Answered step by step

Verified Expert Solution

Question

1 Approved Answer

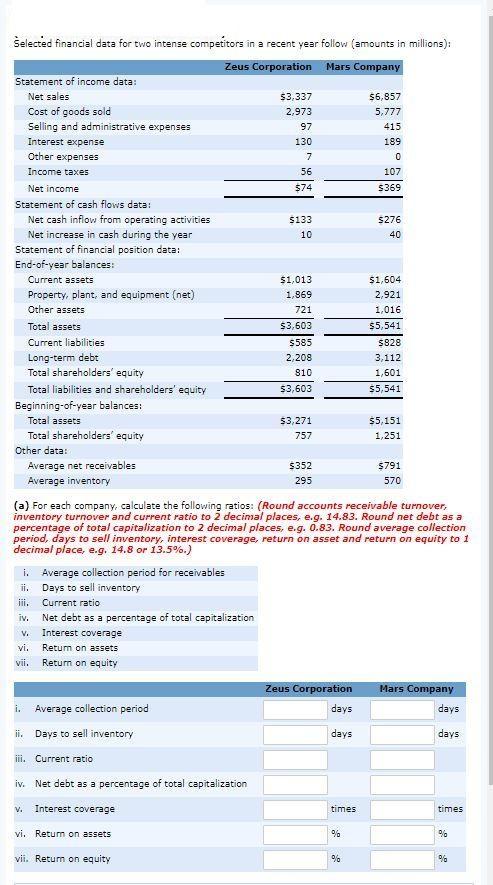

elected financial data for two intense competitors in a recent year follow (amounts in millions): Zeus Corporation Mars Company Statement of income data: Net

elected financial data for two intense competitors in a recent year follow (amounts in millions): Zeus Corporation Mars Company Statement of income data: Net sales $3,337 $6,857 Cost of goods sold Selling and administrative expenses 2,973 5,777 97 415 Interest expense 130 189 Other expenses 7 Income taxes 56 107 Net income $74 $369 Statement of cash flows data: Net cash inflow from operating activities $133 $276 Net increase in cash during the year 10 40 Statement of financial position data: End-of-year balances: Current assets $1,013 $1,604 Property, plant, and equipment (net) Other assets 1,869 2,921 721 1,016 Total assets $3,603 $5,541 Current liabilities $585 $828 Long-term debt Total shareholders' equity 2,208 3,112 810 1,601 Total liabilities and shareholders' equity 53,603 $5,541 Beginning-of-year balances: Total assets $3,271 $5,151 Total shareholders' equity 757 1,251 Other data: Average net receivables $352 $791 Average inventory 295 570 (a) For each company, calculate the following ratios: (Round accounts receivable turnover, inventory turnover and current ratio to 2 decimal places, e.g. 14.83. Round net debt as a percentage of total capitalization to 2 decimal places, e.g. 0.83. Round average collection period, days to sell inventory, interest coverage, return on asset and return on equity to 1 decimal place, e.g. 14.8 or 13.5%.) i. Average collection period for receivables ii. Days to sell inventory ii. Current ratio iv. Net debt as a percentage of total capitalization V. Interest coverage vi. Return on assets vii. Return on equity Zeus Corporation Mars Company i. Average collection period days days ii. Days to sell inventory days days iii. Current ratio iv. Net debt as a percentage of total capitalization Interest coverage times times V. vi. Return on assets % vii. Returm on equity

Step by Step Solution

★★★★★

3.43 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

1Average collection period for receivables Average Net receivable Net Sales x 365 days Zeus corporation 352 3337 x 365 385 days Mars company 791 6857 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started