Answered step by step

Verified Expert Solution

Question

1 Approved Answer

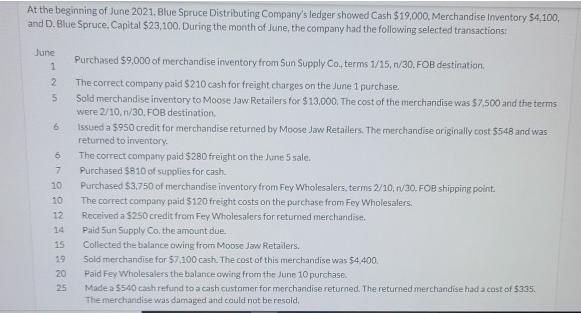

At the beginning of June 2021, Blue Spruce Distributing Company's ledger showed Cash $19,000, Merchandise Inventory $4,100, and D. Blue Spruce, Capital $23,100, During

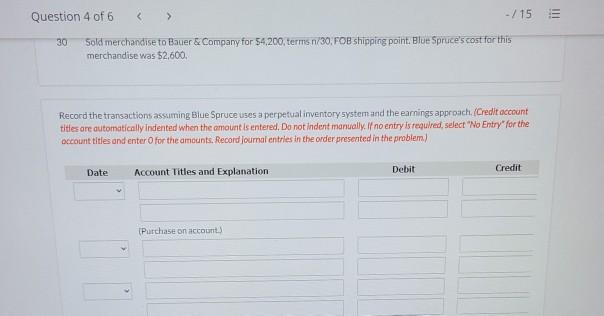

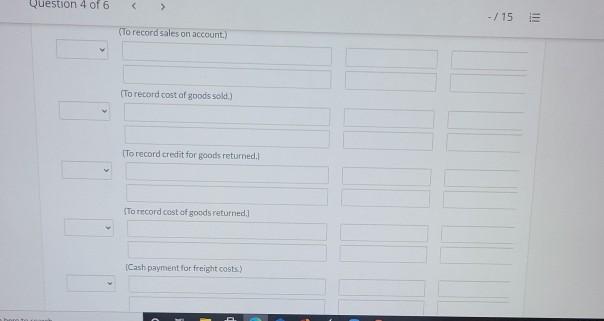

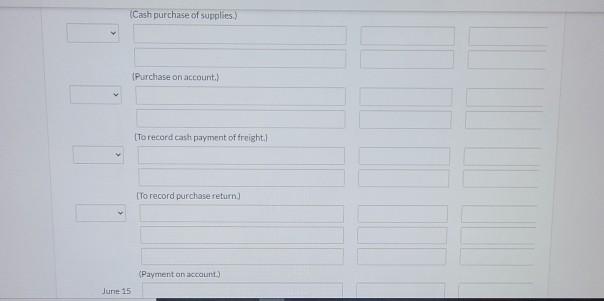

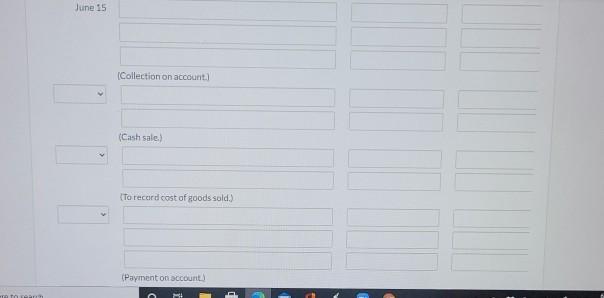

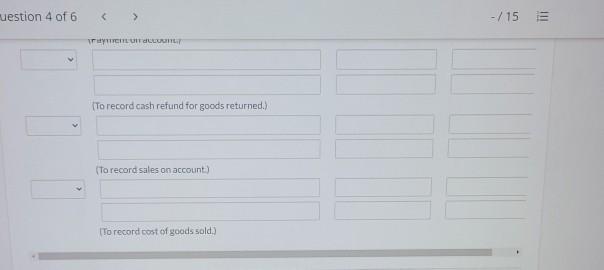

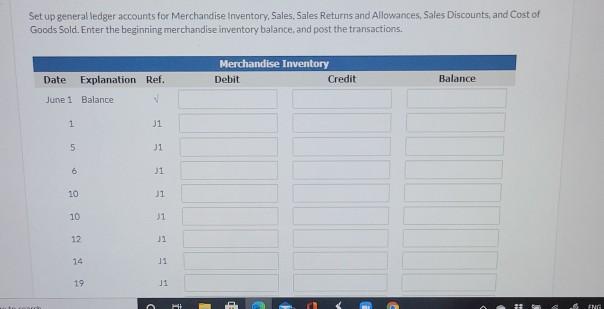

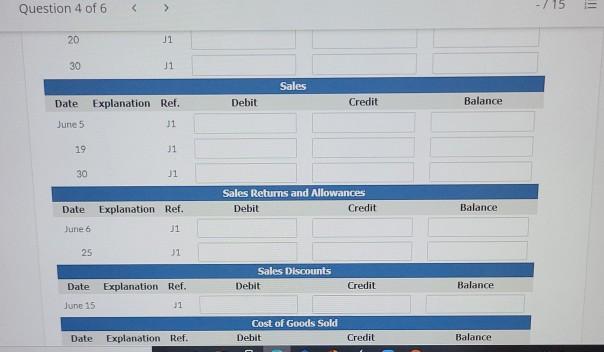

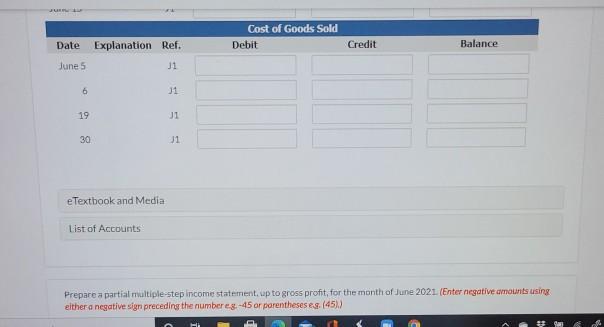

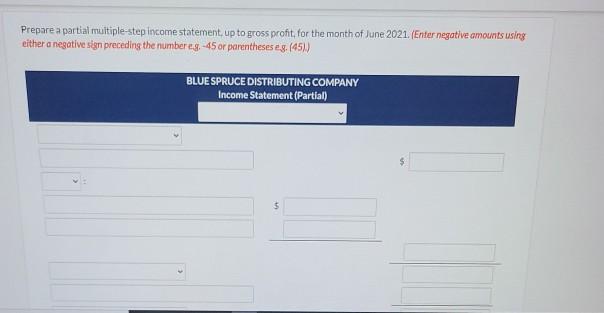

At the beginning of June 2021, Blue Spruce Distributing Company's ledger showed Cash $19,000, Merchandise Inventory $4,100, and D. Blue Spruce, Capital $23,100, During the month of June, the company had the following selected transactions: June Purchased $9.000 of merchandise inventory from Sun Supply Co, terms 1/15, n/30, FOB destination, The correct company paid $210 cash for freight charges on the June 1 purchase. Sold merchandise inventory to Moose Jaw Retailers for $13,000, The cost of the merchandise was $7,500 and the terms were 2/10, n/30. FOB destination. Issued a $950 credit for merchandise returned by Moose Jaw Retailers. The merchandise originally cost $548 and was returned to inventory. The correct company paid $280 freight on the June 5 sale. Purchased $810 of supplies for cash. Purchased $3,750 of merchandise inventory from Fey Wholesalers, terms 2/10, r/30, FOB shipping point. The correct company paid $120 freight costs on the purchase from Fey Wholesalers. Received a $250 credit from Fey Wholesalers for retumed merchandise. Paid Sun Supply Co, the amount due. 7. 10 10 12 14 15 Collected the balance owing from Moose Jaw Retailers. 19 Sold merchandise for $7,100 cash. The cost of this merchandise was $400. Paid Fey Wholesalers the balance owing from the June 10 purchase. Madea S540 cash refund to a cash custamer for merchandise returned. The returned merchandise had a cost of 5335. The mercharidise was damaged and could not beresold. 20 25 Question 4 of 6 -/ 15 E Sold merchandise to Bauer & Company for 54,200, terms n/30, FOB shipping point. Blue Spruce's cost for this merchandise was $2,600, 30 Record the transactions assuming Blue Spruce uses a perpetual inventory system and the earnings approach, (Credit account titles are automatically indented when the amount is entered, Do not indent manually. If no entry is required, select "No Entry" for the occount titles and enter O for the amounts. Record journal entries in the order presented in the problem) Date Account Titles and Explanation Debit Credit (Purchase on account) Question 4 of 6 -/ 15 (To record sales on account.) (To record cost af goods sold.) (To record credit for goods returned.l (To record cost of goods returned.] (Cash payment for freight costs.) (Cash purchase of supplies.) (Purchase on account.) (To record cash payment of freight.) (To record purchase return) (Payment on accaunt.) June 15 June 15 (Collection on account.) (Cash sale.) (To record cost of goods sold.) (Payment on account) ra to rearnh uestion 4 of 6 -/ 15 E (To record cash refund for goods returned.) (To record sales on account.) (To record cost of goods sold.) Set up general ledger accounts for Merchandise Inventory, Sales, Sales Returns and Allowances, Sales Discounts, and Cost of Goods Sold. Enter the beginning merchandise inventory balance, and post the transactions. Merchandise Inventory Date Explanation Ref. Debit Credit Balance June 1 Balance 1 J1 J1 6 10 10 12 14 11 19 ING in Question 4 of 6 -/15 20 30 J1 Sales Date Explanation Ref. Debit Credit Balance June 5 J1 19 1 30 J1 Sales Returns and Allowances Date Explanation Ref. Debit Credit Balance June 6 J1 Sales Discounts Date Explanation Ref. Debit Credit Balance June 15 Cost of Goods Sold Date Explanation Ref. Debit Credit Balance 25 Cost of Goods Sold Date Explanation Ref. Debit Credit Balance June 5 J1 J1 19 J1 30 J1 eTextbook and Media List of Accounts Prepare a partial multiple-step income statement, up to gross profit, for the month of June 2021. (Enter negative amounts using either a negative sign preceding the number eg. -45 or porentheses eg. (45) Prepare a partial muitiple-step income statement, up to gross profit, for the month of June 2021. (Enter negative amounts using either a negative sign preceding the number eg. -45 or parentheses eg. (45) BLUE SPRUCE DISTRIBUTING COMPANY Income Statement (Partial) At the beginning of June 2021, Blue Spruce Distributing Company's ledger showed Cash $19,000, Merchandise Inventory $4,100, and D. Blue Spruce, Capital $23,100, During the month of June, the company had the following selected transactions: June Purchased $9.000 of merchandise inventory from Sun Supply Co, terms 1/15, n/30, FOB destination, The correct company paid $210 cash for freight charges on the June 1 purchase. Sold merchandise inventory to Moose Jaw Retailers for $13,000, The cost of the merchandise was $7,500 and the terms were 2/10, n/30. FOB destination. Issued a $950 credit for merchandise returned by Moose Jaw Retailers. The merchandise originally cost $548 and was returned to inventory. The correct company paid $280 freight on the June 5 sale. Purchased $810 of supplies for cash. Purchased $3,750 of merchandise inventory from Fey Wholesalers, terms 2/10, r/30, FOB shipping point. The correct company paid $120 freight costs on the purchase from Fey Wholesalers. Received a $250 credit from Fey Wholesalers for retumed merchandise. Paid Sun Supply Co, the amount due. 7. 10 10 12 14 15 Collected the balance owing from Moose Jaw Retailers. 19 Sold merchandise for $7,100 cash. The cost of this merchandise was $400. Paid Fey Wholesalers the balance owing from the June 10 purchase. Madea S540 cash refund to a cash custamer for merchandise returned. The returned merchandise had a cost of 5335. The mercharidise was damaged and could not beresold. 20 25 Question 4 of 6 -/ 15 E Sold merchandise to Bauer & Company for 54,200, terms n/30, FOB shipping point. Blue Spruce's cost for this merchandise was $2,600, 30 Record the transactions assuming Blue Spruce uses a perpetual inventory system and the earnings approach, (Credit account titles are automatically indented when the amount is entered, Do not indent manually. If no entry is required, select "No Entry" for the occount titles and enter O for the amounts. Record journal entries in the order presented in the problem) Date Account Titles and Explanation Debit Credit (Purchase on account) Question 4 of 6 -/ 15 (To record sales on account.) (To record cost af goods sold.) (To record credit for goods returned.l (To record cost of goods returned.] (Cash payment for freight costs.) (Cash purchase of supplies.) (Purchase on account.) (To record cash payment of freight.) (To record purchase return) (Payment on accaunt.) June 15 June 15 (Collection on account.) (Cash sale.) (To record cost of goods sold.) (Payment on account) ra to rearnh uestion 4 of 6 -/ 15 E (To record cash refund for goods returned.) (To record sales on account.) (To record cost of goods sold.) Set up general ledger accounts for Merchandise Inventory, Sales, Sales Returns and Allowances, Sales Discounts, and Cost of Goods Sold. Enter the beginning merchandise inventory balance, and post the transactions. Merchandise Inventory Date Explanation Ref. Debit Credit Balance June 1 Balance 1 J1 J1 6 10 10 12 14 11 19 ING in Question 4 of 6 -/15 20 30 J1 Sales Date Explanation Ref. Debit Credit Balance June 5 J1 19 1 30 J1 Sales Returns and Allowances Date Explanation Ref. Debit Credit Balance June 6 J1 Sales Discounts Date Explanation Ref. Debit Credit Balance June 15 Cost of Goods Sold Date Explanation Ref. Debit Credit Balance 25 Cost of Goods Sold Date Explanation Ref. Debit Credit Balance June 5 J1 J1 19 J1 30 J1 eTextbook and Media List of Accounts Prepare a partial multiple-step income statement, up to gross profit, for the month of June 2021. (Enter negative amounts using either a negative sign preceding the number eg. -45 or porentheses eg. (45) Prepare a partial muitiple-step income statement, up to gross profit, for the month of June 2021. (Enter negative amounts using either a negative sign preceding the number eg. -45 or parentheses eg. (45) BLUE SPRUCE DISTRIBUTING COMPANY Income Statement (Partial) At the beginning of June 2021, Blue Spruce Distributing Company's ledger showed Cash $19,000, Merchandise Inventory $4,100, and D. Blue Spruce, Capital $23,100, During the month of June, the company had the following selected transactions: June Purchased $9.000 of merchandise inventory from Sun Supply Co, terms 1/15, n/30, FOB destination, The correct company paid $210 cash for freight charges on the June 1 purchase. Sold merchandise inventory to Moose Jaw Retailers for $13,000, The cost of the merchandise was $7,500 and the terms were 2/10, n/30. FOB destination. Issued a $950 credit for merchandise returned by Moose Jaw Retailers. The merchandise originally cost $548 and was returned to inventory. The correct company paid $280 freight on the June 5 sale. Purchased $810 of supplies for cash. Purchased $3,750 of merchandise inventory from Fey Wholesalers, terms 2/10, r/30, FOB shipping point. The correct company paid $120 freight costs on the purchase from Fey Wholesalers. Received a $250 credit from Fey Wholesalers for retumed merchandise. Paid Sun Supply Co, the amount due. 7. 10 10 12 14 15 Collected the balance owing from Moose Jaw Retailers. 19 Sold merchandise for $7,100 cash. The cost of this merchandise was $400. Paid Fey Wholesalers the balance owing from the June 10 purchase. Madea S540 cash refund to a cash custamer for merchandise returned. The returned merchandise had a cost of 5335. The mercharidise was damaged and could not beresold. 20 25 Question 4 of 6 -/ 15 E Sold merchandise to Bauer & Company for 54,200, terms n/30, FOB shipping point. Blue Spruce's cost for this merchandise was $2,600, 30 Record the transactions assuming Blue Spruce uses a perpetual inventory system and the earnings approach, (Credit account titles are automatically indented when the amount is entered, Do not indent manually. If no entry is required, select "No Entry" for the occount titles and enter O for the amounts. Record journal entries in the order presented in the problem) Date Account Titles and Explanation Debit Credit (Purchase on account) Question 4 of 6 -/ 15 (To record sales on account.) (To record cost af goods sold.) (To record credit for goods returned.l (To record cost of goods returned.] (Cash payment for freight costs.) (Cash purchase of supplies.) (Purchase on account.) (To record cash payment of freight.) (To record purchase return) (Payment on accaunt.) June 15 June 15 (Collection on account.) (Cash sale.) (To record cost of goods sold.) (Payment on account) ra to rearnh uestion 4 of 6 -/ 15 E (To record cash refund for goods returned.) (To record sales on account.) (To record cost of goods sold.) Set up general ledger accounts for Merchandise Inventory, Sales, Sales Returns and Allowances, Sales Discounts, and Cost of Goods Sold. Enter the beginning merchandise inventory balance, and post the transactions. Merchandise Inventory Date Explanation Ref. Debit Credit Balance June 1 Balance 1 J1 J1 6 10 10 12 14 11 19 ING in Question 4 of 6 -/15 20 30 J1 Sales Date Explanation Ref. Debit Credit Balance June 5 J1 19 1 30 J1 Sales Returns and Allowances Date Explanation Ref. Debit Credit Balance June 6 J1 Sales Discounts Date Explanation Ref. Debit Credit Balance June 15 Cost of Goods Sold Date Explanation Ref. Debit Credit Balance 25 Cost of Goods Sold Date Explanation Ref. Debit Credit Balance June 5 J1 J1 19 J1 30 J1 eTextbook and Media List of Accounts Prepare a partial multiple-step income statement, up to gross profit, for the month of June 2021. (Enter negative amounts using either a negative sign preceding the number eg. -45 or porentheses eg. (45) Prepare a partial muitiple-step income statement, up to gross profit, for the month of June 2021. (Enter negative amounts using either a negative sign preceding the number eg. -45 or parentheses eg. (45) BLUE SPRUCE DISTRIBUTING COMPANY Income Statement (Partial) At the beginning of June 2021, Blue Spruce Distributing Company's ledger showed Cash $19,000, Merchandise Inventory $4,100, and D. Blue Spruce, Capital $23,100, During the month of June, the company had the following selected transactions: June Purchased $9.000 of merchandise inventory from Sun Supply Co, terms 1/15, n/30, FOB destination, The correct company paid $210 cash for freight charges on the June 1 purchase. Sold merchandise inventory to Moose Jaw Retailers for $13,000, The cost of the merchandise was $7,500 and the terms were 2/10, n/30. FOB destination. Issued a $950 credit for merchandise returned by Moose Jaw Retailers. The merchandise originally cost $548 and was returned to inventory. The correct company paid $280 freight on the June 5 sale. Purchased $810 of supplies for cash. Purchased $3,750 of merchandise inventory from Fey Wholesalers, terms 2/10, r/30, FOB shipping point. The correct company paid $120 freight costs on the purchase from Fey Wholesalers. Received a $250 credit from Fey Wholesalers for retumed merchandise. Paid Sun Supply Co, the amount due. 7. 10 10 12 14 15 Collected the balance owing from Moose Jaw Retailers. 19 Sold merchandise for $7,100 cash. The cost of this merchandise was $400. Paid Fey Wholesalers the balance owing from the June 10 purchase. Madea S540 cash refund to a cash custamer for merchandise returned. The returned merchandise had a cost of 5335. The mercharidise was damaged and could not beresold. 20 25 Question 4 of 6 -/ 15 E Sold merchandise to Bauer & Company for 54,200, terms n/30, FOB shipping point. Blue Spruce's cost for this merchandise was $2,600, 30 Record the transactions assuming Blue Spruce uses a perpetual inventory system and the earnings approach, (Credit account titles are automatically indented when the amount is entered, Do not indent manually. If no entry is required, select "No Entry" for the occount titles and enter O for the amounts. Record journal entries in the order presented in the problem) Date Account Titles and Explanation Debit Credit (Purchase on account) Question 4 of 6 -/ 15 (To record sales on account.) (To record cost af goods sold.) (To record credit for goods returned.l (To record cost of goods returned.] (Cash payment for freight costs.) (Cash purchase of supplies.) (Purchase on account.) (To record cash payment of freight.) (To record purchase return) (Payment on accaunt.) June 15 June 15 (Collection on account.) (Cash sale.) (To record cost of goods sold.) (Payment on account) ra to rearnh uestion 4 of 6 -/ 15 E (To record cash refund for goods returned.) (To record sales on account.) (To record cost of goods sold.) Set up general ledger accounts for Merchandise Inventory, Sales, Sales Returns and Allowances, Sales Discounts, and Cost of Goods Sold. Enter the beginning merchandise inventory balance, and post the transactions. Merchandise Inventory Date Explanation Ref. Debit Credit Balance June 1 Balance 1 J1 J1 6 10 10 12 14 11 19 ING in Question 4 of 6 -/15 20 30 J1 Sales Date Explanation Ref. Debit Credit Balance June 5 J1 19 1 30 J1 Sales Returns and Allowances Date Explanation Ref. Debit Credit Balance June 6 J1 Sales Discounts Date Explanation Ref. Debit Credit Balance June 15 Cost of Goods Sold Date Explanation Ref. Debit Credit Balance 25 Cost of Goods Sold Date Explanation Ref. Debit Credit Balance June 5 J1 J1 19 J1 30 J1 eTextbook and Media List of Accounts Prepare a partial multiple-step income statement, up to gross profit, for the month of June 2021. (Enter negative amounts using either a negative sign preceding the number eg. -45 or porentheses eg. (45) Prepare a partial muitiple-step income statement, up to gross profit, for the month of June 2021. (Enter negative amounts using either a negative sign preceding the number eg. -45 or parentheses eg. (45) BLUE SPRUCE DISTRIBUTING COMPANY Income Statement (Partial) At the beginning of June 2021, Blue Spruce Distributing Company's ledger showed Cash $19,000, Merchandise Inventory $4,100, and D. Blue Spruce, Capital $23,100, During the month of June, the company had the following selected transactions: June Purchased $9.000 of merchandise inventory from Sun Supply Co, terms 1/15, n/30, FOB destination, The correct company paid $210 cash for freight charges on the June 1 purchase. Sold merchandise inventory to Moose Jaw Retailers for $13,000, The cost of the merchandise was $7,500 and the terms were 2/10, n/30. FOB destination. Issued a $950 credit for merchandise returned by Moose Jaw Retailers. The merchandise originally cost $548 and was returned to inventory. The correct company paid $280 freight on the June 5 sale. Purchased $810 of supplies for cash. Purchased $3,750 of merchandise inventory from Fey Wholesalers, terms 2/10, r/30, FOB shipping point. The correct company paid $120 freight costs on the purchase from Fey Wholesalers. Received a $250 credit from Fey Wholesalers for retumed merchandise. Paid Sun Supply Co, the amount due. 7. 10 10 12 14 15 Collected the balance owing from Moose Jaw Retailers. 19 Sold merchandise for $7,100 cash. The cost of this merchandise was $400. Paid Fey Wholesalers the balance owing from the June 10 purchase. Madea S540 cash refund to a cash custamer for merchandise returned. The returned merchandise had a cost of 5335. The mercharidise was damaged and could not beresold. 20 25 Question 4 of 6 -/ 15 E Sold merchandise to Bauer & Company for 54,200, terms n/30, FOB shipping point. Blue Spruce's cost for this merchandise was $2,600, 30 Record the transactions assuming Blue Spruce uses a perpetual inventory system and the earnings approach, (Credit account titles are automatically indented when the amount is entered, Do not indent manually. If no entry is required, select "No Entry" for the occount titles and enter O for the amounts. Record journal entries in the order presented in the problem) Date Account Titles and Explanation Debit Credit (Purchase on account) Question 4 of 6 -/ 15 (To record sales on account.) (To record cost af goods sold.) (To record credit for goods returned.l (To record cost of goods returned.] (Cash payment for freight costs.) (Cash purchase of supplies.) (Purchase on account.) (To record cash payment of freight.) (To record purchase return) (Payment on accaunt.) June 15 June 15 (Collection on account.) (Cash sale.) (To record cost of goods sold.) (Payment on account) ra to rearnh uestion 4 of 6 -/ 15 E (To record cash refund for goods returned.) (To record sales on account.) (To record cost of goods sold.) Set up general ledger accounts for Merchandise Inventory, Sales, Sales Returns and Allowances, Sales Discounts, and Cost of Goods Sold. Enter the beginning merchandise inventory balance, and post the transactions. Merchandise Inventory Date Explanation Ref. Debit Credit Balance June 1 Balance 1 J1 J1 6 10 10 12 14 11 19 ING in Question 4 of 6 -/15 20 30 J1 Sales Date Explanation Ref. Debit Credit Balance June 5 J1 19 1 30 J1 Sales Returns and Allowances Date Explanation Ref. Debit Credit Balance June 6 J1 Sales Discounts Date Explanation Ref. Debit Credit Balance June 15 Cost of Goods Sold Date Explanation Ref. Debit Credit Balance 25 Cost of Goods Sold Date Explanation Ref. Debit Credit Balance June 5 J1 J1 19 J1 30 J1 eTextbook and Media List of Accounts Prepare a partial multiple-step income statement, up to gross profit, for the month of June 2021. (Enter negative amounts using either a negative sign preceding the number eg. -45 or porentheses eg. (45) Prepare a partial muitiple-step income statement, up to gross profit, for the month of June 2021. (Enter negative amounts using either a negative sign preceding the number eg. -45 or parentheses eg. (45) BLUE SPRUCE DISTRIBUTING COMPANY Income Statement (Partial)

Step by Step Solution

★★★★★

3.58 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Blue Spruce Distributing company Journal entries June 2017 Date Account Titles and explanations Debit Credit Jun01 Inventory 9000 Accounts Payable 900...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started