000 $ 40,000 Supplies Utilites Services 24,855 Miscellaneous $ 40,000 Miscellaneous $ 10,000 TOTAL COST OF GOODS SOLD 214,137 Travel Expense $ 20,000 GROSS PROFIT 169,148 Total Expenses $ 255,000 Total Expenses $ 270,000 Miscellaneous Travel Expense Total Expenses $ 25,000 $ 40,000 $ 20,000 $ 25,000 $ 5,000 $ 10,000 $ 195,000 OPERATING EXPENSE: Net Income $ (255,000) Net Income $ (270,000) Net Income $ (195,000) Research and development 29,915 Selling, general and administrative 24,932 ROI ROI ROI Total operating expenses 54,847 Return (Benefit) Investment (Cost) Return (Benefit) Investment (Cost) Return (Benefit) Investment (Cost) Operating income 114,301 Other income/(expenses),net (565) Income before provision of income taxes 113,736 Provision for income taxes NET INCOME $ 16,741 96,995 ROI = Cash Payback Period Initial Cost Annual Net Cash Inflow ROI = ROI = Payback Perid Years = Cash Payback Period Initial Cost Annual Net Cash Inflow Payback Perid Years= Cash Payback Period Initial Cost Annual Net Cash Inflow Payback Perid Years= Permits and Licenses $ 20,000 Taxes Insurance Salaries and Wages SPREADSHEET DIRECTIONS: Apple Inc. is looking to expand their operations. Help them determine which Factory will be the best option to build their new iPhone 14 in. Utilize the provided data from the Investment Options within the three factories provided. With the provided Loan Amounts, Revenue, Expenses, and Net Income, determine the Return on Investment and Payback Period for Apple Inc. To determine the Return on Investment and the Payback Period, you will need to utilize the data from the Income Statement, the Loan Amount for each possible Factory Investment, and the provided Expenses. The posted purchase price of each factory is as follows: Factory in Japan = $350,000 Factory in United States = $400,000 Factory in Ireland = $500,000 The Total Revenue is provided within the Apple Inc. Income Statement. (You will need to be familiar with all terms related to Total Revenue.) Fill in missing data to complete the missing yellow cells. ESSAY QUESTION: or or Months 0.00 or Months or 0.00 or Months or 0.00 Which investment opportunity would you choose for Apple to expand their operations. Explain why you feel this investment is the best choice using the ROI and Payback Period. Factory in Japan Factory in United States Cost of iPhone 14 Cost of iPhone 14 FIXED COST MONTHLY FIXED COST MONTHLY FIXED COST MONTHLY Permits and Licenses $ 1,667 Permits and Licenses $1,667 Permits and Licenses Taxes $ 4,167 Taxes $6,667 Taxes Insurance $4,583 Insurance $ 4,167 Insurance $1,667 $4,167 $2,083 Salaries and Wages $2,500 Salaries and Wages $5,000 Salaries and Wages $3,333 Supplies $ 833 Supplies $ 833 Supplies $1,667 Factory in Ireland Cost of iPhone 14 SPREADSHEET DIRECTIONS: Utilize the provided data from the Investment Options within the three factories provided. With the provided monthly Fixed Costs and monthly Variable Costs, determine the number of unites Apple Inc. will need to sell in order to Break-Even for the Month. To determine the Beak-Even Point in Unites, you will need to find the Contribution Margin. You will also need to find the Contribution Margin Ratio so that Apple Inc. can find the Break-Even point for the Monthly Dollar Amount. Utilities $2,500 Utilities $3,333 Utilities $2,083 Miscellaneous $3,333 Miscellaneous $ 833 Miscellaneous $ 417 Apple Inc. has decided to sell the iPhone 14 for $999 Total Fixed Costs #### Total Fixed Costs #### Total Fixed Costs #### The Fixed Costs and Variable Costs for each Factory has been provided. VARIABLE COSTS PER PHONE VARIABLE COSTS PER PHONE VARIABLE COSTS PER PHONE Cover $ 50 Cover $ 50 Cover $ 50 Fill in missing data to complete the missing yellow cells. Screen $ 20 Screen $ 20 Screen $ 20 Battery $ 114 Battery $ 114 Battery $ 114 Camera $ 200 Camera $ 200 Camera $ 200 SIM card $ 30 SIM card $ 30 SIM card $ 30 ESSAY QUESTION: Audio output $ 20 Audio output $ 20 Audio output Cable Connector $ 40 Total Variable Costs $ 474 $ 40 $ 474 Cable Connector Total Variable Costs $ 20 $ 40 $474 Contribution Margin Selling Price Per Unit Variable Price Per Unit Contribution Margin= Break Even (Unit) Fixed Cost Unit Contribution Margin Units Contribution Margin Ratio Contribution Margin Selling Price Per Unit atribution Margin Ratio = Break Even [Dollars) Fixed Cost nit Contribution Margin Ratio Dollars Cable Connector Total Variable Costs Contribution Margin Selling Price Per Unit Variable Price Per Unit Contribution Margin = Break Even [Unit] Fixed Cost Unit Contribution Margin Units Contribution Margin Ratio Contribution Margin Selling Price Per Unit Contribution Margin Ratio = Break Even [Dollars) Fixed Cost Unit Contribution Margin Ratio Dollars Contribution Margin Selling Price Per Unit Variable Price Per Unit Contribution Margin = Break Even [Unit] Fixed Cost Unit Contribution Margin Units Contribution Margin Ratio Contribution Margin Selling Price Per Unit Contribution Margin Ratio = Break Even [Dollars) Fixed Cost Unit Contribution Margin Ratio Dollars Which Factory would you choose for Apple to begin producing their new iPhone 14? Explain why you feel this investment is the best choice using the Break Even analysis. Provide the Units and Dollar amount needed to Break Even for your chosen Factory. Color Coding Color Account Revenue Gross Profit Net Income Total Debt Total Assets Current Assets Current Liabilities Inventory Statement Income Income Income Balance Sheet Balance Sheet Balance Sheet Balance Sheet Balance Sheet Income Balance Sheet Cost of Goods Sold Accounts Receivables Accounts Payable Selling Expenses, Research Expenses, Other Expenses Net Cash Provided from Operating Activities & Property, Plant, & Equip. Formula Cells Balance Sheet Income Cash Flow Apple Inc CONSOLIDATED STATEMENT OF OPERATIONS (In millions, except number of shares which are reflected in thousands and per share amounts) NET SALES: Sept. 30 2023 Sept. 24, 2022 Sept. 24, 2021 Sept. 26, 2020 Products Services TOTAL NET SALES: COST OF GOODS SOLD: $ 298,085 $ 316,199 $ 297,392 $ 220,747 85,200 78,129 68,425 383,285 394,328 365,817 53,768 274,515 Products 189,282 201,471 192,266 151,286 Services 24,855 22,075 20,715 18,273 TOTAL COST OF GOODS SOLD 214,137 223,546 212,981 169,559 GROSS PROFIT 169,148 170,782 152,836 104,956 OPERATING EXPENSE: Research and development 29,915 26,251 21,914 18,752 Selling, general and administrative 24,932 25,094 21,973 19,916 Total operating expenses 54,847 51,345 43,887 38,668 Operating income 114,301 119,437 108,949 66,288 Other income/(expenses), net Income before provision of income taxes Provision for income taxes NET INCOME EARNINGS PER SHARE: Basic Diluted SHARES USED IN COMPUTING EARNINGS PER SHARE: Basic Diluted $ 96,995 $ 99,803 $ 94,680 $ 57,411 $ 6.16 $ 6.15 $ $ 6.13 $ 6.11 $ 5.67 $ 5.61 $ 3.31 3.28 15,744,231 16,215,963 | 16,701,272 17,352,119 15,812,547 16,325,819 16,864,919 17,528,214 (565) (334) 258 803 113,736 119,103 109,207 67,091 16,741 19,300 14,527 9,680 Apple Inc CONSOLIDATED BALANCE SHEET (In millions, except number of shares which are reflected in thousands and per share amounts) ASSETS CURRENT ASSETS: Cash and cash equivalents Marketable securities Accounts receivable, net Inventories Vendor non-trade receivables Other current assets TOTAL CURRENT ASSETS NON-CURRENT ASSETS Marketable securities Property, plant and equipment, net Other non-current assets TOTAL NON-CURRENT ASSETS TOTAL ASSETS CURRENT LIABILITIES Accounts Payable Other current liabilities Deferred revenue Commercial paper LIABILITIES AND SHAREHOLDERS' EQUITY Term debt TOTAL CURRENT LIABILITIES NON-CURRENT LIABILITIES Term Debt Other non-current liabilities TOTAL NON-CURRENT LIABILITIES TOTAL LIABILITIES COMMITMENTS AND CONTINGENCIES SHAREHOLDERS EQUITY Common stock and additional paid-in capital, 0.00001 par value 50,400,000 Shares authorized; 15,943,425 and 16,426,786 shares issued and outstanding, respectively Retained earnings/(Accumulated deficit) Accumulated other comprehensive income/(loss) TOTAL SHAREHOLDERS EQUITY TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY Sept. 24, 2023 Sept. 24, 2022 Sept. 24, 2021 Sept. 26, 2020 $ 29,965 $ 23,646 $ 34,940 $ 38,016 31,590 24,658 27,699 52,927 29,508 28,184 26,278 16,120 31,477 4,946 6,580 4,061 6,331 32,748 25,228 21,325 14,695 21,223 14,111 11,264 143,566 135,405 134,836 143,713 100,544 120,805 127,877 100,887 43,715 42,117 39,440 36,766 64,758 54,428 48,849 42,522 209,017 217,350 216,166 180,175 $ 352,583 $ 352,755 $ 351,002 $ 323,888 62,611 $ 64,115 $ 54,763 $ 42,296 58,829 60,845 47,493 42,684 8,061 7,912 7,612 6,643 5,985 9,982 6,000 4,996 9,822 11,128 9,613 8,773 145,308 153,982 125,481 105,392 95,281 98,959 109,106 98,667 49,848 49,142 53,325 54,490 145,129 148,101 162,431 153,157 290,437 302,083 287,912 258,549 73,812 64,849 57,365 50,779 (214) (3,068) 5,562 14,966 (11,452) (11,109) 163 (406) 62,146 50,672 63,090 65,339 $ 352,583 $ 352,755 $ 351,002 $ 323,888 Apple Inc CONSOLIDATED STATEMENT OF OPERATIONS (In millions, except number of shares which are reflected in thousands and per share amounts) Sept. 30 2023 Sept. 24, 2022 Sept. 24, 2021 Sept. 26, 2020 Cash, cash equivalents and restricted cash, beginning balances $ 24,977 $ 35,929 $ 39,789 $ 50,224 OPERATING ACTIVITIES: Net Income 96,995 99,803 94,680 57,411 Adjustments to reconcile net income to cash generated by operating activities Depreciation and amortization 11,519 11,104 11,284 11,056 share-based compensation expense 10,833 9,038 7,906 6,829 Other Changes in operating assets and liabilities: Accounts receivable, net Inventories Vendor non-trade receivables Other current and non-current assets -2,227 1,006 -4,921 (312) (1,688) (1,823) (10,125) 6,917 1,271 1,484 (3,903) (127) (1,618) (7,520) (2,642) 1,553 (5,684) (6,499) (8,042) (9,588) Accounts Payable (1,889) 9,448 12,326 (4,062) Other current and non-current liabilities 3,031 6,110 7,475 10,997 CASH GENERATED BY OPERATING ACTIVITIES 110,543 122,151 104,038 80,674 INVESTING ACTIVITES: Purchase of marketable securities (29,513) (76,923) (109,558) (114,938) Proceeds from maturities of marketable securities 39,686 29,917 59,023 69,918 Proceeds from sale of marketable securities 5,828 37,446 47,460 50,473 Payments for acquisition of property, plant and equipment (10,959) (10,708) (11,085) (7,309) Payments made in connection with business acquisitions, net (306) (33) (1,524) Other (1,337) (1,780) (352) (909) CASH USED IN INVESTING ACTIVITIES 3,705 (22,354) (14,545) (4,289) FINANCING ACTIVITIES: Payments for taxes related to net share settlement of equity award (5,431) (6,223) (6,556) (3,634) Payment for dividends and dividend equivalents (15,025) (14,841) (14,467) (14,081) Repurchases of common stock (77,550) (89,402) (85,971) (72,358) Proceeds from issuance of term debt, net 5,228 5,465 20,393 16,091 Repayment of term debt (11,151) (9,543) (8,750) (12,629) Proceeds from/(Repayments of) commercial paper, net Other CASH USED IN FINANCING ACTIVITIES (3,978) 3,955 1,022 (963) (581) (160) 976 754 (108,488) (110,749) (93,353) (86,820) Decrease in cash, cash equivalents and restricted cash 5,760 Cash, cash equivalents and restricted cash, ending balances $ 30,737 $ (10,952) 24,977 $ (3,860) (10,435) 35,929 $ 39,789 Supplemental cash flow disclosure: Cash paid for income taxes, net Cash paid for interest $ 18,679 $ 19,573 $ 25,385 $ 9,501 $ 3,803 $ 2,865 $ 2,687 $ 3,002

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started