Answered step by step

Verified Expert Solution

Question

1 Approved Answer

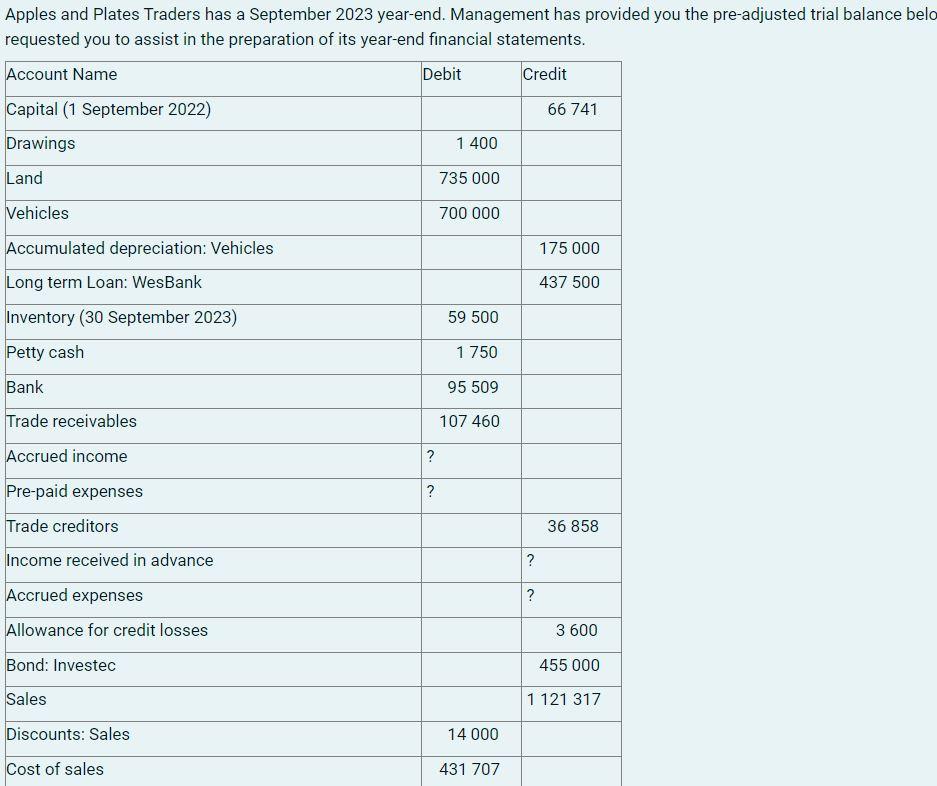

Apples and Plates Traders has a September 2023 year-end. Management has provided you the pre-adjusted trial balance belo requested you to assist in the

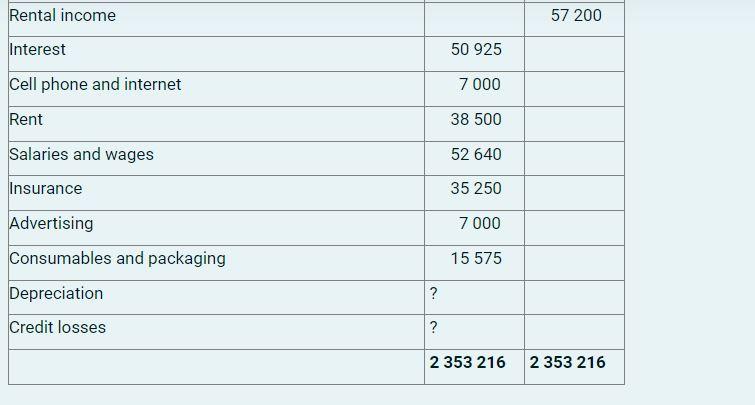

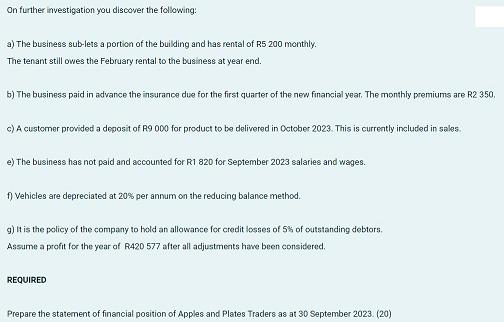

Apples and Plates Traders has a September 2023 year-end. Management has provided you the pre-adjusted trial balance belo requested you to assist in the preparation of its year-end financial statements. Account Name Debit Credit Capital (1 September 2022) Drawings Land Vehicles Accumulated depreciation: Vehicles Long term Loan: WesBank Inventory (30 September 2023) Petty cash Bank Trade receivables Accrued income Pre-paid expenses Trade creditors Income received in advance Accrued expenses Allowance for credit losses Bond: Investec Sales Discounts: Sales Cost of sales ? ? 1 400 735 000 700 000 59 500 1 750 95 509 107 460 14 000 431 707 ? ? 66 741 175 000 437 500 36 858 3 600 455 000 1 121 317 Rental income Interest Cell phone and internet Rent Salaries and wages Insurance Advertising Consumables and packaging Depreciation Credit losses ? ? 50 925 7 000 38 500 52 640 35 250 7 000 15 575 57 200 2 353 216 2 353 216 On further investigation you discover the following: a) The business sub-lets a portion of the building and has rental of R5 200 monthly. The tenant still owes the February rental to the business at year end. b) The business paid in advance the insurance due for the first quarter of the new financial year. The monthly premiums are R2 350, c) A customer provided a deposit of R9 000 for product to be delivered in October 2023. This is currently included in sales. e) The business has not paid and accounted for R1 820 for September 2023 salaries and wages. f) Vehicles are depreciated at 20% per annum on the reducing balance method. g) It is the policy of the company to hold an allowance for credit losses of 5% of outstanding debtors. Assume a profit for the year of R420 577 after all adjustments have been considered. REQUIRED Prepare the statement of financial position of Apples and Plates Traders as at 30 September 2023. (20)

Step by Step Solution

★★★★★

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

To prepare the statement of financial position balance sheet of Apples and Plates Traders as at 30 S...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started