Answered step by step

Verified Expert Solution

Question

1 Approved Answer

AQ-1 Markum Enterprises is an all-equity firm. It has 50 million shares outstanding with a current price of $20 per share. Markum is considering permanently

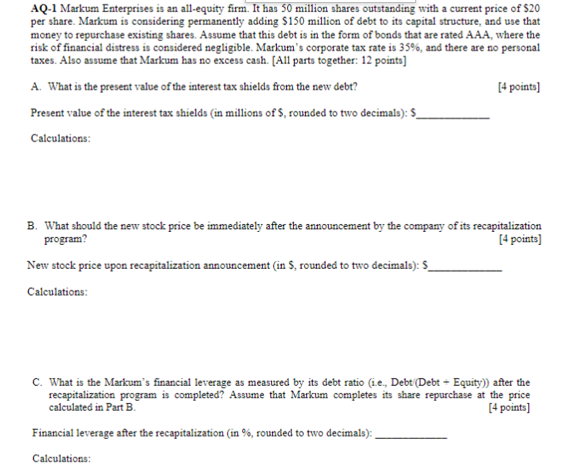

AQ-1 Markum Enterprises is an all-equity firm. It has 50 million shares outstanding with a current price of $20 per share. Markum is considering permanently adding $150 million of debt to its capital structure, and use that money to repurchase existing shares. Assume that this debt is in the form of bonds that are rated A.A., where the risk of financial distress is considered negligible. Markum's corporate tax rate is 35%, and there are no personal taxes. Also assume that Markum has no excess cash. [All parts together: 12 points] A. What is the present value of the interest tax shields from the new debt? [4 points] Present value of the interest tax shields (in millions of \$, rounded to two decimals): $ Calculations: B. What should the new stock price be immediately after the announcement by the company of its recapitalization program? [4 points] New stock price upon recapitalization announcement (in \$, rounded to two decimals): \$ Calculations: C. What is the Markum's financial leverage as measured by its debt ratio (i.e., Debt (Debt - Equity)) after the recapitalization program is completed? Assume that Markum completes its share repurchase at the price calculated in Part B. [4 points] Financial leverage after the recapitalization (in %, rounded to two decimals): Calculations

AQ-1 Markum Enterprises is an all-equity firm. It has 50 million shares outstanding with a current price of $20 per share. Markum is considering permanently adding $150 million of debt to its capital structure, and use that money to repurchase existing shares. Assume that this debt is in the form of bonds that are rated A.A., where the risk of financial distress is considered negligible. Markum's corporate tax rate is 35%, and there are no personal taxes. Also assume that Markum has no excess cash. [All parts together: 12 points] A. What is the present value of the interest tax shields from the new debt? [4 points] Present value of the interest tax shields (in millions of \$, rounded to two decimals): $ Calculations: B. What should the new stock price be immediately after the announcement by the company of its recapitalization program? [4 points] New stock price upon recapitalization announcement (in \$, rounded to two decimals): \$ Calculations: C. What is the Markum's financial leverage as measured by its debt ratio (i.e., Debt (Debt - Equity)) after the recapitalization program is completed? Assume that Markum completes its share repurchase at the price calculated in Part B. [4 points] Financial leverage after the recapitalization (in %, rounded to two decimals): Calculations Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started