APV

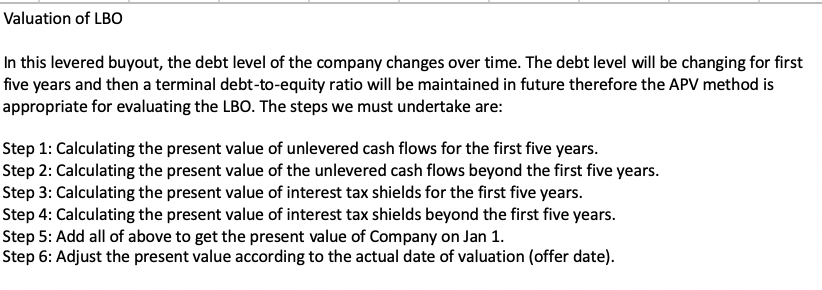

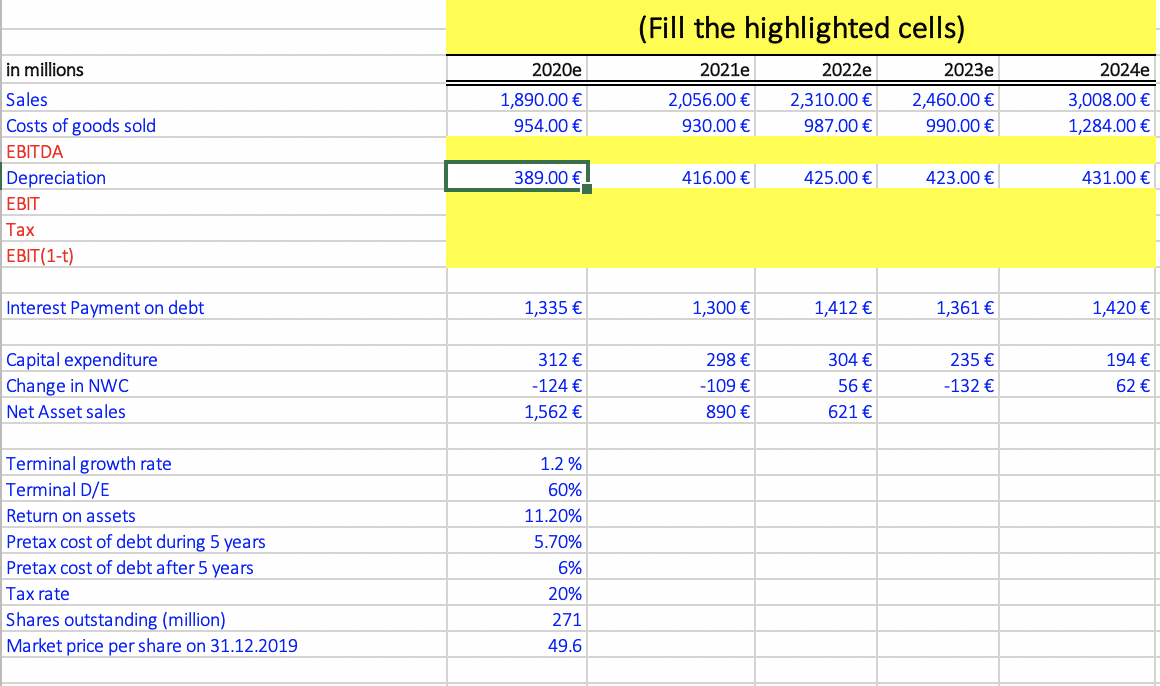

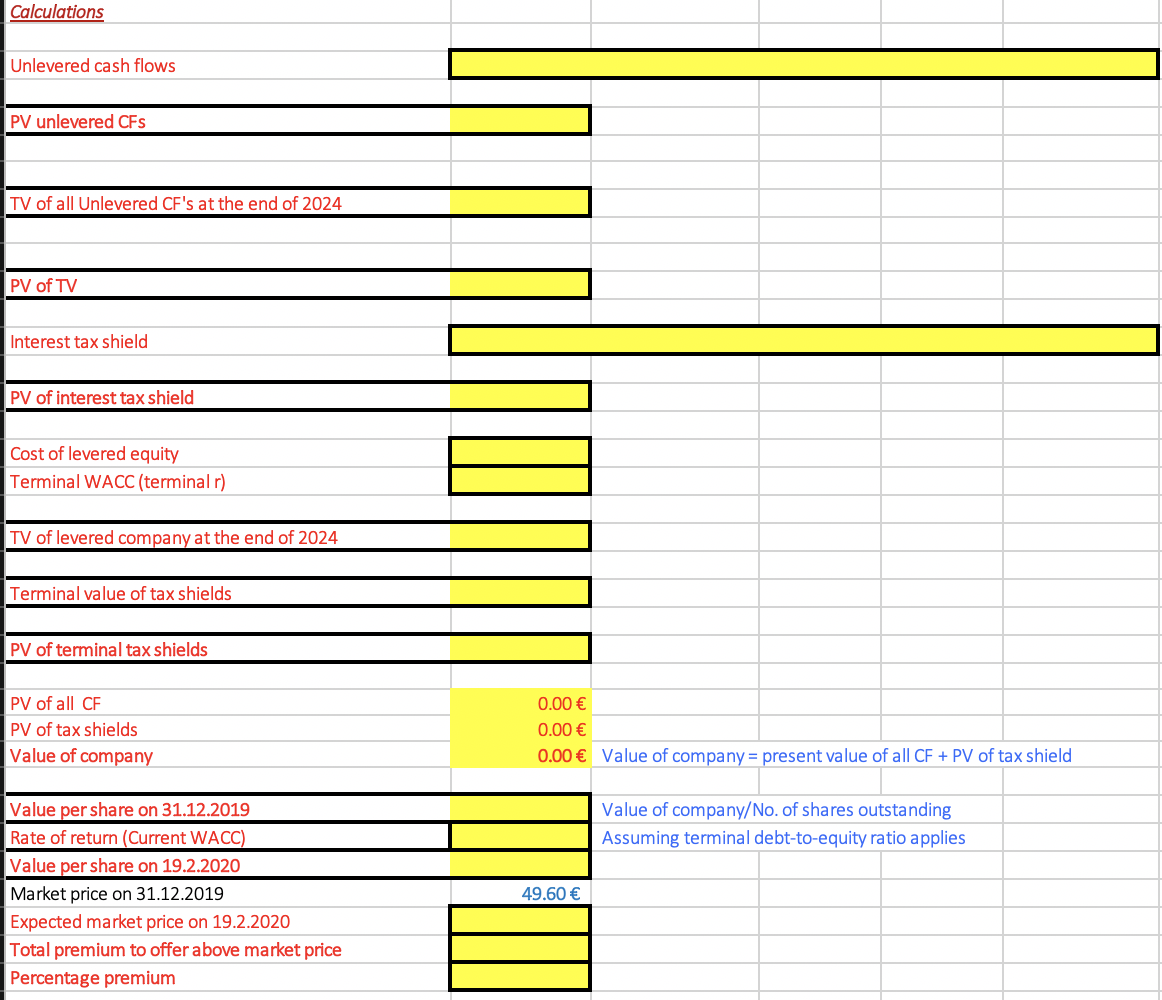

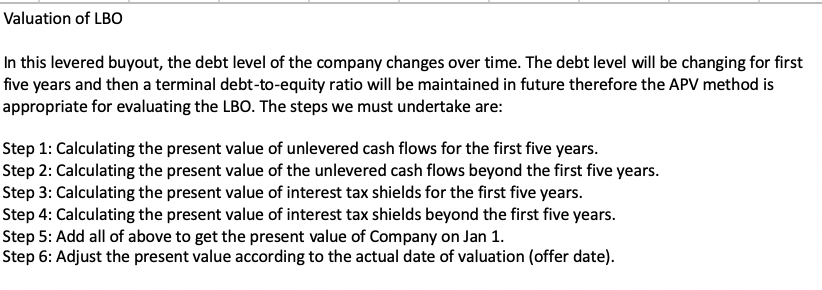

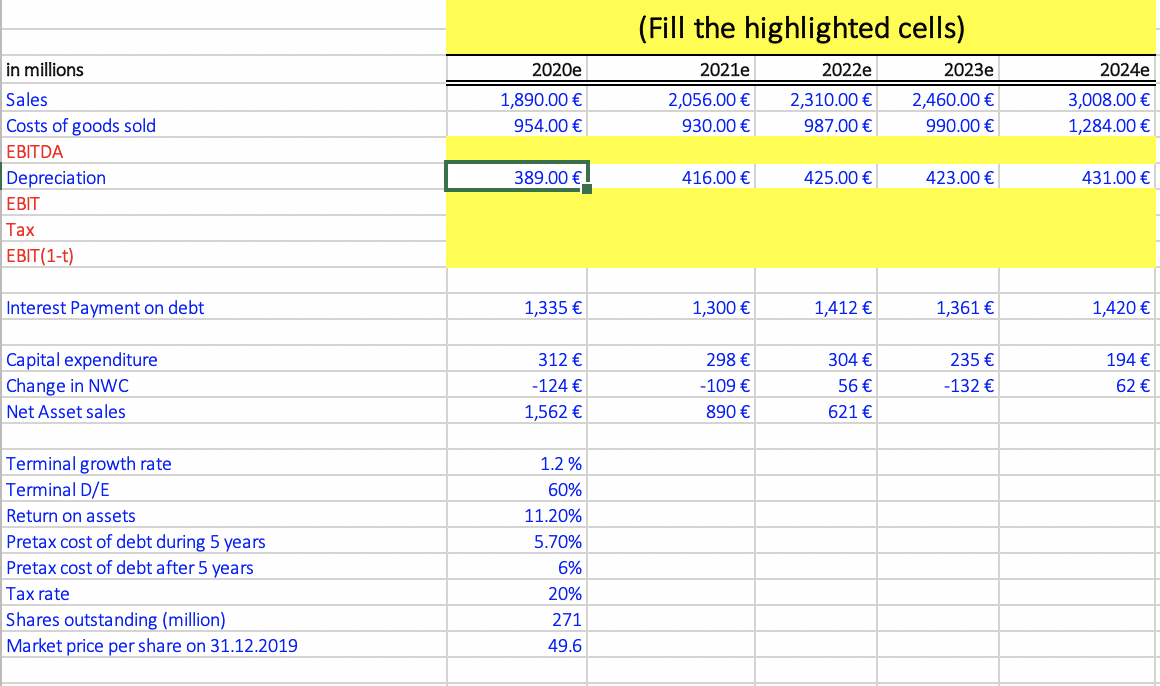

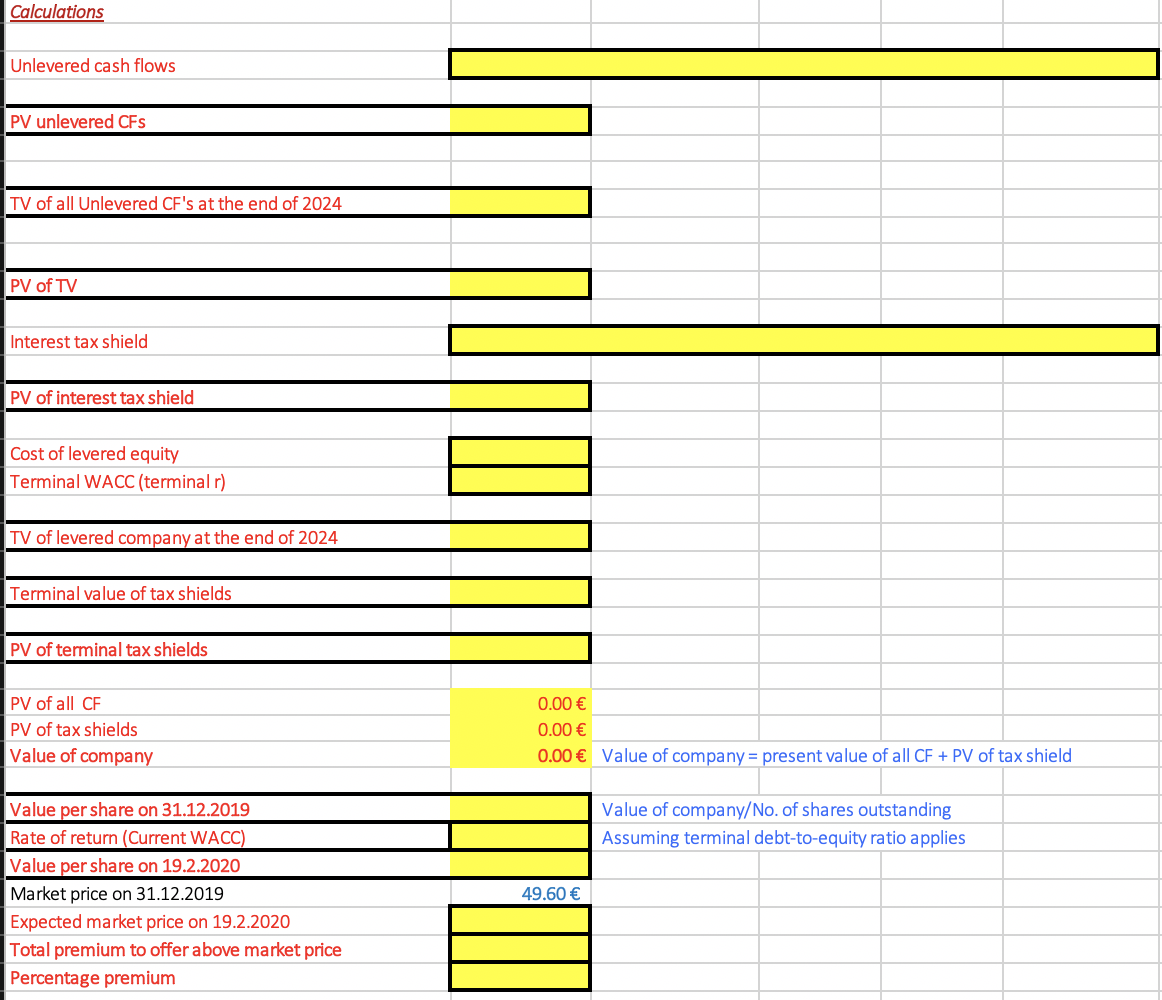

Valuation of LBO In this levered buyout, the debt level of the company changes over time. The debt level will be changing for first five years and then a terminal debt-to-equity ratio will be maintained in future therefore the APV method is appropriate for evaluating the LBO. The steps we must undertake are: Step 1: Calculating the present value of unlevered cash flows for the first five years. Step 2: Calculating the present value of the unlevered cash flows beyond the first five years. Step 3: Calculating the present value of interest tax shields for the first five years. Step 4: Calculating the present value of interest tax shields beyond the first five years. Step 5: Add all of above to get the present value of Company on Jan 1. Step 6: Adjust the present value according to the actual date of valuation (offer date). (Fill the highlighted cells) 2020e 2021e 2024e 1,890.00 954.00 2,056.00 930.00 2022e 2,310.00 987.00 2023e 2,460.00 990.00 3,008.00 1,284.00 in millions Sales Costs of goods sold EBITDA Depreciation EBIT Tax EBIT(1-t) 389.00 ! 416.00 425.00 423.00 431.00 Interest Payment on debt 1,335 1,300 1,412 1,361 1,420 Capital expenditure Change in NWC Net Asset sales 312 -124 1,562 298 -109 890 304 56 621 235 -132 194 62 Terminal growth rate Terminal D/E Return on assets Pretax cost of debt during 5 years Pretax cost of debt after 5 years Tax rate Shares outstanding (million) Market price per share on 31.12.2019 1.2 % 60% 11.20% 5.70% 6% 20% 271 49.6 Calculations Unlevered cash flows PV unlevered CFS TV of all Unlevered CF's at the end of 2024 PV of TV Interest tax shield PV of interest tax shield Cost of levered equity Terminal WACC (terminalr) TV of levered company at the end of 2024 Terminal value of tax shields PV of terminal tax shields PV of all CF PV of tax shields Value of company 0.00 0.00 0.00 Value of company = present value of all CF + PV of tax shield Value of company/No. of shares outstanding Assuming terminal debt-to-equity ratio applies Value per share on 31.12.2019 Rate of return (Current WACC) Value per share on 19.2.2020 Market price on 31.12.2019 Expected market price on 19.2.2020 Total premium to offer above market price Percentage premium 49.60