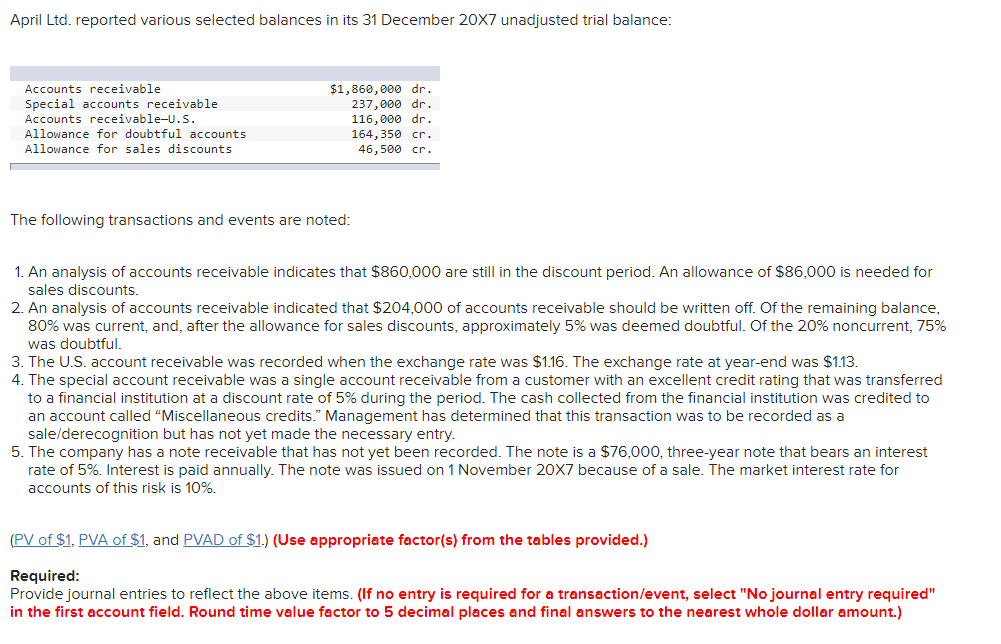

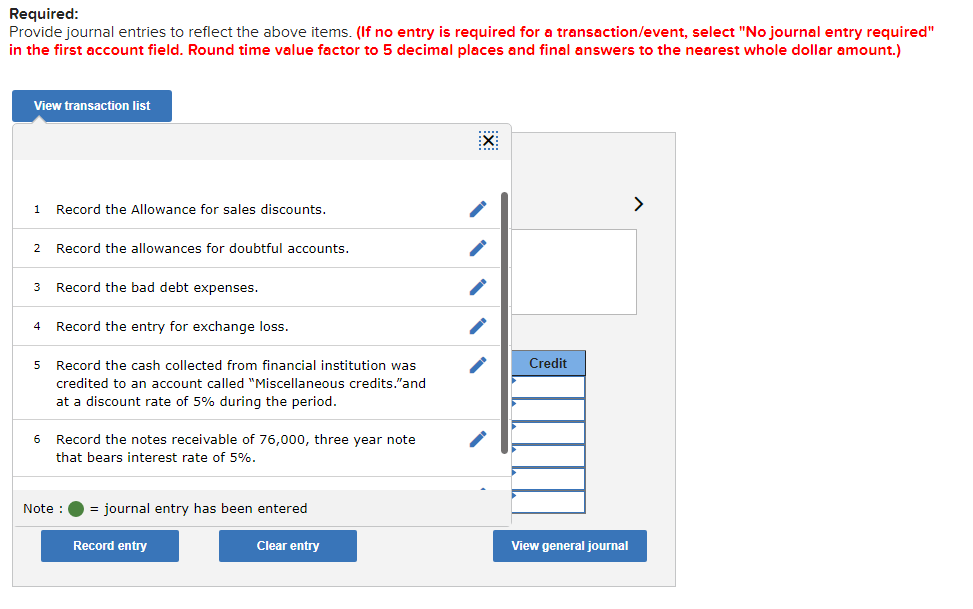

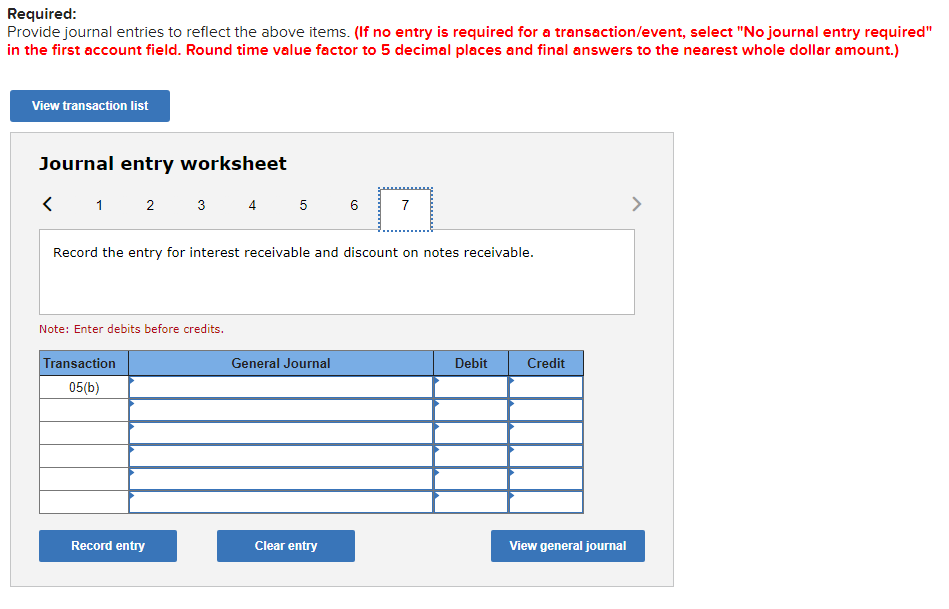

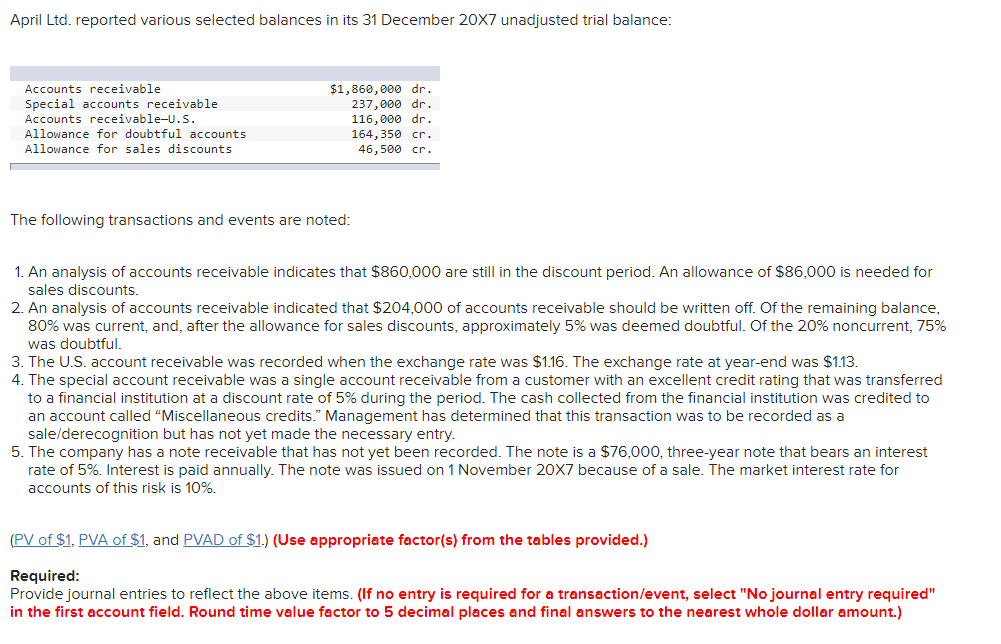

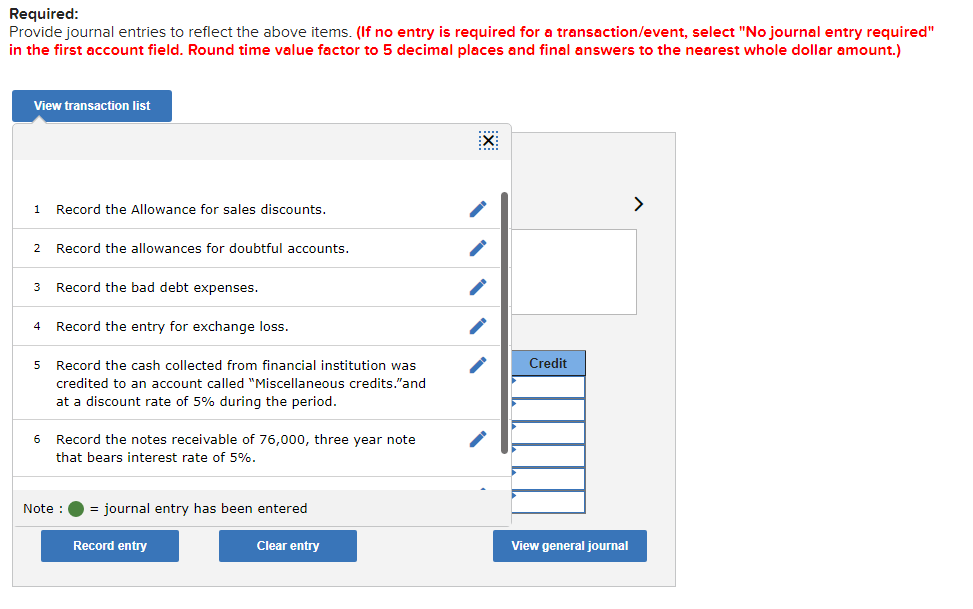

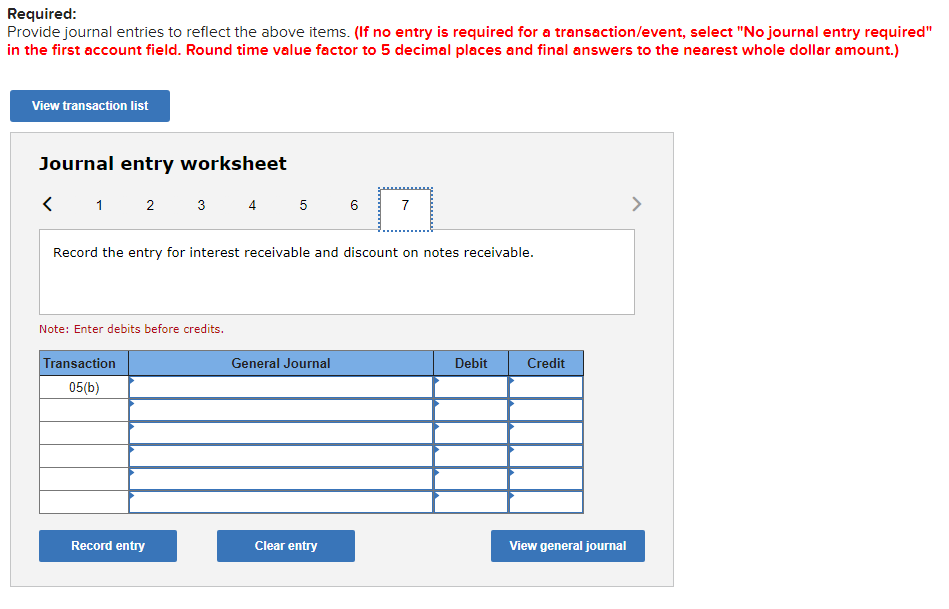

April Ltd. reported various selected balances in its 31 December 20X7 unadjusted trial balance: Accounts receivable Special accounts receivable Accounts receivable-U.S. Allowance for doubtful accounts Allowance for sales discounts $1,860,000 dr. 237,000 dr. 116,000 dr. 164,350 cr. 46,500 cr. The following transactions and events are noted: 1. An analysis of accounts receivable indicates that $860,000 are still in the discount period. An allowance of $86,000 is needed for sales discounts. 2. An analysis of accounts receivable indicated that $204,000 of accounts receivable should be written off. Of the remaining balance, 80% was current, and, after the allowance for sales discounts, approximately 5% was deemed doubtful. Of the 20% noncurrent, 75% was doubtful. 3. The U.S. account receivable was recorded when the exchange rate was $1.16. The exchange rate at year-end was $1.13. 4. The special account receivable was a single account receivable from a customer with an excellent credit rating that was transferred to a financial institution at a discount rate of 5% during the period. The cash collected from the financial institution was credited to an account called "Miscellaneous credits." Management has determined that this transaction was to be recorded as a sale/derecognition but has not yet made the necessary entry. 5. The company has a note receivable that has not yet been recorded. The note is a $76,000, three-year note that bears an interest rate of 5%. Interest is paid annually. The note was issued on 1 November 20X7 because of a sale. The market interest rate for accounts of this risk is 10%. (PV of $1, PVA of $1, and PVAD of $1.) (Use appropriate factor(s) from the tables provided.) Required: Provide journal entries to reflect the above items. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round time value factor to 5 decimal places and final answers to the nearest whole dollar amount.) Required: Provide journal entries to reflect the above items. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round time value factor to 5 decimal places and final answers to the nearest whole dollar amount.) View transaction list X 1 Record the Allowance for sales discounts. > 2 Record the allowances for doubtful accounts. 3 Record the bad debt expenses. 4 Record the entry for exchange loss. Credit 5 Record the cash collected from financial institution was credited to an account called "Miscellaneous credits."and at a discount rate of 5% during the period. 6 Record the notes receivable of 76,000, three year note that bears interest rate of 5%. Note : = journal entry has been entered Record entry Clear entry View general journal Required: Provide journal entries to reflect the above items. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round time value factor to 5 decimal places and final answers to the nearest whole dollar amount.) View transaction list Journal entry worksheet 1 2 3 4 4 5 6 7 > Record the entry for interest receivable and discount on notes receivable. Note: Enter debits before credits. General Journal Debit Credit Transaction 05(b) Record entry Clear entry View general journal