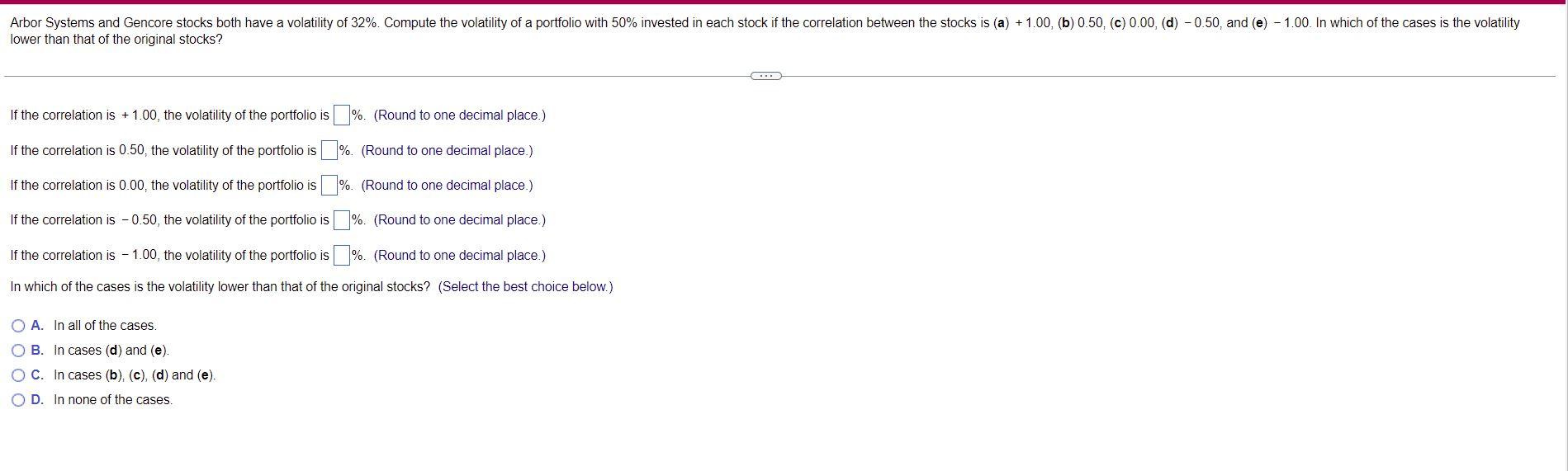

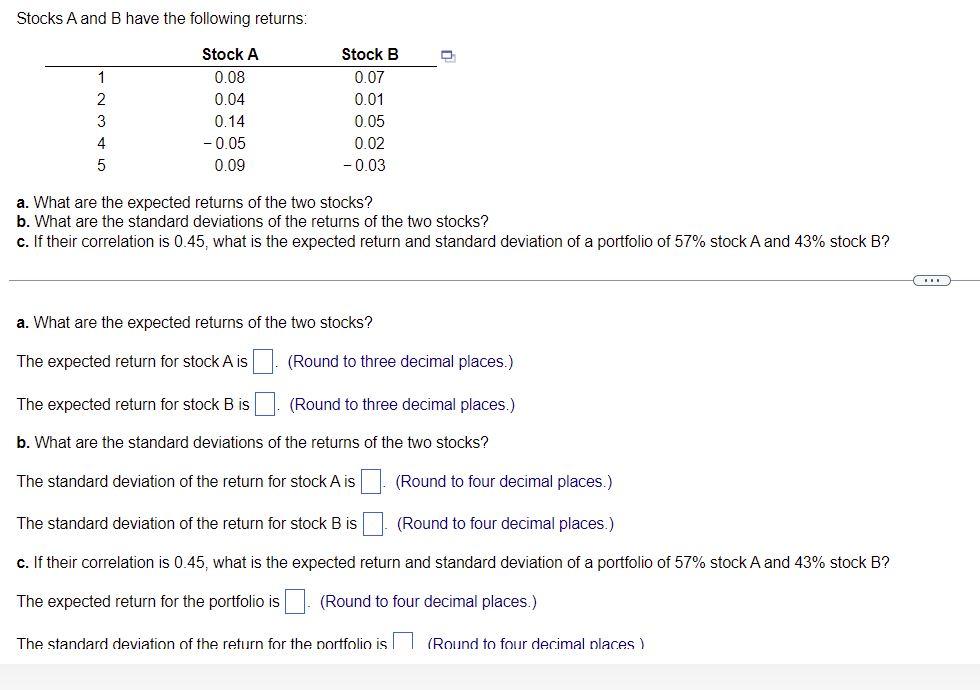

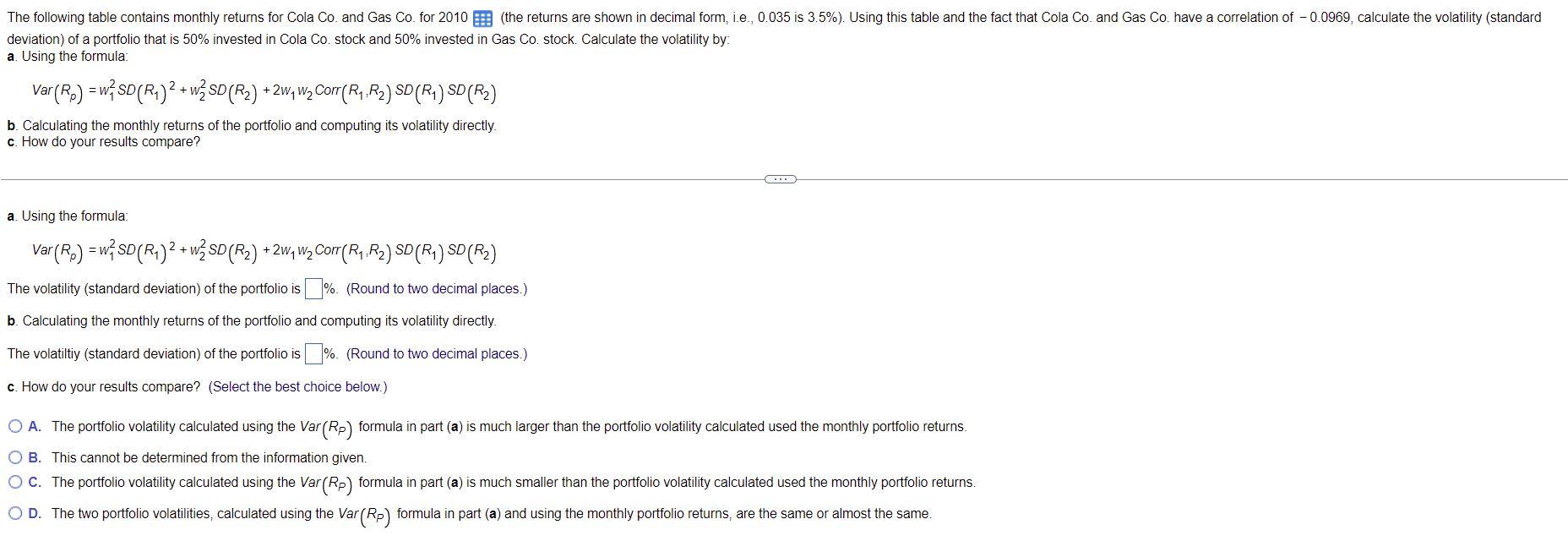

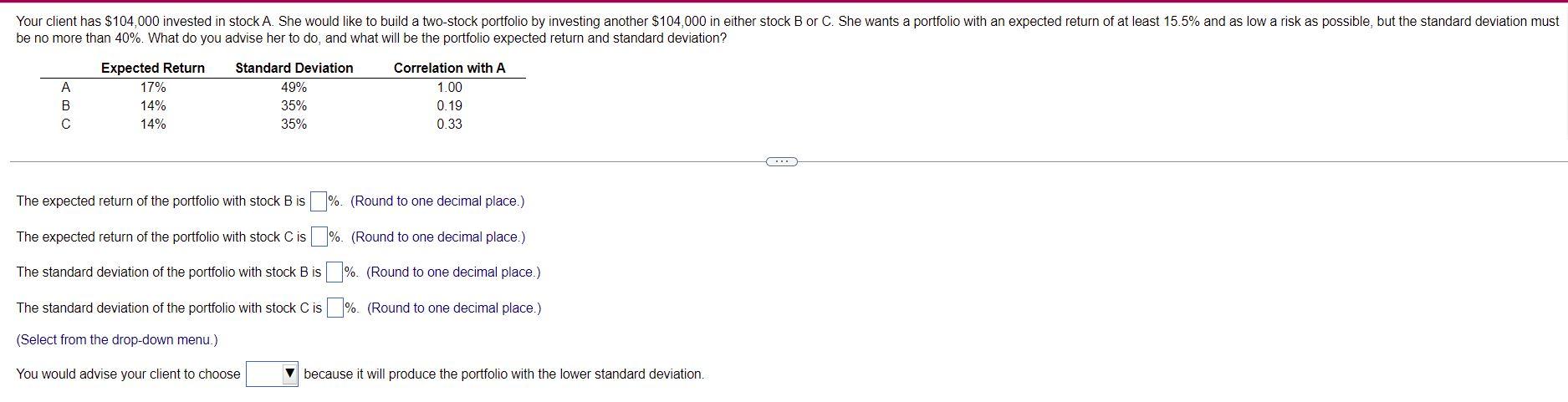

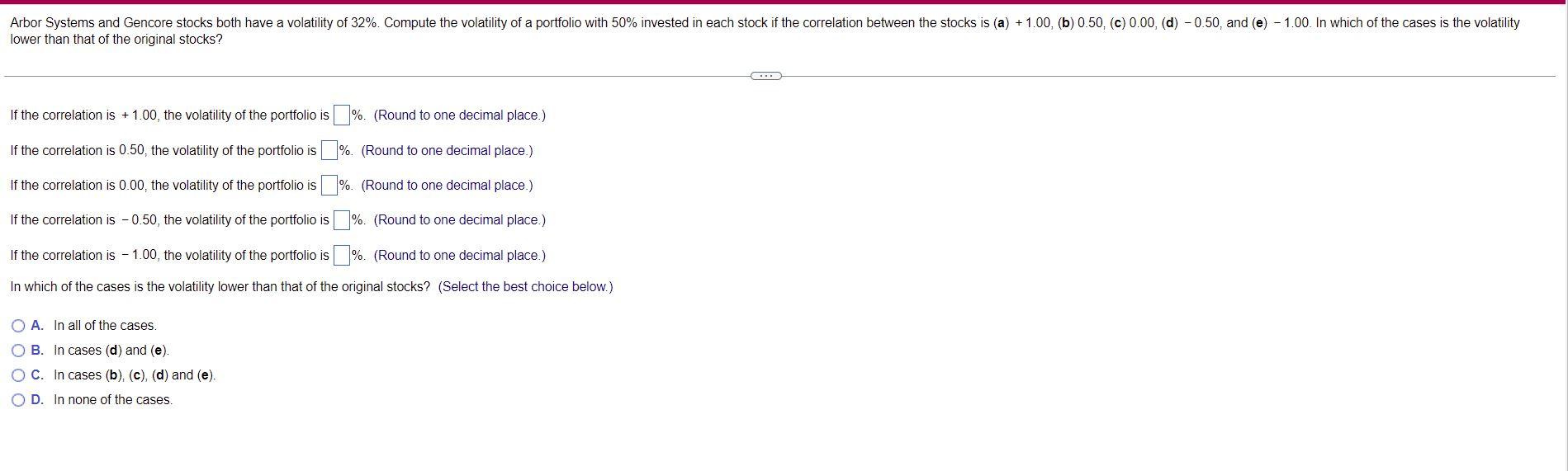

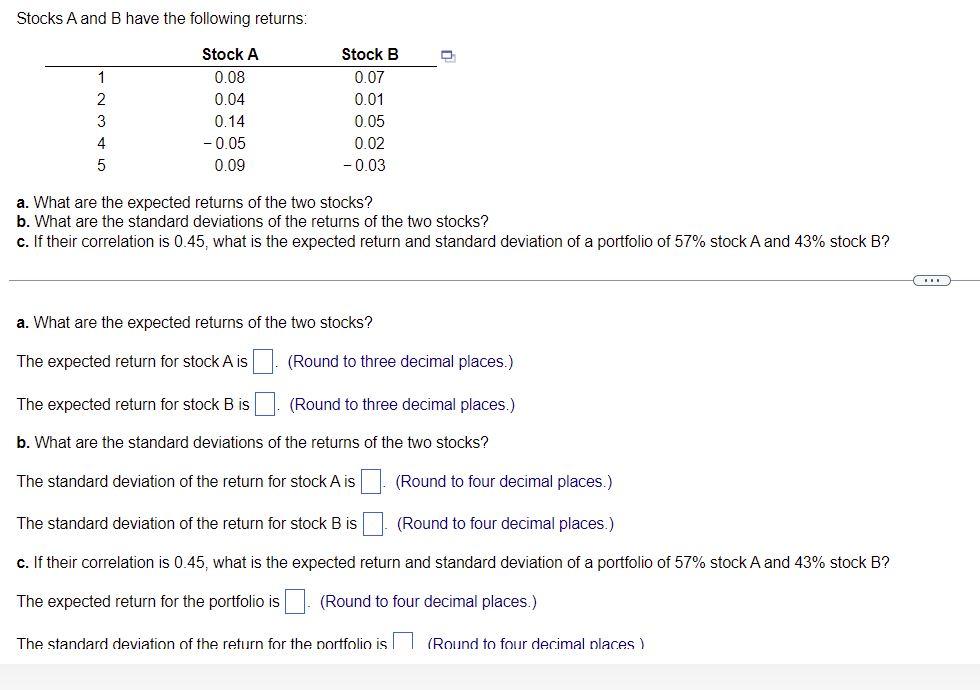

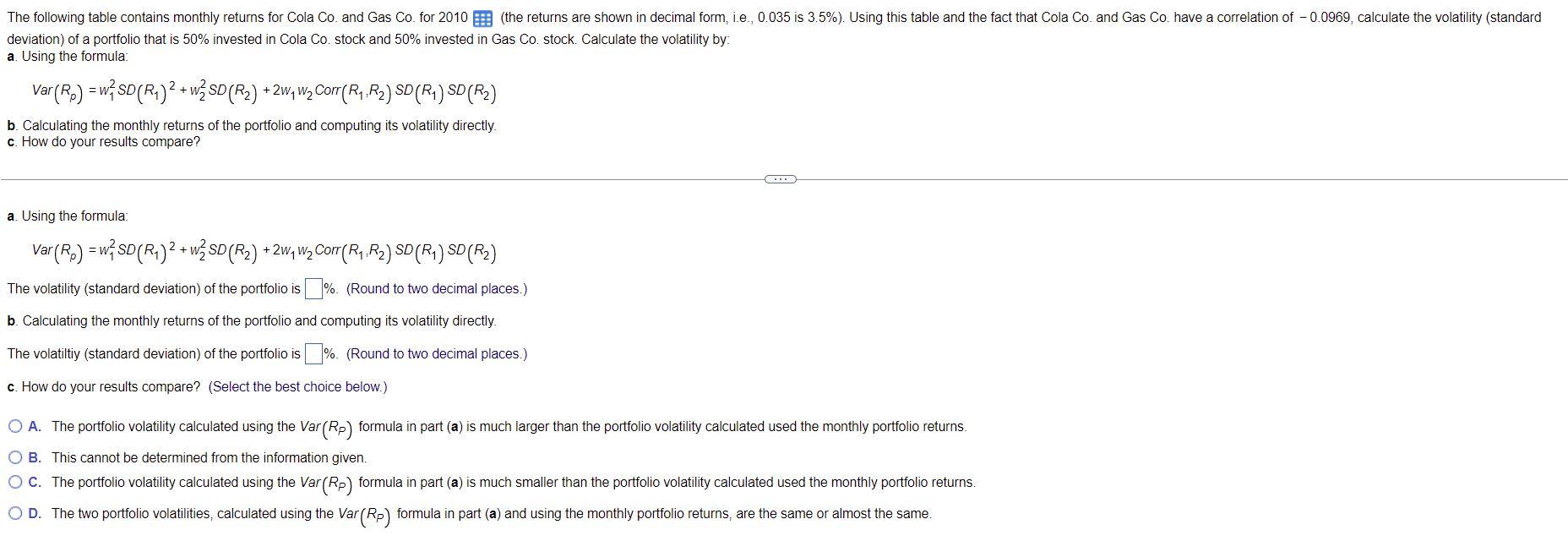

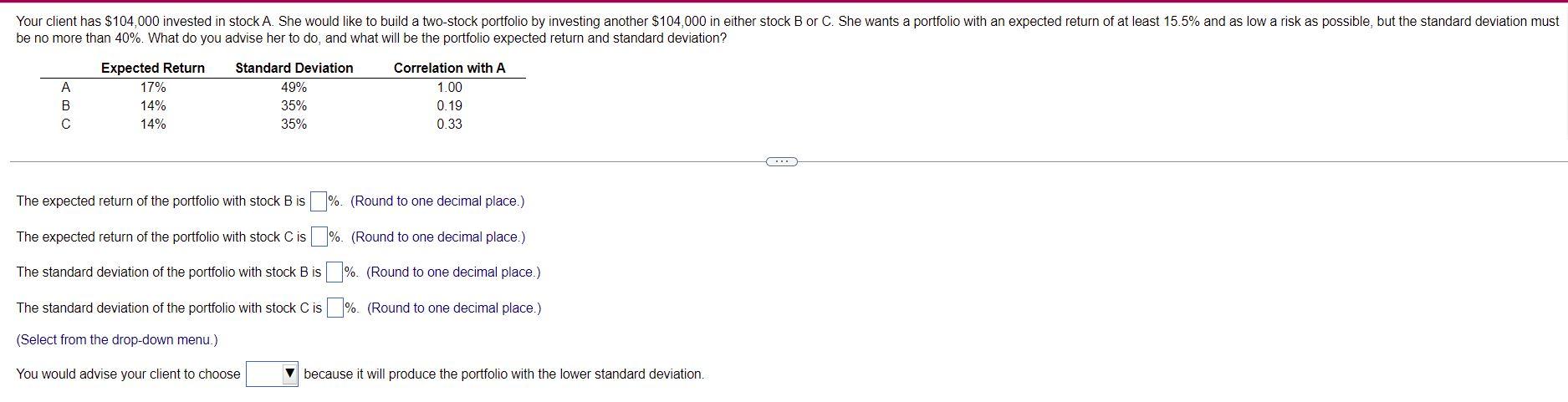

Arbor Systems and Gencore stocks both have a volatility of 32%. Compute the volatility of a portfolio with 50% invested in each stock if the correlation between the stocks is (a) +1.00, (b) 0.50, (C) 0.00,(d) -0.50, and (e) - 1.00. In which of the cases is the volatility lower than that of the original stocks? ... If the correlation is +1.00, the volatility of the portfolio is %. (Round to one decimal place.) If the correlation is 0.50, the volatility of the portfolio is 1%. (Round to one decimal place.) If the correlation is 0.00, the volatility of the portfolio is %. (Round to one decimal place.) If the correlation is - 0.50, the volatility of the portfolio is %. (Round to one decimal place.) If the correlation is - 1.00, the volatility of the portfolio is ^%. (Round to one decimal place.) In which of the cases is the volatility lower than that of the original stocks? (Select the best choice below.) O A. In all of the cases. OB. In cases (d) and (e). OC. In cases (b), (c), (d) and (e). OD. In none of the cases. Stocks A and B have the following returns: Stock B 0.07 0.01 1 2 3 4 Stock A 0.08 0.04 0.14 -0.05 0.09 0.05 0.02 -0.03 5 a. What are the expected returns of the two stocks? b. What are the standard deviations of the returns of the two stocks? c. If their correlation is 0.45, what is the expected return and standard deviation of a portfolio of 57% stock A and 43% stock B? IR a. What are the expected returns of the two stocks? The expected return for stock A is (Round to three decimal places.) The expected return for stock B is (Round to three decimal places.) b. What are the standard deviations of the returns of the two stocks? The standard deviation of the return for stock A is (Round to four decimal places.) The standard deviation of the return for stock B is (Round to four decimal places.) c. If their correlation is 0.45, what is the expected return and standard deviation of a portfolio of 57% stock A and 43% stock B? The expected return for the portfolio is . (Round to four decimal places.) The standard deviation of the return for the portfolio is (Round to four decimal places) The following table contains monthly returns for Cola Co. and Gas Co. for 2010 (the returns are shown in decimal form, i.e., 0.035 is 3.5%). Using this table and the fact that Cola Co. and Gas Co. have a correlation of - 0.0969, calculate the volatility (standard deviation) of a portfolio that is 50% invested in Cola Co. stock and 50% invested in Gas Co. stock. Calculate the volatility by: a. Using the formula Var (Ro) = w} SD (R1)2 + w SD (R2) +2W, W2 Corr(R1,R2) SD (R1) SD (R2) b. Calculating the monthly returns of the portfolio and computing its volatility directly. c. How do your results compare? ... a. Using the formula: Var (Ro) = w;SD (RA)2 + w SD (R2) +2W, W2 Corr (R1,R2) SD (R1) SD (R2) + The volatility (standard deviation) of the portfolio is %. (Round to two decimal places.) b. Calculating the monthly returns of the portfolio and computing its volatility directly The volatiltiy (standard deviation) of the portfolio is %. (Round to two decimal places.) c. How do your results compare? (Select the best choice below.) O A. The portfolio volatility calculated using the Var(Rp) formula in part (a) is much larger than the portfolio volatility calculated used the monthly portfolio returns. OB. This cannot be determined from the information given. O C. The portfolio volatility calculated using the Var(Rp) formula in part (a) is much smaller than the portfolio volatility calculated used the monthly portfolio returns. OD. The two portfolio volatilities, calculated using the Var(Rp) formula in part (a) and using the monthly portfolio returns, are the same or almost the same. Your client has $104,000 invested in stock A. She would like to build a two-stock portfolio by investing another $104,000 in either stock B or C. She wants a portfolio with an expected return of at least 15.5% and as low a risk as possible, but the standard deviation must be no more than 40%. What do you advise her to do, and what will be the portfolio expected return and standard deviation? A B Expected Return 17% 14% 14% Standard Deviation 49% 35% 35% Correlation with A 1.00 0.19 0.33 ... The expected return of the portfolio with stock B is %. (Round to one decimal place.) The expected return of the portfolio with stock C is %. (Round to one decimal place.) The standard deviation of the portfolio with stock B is %. (Round to one decimal place.) The standard deviation of the portfolio with stock C is % (Round to one decimal place.) (Select from the drop-down menu.) You would advise your client to choose because it will produce the portfolio with the lower standard deviation