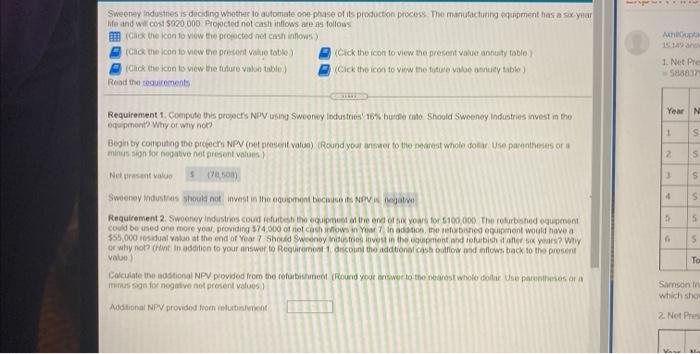

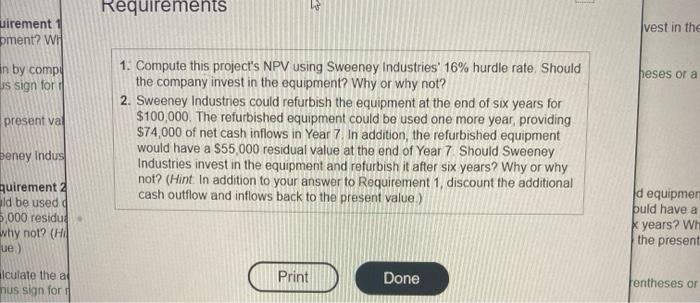

Apt Sweeney industries is deciding whether to automate one phase of its production process. The manufacturing equipment has a six your We and will cost 5920,000 Projected not cash inflows are as follows mio the con to view the projected net casinows) (Click the icon to view the present vole table (click the icon to view the present value anticity table) (Click the icon to view the future valon table) Click the icon to ww mette valority table) Read the tournements 1. Net Pre 58883 Year N Requirement 1. Compute this project's NPV using Swooney Industries16% hurderito Should Sweeney Industries invest in the equipment? Why or wtly not? 1 S Begin by contripting the proc's NPV (net present value) Round your answer to the nearest whole dotar Use parentheses or minussion for negative not present valus) 2 s Net present value SON S 4 s 5 5 Sweeney industries should not invest in the equipment bocs NAV gali Requirement 2. Swooney industries could refurbesh the the end of six you for $100,000 The Furbished og could be used one more your providing 174,000 flashows in You In adation, the bished opent would have $55,000 dual value at the end of Year Should Swoonoy industries lovest in the equipment and furbisher years? Why or why not Hint in addition to your answer to Requirement discount the additional cash outflow and allows back to the present val Calculate the national NPV provided from the tourbishment (Round your answer to the nearest whole doti ne parenthesesora Tinus sign for nogle not present values 5 To Samson which she Additional NPV provided from 2. Not Pre Requirements uirement 1 pment? WH vest in the in by comp! heses or a is sign for present val 1. Compute this project's NPV using Sweeney Industries' 16% hurdle rate. Should the company invest in the equipment? Why or why not? 2. Sweeney Industries could refurbish the equipment at the end of six years for $100,000. The refurbished equipment could be used one more year, providing $74,000 of net cash inflows in Year 7. In addition, the refurbished equipment would have a $55,000 residual value at the end of Year 7 Should Sweeney Industries invest in the equipment and refurbish it after six years? Why or why not? (Hint. In addition to your answer to Requirement 1, discount the additional cash outflow and inflows back to the present value) beney Indus quirement 2 ald be used 5000 residud why not? (HA ue) alculate the al nus sign for Id equipmen buld have a k years? WH the present Print Done Tentheses or Apt Sweeney industries is deciding whether to automate one phase of its production process. The manufacturing equipment has a six your We and will cost 5920,000 Projected not cash inflows are as follows mio the con to view the projected net casinows) (Click the icon to view the present vole table (click the icon to view the present value anticity table) (Click the icon to view the future valon table) Click the icon to ww mette valority table) Read the tournements 1. Net Pre 58883 Year N Requirement 1. Compute this project's NPV using Swooney Industries16% hurderito Should Sweeney Industries invest in the equipment? Why or wtly not? 1 S Begin by contripting the proc's NPV (net present value) Round your answer to the nearest whole dotar Use parentheses or minussion for negative not present valus) 2 s Net present value SON S 4 s 5 5 Sweeney industries should not invest in the equipment bocs NAV gali Requirement 2. Swooney industries could refurbesh the the end of six you for $100,000 The Furbished og could be used one more your providing 174,000 flashows in You In adation, the bished opent would have $55,000 dual value at the end of Year Should Swoonoy industries lovest in the equipment and furbisher years? Why or why not Hint in addition to your answer to Requirement discount the additional cash outflow and allows back to the present val Calculate the national NPV provided from the tourbishment (Round your answer to the nearest whole doti ne parenthesesora Tinus sign for nogle not present values 5 To Samson which she Additional NPV provided from 2. Not Pre Requirements uirement 1 pment? WH vest in the in by comp! heses or a is sign for present val 1. Compute this project's NPV using Sweeney Industries' 16% hurdle rate. Should the company invest in the equipment? Why or why not? 2. Sweeney Industries could refurbish the equipment at the end of six years for $100,000. The refurbished equipment could be used one more year, providing $74,000 of net cash inflows in Year 7. In addition, the refurbished equipment would have a $55,000 residual value at the end of Year 7 Should Sweeney Industries invest in the equipment and refurbish it after six years? Why or why not? (Hint. In addition to your answer to Requirement 1, discount the additional cash outflow and inflows back to the present value) beney Indus quirement 2 ald be used 5000 residud why not? (HA ue) alculate the al nus sign for Id equipmen buld have a k years? WH the present Print Done Tentheses or