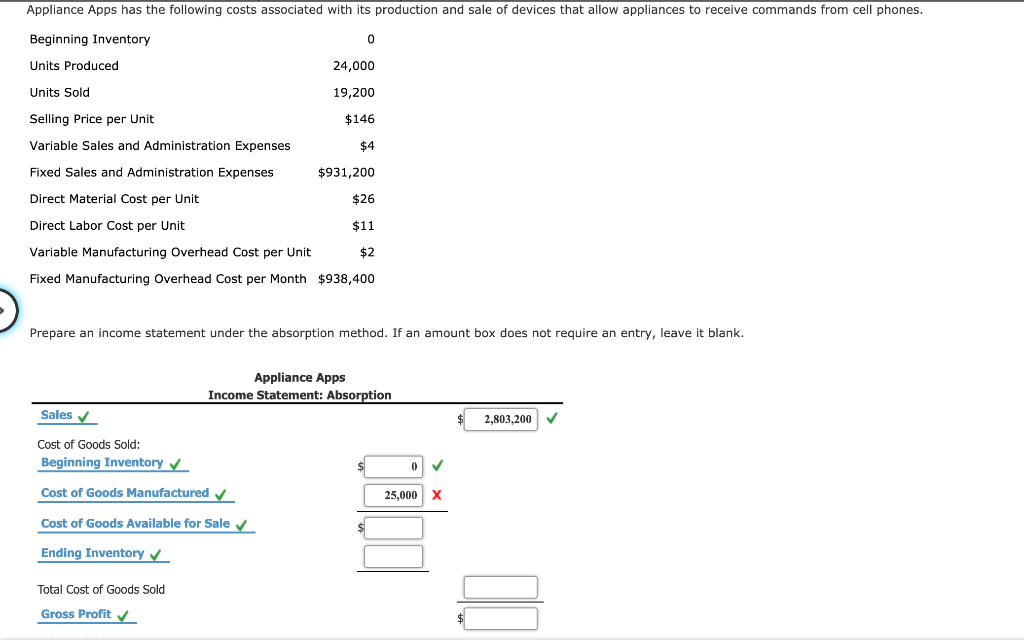

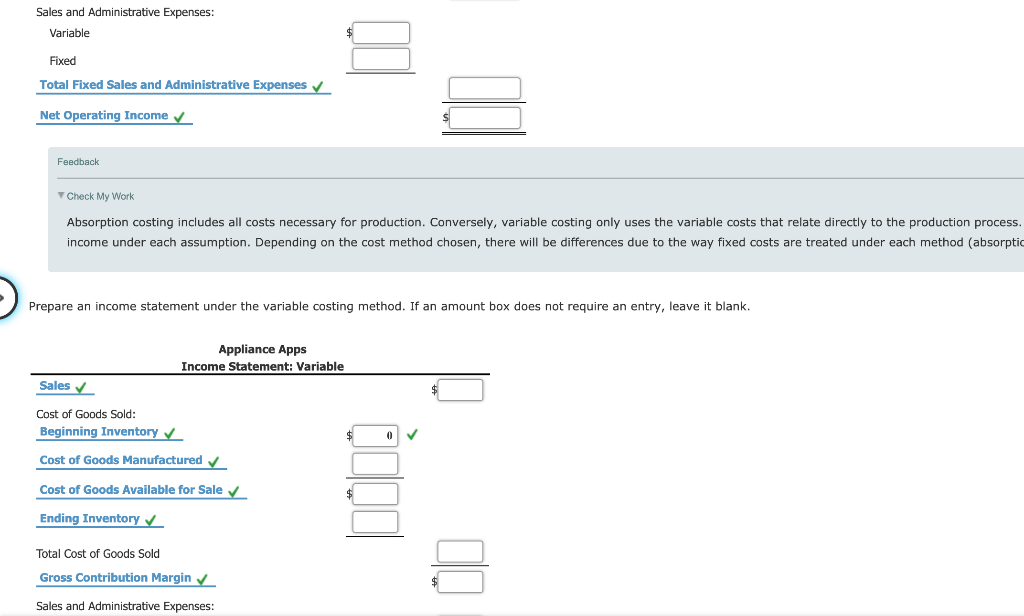

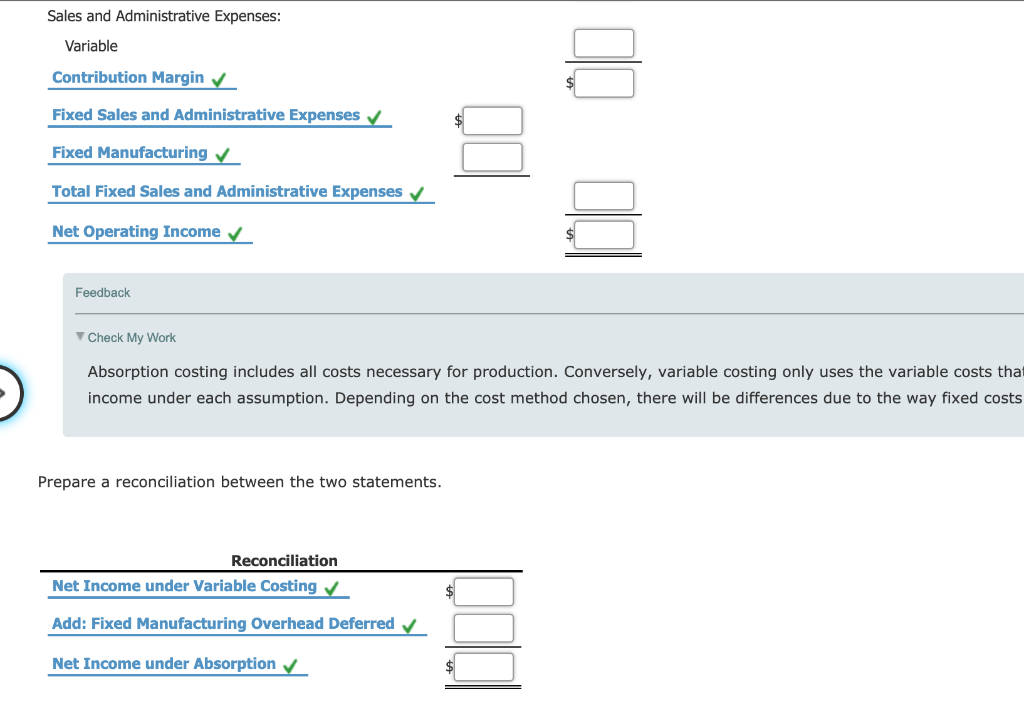

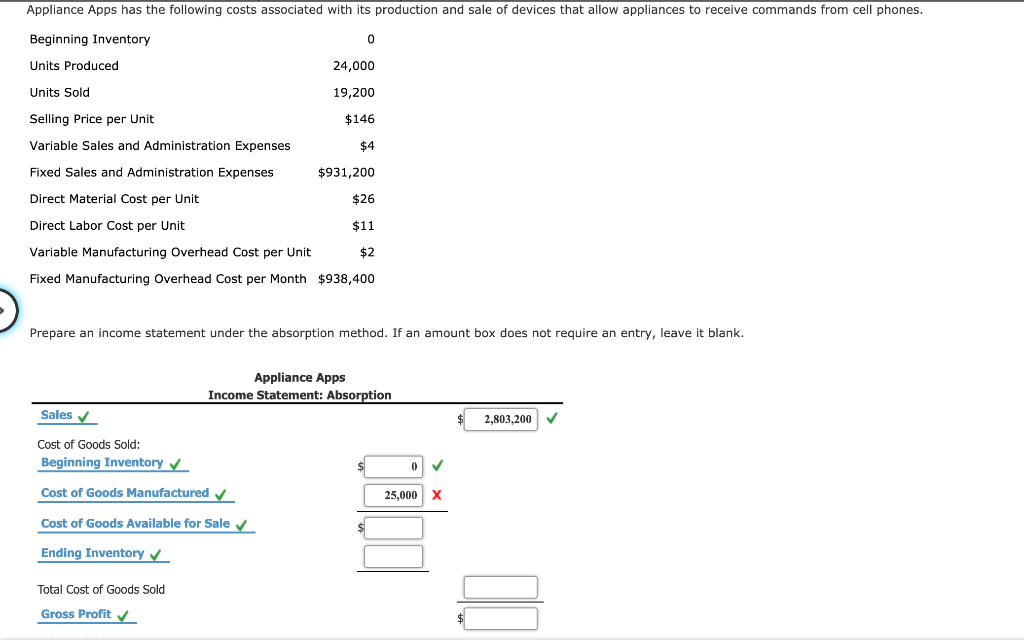

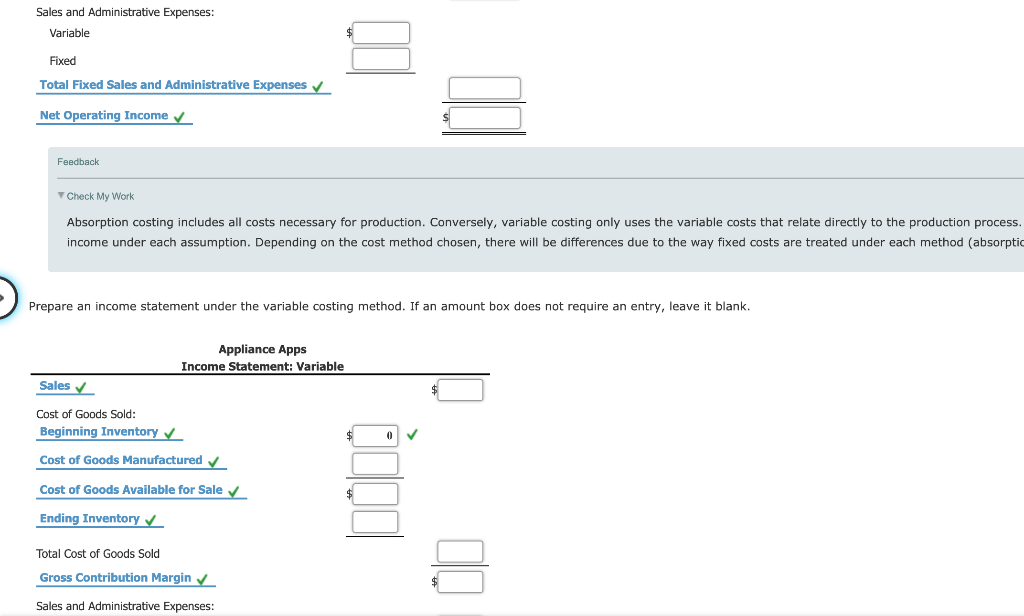

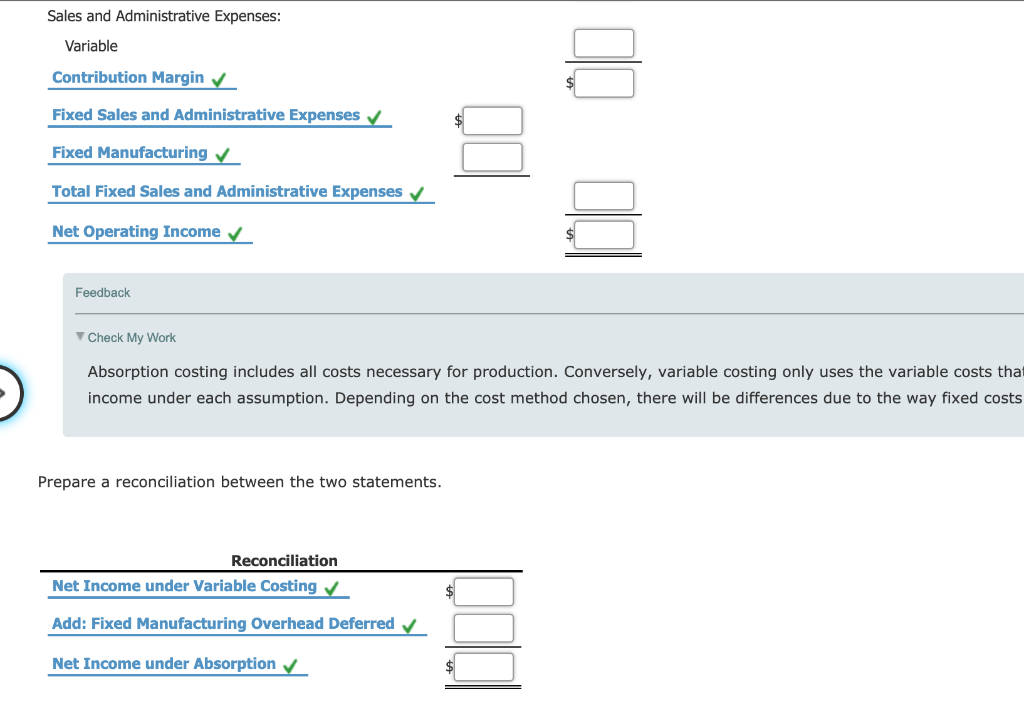

Appliance Apps has the following costs associated with its production and sale of devices that allow appliances to receive commands from cell phones. Beginning Inventory Units Produced 24,000 Units Sold 19,200 Selling Price per Unit $146 Variable Sales and Administration Expenses Fixed Sales and Administration Expenses $931,200 Direct Material Cost per Unit $26 Direct Labor Cost per Unit $11 Variable Manufacturing Overhead Cost per Unit $2 Fixed Manufacturing Overhead Cost per Month $938,400 Prepare an income statement under the absorption method. If an amount box does not require an entry, leave it blank. Appliance Apps Income Statement: Absorption Sales $ 2,803,200 Cost of Goods Sold: Beginning Inventory Cost of Goods Manufactured 25,000 X Cost of Goods Available for Sale Ending Inventory Total Cost of Goods Sold Gross Profit Sales and Administrative Expenses: Variable Fixed Total Fixed Sales and Administrative Expenses Net Operating Income Feedback Check My Work Absorption costing includes all costs necessary for production. Conversely, variable costing only uses the variable costs that relate directly to the production process. income under each assumption. Depending on the cost method chosen, there will be differences due to the way fixed costs are treated under each method (absorptic Prepare an income statement under the variable costing method. If an amount box does not require an entry, leave it blank. Appliance Apps Income Statement: Variable Sales Cost of Goods Sold: Beginning Inventory Cost of Goods Manufactured Cost of Goods Available for Sale Ending Inventory Total Cost of Goods Sold Gross Contribution Margin Sales and Administrative Expenses: Sales and Administrative Expenses: Variable Contribution Margin Fixed Sales and Administrative Expenses Fixed Manufacturing Do Total Fixed Sales and Administrative Expenses Net Operating Income Feedback Check My Work Absorption costing includes all costs necessary for production. Conversely, variable costing only uses the variable costs that income under each assumption. Depending on the cost method chosen, there will be differences due to the way fixed costs Prepare a reconciliation between the two statements. Reconciliation Net Income under Variable Costing Add: Fixed Manufacturing Overhead Deferred Net Income under Absorption