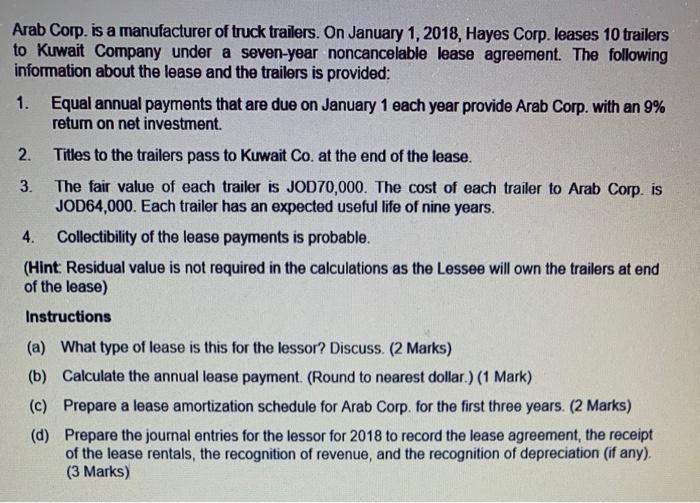

Arab Corp. is a manufacturer of truck trailers. On January 1, 2018, Hayes Corp.leases 10 trailers to Kuwait Company under a seven-year noncancelable lease agreement. The following information about the lease and the trailers is provided: 1. Equal annual payments that are due on January 1 each year provide Arab Corp. with an 9% return on net investment. 2. Titles to the trailers pass to Kuwait Co. at the end of the lease. 3. The fair value of each trailer is JOD 70,000. The cost of each trailer to Arab Corp. is JOD64,000. Each trailer has an expected useful life of nine years. 4. Collectibility of the lease payments is probable. (Hint: Residual value is not required in the calculations as the Lessee will own the trailers at end of the lease) Instructions (a) What type of lease is this for the lessor? Discuss. (2 Marks) (b) Calculate the annual lease payment. (Round to nearest dollar.) (1 mark) (c) Prepare a lease amortization schedule for Arab Corp. for the first three years. (2 Marks) (d) Prepare the journal entries for the lessor for 2018 to record the lease agreement, the receipt of the lease rentals, the recognition of revenue, and the recognition of depreciation (if any). (3 Marks) Arab Corp. is a manufacturer of truck trailers. On January 1, 2018, Hayes Corp.leases 10 trailers to Kuwait Company under a seven-year noncancelable lease agreement. The following information about the lease and the trailers is provided: 1. Equal annual payments that are due on January 1 each year provide Arab Corp. with an 9% return on net investment. 2. Titles to the trailers pass to Kuwait Co. at the end of the lease. 3. The fair value of each trailer is JOD 70,000. The cost of each trailer to Arab Corp. is JOD64,000. Each trailer has an expected useful life of nine years. 4. Collectibility of the lease payments is probable. (Hint: Residual value is not required in the calculations as the Lessee will own the trailers at end of the lease) Instructions (a) What type of lease is this for the lessor? Discuss. (2 Marks) (b) Calculate the annual lease payment. (Round to nearest dollar.) (1 mark) (c) Prepare a lease amortization schedule for Arab Corp. for the first three years. (2 Marks) (d) Prepare the journal entries for the lessor for 2018 to record the lease agreement, the receipt of the lease rentals, the recognition of revenue, and the recognition of depreciation (if any)