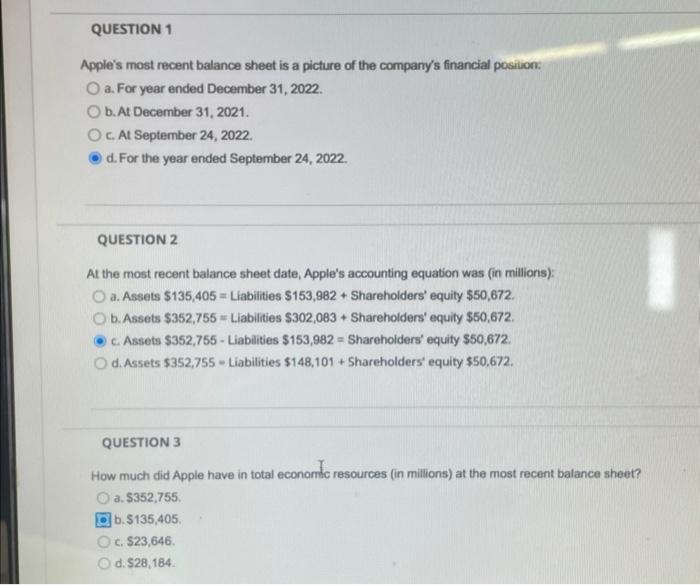

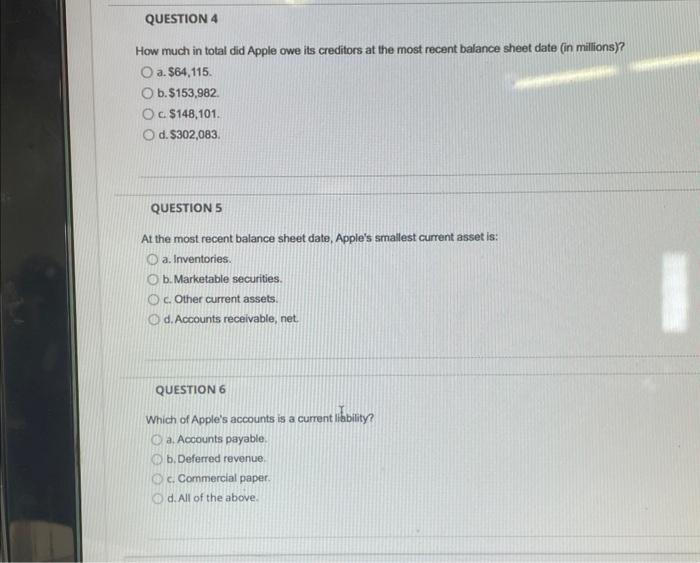

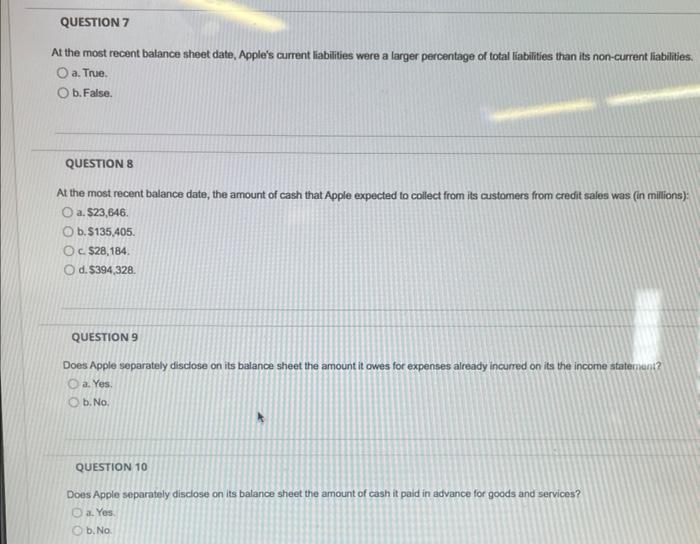

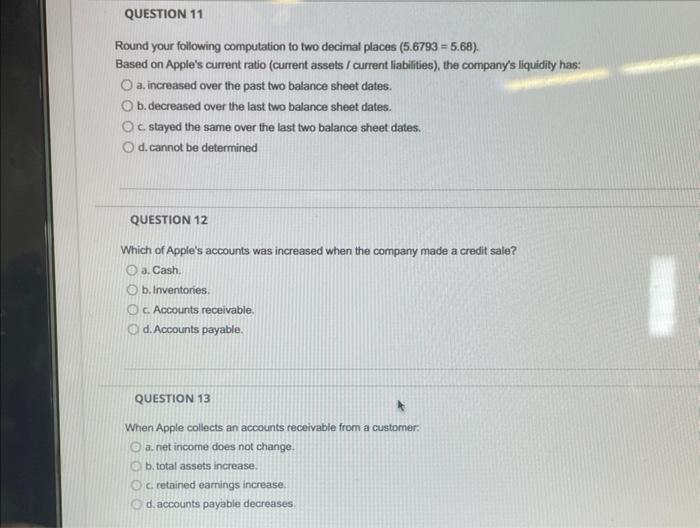

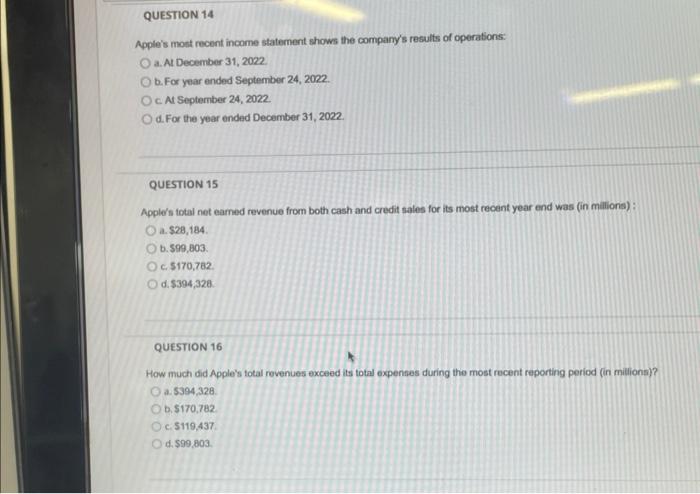

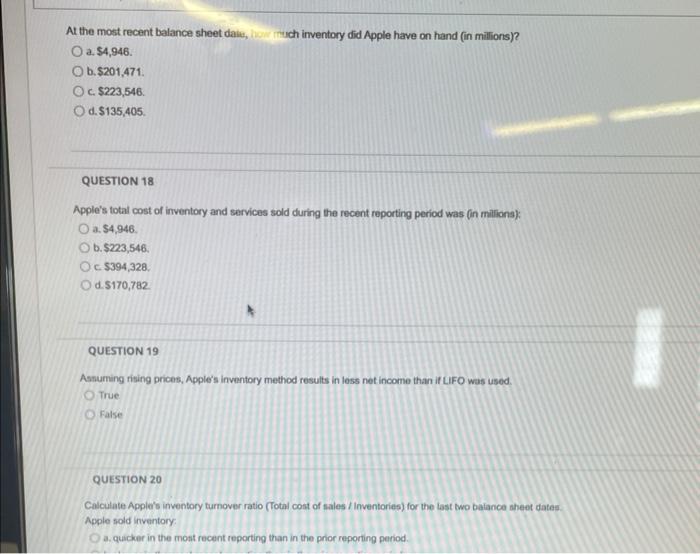

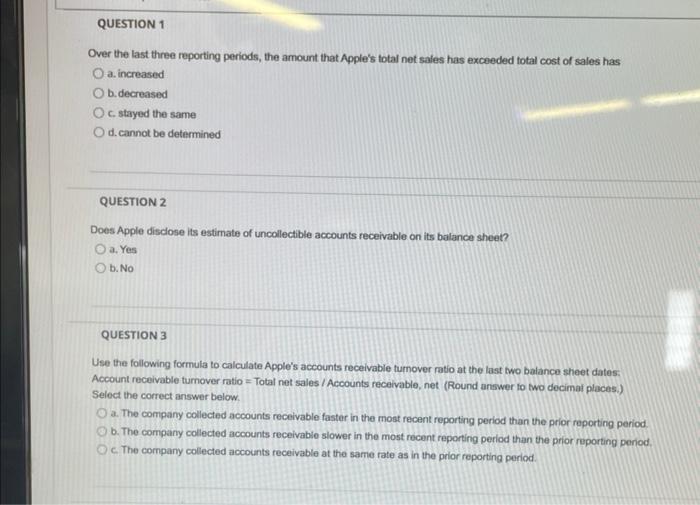

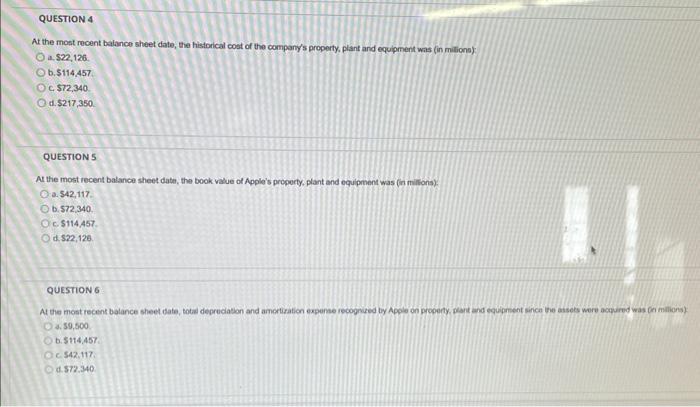

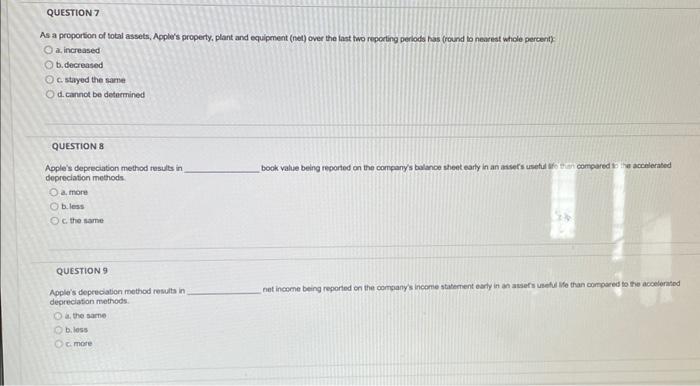

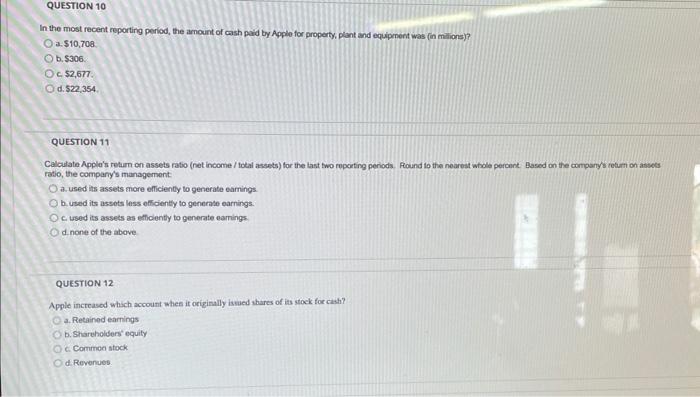

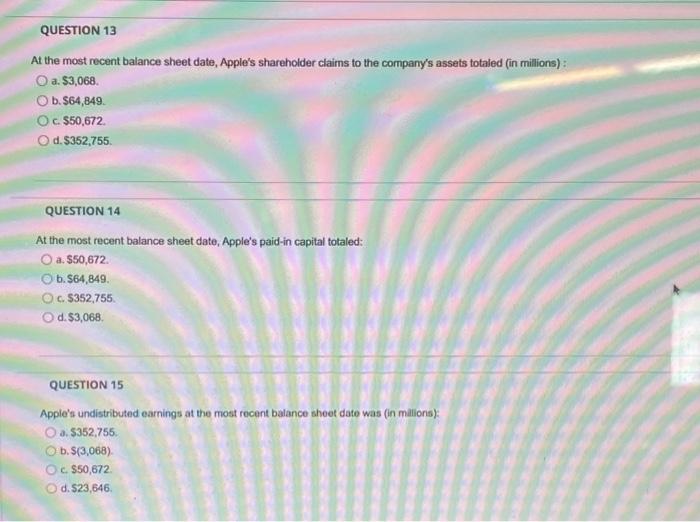

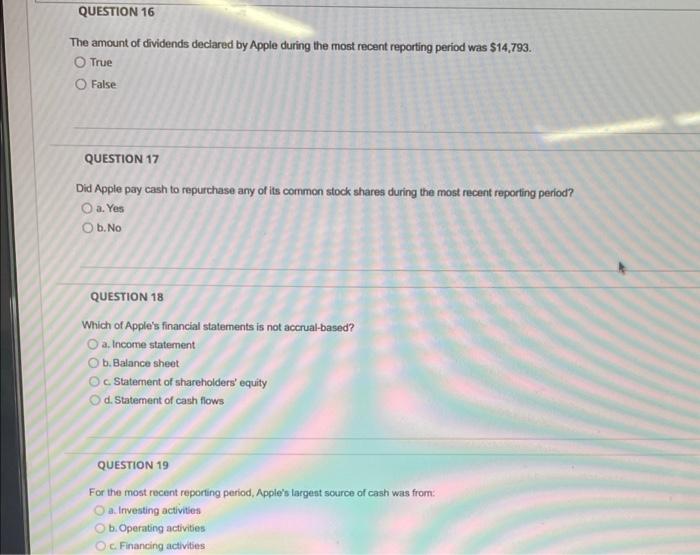

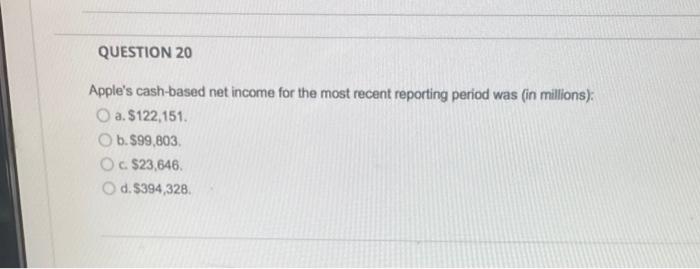

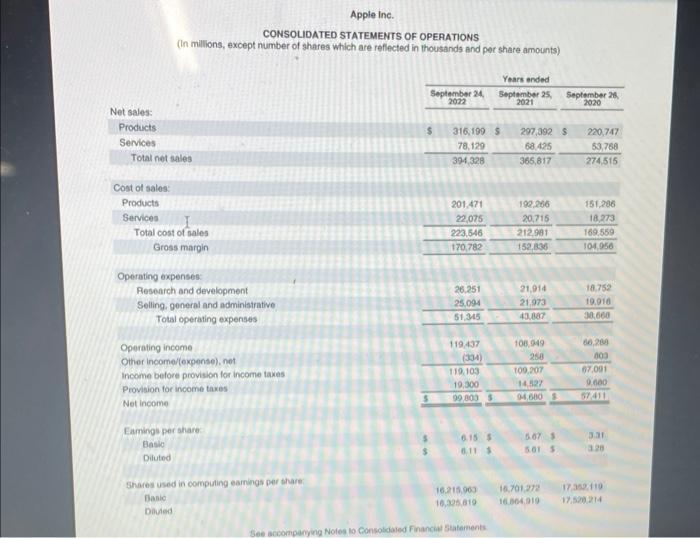

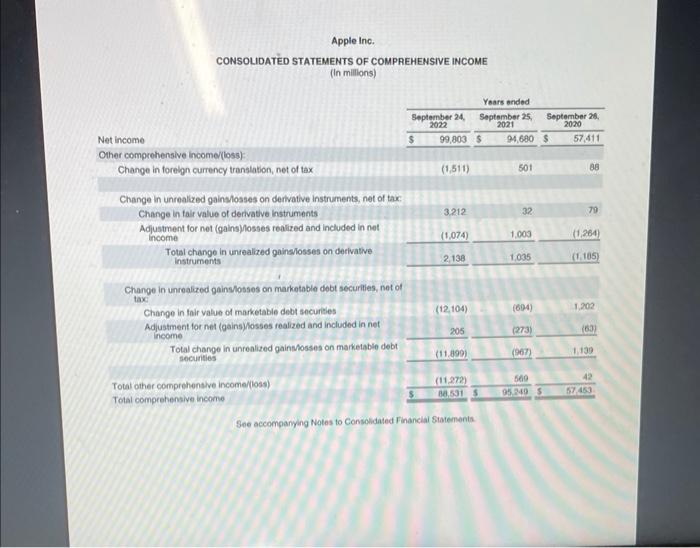

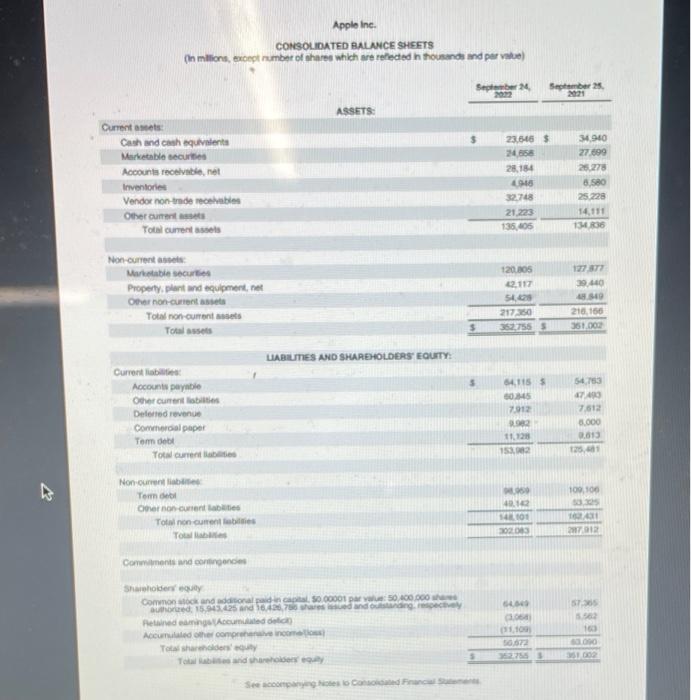

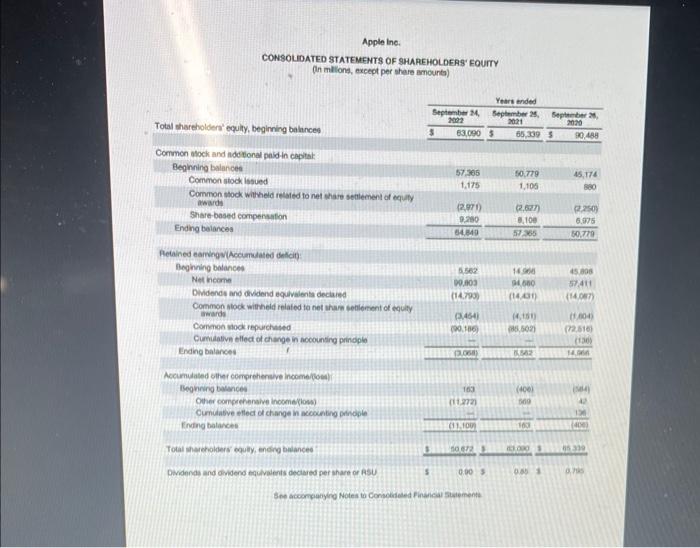

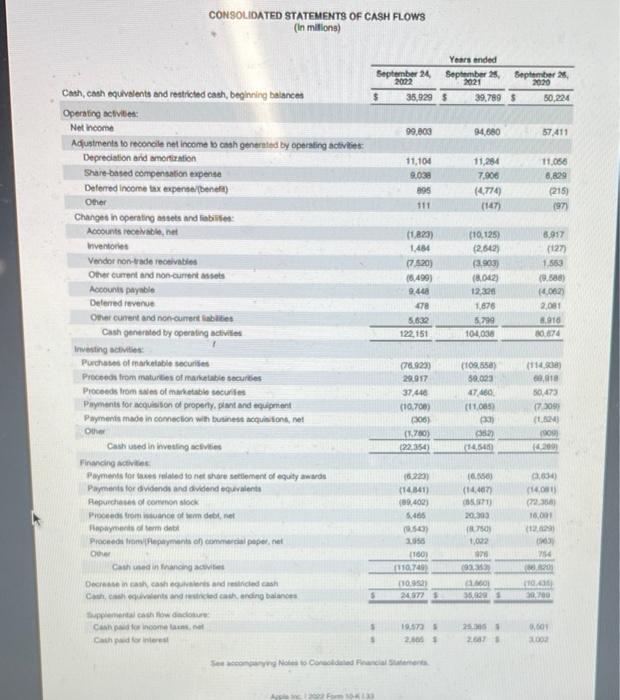

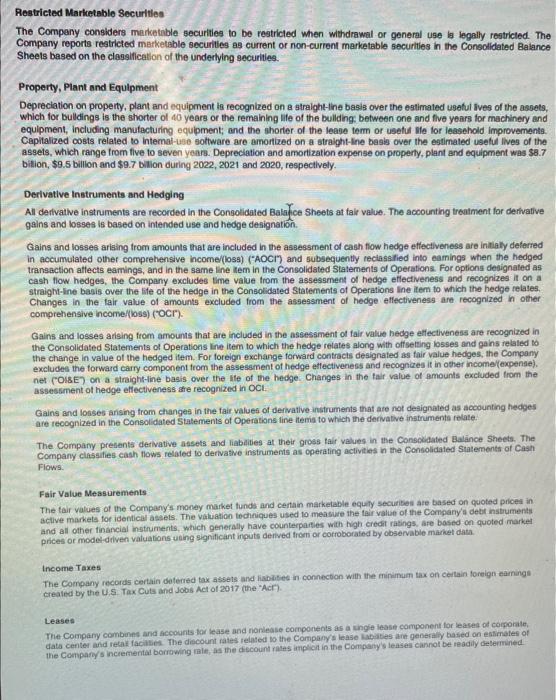

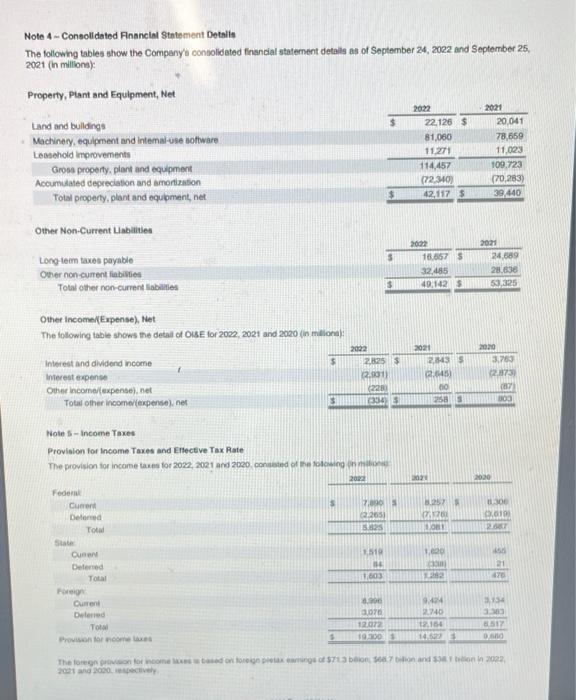

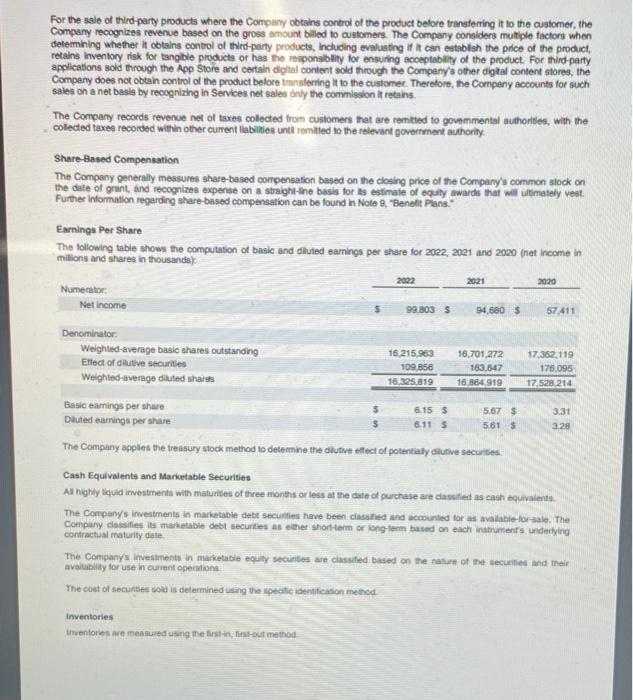

Apple's most recent balance sheet is a picture of the company's financial posiion: a. For year ended December 31, 2022. b. At December 31, 2021. c. At September 24, 2022. d. For the year ended September 24, 2022. QUESTION 2 At the most recent balance sheet date, Apple's accounting equation was (in millions): a. Assets $135,405 = Llabilities $153,982+ Shareholders' equity $50,672. b. Assets $352,755 = Liabilities $302,083+ Shareholders' equity $50,672. c. Assets $352,755 - Liabilities $153,982= Shareholders' equity $50,672. d. Assets $352,755 - Liabilities $148,101+ Shareholders' equity $50,672. QUESTION 3 How much did Apple have in total economic resources (in millions) at the most recent balance sheet? a. $352,755 b. $135,405 c. $23,646 d. $28,184 How much in total did Apple owe its creditors at the most recent balance sheet date (in millions)? a. $64,115. b. $153,982. c. $148,101. d. $302,083. QUESTION 5 At the most recent balance sheet date, Apple's smallest current asset is: a. Inventories. b. Marketable securities. c. Other current assets. d. Accounts receivable, net. QUESTION 6 Which of Apple's accounts is a current litability? a. Accounts payable. b. Deferred revenue. c. Commercial paper. d. All of the above. At the most recent balance sheet date, Apple's current liabilities were a larger percentage of total liabilities than its non-current liabilities. a. True. b. False. QUESTION 8 At the most recent balance date, the amount of cash that Apple expected to collect from its customers from credit sales was (in millions): a. $23,646. b. $135,405. c. $28,184 d. 5394,328 QUESTION 9 Does Apple separately disclose on its balance sheet the amount it owes for expenses already incurred on its the incorne statement? a. Yes. b. No. QUESTION 10 Does Apple separately disclose on its balance sheet the amount of cash it paid in advance for goods and services? a. Yes. b. No. Round your following computation to two decimal places (5.6793=5.68). Based on Apple's current ratio (current assets / current liabilities), the company's liquidity has: a. increased over the past two balance sheet dates. b. decreased over the last two balance sheet dates. c. stayed the same over the last two balance sheet dates. d. cannot be determined QUESTION 12 Which of Apple's accounts was increased when the company made a credit sale? a. Cash. b. Inventories. c. Accounts receivable. d. Accounts payable. QUESTION 13 When Apple collects an accounts receivable from a customer. a. net income does not change. b. total assets increase. c. retained earnings increase. d. accounts payable decreases Apple's mont recent income statement shows the company's results of operabions: a. At December 31, 2022. b. For year ended September 24, 2022. c. At September 24, 2022. d. For the year ended December 31, 2022. QUESTION 15 Apple's total net eamed revenue from both cash and credit sales for its most recent year end was (in mallione) : a. 528,184. b. 599,603 c. 5170,782 d. 5394,328 QUESTION 16 How much did Apple's total revenues exceed its total expenses during the most recent reporting period (in millions)? a. 5394,328. b. $170.782 c. 5119,437. d. $99.803. At the most recent balance sheet dalic, hicw ruch irventory did Apple have on hand (in millions)? a. $4,946. b. $201,471. c. $223,546. d. $135,405. QUESTION 18 Apple's total cost of inventory and services sold during the recent reporting period was (in milions): a. $4,946 b. $223,546. c. $394,328. d. $170,782 QUESTION 19 Asnuming rising prices, Apple's inventory method results in less net income than if LFF was used. True False QUESTION 20 Calculate Appie's inventory turnover ratio (Total cost of sales / inventories) for the lost two batance sheot dates. Apple sold inventory: a. quicker in the most recent reporting than in the pror reporting period. Over the last three reporting periods, the amount that Apple's total net sales has exceeded total cost of sales has a. increased b. decreased c. stayed the sarme d. cannot be determined QUESTION 2 Does Apple disclose its estimate of uncollectible accounts receivable on its balance sheet? a. Yes b. No QUESTION 3 Use the following formula to calculate Apple's accounts receivable furnover ratio at the last two balance sheet dates: Account receivable turnover ratio = Total net sales / Accounts receivable, net (Round answer fo two decimal places.) Select the correct answer below. a. The company collected accounts receivable faster in the most recent reporting period than the prior raporting period b. The company collected accounts receivabie slower in the most recent reporting period than the prior reporting period. c. The company collected accounts receivable at the same rate as in the prior reporting period. At the most recent baiance sheet date, the historical cost of the company's property, plant and equipment was (in mitions): a. $22,126. 6.5114 .457 c. $12,340 a. 5217,350 QUESTION 5 At the most recent balance sheet date, the book value of Apple's property, plant and equipment was (in millons). a. 542,117 b. 572,340, c. 5114,457 . d. 522,126. QUESTION 6 4.59,500 6.5114 .457 C. 542.117. d. 572.340 As a proportion of total assets, Appls property, plant and equipment (net) over the last two reporing perlods fas (oound io nesirest whole percent) , increased b.decreased cistryed the same d. cannot be detarrnined QUESTION 8 Apple's depreciation method results in book value being reportod on the company's talance sheet early in an assers useful aro than compared to ine accelerated depreciation methods a. more b. less c. the same QUESTION 9 Apple's depreblation method result in net income being reporied on the oonrsany's income staternent early in an atsefs usefl Me than compored to the acoeterntod depreclation methods. a. the same b. 1055 c. more In the most recent reporting period, the amount of cash paid by Apple for property, plant and equipment was (in mitions)? a. $10,706 b. 5306 c. $2,677. d. 522,354 QUESTION 11 Calculate Appla's return on assets ratio (net income / fotal assets) for the last two reporing peniods. Found to the nearest whole percont. Basod on the compary's retumi on assots ratio, the company's management. a. used its assets more efficiently to generate earnings. b. used its assets less efficiently to genernte earnings. c. Ised its assets as efliciently to generate eamings d. none of the above QUESTION 12 Apple increasod which account when it originally ismied thares of ias stock for cish? a. Retained earnings b. Shareholders' equity c. Commen stock d. Revenues. At the most recent balance sheet date, Apple's shareholder claims to the company's assets totaled (in milions) : a. $3,068. b. 564,849 . c. $50.672. d. $352,755 QUESTION 14 At the most recent balance sheet date, Apple's paid-in capital totaled: a. $50,672. b. 564,849 . c. 5352,755 . d. $3,068 QUESTION 15 Apple's undistributed earnings at the most rocent balance sheet date was (in mallions): a. $352.755 b. $(3,068) c. 550,672 d. 523,646 The amount of dividends declared by Apple during the most recent reporting period was $14,793. True False QUESTION 17 Did Apple pay cash to repurchase any of its common stock shares during the most recent reporting period? a. Yes b. No QUESTION 18 Which of Apple's financial statements is not accrual-based? a. Income statement b. Balance sheet c. Statement of shareholders' equity d. Statement of cash flows QUESTION 19 For the most recent reporting period, Apple's largent scurce of cash was from: a. Investing activities b. Operating activities c. Financing activities Apple's cash-based net income for the most recent reporting period was (in millions): a. $122,151. b. $99,803. c. $23,646. d. $394,328. Apple Inc. CONSOLIDATED STATEMENTS OF OPEPATIONS (In millions, except number of shares which are reflected in thoustands and nar ehana ammunter Apple Inc. CONSOLDATED STATEMENTS OF COMPAEHENSIVE INCOME (in milions) See accompanying Notes to Consolidated Financlai Statements. Apple ine. CONBOLDATED BALNCE SHEFTS (In millions, except number of thares which are rehected h thouswnde and per value) Won-ourtent abeets: Mukemabie securtes Property, plant and equipment, net Oenter non-cuevent absets Total non-cument assets Total assels WABUTES NO SHAREHOLDEAS EQUTY: Cument liabiltest: Aocounts paynble Oever curtent labilsies Delerted revenue Comeneroal paper Tem debl Total cumeri laablies 15309211.128126.6410.613 Non-cument liabifiet. Tern dech Cher non curtent labkites Total non oument labilfies Total liablikes Commitnents and oortirgencies Shaveholden' equaty Common abock and addisoral pad in captal. So 00001 par vahee: 50,900,000 ahe wi Petwined eamingstAccumdialed detcon Accumilaled olher conprehachake inconelians: Total shareholden' pquty Toial Kabites and thanhobery equay Apple tne. CONSOLDATED STATEMENTS OF SHAREHOLDEAS' EOUTY (in millions, except per shere Bmounty) CONSOLIDATED STATEMENTS OF CASH FLOWS (in milions) Cash, cash equivalents and restricted cash, beginning balances Operating aefives: Net incone Adustrents to reconole net income b cash genereted by opersting activiet: Chahoes in operating asets and liabilife: Investing acmiles: Purcheses of inarkiable secuilies Proceed from maturtes of manktabio securties Proceeds lrom aNes of manketable seciniles Payments for acquieion of groperty, piant and equigment Pliyments made in oonection with businest acquibions, ne! Finaving actviles Payments tor laxws rilaled io net thare setlement of equity aw ards Parments for dvidenow and dvelend oeveralente Pepurchases of comenon slock Prooeced tiom isiuance of lem debt, net Heperymerts of verm deth ober Cath uee in thancing awites Oecresue in ranh cash eoulvaleris and realficled cash Couh, eael pquivitents and redincled cauk anding balanors Amplemertal cash how dacloave: Cask pas to inoone latns. net Cath pad lor inlered Note 4 - Consolidated Financlal Stntement Detalis The followhy tables show the Company's connolideted financial statement detall as of September 24, 20e2 and September 25. 2021 (n milisons): Other incomeN(Expense), Net The following table shows the detall of OSE for 2022,2021 and 2020 (in miliore): Wole 5 - income Taxes Provision for income Taxes and Eliectve Tax Pate zocet ana 2020. menfectivel? For the sale of third-party products where the Company obtains control of the product belore trangferring it to the customer, the Company recognizes revenue based on the gross amount blled to customers. The Compeny considers multiple tactors when detemining whether it obtsins control of third-party products, including evaluating it it can establish the price of the product, retains inventory risk for tangble products or has the renponsiblity lor ensuring acceptablity of the product. For thind-party applicasons sold through the App Store and certah digtal content sold through the Company's other digtal content stores, the Company does not obtain control of the product belore translering it to the customer. Therelore, the Company accounts for such sales on a net basis by recognizing in Services net sales donly the commission it retains. The Company records revenue net of taxes colected from cuslomers that are remtled to govemmental authoribes, with the colected taxes recorded within other current labilifies untli remilied to the relevant government authorily. Share-Based Compensation The Company generally measures share-based compensation based on the closing price of the Compary's common stock on the date of grant, and recognlzes expense on a straghi-the basis for the estimate of equly awards that will ultimately vest. Further information regarding share-based compensation can be found in Note 9, "Beneft Pans." Earnings Per Share The lollowing table shows the computasion of basic and oluled eamings per share for 20e2, 2021 and 2020 (net income in milions and shares in thousands): The Company apples the treasury slook method to detemine the dilutive elifect of potentaby allive securibes. Cash Equivalents and Marketable Securities All highly liquid irvestmenta with maturites of three months or less at the date of purchase are classited as cash equivaienta. The Companys investments in marketable debt securties have been ciasstied and accounted for as avalable-for-sale. The Compary dassilies its maketable debt securles as ether shortherm or iong-term based on each inatrumentrs underlying contractual maturity date The Company's investments in marketacle equay secialtes are classifed based on the nasan of the secuaties and their avaliability tor use in ourent ogerations. The cost of secuntes sold is delermined using the ipectic identification method. inventories inventorios are maasubd wsing the lirst in, firs-out method