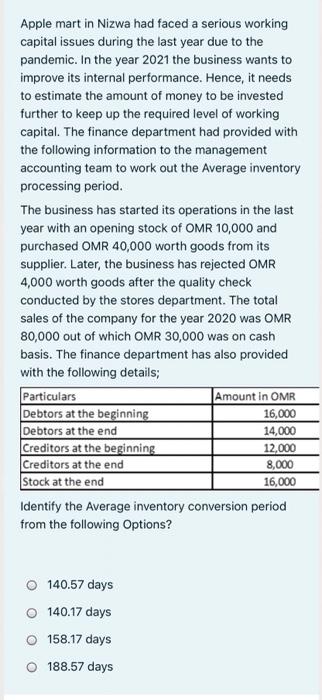

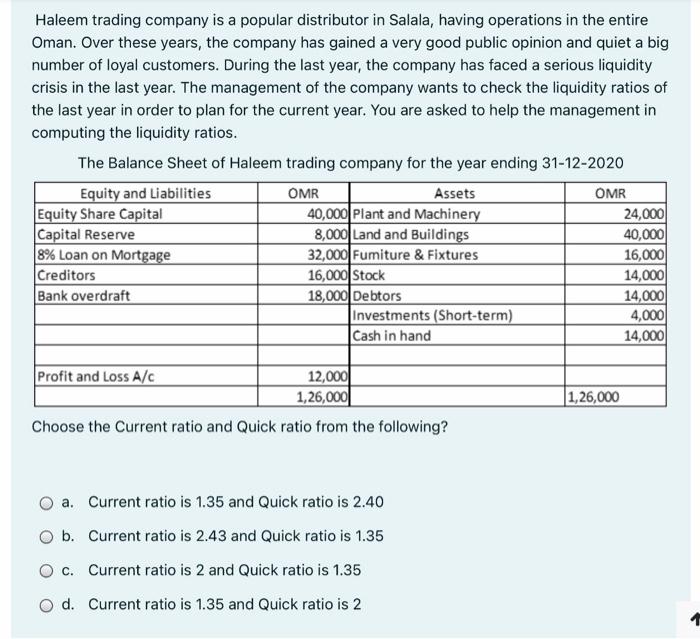

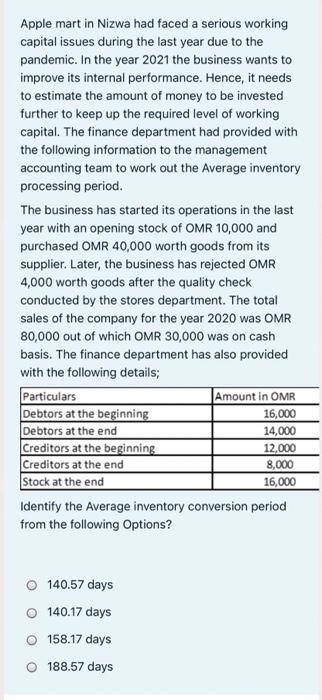

Apple martin Nizwa had faced a serious working capital issues during the last year due to the pandemic. In the year 2021 the business wants to improve its internal performance. Hence, it needs to estimate the amount of money to be invested further to keep up the required level of working capital. The finance department had provided with the following information to the management accounting team to work out the Average inventory processing period. The business has started its operations in the last year with an opening stock of OMR 10,000 and purchased OMR 40,000 worth goods from its supplier. Later, the business has rejected OMR 4,000 worth goods after the quality check conducted by the stores department. The total sales of the company for the year 2020 was OMR 80,000 out of which OMR 30,000 was on cash basis. The finance department has also provided with the following details; Particulars Amount in OMR Debtors at the beginning 16,000 Debtors at the end 14,000 Creditors at the beginning 12,000 Creditors at the end 8,000 Stock at the end 16,000 Identify the Average inventory conversion period from the following Options? 140.57 days 140.17 days 158.17 days 188.57 days Haleem trading company is a popular distributor in Salala, having operations in the entire Oman. Over these years, the company has gained a very good public opinion and quiet a big number of loyal customers. During the last year, the company has faced a serious liquidity crisis in the last year. The management of the company wants to check the liquidity ratios of the last year in order to plan for the current year. You are asked to help the management in computing the liquidity ratios. The Balance Sheet of Haleem trading company for the year ending 31-12-2020 Equity and Liabilities OMR Assets OMR Equity Share Capital 40,000 plant and Machinery 24,000 Capital Reserve 8,000 Land and Buildings 40,000 8% Loan on Mortgage 32,000 Fumiture & Fixtures 16,000 Creditors 16,000 Stock 14,000 Bank overdraft 18,000 Debtors 14,000 Investments (Short-term) 4,000 Cash in hand 14,000 Profit and Loss A/C 12,000 1,26,000 Choose the Current ratio and Quick ratio from the following? 1,26,000 a. Current ratio is 1.35 and Quick ratio is 2.40 ob. Current ratio is 2.43 and Quick ratio is 1.35 Oc. Current ratio is 2 and Quick ratio is 1.35 d. Current ratio is 1.35 and Quick ratio is 2 Apple mart in Nizwa had faced a serious working capital issues during the last year due to the pandemic. In the year 2021 the business wants to improve its internal performance. Hence, it needs to estimate the amount of money to be invested further to keep up the required level of working capital. The finance department had provided with the following information to the management accounting team to work out the Average inventory processing period. The business has started its operations in the last year with an opening stock of OMR 10,000 and purchased OMR 40,000 worth goods from its supplier. Later, the business has rejected OMR 4,000 worth goods after the quality check conducted by the stores department. The total sales of the company for the year 2020 was OMR 80,000 out of which OMR 30,000 was on cash basis. The finance department has also provided with the following details; Particulars Amount in OMR Debtors at the beginning 16,000 Debtors at the end 14,000 Creditors at the beginning 12,000 Creditors at the end 8,000 Stock at the end 16,000 Identify the Average inventory conversion period from the following Options? 140.57 days 140.17 days 158.17 days 188.57 days