Answered step by step

Verified Expert Solution

Question

1 Approved Answer

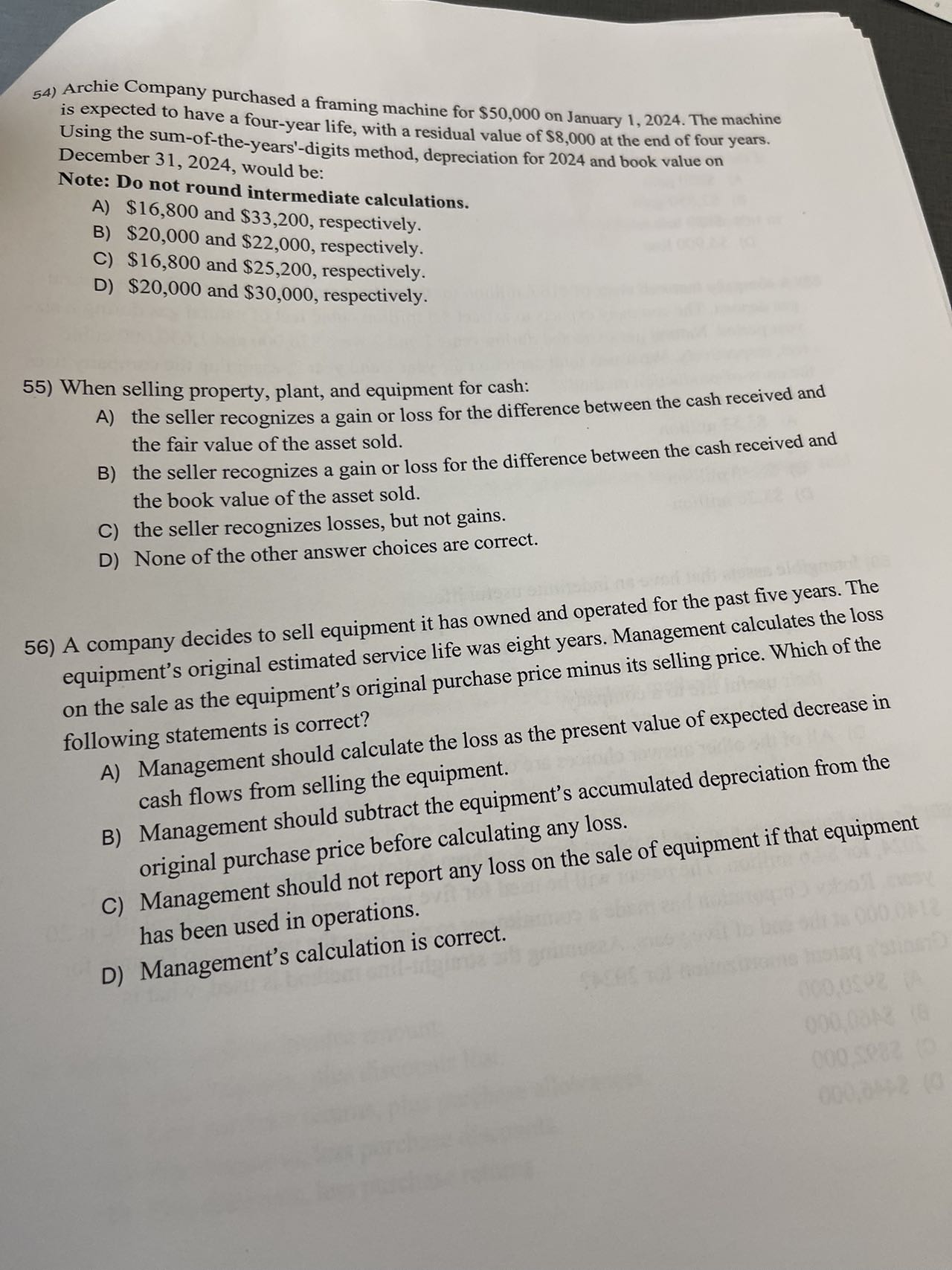

Archie Company purchased a framing machine for $ 5 0 , 0 0 0 on January 1 , 2 0 2 4 . The machine

Archie Company purchased a framing machine for $ on January The machine

is expected to have a fouryear life, with a residual value of $ at the end of four years.

Using the sumoftheyears'digits method, depreciation for and book value on

December would be:

Note: Do not round intermediate calculations.

A $ and $ respectively.

B $ and $ respectively.

C $ and $ respectively.

D $ and $ respectively.

When selling property, plant, and equipment for cash:

A the seller recognizes a gain or loss for the difference between the cash received and

the fair value of the asset sold.

B the seller recognizes a gain or loss for the difference between the cash received and

the book value of the asset sold.

C the seller recognizes losses, but not gains.

D None of the other answer choices are correct.

A company decides to sell equipment it has owned and operated for the past five years. The

equipment's original estimated service life was eight years. Management calculates the loss

on the sale as the equipment's original purchase price minus its selling price. Which of the

following statements is correct?

A Management should calculate the loss as the present value of expected decrease in

cash flows from selling the equipment.

B Management should subtract the equipment's accumulated depreciation from the

original purchase price before calculating any loss.

C Management should not report any loss on the sale of equipment if that equipment

has been used in operations.

D Management's calculation is correct.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started