Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Appraisal Assignment Using the Cost Approach This assignment utilizes the Cost Approach to determine the current Market Value of a New Construction Single Story

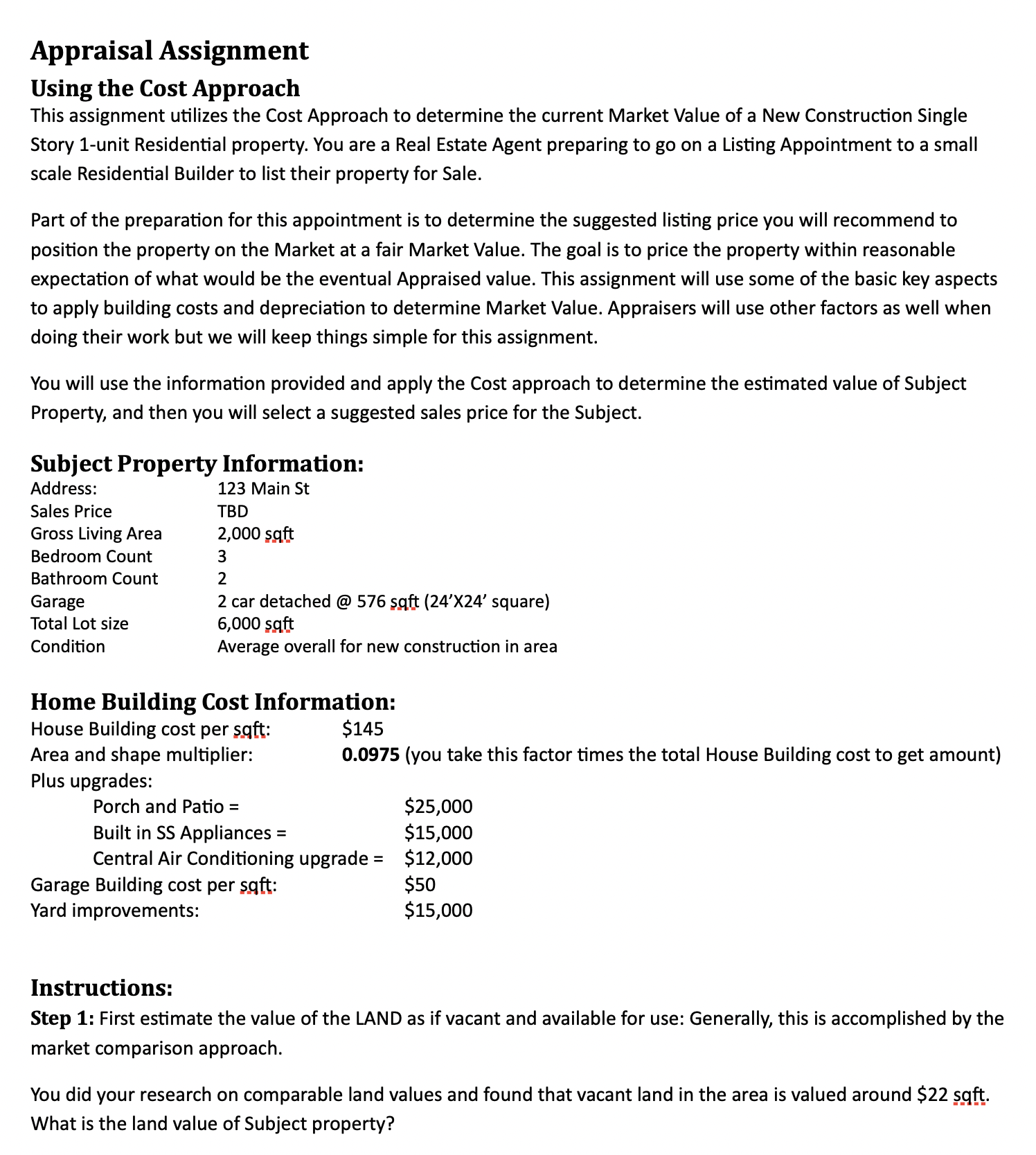

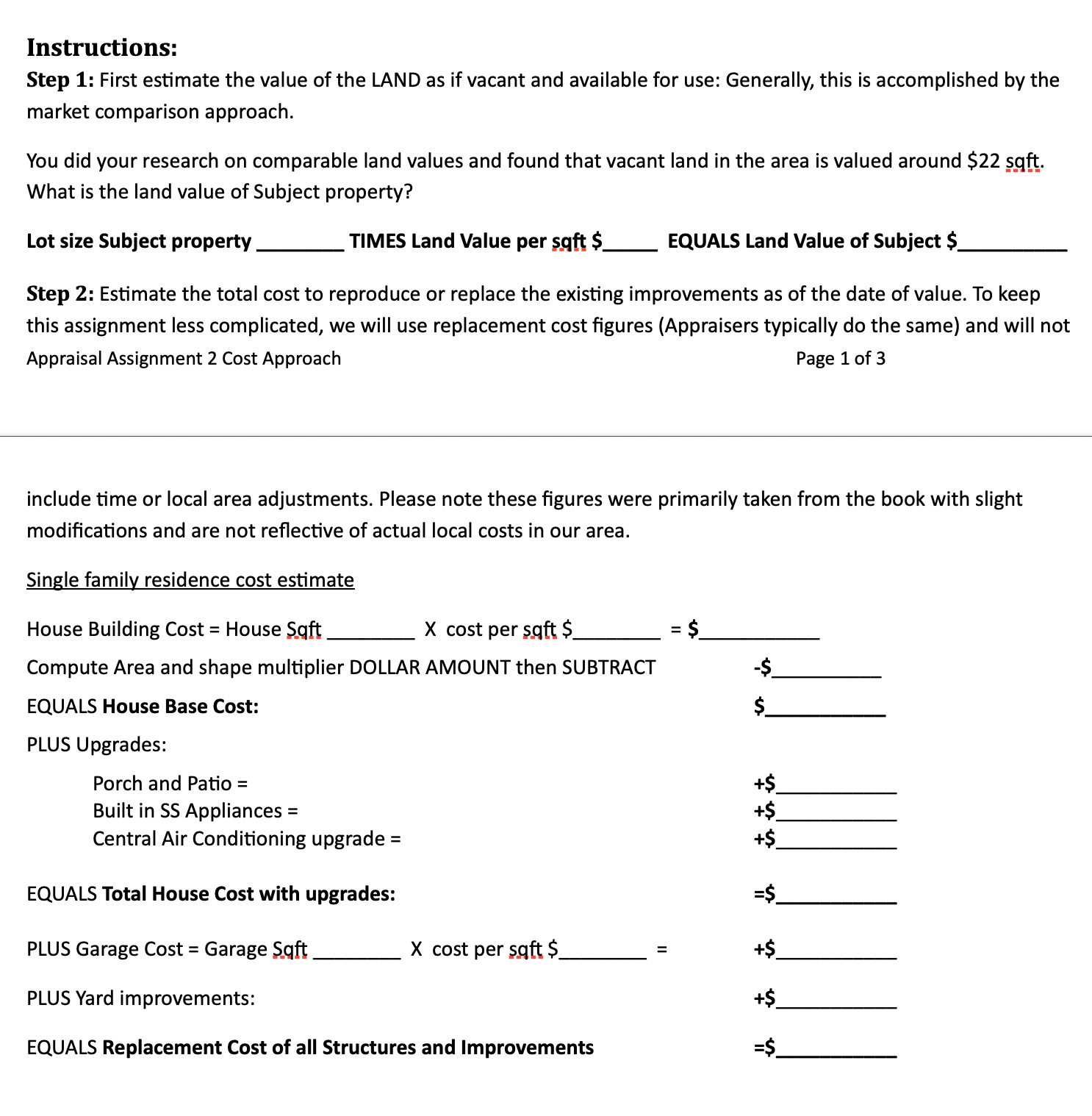

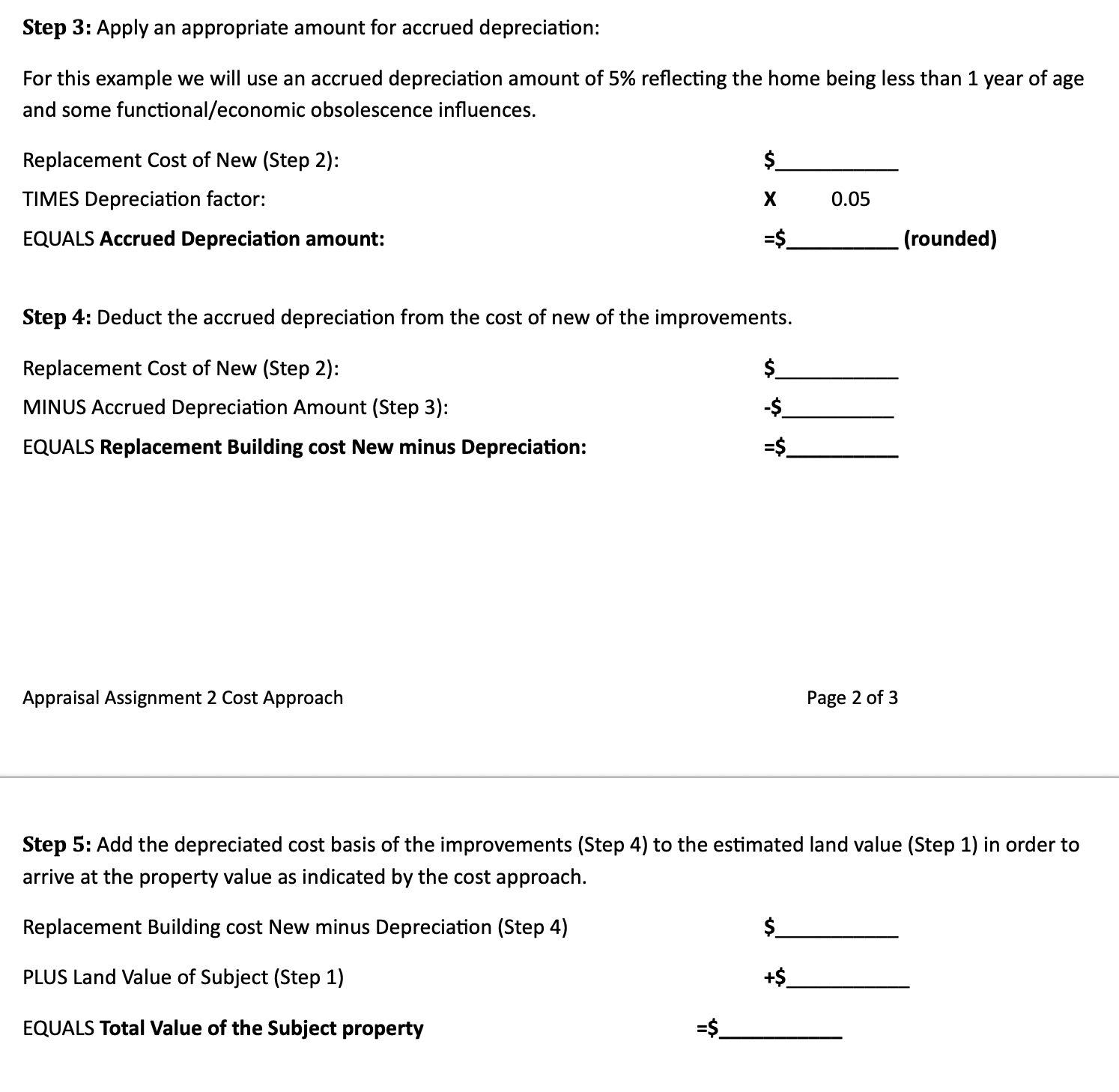

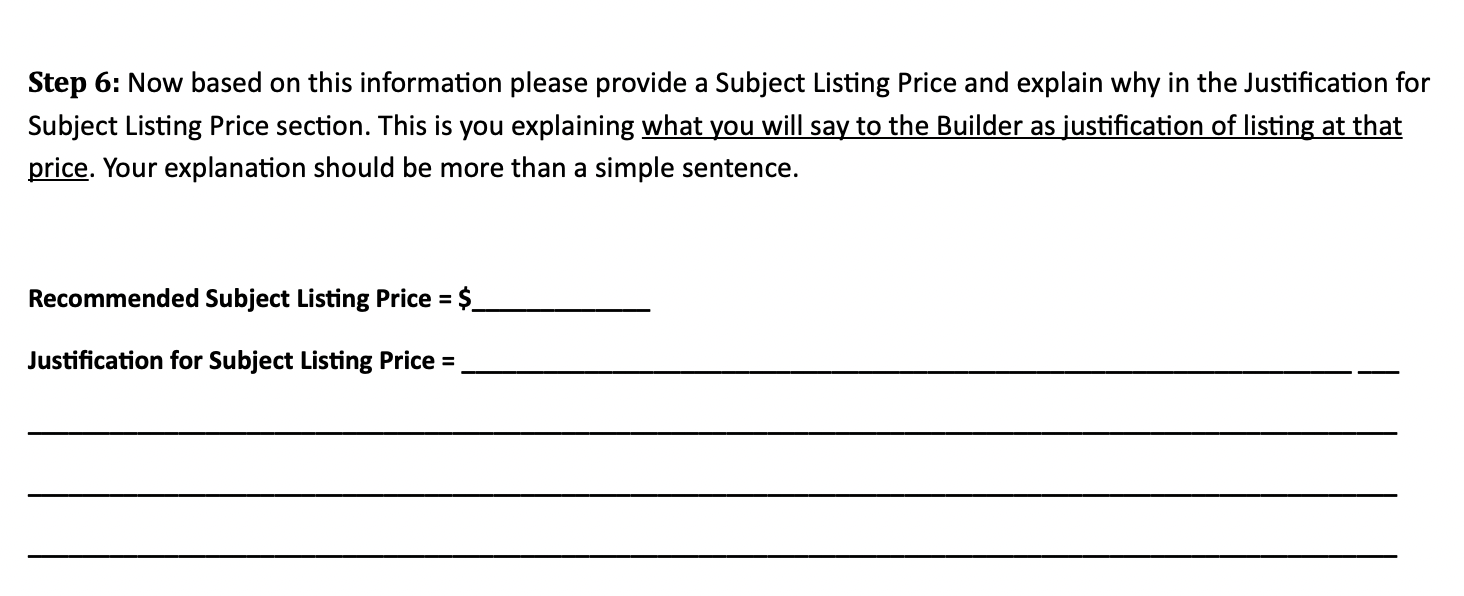

Appraisal Assignment Using the Cost Approach This assignment utilizes the Cost Approach to determine the current Market Value of a New Construction Single Story 1-unit Residential property. You are a Real Estate Agent preparing to go on a Listing Appointment to a small scale Residential Builder to list their property for Sale. Part of the preparation for this appointment is to determine the suggested listing price you will recommend to position the property on the Market at a fair Market Value. The goal is to price the property within reasonable expectation of what would be the eventual Appraised value. This assignment will use some of the basic key aspects to apply building costs and depreciation to determine Market Value. Appraisers will use other factors as well when doing their work but we will keep things simple for this assignment. You will use the information provided and apply the Cost approach to determine the estimated value of Subject Property, and then you will select a suggested sales price for the Subject. Subject Property Information: Address: 123 Main St TBD Sales Price Gross Living Area 2,000 sqft Bedroom Count 3 Bathroom Count 2 Garage Total Lot size Condition 2 car detached @ 576 sqft (24'x24' square) 6,000 sqft Average overall for new construction in area Home Building Cost Information: House Building cost per sqft: Area and shape multiplier: Plus upgrades: Porch and Patio = Built in SS Appliances = $145 0.0975 (you take this factor times the total House Building cost to get amount) $25,000 $15,000 Central Air Conditioning upgrade = $12,000 Garage Building cost per sqft: Yard improvements: $50 $15,000 Instructions: Step 1: First estimate the value of the LAND as if vacant and available for use: Generally, this is accomplished by the market comparison approach. You did your research on comparable land values and found that vacant land in the area is valued around $22 sqft. What is the land value of Subject property? Instructions: Step 1: First estimate the value of the LAND as if vacant and available for use: Generally, this is accomplished by the market comparison approach. You did your research on comparable land values and found that vacant land in the area is valued around $22 sqft. What is the land value of Subject property? Lot size Subject property TIMES Land Value per sqft $ EQUALS Land Value of Subject $ Step 2: Estimate the total cost to reproduce or replace the existing improvements as of the date of value. To keep this assignment less complicated, we will use replacement cost figures (Appraisers typically do the same) and will not Appraisal Assignment 2 Cost Approach Page 1 of 3 include time or local area adjustments. Please note these figures were primarily taken from the book with slight modifications and are not reflective of actual local costs in our area. Single family residence cost estimate House Building Cost = House Sqft X cost per sqft $ Compute Area and shape multiplier DOLLAR AMOUNT then SUBTRACT EQUALS House Base Cost: PLUS Upgrades: $ Porch and Patio = Built in SS Appliances Central Air Conditioning upgrade = in is in +$ +$ EQUALS Total House Cost with upgrades: =$ PLUS Garage Cost = Garage Sqft X cost per sqft $ +$ PLUS Yard improvements: +$ EQUALS Replacement Cost of all Structures and Improvements =$ Step 3: Apply an appropriate amount for accrued depreciation: For this example we will use an accrued depreciation amount of 5% reflecting the home being less than 1 year of age and some functional/economic obsolescence influences. Replacement Cost of New (Step 2): TIMES Depreciation factor: EQUALS Accrued Depreciation amount: $ 0.05 =$ (rounded) Step 4: Deduct the accrued depreciation from the cost of new of the improvements. Replacement Cost of New (Step 2): $ MINUS Accrued Depreciation Amount (Step 3): -$ EQUALS Replacement Building cost New minus Depreciation: =$_ Appraisal Assignment 2 Cost Approach Page 2 of 3 Step 5: Add the depreciated cost basis of the improvements (Step 4) to the estimated land value (Step 1) in order to arrive at the property value as indicated by the cost approach. Replacement Building cost New minus Depreciation (Step 4) PLUS Land Value of Subject (Step 1) EQUALS Total Value of the Subject property $ +$ Step 6: Now based on this information please provide a Subject Listing Price and explain why in the Justification for Subject Listing Price section. This is you explaining what you will say to the Builder as justification of listing at that price. Your explanation should be more than a simple sentence. Recommended Subject Listing Price = $ Justification for Subject Listing Price =

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started