Question

Aquafena Inc. recognized taxable income of $120,000 for the year ended December 31. Aquafena calculated a deferred tax asset and a deferred tax liability

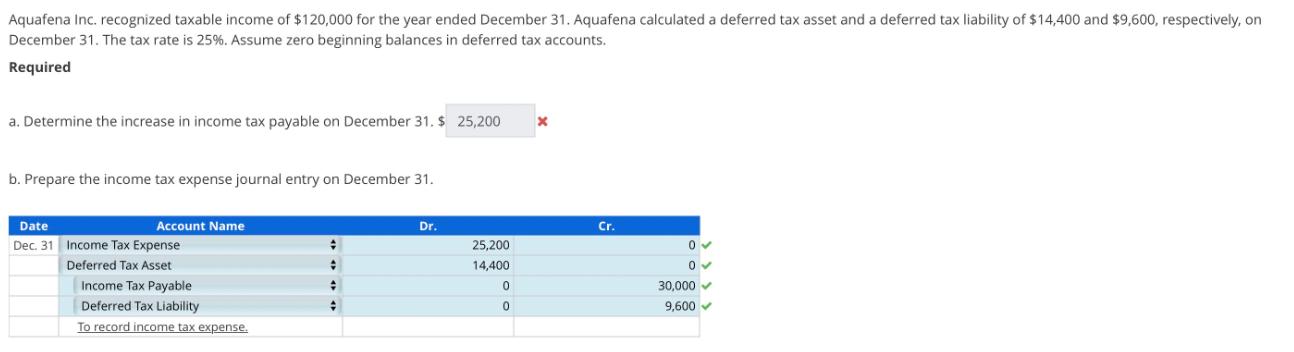

Aquafena Inc. recognized taxable income of $120,000 for the year ended December 31. Aquafena calculated a deferred tax asset and a deferred tax liability of $14,400 and $9,600, respectively, on December 31. The tax rate is 25%. Assume zero beginning balances in deferred tax accounts. Required a. Determine the increase in income tax payable on December 31. $ 25,200 b. Prepare the income tax expense journal entry on December 31. Date Dec. 31 Account Name Income Tax Expense Deferred Tax Asset Income Tax Payable Deferred Tax Liability To record income tax expense. + # + # Dr. 25,200 14,400 0 0 X Cr. 0 0 30,000 9,600

Step by Step Solution

3.35 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

a Determining the increase in income tax payable on December 31 The increa...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting

Authors: J. David Spiceland, James Sepe, Mark Nelson

6th edition

978-0077328894, 71313974, 9780077395810, 77328892, 9780071313971, 77395816, 978-0077400163

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App