Answered step by step

Verified Expert Solution

Question

1 Approved Answer

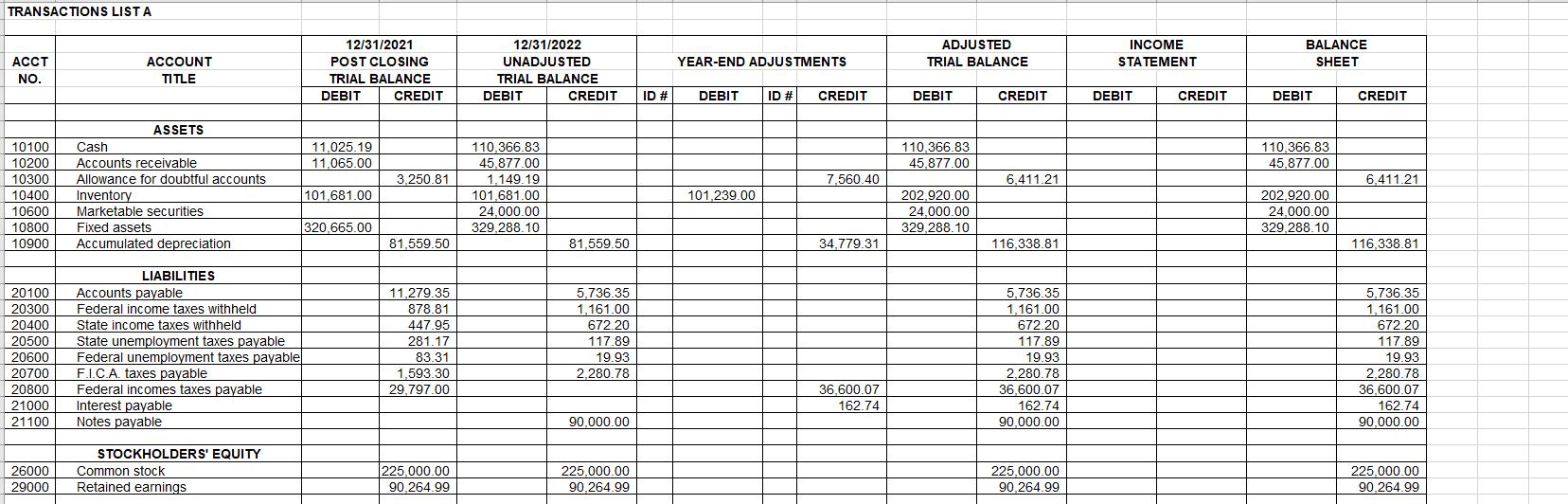

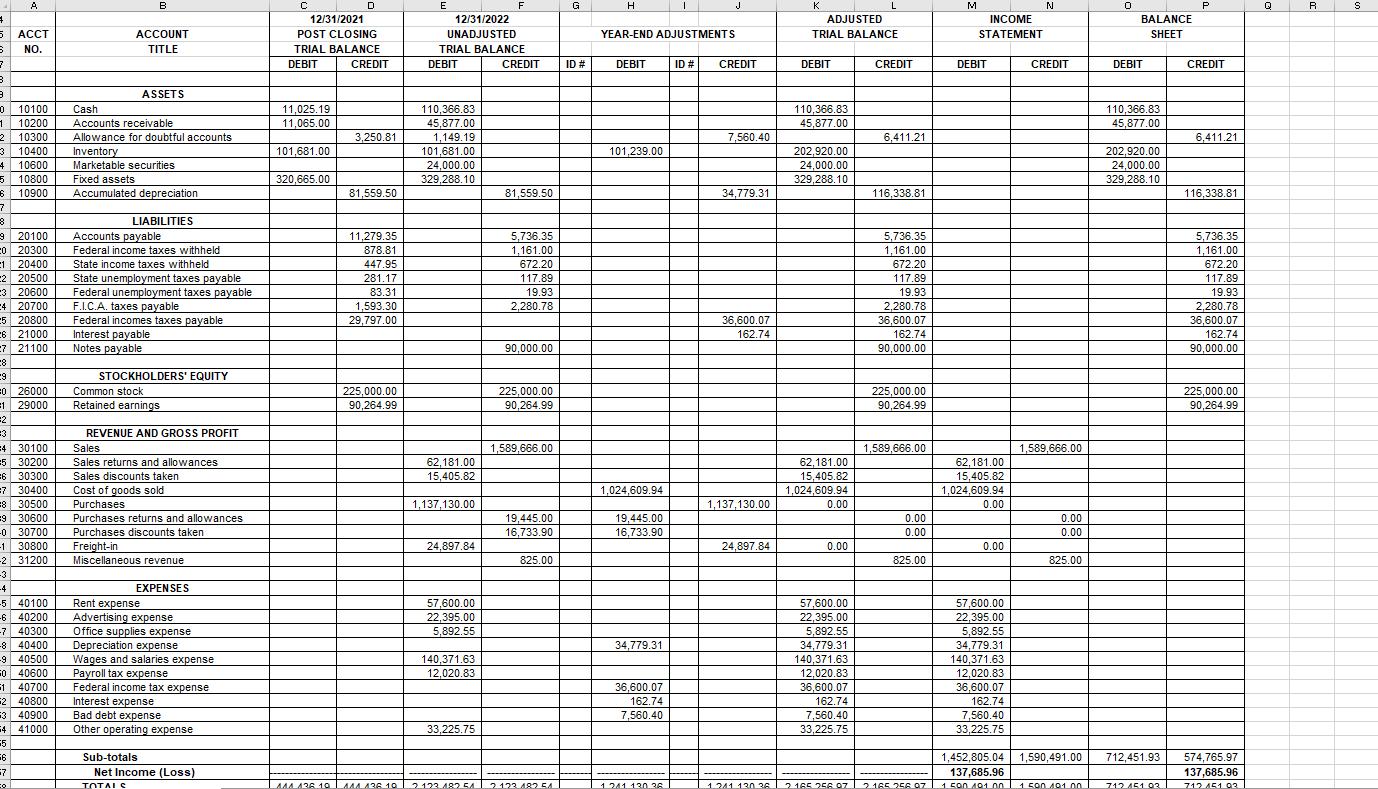

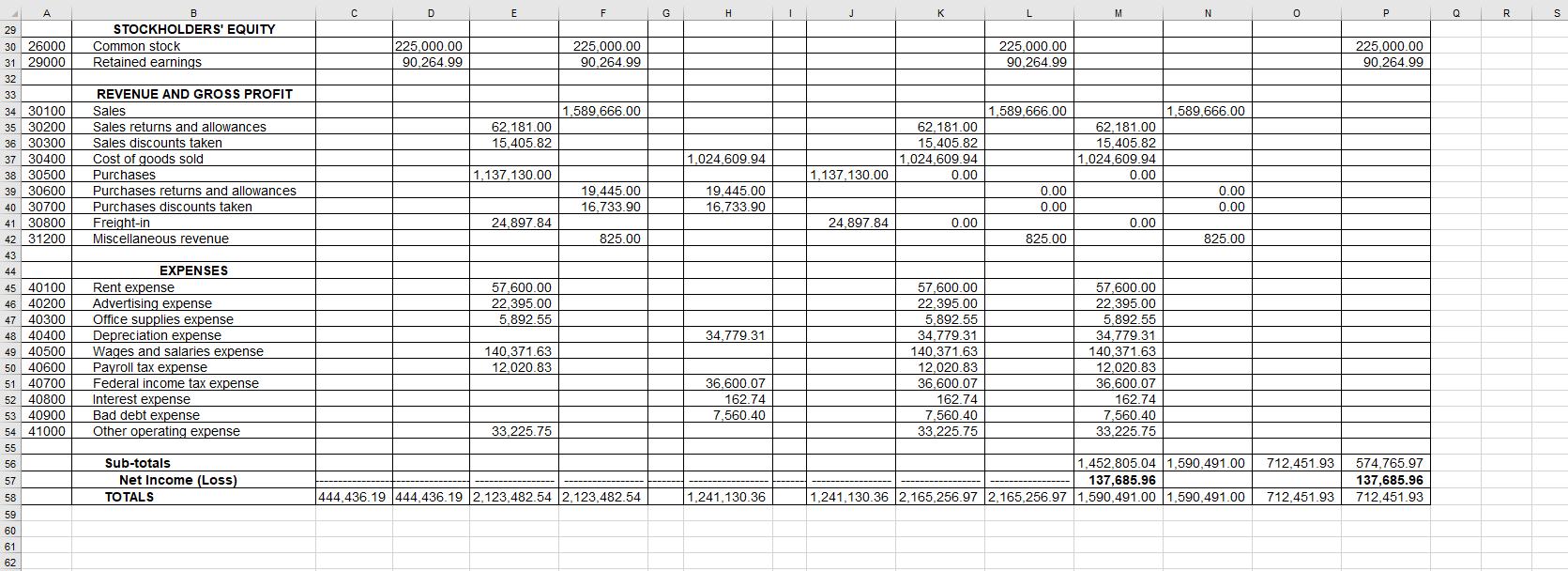

Prepare income statement with correct form. TRANSACTIONS LIST A ACCT NO. ACCOUNT TITLE ASSETS 10100 Cash 10200 Accounts receivable 10300 Allowance for doubtful accounts 10400

Prepare income statement with correct form.

TRANSACTIONS LIST A ACCT NO. ACCOUNT TITLE ASSETS 10100 Cash 10200 Accounts receivable 10300 Allowance for doubtful accounts 10400 Inventory 10600 Marketable securities 10800 Fixed assets 10900 Accumulated depreciation LIABILITIES 20100 Accounts payable 20300 Federal income taxes withheld 20400 20500 20600 Federal unemployment taxes payable 20700 F.I.C.A. taxes payable 20800 21000 21100 State income taxes withheld State unemployment taxes payable Federal incomes taxes payable Interest payable Notes payable STOCKHOLDERS' EQUITY 26000 Common stock 29000 Retained earnings 12/31/2021 POST CLOSING TRIAL BALANCE DEBIT 11,025.19 11,065.00 101,681.00 320,665.00 CREDIT 3,250.81 81,559.50 11,279.35 878.81 447.95 281.17 83.31 1,593.30 29,797.00 225,000.00 90,264.99 12/31/2022 UNADJUSTED TRIAL BALANCE DEBIT 110,366.83 45,877.00 1,149.19 101,681.00 24,000.00 329,288.10 CREDIT 81,559.50 5,736.35 1,161.00 672.20 117.89 19.93 2,280.78 90,000.00 225,000.00 90,264.99 ID # YEAR-END ADJUSTMENTS DEBIT 101,239.00 ID # CREDIT 7,560.40 34,779.31 36,600.07 162.74 ADJUSTED TRIAL BALANCE DEBIT 110,366.83 45,877.00 202,920.00 24,000.00 329,288.10 CREDIT 6,411.21 116,338.81 5,736.35 1,161.00 672.20 117.89 19.93 2,280.78 36,600.07 162.74 90,000.00 225,000.00 90,264.99 INCOME STATEMENT DEBIT CREDIT BALANCE SHEET DEBIT 110,366.83 45,877.00 202,920.00 24,000.00 329,288.10 CREDIT 6,411.21 116,338.81 5,736.35 1,161.00 672.20 117.89 19.93 2,280.78 36,600.07 162.74 90,000.00 225,000.00 90,264.99

Step by Step Solution

★★★★★

3.39 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

To prepare the income statement we need to gather the relevant revenue and expense accounts from the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started