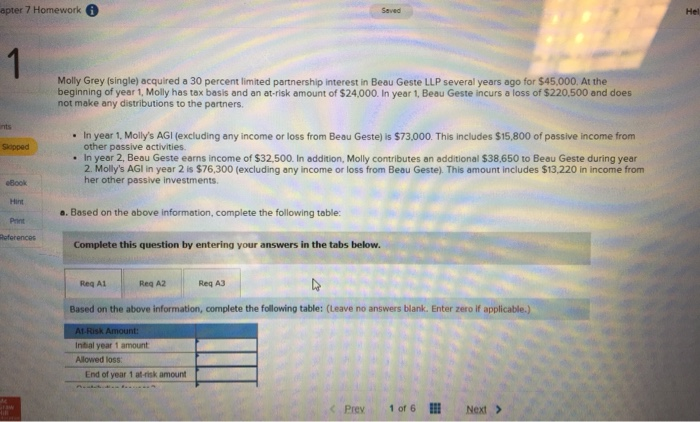

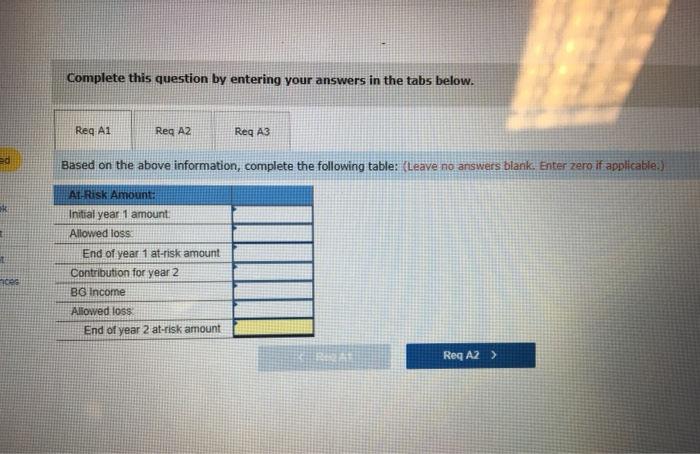

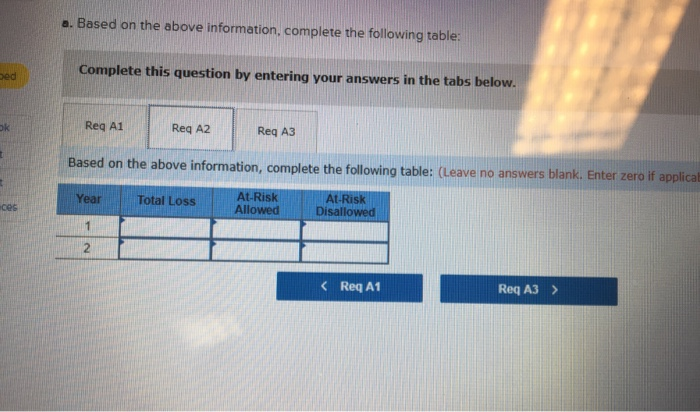

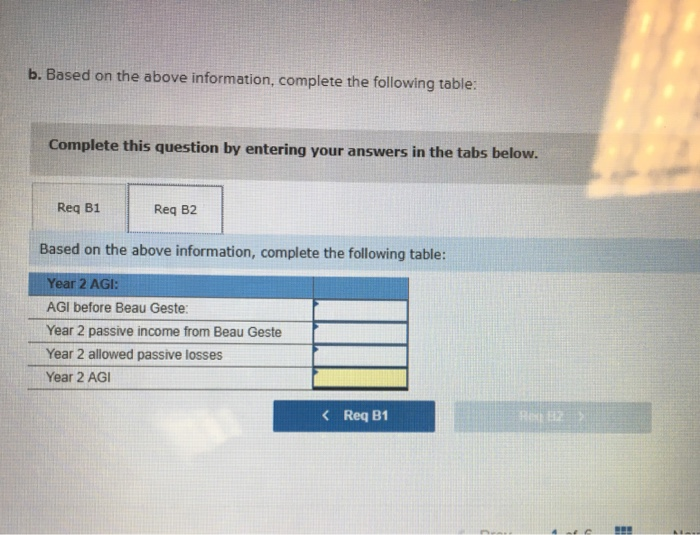

apter 7 Homework Hel Saved 1 Molly Grey (single) acquired a 30 percent limited partnership interest in Beau Geste LLP several years ago for $45,000. At the beginning of year 1, Molly has tax basis and an at-risk amount of $24,000. In year 1, Beau Geste incurs a loss of $220,500 and does not make any distributions to the partners nts In year 1, Molly's AGI (excluding any income or loss from Beau Geste) is $73,000. This includes $15,800 of passive income from other passive activities. In year 2, Beau Geste earns income of $32,500. In addition, Molly contributes an additional $38,650 to Beau Geste during year 2. Molly's AGI in year 2 is $76,300 (excluding any income or loss from Beau Geste). This amount includes $13,220 in income from her other passive investments. Skipped eBook Hint a. Based on the above information, complete the following table: Print Roforences Complete this question by entering your answers in the tabs below. Reg A1 Reg A2 Req A3 Based on the above information, complete the following table: (Leave no answers blank. Enter zero if applicable.) At-Risk Amount: Intial year 1 amount Allowed loss: End of year 1 at-risk amount Prev 1 of 6 taw Next > Complete this question by entering your answers in the tabs below. Req A1 Req A2 Reg A3 ed Based on the above information, complete the following table: (Leave no answers blank. Enter zero if applicable.) At-Risk Amount: k Initial year 1 amount Allowed loss End of year 1 at-risk amount Contribution for year 2 ces BG Income Allowed loss End of year 2 at-risk amount Req A2 a. Based on the above information, complete the following table: Complete this question by entering your answers in the tabs below. bed Req A1 ok Req A2 Req A3 Based on the above information, complete the following table: (Leave no answers blank. Enter zero if applica At-Risk Allowed Year Total Loss At-Risk Disallowed ces 1 2

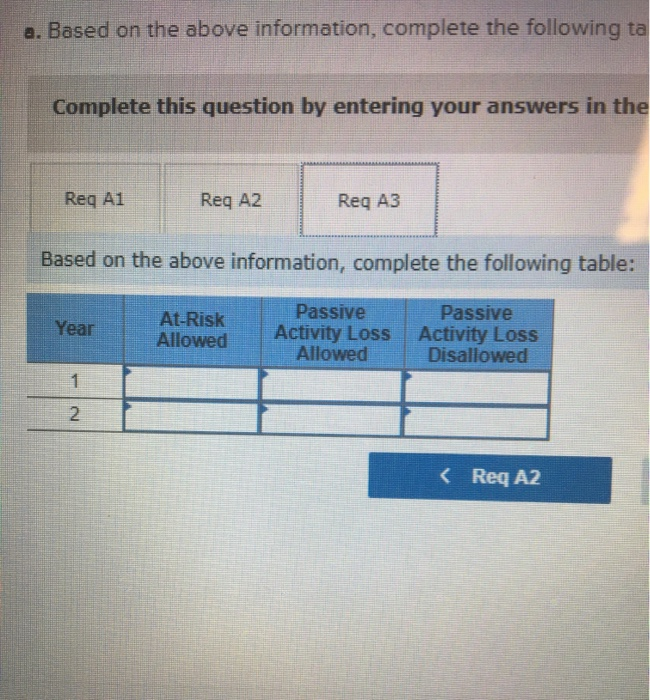

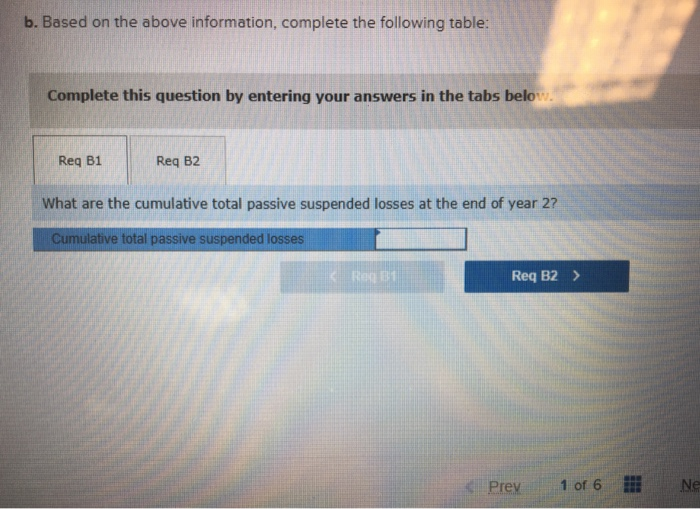

a. Based on the above information, complete the following ta Complete this question by entering your answers in the Req A1 Req A2 Req A3 Based on the above information, complete the following table: Passive Activity Loss Allowed Passive At-Risk Allowed Year Activity Loss Disallowed 1 2 Req A2 b. Based on the above information, complete the following table: Complete this question by entering your answers in the tabs below. Req B1 Req B2 What are the cumulative total passive suspended losses at the end of year 2? Cumulative total passive suspended losses