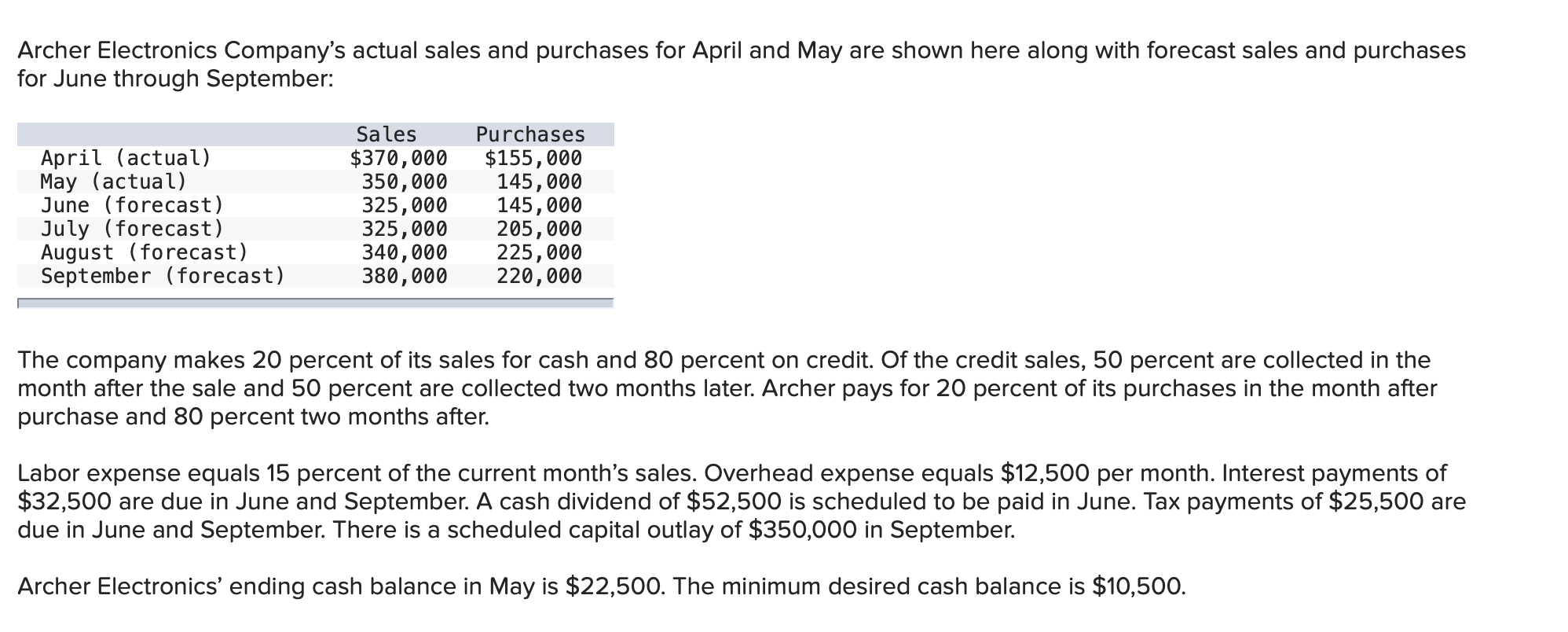

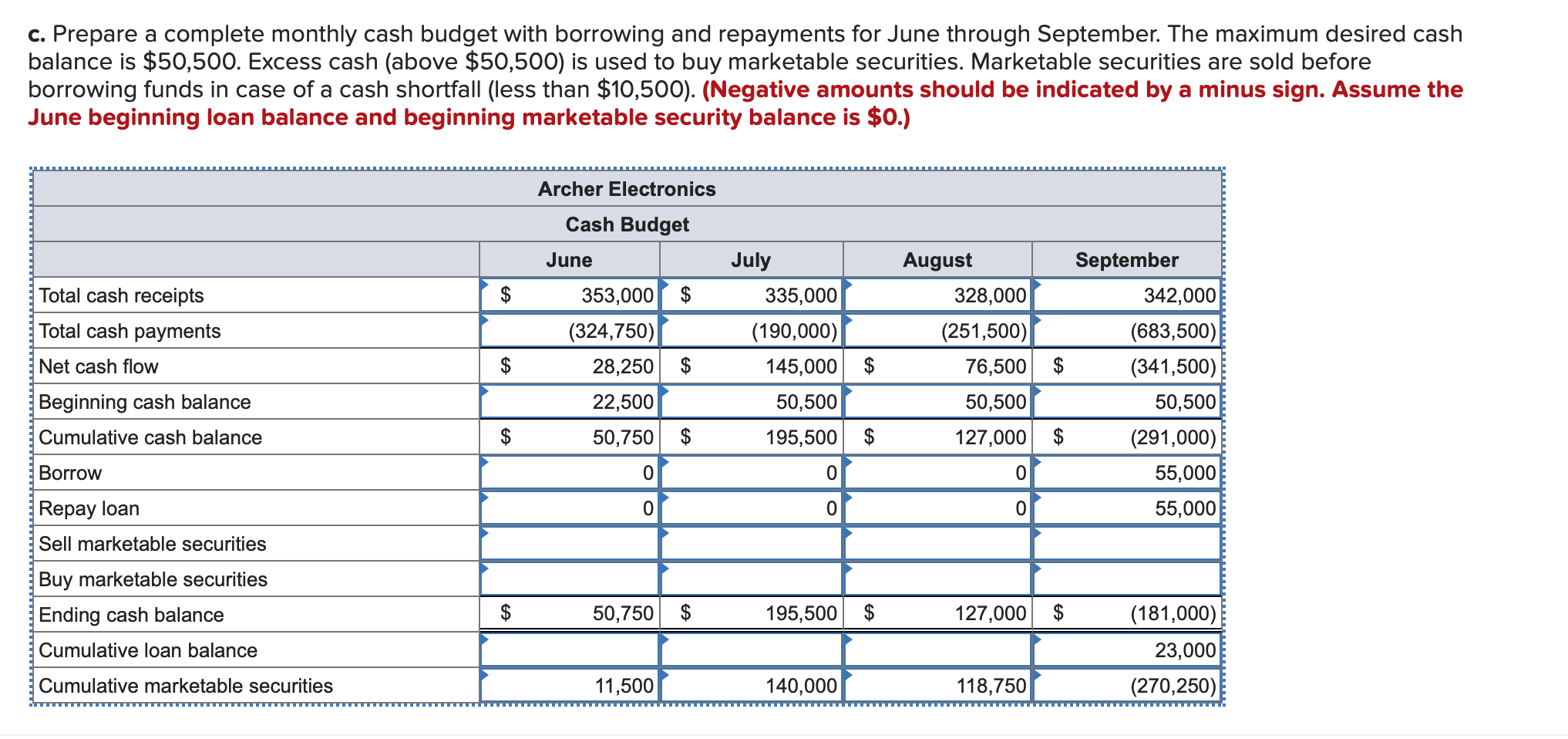

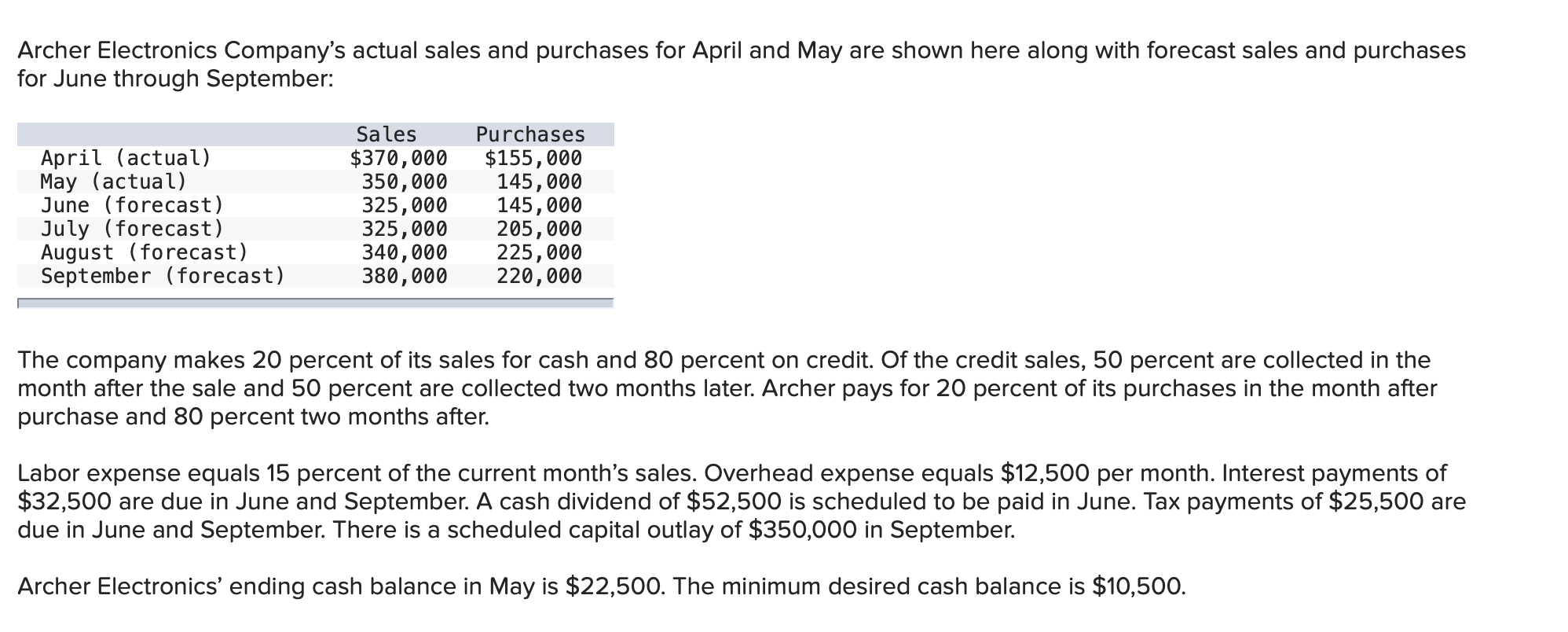

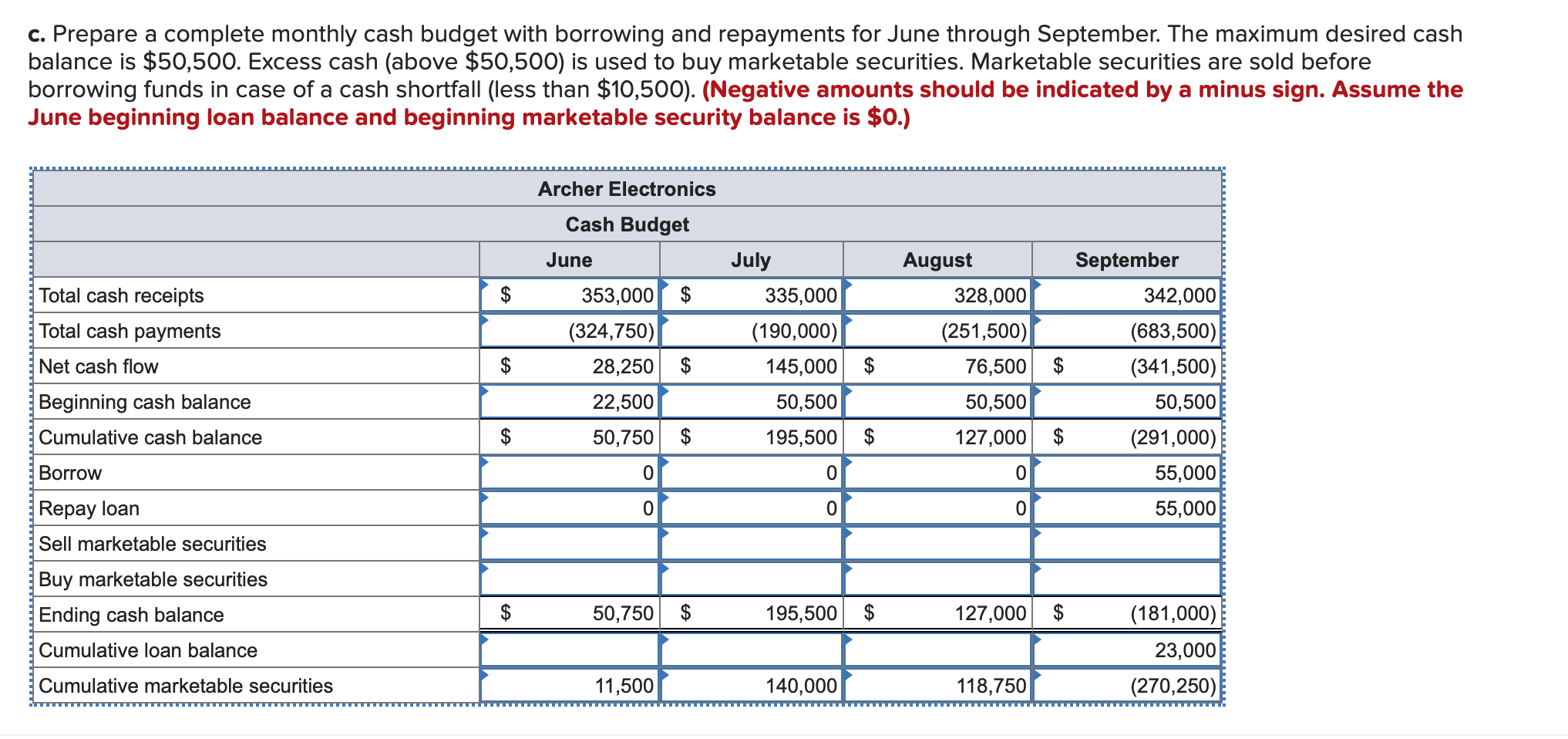

Archer Electronics Company's actual sales and purchases for April and May are shown here along with forecast sales and purchases for June through September: April (actual) May (actual) June (forecast) July (forecast) August (forecast) September (forecast) Sales $370,000 350,000 325,000 325,000 340,000 380,000 Purchases $155,000 145,000 145,000 205,000 225,000 220,000 The company makes 20 percent of its sales for cash and 80 percent on credit. Of the credit sales, 50 percent are collected in the month after the sale and 50 percent are collected two months later. Archer pays for 20 percent of its purchases in the month after purchase and 80 percent two months after. Labor expense equals 15 percent of the current month's sales. Overhead expense equals $12,500 per month. Interest payments of $32,500 are due in June and September. A cash dividend of $52,500 is scheduled to be paid in June. Tax payments of $25,500 are due in June and September. There is a scheduled capital outlay of $350,000 in September. Archer Electronics' ending cash balance in May is $22,500. The minimum desired cash balance is $10,500. c. Prepare a complete monthly cash budget with borrowing and repayments for June through September. The maximum desired cash balance is $50,500. Excess cash (above $50,500) is used to buy marketable securities. Marketable securities are sold before borrowing funds in case of a cash shortfall (less than $10,500). (Negative amounts should be indicated by a minus sign. Assume the June beginning loan balance and beginning marketable security balance is $0.) Archer Electronics Cash Budget June $ Total cash receipts Total cash payments July 335,000 (190,000) 145,000 $ 50,500 195,500 $ August 328,000 (251,500) 76,500 $ 50,500 127,000 $ 353,000 $ (324,750) 28,250 $ 22,500 50,750 $ Net cash flow $ September 342,000 (683,500) (341,500) 50,500 (291,000) 55,000 55,000 Beginning cash balance Cumulative cash balance $ Borrow 0 0 0 Repay loan 0 0 0 Sell marketable securities Buy marketable securities Ending cash balance $ 50,750 $ 195,500 $ 127,000 $ Cumulative loan balance (181,000) 23,000 (270,250) Cumulative marketable securities 11,500 140,000 118,750