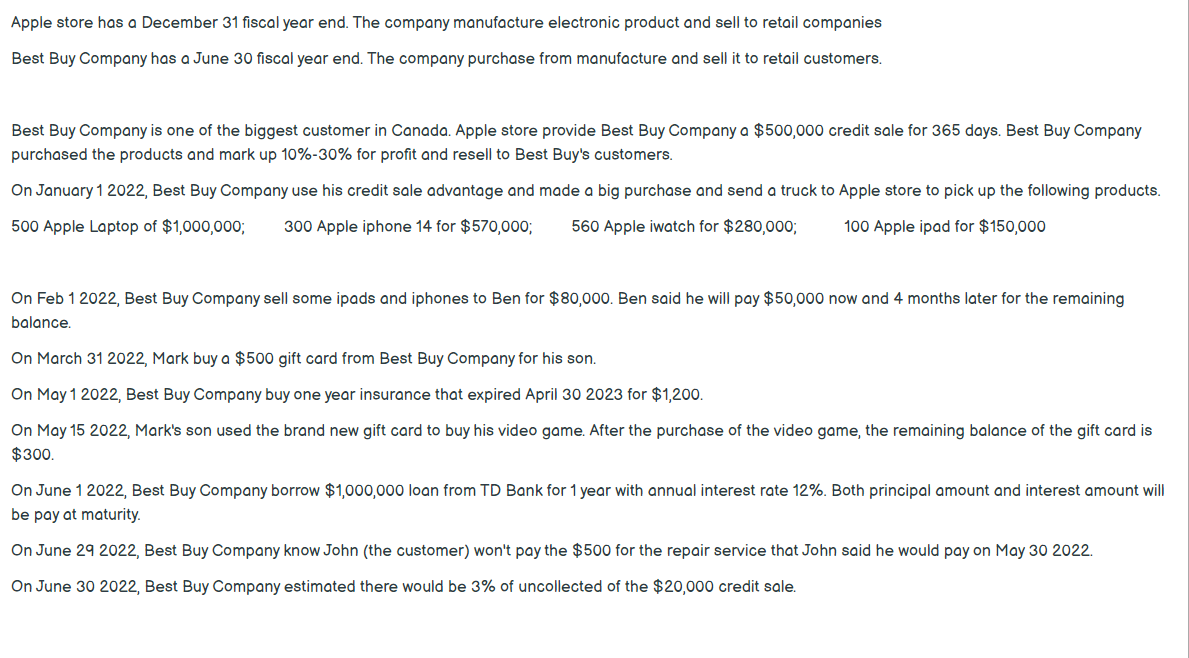

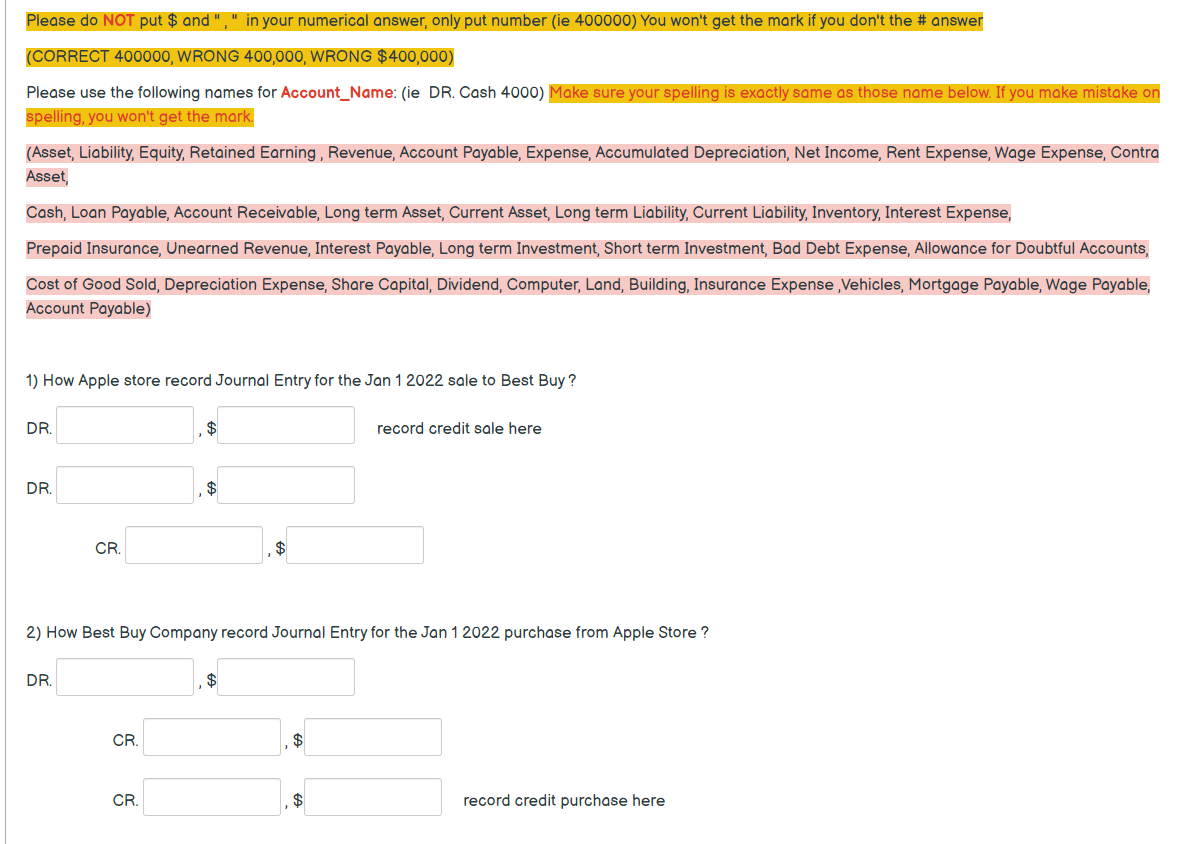

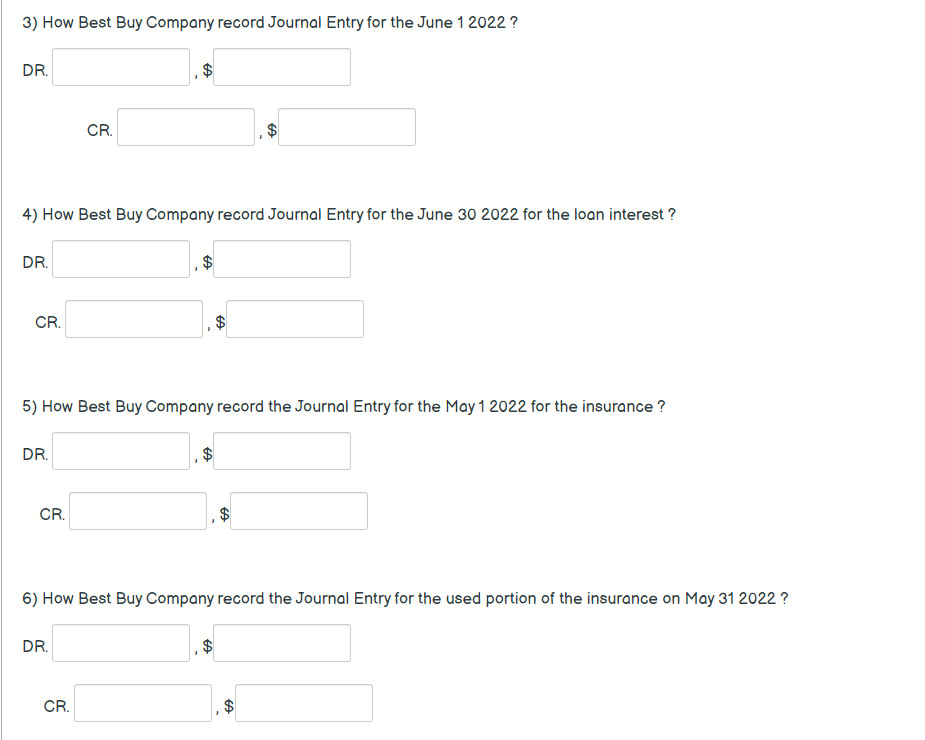

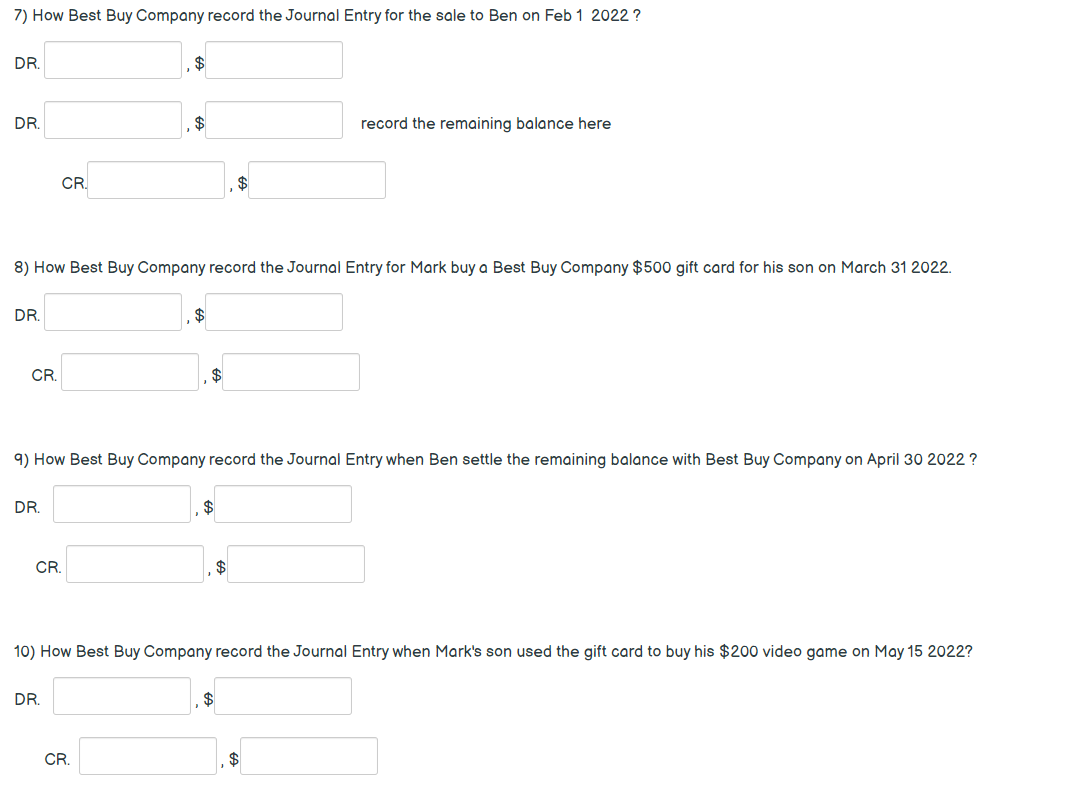

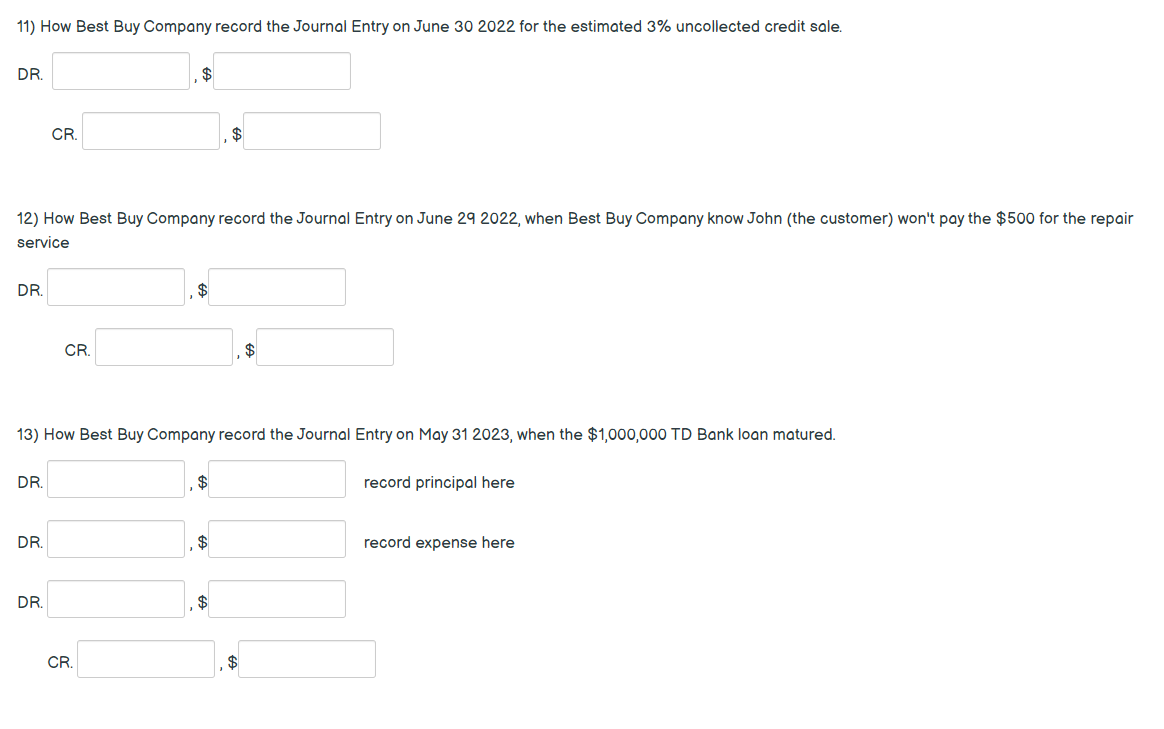

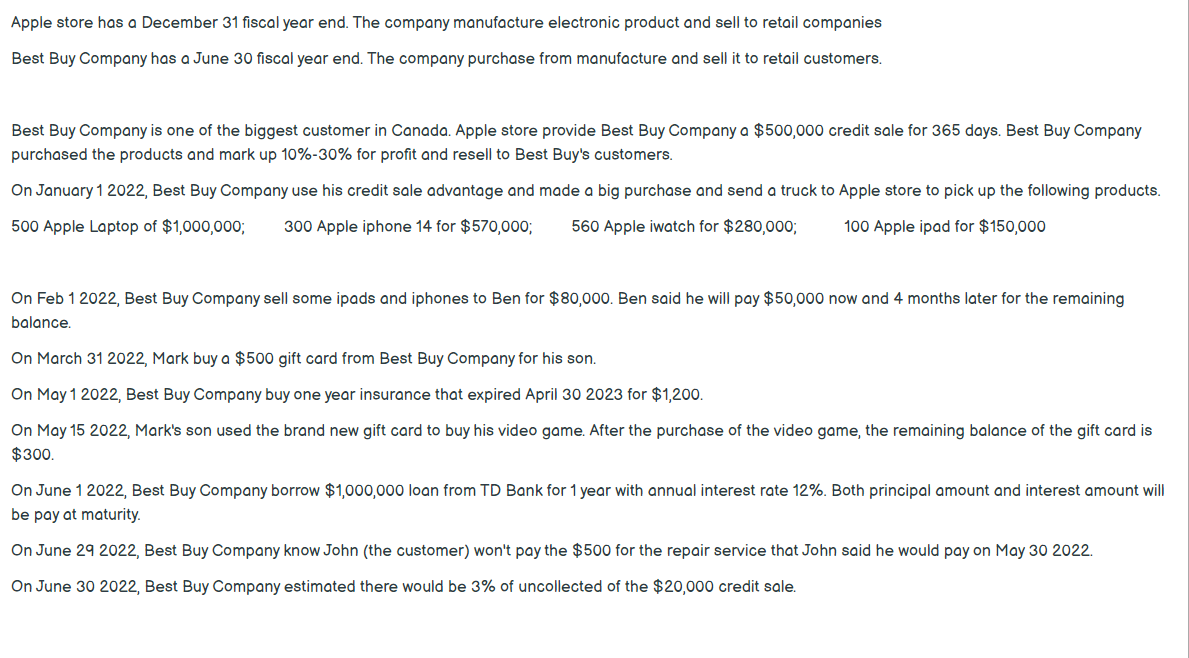

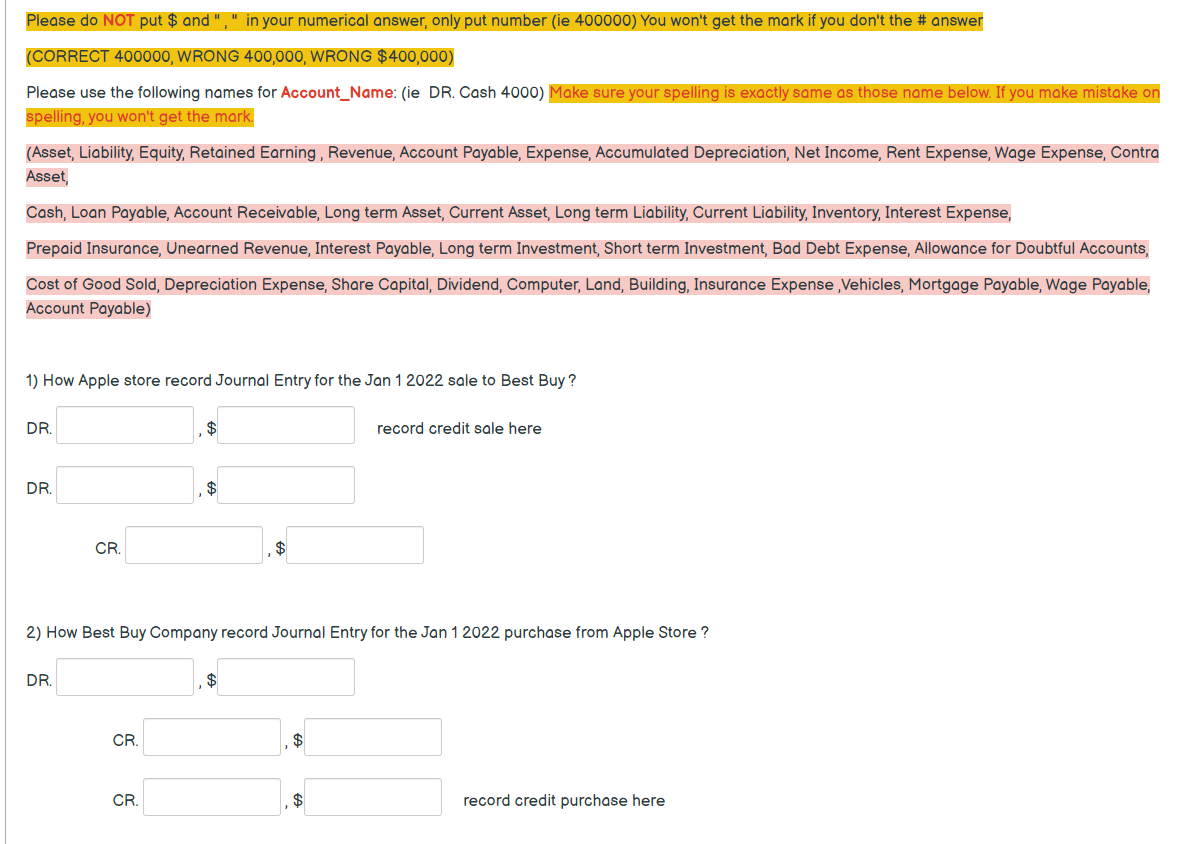

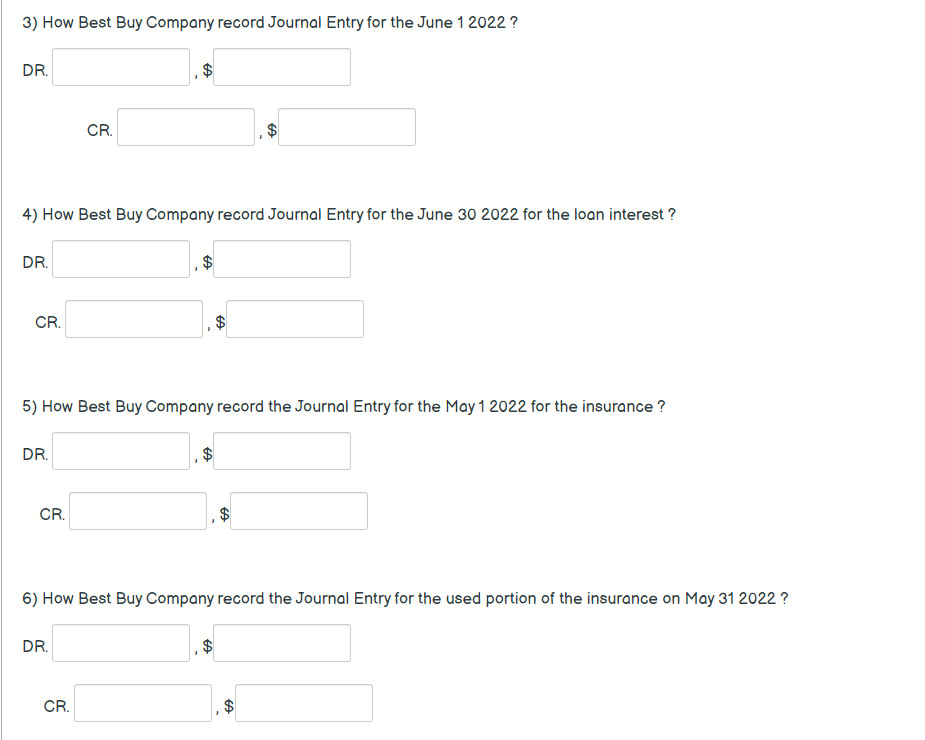

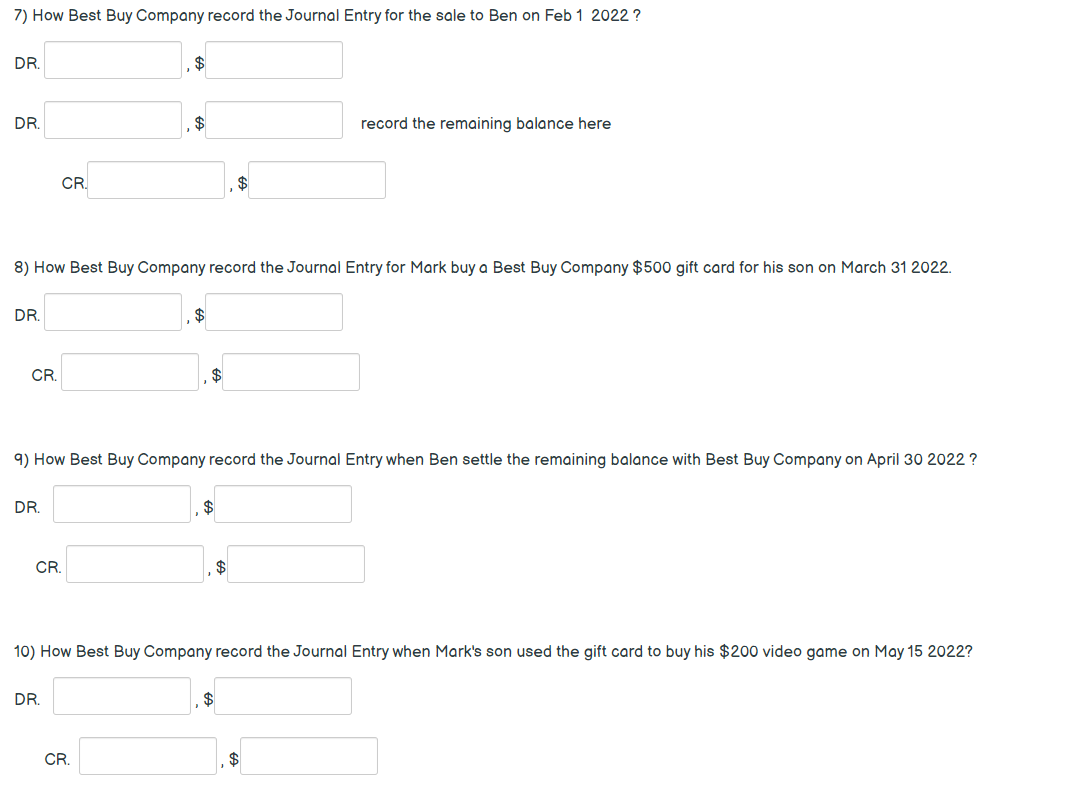

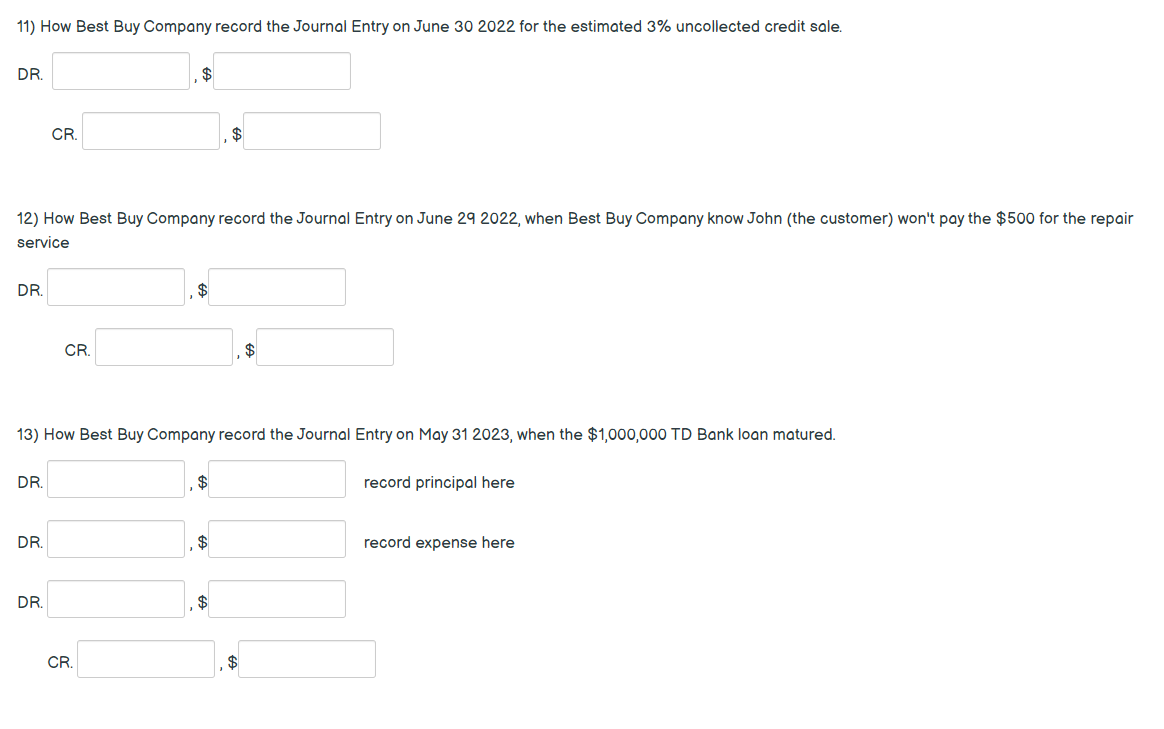

Apple store has a December 31 fiscal year end. The company manufacture electronic product and sell to retail companies Best Buy Company has a June 30 fiscal year end. The company purchase from manufacture and sell it to retail customers. Best Buy Company is one of the biggest customer in Canada. Apple store provide Best Buy Company a $500,000 credit sale for 365 days. Best Buy Company purchased the products and mark up 10%30% for profit and resell to Best Buy's customers. On January 12022 , Best Buy Company use his credit sale advantage and made a big purchase and send a truck to Apple store to pick up the following products. 500 Apple Laptop of $1,000,000;300 Apple iphone 14 for $570,000;560 Apple iwatch for $280,000; 100 Apple ipad for $150,000 On Feb 12022 , Best Buy Company sell some ipads and iphones to Ben for $80,000. Ben said he will pay $50,000 now and 4 months later for the remaining balance. On March 312022 , Mark buy a $500 gift card from Best Buy Company for his son. On May 12022 , Best Buy Company buy one year insurance that expired April 302023 for $1,200. On May 15 2022, Mark's son used the brand new gift card to buy his video game. After the purchase of the video game, the remaining balance of the gift card is $300. On June 12022 , Best Buy Company borrow $1,000,000 loan from TD Bank for 1 year with annual interest rate 12%. Both principal amount and interest amount will be pay at maturity. On June 292022 , Best Buy Company know John (the customer) won't pay the $500 for the repair service that John said he would pay on May 302022. On June 302022 , Best Buy Company estimated there would be 3% of uncollected of the $20,000 credit sale. Please do NOT put $ and "," in your numerical answer, only put number (ie 400000) You won't get the mark if you don't the \# answer (CORRECT 400000, WRONG 400,000, WRONG $400,000 ) Please use the following names for Account_Name: (ie DR. Cash 4000) Make sure your spelling is exactly same as those name below. If you make mistake on (Asset, Liability, Equity, Retained Earning, Revenue, Account Payable, Expense, Accumulated Depreciation, Net Income, Rent Expense, Wage Expense, Contra Asset, Cash, Loan Payable, Account Receivable, Long term Asset, Current Asset, Long term Liability, Current Liability, Inventory, Interest Expense, Prepaid Insurance, Unearned Revenue, Interest Payable, Long term Investment, Short term Investment, Bad Debt Expense, Allowance for Doubtful Accounts, Cost of Good Sold, Depreciation Expense, Share Capital, Dividend, Computer, Land, Building, Insurance Expense , Vehicles, Mortgage Payable, Wage Payable, Account Payable) 1) How Apple store record Journal Entry for the Jan 12022 sale to Best Buy? DR. ,$ record credit sale here DR. ,$ CR. ,$ 2) How Best Buy Company record Journal Entry for the Jan 12022 purchase from Apple Store? DR. ,$ CR. $ CR. $ record credit purchase here 3) How Best Buy Company record Journal Entry for the June 12022 ? DR. $ CR. $ 4) How Best Buy Company record Journal Entry for the June 302022 for the loan interest? DR. , \$ CR. ,$ 5) How Best Buy Company record the Journal Entry for the May 12022 for the insurance? DR. CR. 6) How Best Buy Company record the Journal Entry for the used portion of the insurance on May 312022 ? DR. CR. ,$ 7) How Best Buy Company record the Journal Entry for the sale to Ben on Feb 12022 ? DR. $ DR. ,$ record the remaining balance here CR , \$ 8) How Best Buy Company record the Journal Entry for Mark buy a Best Buy Company $500 gift card for his son on March 312022. DR. ,$ CR. ,$ 9) How Best Buy Company record the Journal Entry when Ben settle the remaining balance with Best Buy Company on April 302022 ? DR. CR. ,\$ 10) How Best Buy Company record the Journal Entry when Mark's son used the gift card to buy his $200 video game on May 152022? DR. , \$ CR. ,$ 11) How Best Buy Company record the Journal Entry on June 302022 for the estimated 3% uncollected credit sale. DR. ,$ CR. 12) How Best Buy Company record the Journal Entry on June 292022 , when Best Buy Company know John (the customer) won't pay the $500 for the repair service DR. ,$ CR. ,$ 13) How Best Buy Company record the Journal Entry on May 312023 , when the $1,000,000 TD Bank loan matured. DR. record principal here DR. DR. record expense here CR. ,$