Question

Apply the statistical concepts and techniques covered in this week's reading about one-way analysis of variance (ANOVA). An investment analyst is evaluating the 10-year mean

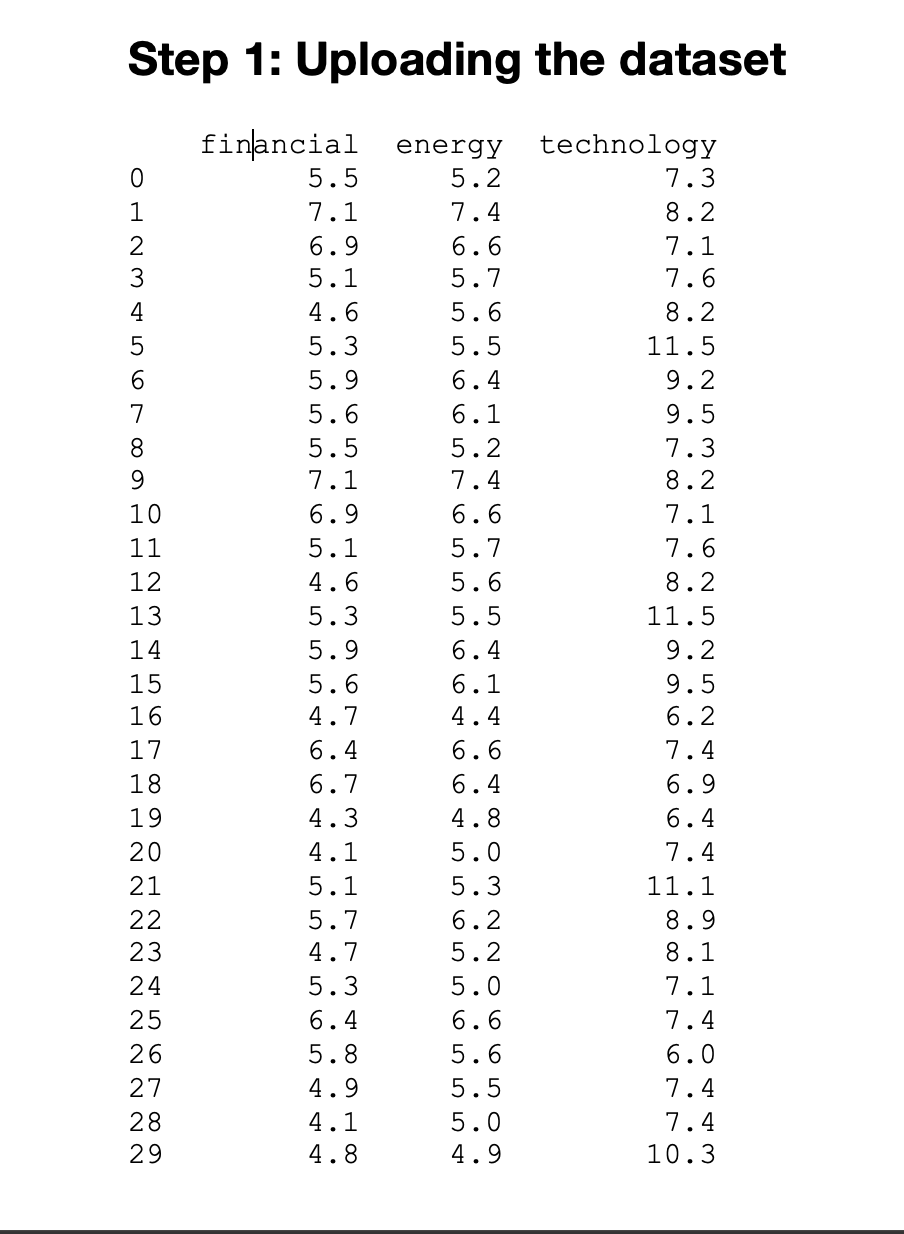

Apply the statistical concepts and techniques covered in this week's reading about one-way analysis of variance (ANOVA). An investment analyst is evaluating the 10-year mean return on investment for industry-specific exchange-traded funds (ETFs) for three sectors: financial, energy, and technology. The analyst obtains a random sample of 30 ETFs for each sector and calculates the 10-year return of each ETF. The analyst has provided you with this data set. Run Step 1 in the Python script to upload the data file.

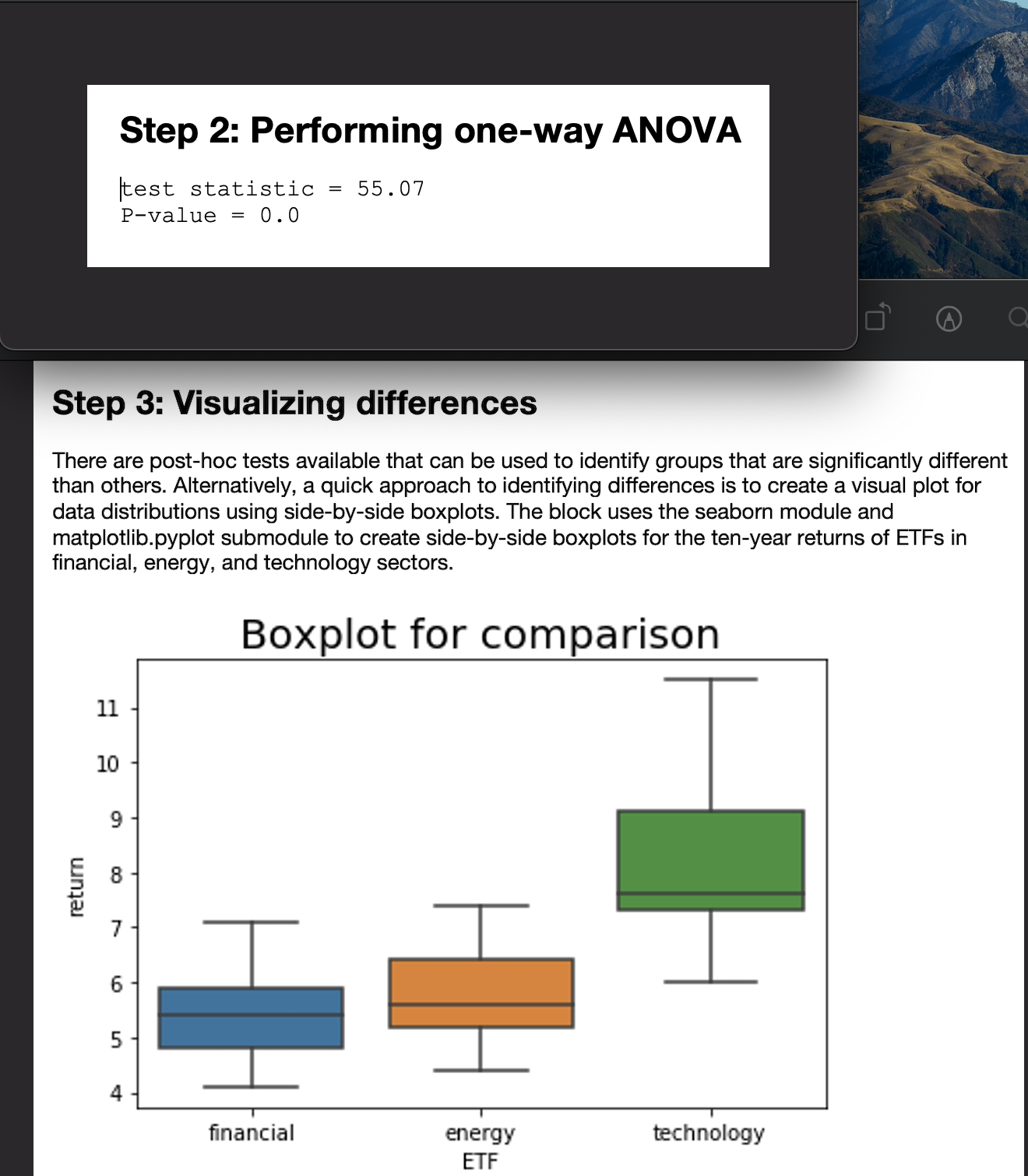

Using the sample data, perform one-way analysis of variance (ANOVA). Evaluate whether the average return ofat least oneof the industry-specific ETFs is significantly different. Use a 5% level of significance.

In your initial post, address the following items:

- Define the null and alternative hypothesis in mathematical terms and in words.

- Report the level of significance.

- Include the test statistic and the P-value. See Step 2 in the Python script.

- Provide your conclusion and interpretation of the test. Should the null hypothesis be rejected? Why or why not?

- Does a side-by-side of the 10-year returns of ETFs from the three sectors confirm your conclusion of the hypothesis test? Why or why not? See Step 3 in the Python script.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started