Question

APQ Surgical Supply Corporation has 200 shares of voting stock outstanding. Of these shares, 116 shares are owned by Moe and the remaining 84

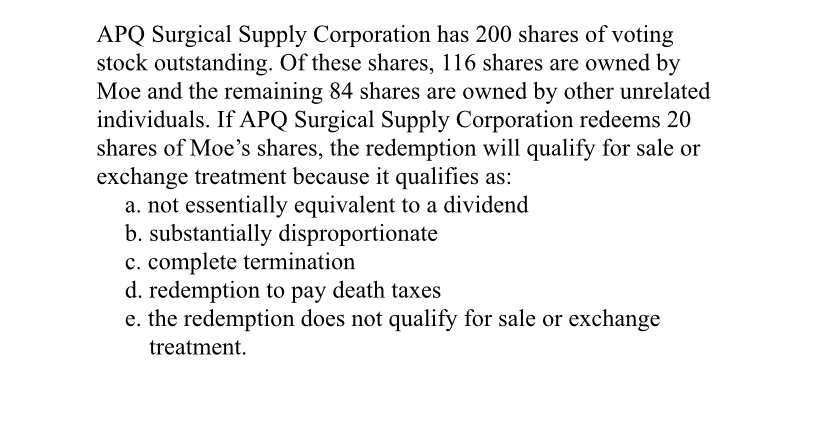

APQ Surgical Supply Corporation has 200 shares of voting stock outstanding. Of these shares, 116 shares are owned by Moe and the remaining 84 shares are owned by other unrelated individuals. If APQ Surgical Supply Corporation redeems 20 shares of Moe's shares, the redemption will qualify for sale or exchange treatment because it qualifies as: a. not essentially equivalent to a dividend b. substantially disproportionate c. complete termination d. redemption to pay death taxes e. the redemption does not qualify for sale or exchange treatment.

Step by Step Solution

3.56 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Option a not essentially equivalent to a dividend Reason A stock redemption qualifies for ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Federal Taxation 2016 Comprehensive

Authors: Thomas R. Pope, Timothy J. Rupert, Kenneth E. Anderson

29th Edition

134104374, 978-0134104379

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App