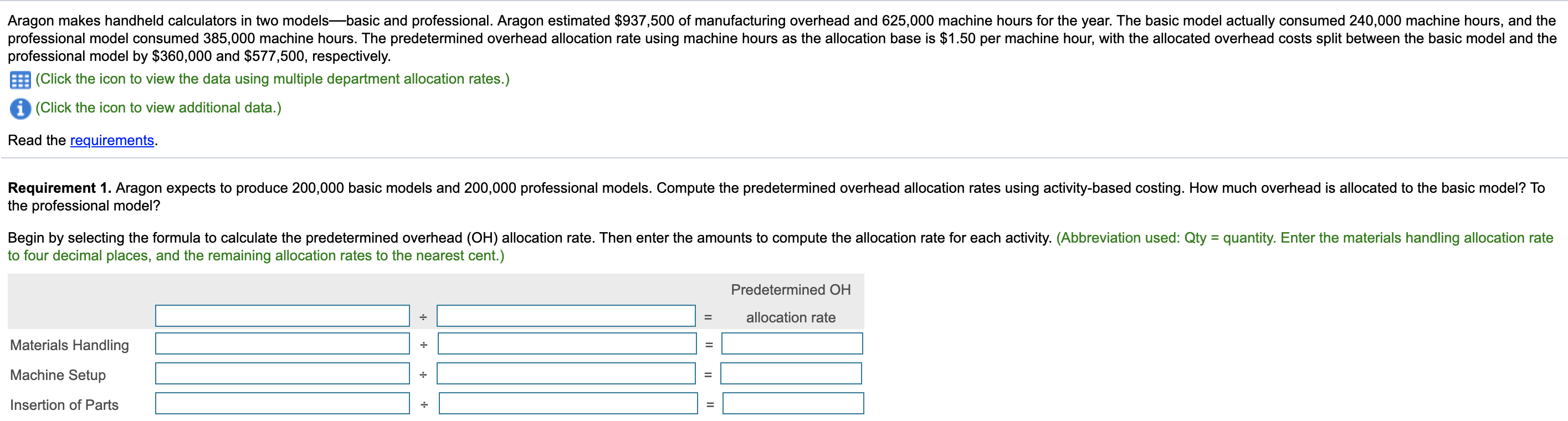

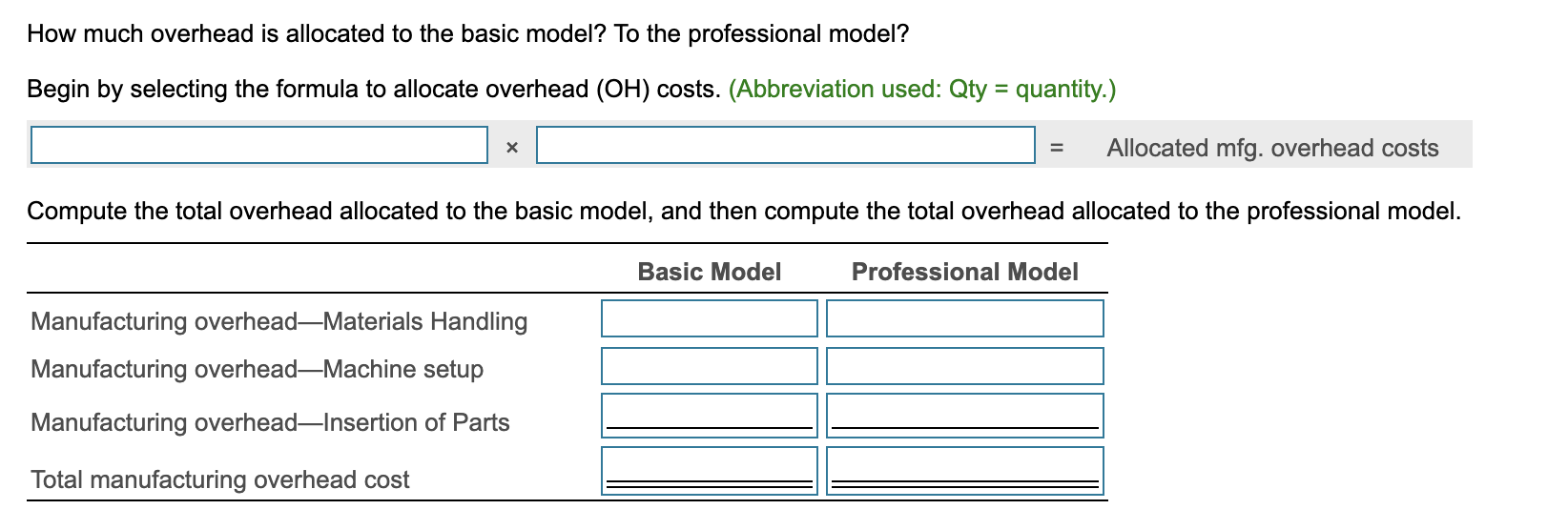

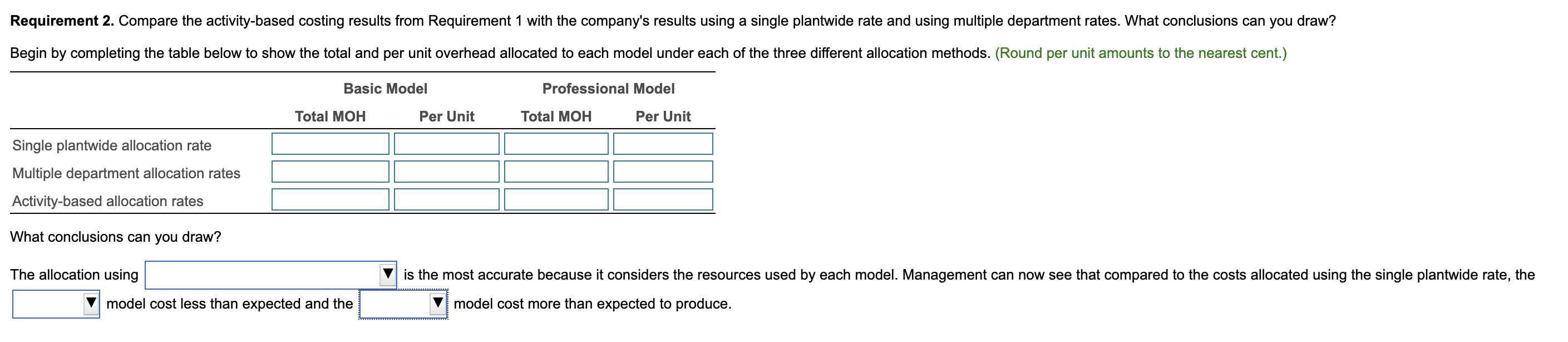

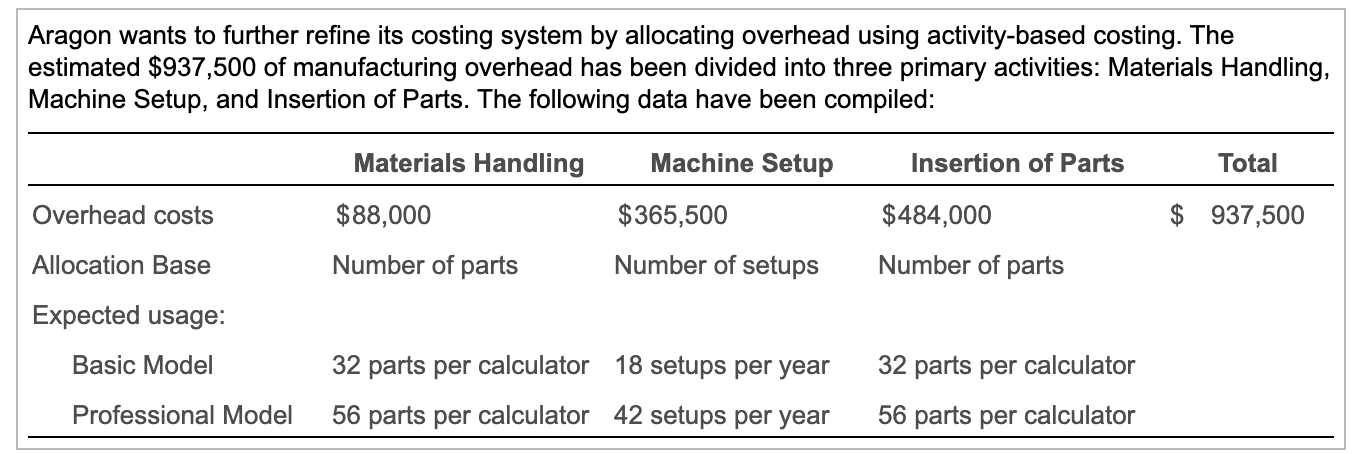

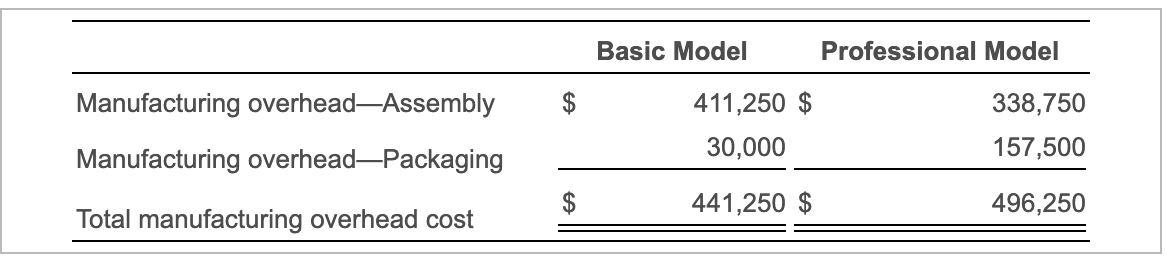

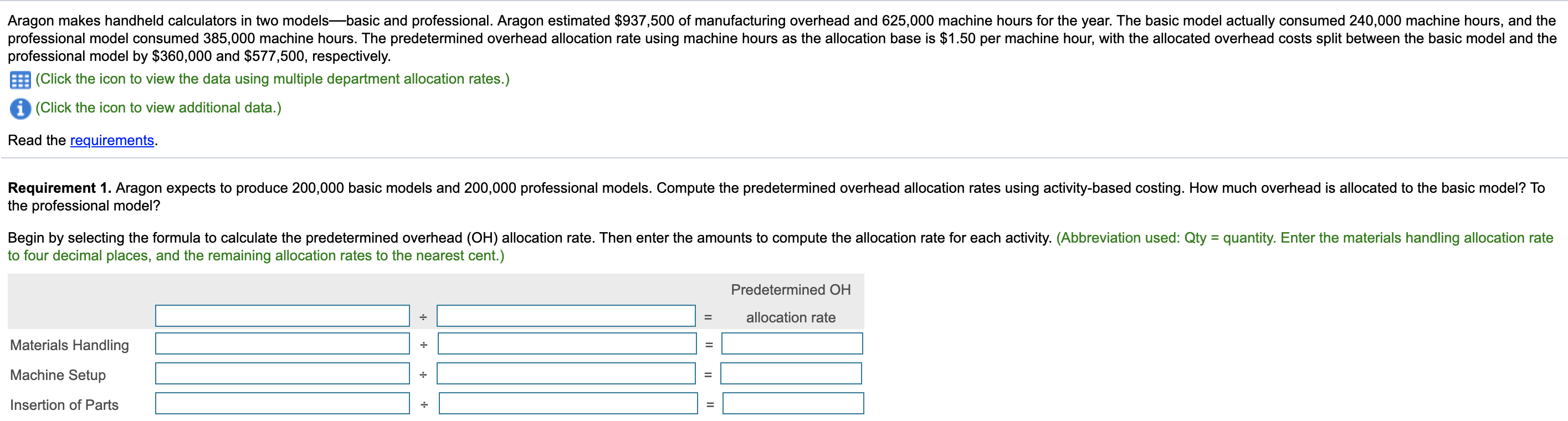

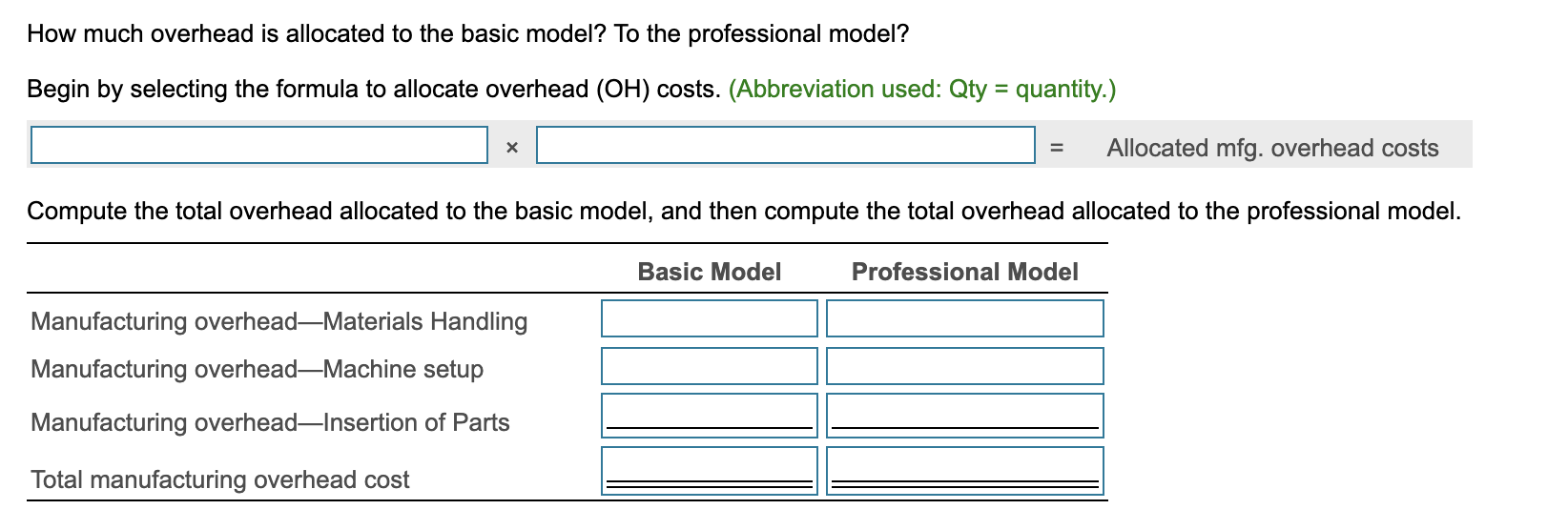

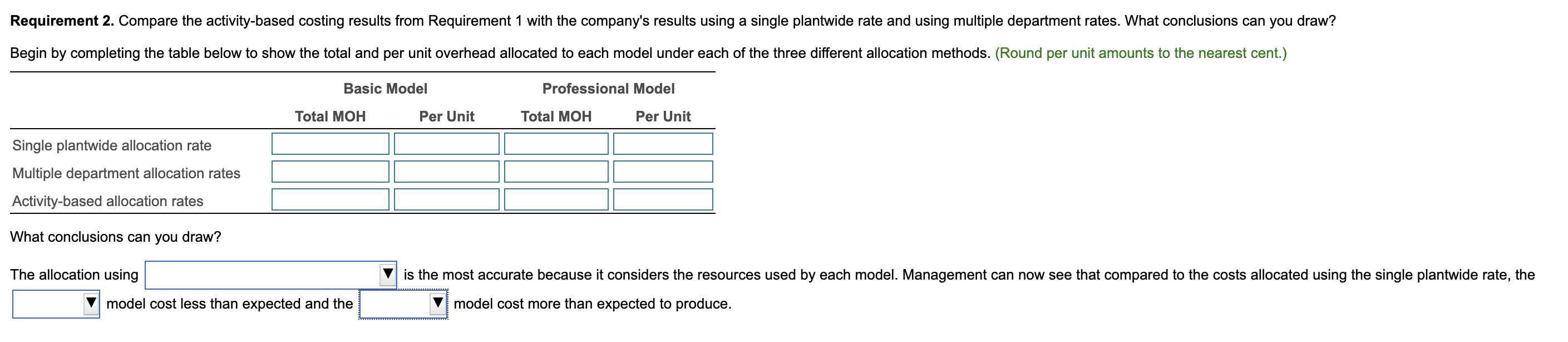

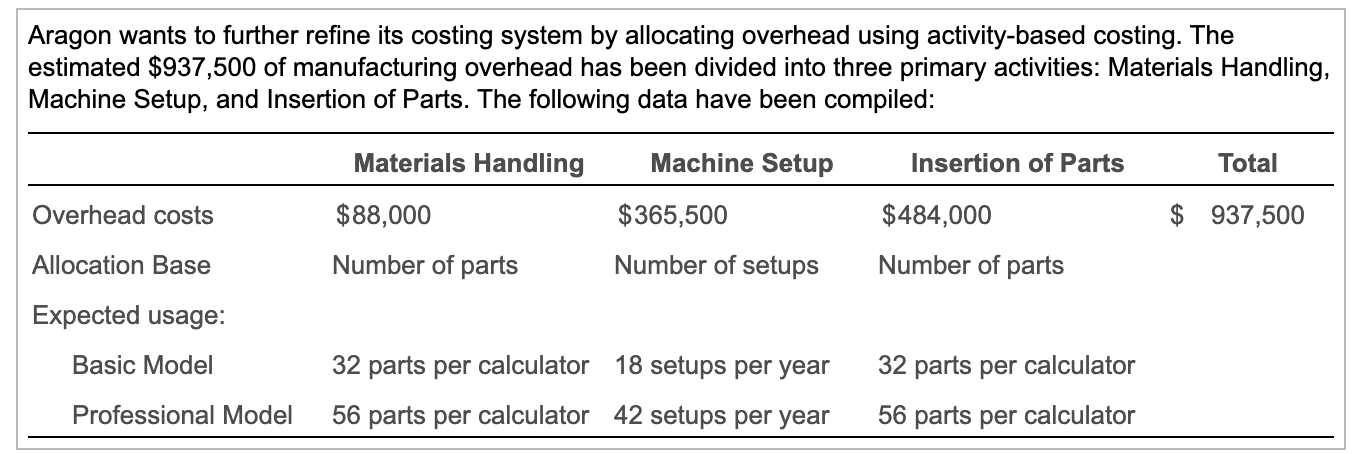

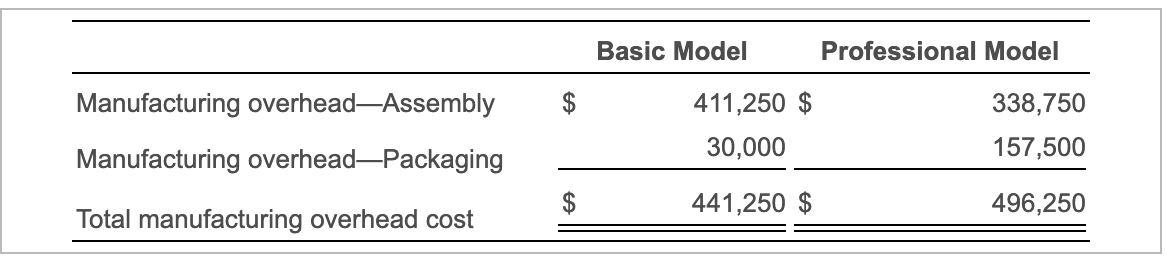

Aragon makes handheld calculators in two modelsbasic and professional. Aragon estimated $937,500 of manufacturing overhead and 625,000 machine hours for the year. The basic model actually consumed 240,000 machine hours, and the professional model consumed 385,000 machine hours. The predetermined overhead allocation rate using machine hours as the allocation base is $1.50 per machine hour, with the allocated overhead costs split between the basic model and the professional model by $360,000 and $577,500, respectively. (Click the icon to view the data using multiple department allocation rates.) (Click the icon to view additional data.) Read the requirements. Requirement 1. Aragon expects to produce 200,000 basic models and 200,000 professional models. Compute the predetermined overhead allocation rates using activity-based costing. How much overhead is allocated to the basic model? To the professional model? Begin by selecting the formula to calculate the predetermined overhead (OH) allocation rate. Then enter the amounts to compute the allocation rate for each activity. (Abbreviation used: Qty = quantity. Enter the materials handling allocation rate to four decimal places, and the remaining allocation rates to the nearest cent.) Predetermined OH allocation rate = = Materials Handling Machine Setup Insertion of Parts Il How much overhead is allocated to the basic model? To the professional model? Begin by selecting the formula to allocate overhead (OH) costs. (Abbreviation used: Qty = quantity.) Allocated mfg. overhead costs Compute the total overhead allocated to the basic model, and then compute the total overhead allocated to the professional model. Basic Model Professional Model Manufacturing overhead-Materials Handling Manufacturing overhead-Machine setup Manufacturing overheadInsertion of Parts Total manufacturing overhead cost Requirement 2. Compare the activity-based costing results from Requirement 1 with the company's results using a single plantwide rate and using multiple department rates. What conclusions can you draw? Begin by completing the table below to show the total and per unit overhead allocated to each model under each of the three different allocation methods. (Round per unit amounts to the nearest cent.) Basic Model Professional Model Total MOH Per Unit Total MOH Per Unit Single plantwide allocation rate Multiple department allocation rates Activity-based allocation rates What conclusions can you draw? The allocation using is the most accurate because it considers the resources used by each model. Management can now see that compared to the costs allocated using the single plantwide rate, the model cost less than expected and the model cost more than expected to produce. Aragon wants to further refine its costing system by allocating overhead using activity-based costing. The estimated $937,500 of manufacturing overhead has been divided into three primary activities: Materials Handling, Machine Setup, and Insertion of Parts. The following data have been compiled: Materials Handling Machine Setup Insertion of Parts Total Overhead costs $88,000 $365,500 $ 937,500 $484,000 Number of parts Allocation Base Number of parts Number of setups Expected usage: Basic Model 32 parts per calculator 18 setups per year 56 parts per calculator 42 setups per year 32 parts per calculator 56 parts per calculator Professional Model Basic Model Professional Model Manufacturing overhead-Assembly 411,250 $ 30,000 338,750 157,500 Manufacturing overhead-Packaging $ 441,250 $ 496,250 Total manufacturing overhead cost