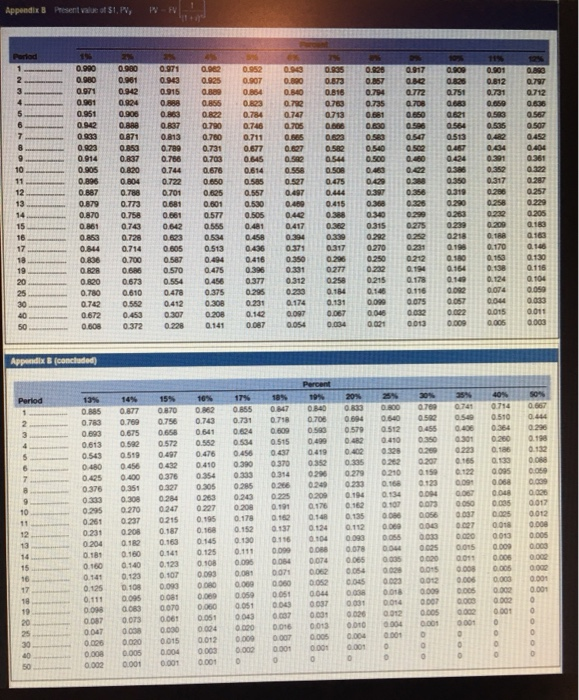

approximale answer but calculafe your inal answer using the tormula and financial calculator methods b. The firm proposes to offer new common slock to the preferred stockhokders to wipe out the defict The common stock will pay the tollowing dividends over the next four years 01 $1.85 D2 1.95 D 205 D4 2.15 The company anticipates earnings per share after four years will be $4 23 with a PVE ratio of 12 The common stock will be valued as the present value of future dvidends plus the present value of the future stock price after Compute the value of the common stock (Do not round intermediate calculations and round your answer to 2 decimal places) tour years The discount rate used by the investment banker is 9 percent n part a? (Do not round intermediate caiculations and round you .How many shares of common stock must be issued at the value computed in part e to einirate the deet answer to the nearest whole share.) Appendix B Present value of$1,PV, 9800.901 0.9430.925 0.9070.800 0873 07 0842 082 0812 797 0.001 0904 0888 0855 0823 0782 0763 0735 ans aseg 0535 0.942 0888 0.307 0790 0746 0 0 0E 0 096 0564 0505 0507 0933 0871 0a13 0780 0711 0ses om 0583 0547 ast3 0 0452 0.914 0007 a786 0703 0BAS 0.502 0S44 050 0424 0201 0361 0.896 0.8040722 0.850 0585 0.527 0.475 0429 0.388 a350 0.317 0.287 0.887 078807010.6250.5570.4970.4440.3970356 03190.2860257 0.8790.77306810.601 0.530 0.489 0415 0368 0.326 029 258 0229 0.870 07580.66105770.505 0.442 0388 0340 0299 0263 02320205 0.861 0743 0642 5 0481 0417 03620.315 0275 0239 0.209 .183 0.863 0728 0.623 0534 0458 0.394 0.339 0292 02520218 0.188 13 0BA4 0714 0605 0.513 0496 0371 0317 0270 022s ans at70 at45 0806 0.700 0.587 0.494 Q416 0350 0296 0250 0.212 a180 aisa at30 O R28 0686 0570 0475 0.396 0.331 02770232 0194 164 0.138116 0820 0673 0554 a456 0.377 0312 0.258 0215 a178 0149 an4 a104 0.780 0.610 0478 037S 0.295 0.223 0.164014116 0920074009 0742 0.552 0412 0.3080231 0174 0.131 0099 0rs0057.0443 50O 0608 0.372 228 0141 007 0054 0.0040 0210013 0.009.0050.003 14% 17% 18% 0714 0.667 0.783 0.769 0756 0743 0731 0718 0708 04 0.640 0582 0510 0.444 0.693 0675 0658 0641 0.624 0.609 0. 0579 05120455 40 0364 .29 0885 0877 0870 0862 0.855 0847 0840 833 0.8000769 0741 0.613 0.592 0572 0.552 0534 0.515 0.499 0543 0519 04970476 0456 0437 0419 0402 0.32 0.482 0410 0350 301 0.260 0198 0.269 0223 0.186 0.32 0456 0432 0410 0390 0200 0352 a 5 at 0086 0376 0354 0303 0314 0296 0279 0210 e122 0096 ecee 0.376 0.351 0327 0305 0285 026 0249 0233 68 0123.09.068 0 1 0333 308 24 263 0.243225 0209a 0295 0270 0247 0227 0.20 019 4176 0261 0237 0215 0.195 0.178 162 0148 .13 0 0056 0037 aas 0012 0.137 0124 0112 0 e a043 .027 0.018 0.008 0.187 0.168 0.152 0. 0.125 0.112 " 018, 0.160 0.141 0.125 0.111 0D99 0088 0078 0.044 0025 0015 50 160 0140 0.123 01080.0 0.064 0.074 0.065 aas 16 0 035 0 020 a011 0.006 0.002 0.062 0.054 0028 001s 0 008 0,0050:002 17 0125 108 0090 0060 0.005 0.002 0.00 0.087 0.073 006 0051 0043. 0047 0 038 0.0000040.000 006 0013 0010.004 000 000 0026 000) 0015 0012 0 0007 0 0.004 0.001 0 0.008 0.005 0.004 0.003 0.002 0.00100010.001 a002 a001 0001 0001